Lost in the Shuffle: China’s New, Overlooked Financial Regulatory Commission

Publication: China Brief Volume: 18 Issue: 5

By:

Momentous developments have taken place over the past several weeks in China. The entire government has been reorganized, key personnel appointments have been made, the Party’s imprint on the State has been institutionalized, and Xi Jinping has opened the door to an indefinite term as China’s leader. With so many landmark changes taking place, the many more nuanced developments have become difficult to track. But some of these more granular developments, which seem small by comparison, will have a considerable and immediate impact macroeconomic management in China.

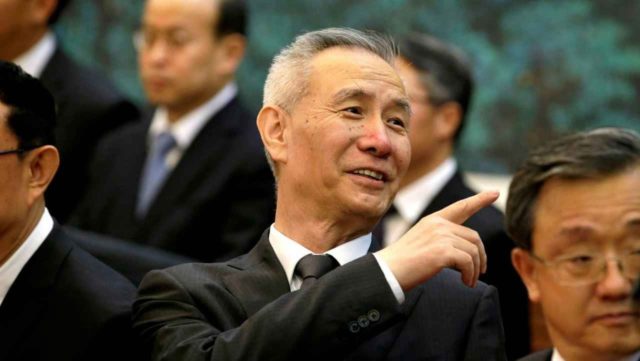

One such development has been the rising influence of a key new economic body, which has largely been overlooked during this National People’s Congress. It is called the Financial Stability and Development Committee (FSDC), and it will play a critical role in macroeconomic policymaking. What’s more, it should lead to more coordinated policies across the monetary, fiscal, and industrial spaces—giving China a powerful new macroprudential toolkit to avoid a financial crisis and fund its industrial policy priorities. Given that it will be headed by China’s most powerful economic official, Vice Premier Liu He, businesses, governments, and serious analysts would be wise to get better acquainted with the new committee.

A Powerful New Body

The FSDC is a relatively new committee under the State Council, headed by the Vice Premier charged with the economic portfolio. Until last week, that person was Ma Kai, but now it is Xi’s go-to economist, Liu He. The fact that it is headed by a key lieutenant of Xi Jinping should demonstrate the import of the new entity, in and of itself. Indeed, its recent establishment appears to have effectively been undertaken with Liu’s pending leadership in mind.

The relatively new FSDC was established in July 2017 at the National Financial Work Conference, a meeting that was notable in its own right for a number of reasons:

- The meeting was long-delayed, having been expected to take place in 2016. The delays led to speculation that a lack of consensus would lead to few changes in the financial regulatory architecture, but those expectations were proven wrong by the outcomes of the meeting and the subsequent regulatory overhaul.

- Xi’s Jinping’s presence at and leadership of the conference elevated its importance, given that financial regulation is not generally considered the remit of a General Secretary of the CCP.

- The meeting cemented financial policy as an overall priority for the Party and the government, reiterating Xi’s statement from early 2017 that financial risk has become a national security risk.

- It thoroughly ensconced the “back to basics” theme, discussed in more detail below, as a mantra for the financial sector.

- Finally, it established the new Financial Stability and Development Committee (Xinhua, July 15, 2017).

Indeed, in the immediate wake of the National Financial Work conference, each of the main financial regulatory bodies (as they were then constituted) held meetings to study and express fealty to the leadership of the newly created body — an early, but clear, indication of where the balance of power is gravitating in the financial sector (PBOC Press Release, July 18, 2017).

While the committee was officially established at the State Council level, day-to-day operations for the committee are run out of the central bank—the People’s Bank of China (PBOC). The FSDC is meant to be a high-level deliberative body, where stakeholders from across the financial spectrum can debate policy. And given that its daily operations will take place within the central bank, this deliberative function should give the PBOC enhanced standing as an intermediary between the State Council and the other regulators. Additionally, the FSDC will cut across various parts of the financial system, allowing the body to be used as a venue to break deadlocks when regulators cannot agree over the proper trajectory of policy (Xinhua, July 15, 2017).

What’s more, the FSDC is expected to be used to exert greater authority over local governments when it comes to financial policy, given that the individual regulators largely lack this capability. Authority over the localities will be ensured by the fact that the FSDC is also planning to build out a mechanism to undertake inspection tours over local regulators and governments (Caixin, July 17, 2017).

Given these wide-ranging responsibilities, the FSDC is meant to be much more than simply a financial cat herded—i.e. making sure that policy emanating from the various commissions and the central bank are all aligned, instead of working at cross purposes (Xinhua, November 8, 2017). Rather, the goal for the entities is not only to coordinate financial regulators among themselves, but to ensure that overall financial policy is aligned with monetary policy, fiscal policy, and industrial policy. In other words, a host of important policymakers will lay out industrial policy goals, after which the FSDC will ensure that those goals receive adequate financial and fiscal resources.

So rather than thinking of the FSDC as a traditional commission—like the CBRC or the CIRC—or even a bread-and-butter office of the State Council, it is better conceived as a type of leading small group. And while it will not rival the Party’s Central Leading Small Group on Finance and Economics, it will essentially act a government counterpart to that entity.

Devil in the Details

While the broad strokes of the FSDC’s remit are basically agreed upon, the details of how it will function are still evolving. Over the past several months, that evolution has occasionally played out in public, giving clues as to the ultimate fate of the body. The basic question that most policymakers and Chinese analysts are asking, though, is not whether the FSDC will be powerful, but exactly how much authority will it need to have in order to accomplish its key tasks.

The primary financial priorities that the FSDC will support were delineated in the official newspaper of the central bank, The Financial News, in late October, 2017 (Financial News, October 30, 2017). First, the FSDC is to ensure that financial activity is geared toward supporting the real economy. One of Xi Jinping’s mantras for the financial sector over the past year has been “back to basics.” That effectively means doing more to finance the smooth functioning of businesses and doing less to engage in speculative financing behavior to boost bank profits. The FSDC is meant to oversee that process. Secondly, the FSDC will seek to improve overall macroeconomic regulation and control. Thirdly, it will strengthen policy coordination. Finally, it will seek to help institutions prevent and resolve financial risks.

Accomplishing those difficult tasks will require a high level of authority. And so policymakers are trying to decide whether the FSDC should establish special sub-committees within each of the various financial regulators—a so-called regulation matrix that would see the various sub-committees report upward to the main FSDC (Caixin, February 9, 2018). A second option would be to devolve various decision-making authority to the FSDC over time while embarking on a wider financial regulatory consolidation (Caixin, February 12, 2018). Given the recent announcement of the government restructuring plan, it appears that the latter path may have won out for now.

How the FSDC Fits into a Revamped Government

When it comes to the financial sector, the key development from the government restructuring plan that was announced on March 13 included a merging of the China Banking Regulatory Commission (CBRC) with the China Insurance Regulatory Commission (CIRC). Equally important was the elevation of the central bank’s role in macro-prudential policy-making that was accomplished by transferring the CBRC’s and CIRC’s responsibilities for writing major regulation and financial laws to the central bank. Such an arrangement will allow the central bank to play a more dedicated macro-prudential role, while the CBRC and CIRC focus on strict implementation of policy at the individual institution level. The elevation of policymaking power to the central bank appears to be a pre-cursor for the centralization of decision-making into the FSDC.

That likelihood, though, made the absence of the FSDC—and its role in financial and economic policy making—in the government restructuring plan seem quite conspicuous. However, the explanation for the body’s absence in the wide-ranging government reorganization is straightforward. The most basic reason that the FSDC wasn’t mentioned in the government restructuring plan that was approved by the National People’s Congress (NPC) was that it didn’t need to be, for two reasons. First, the FSDC wasn’t actually restructured in any way by the recent plan, even though entities under its authority were. Entities that weren’t affected by the sweeping changes were left out of the draft.

But more fundamentally, as a special committee that reports to the State Council, legislative approval is not required for changes to this particular body. Even when the committee was first announced in July 2017, it didn’t require NPC approval; neither is an official legislative explanation required to explain how the FSDC fits into the new regulatory architecture involved in the government restructuring plan.

Still, the fact that the FSDC was not listed in the government restructuring plan has not stopped market actors from recognizing its importance. Just 24 hours after the plan was announced, China’s financial media had coined a new acronym to refer to the regulatory architecture. Over the past decade, the four key financial regulators have been referred to as 一行三会—one bank and three commissions. The phrase was not only a pithy way to refer to the full group of financial regulators, but it also clearly indicated that the PBOC was the first among equals. The new phrase the financial media is using, however, is 一委一行两会—one committee, one bank, and two commissions (China Securities Journal, March 14, 2018).

The phrase is a touch less pithy, but it has the same effect of being reasonably compact and conveying a clear hierarchy. The FSDC will be the clear leader of the financial regulatory pack going forward. That means that the early gains that China has made in reducing financial risks over the past year will be advanced by this powerful new body that has both a broad remit, and the ability to see across various silos in the financial system. To be sure, the specter of a regulatory misstep will always hang over China’s financial officials. But the FSDC gives Vice Premier Liu He a much stronger chance of keeping the ghosts of an acute financial crisis at bay.

Andrew Polk is a founding partner of Trivium/China, a Beijing-based advisory firm. He was formerly director of China research at Medley Global Advisors and senior China economist at the Conference Board’s China Center. Follow him on Twitter at @andrewpolk81.