Next Focal Point of China’s Stock Market: Earnings—But Can We Trust the Numbers?

Publication: China Brief Volume: 15 Issue: 20

By:

The recent stock market turmoil and the economic slowdown in China have kept analysts busy projecting where the economy is going and what the government will do. The Chinese government has also issued a number of reforms of state-owned enterprises and other aspects of the economy. However, these reforms and increased scrutiny by both regulators and investors will be futile unless larger problems with market fundamentals in Chinese companies are addressed.

While the world’s attention has been fixed on what the Chinese government is going to do next, there has been a tendency to neglect market fundamentals and to forget about the very reason why people invest (or speculate, more appropriately in this case) in the stock market in the first place: the stocks we buy give us shares of ownership of a company that creates value for the owners by making products or services that people or companies want. And from selling these products/services the company we bought into will generate earnings, which, ultimately, will go to us the investors. This is why the ratio of a stock’s price to its earnings, or the P/E ratio, is one of the most important vital statistics of a stock market. At the end of September this year, the average P/E of stock markets worldwide was 17.7, while the P/E of the Shenzhen Stock Exchange was about 39, already substantially down from 69 in June. If the P/E is too high, which is the case of the Chinese stock markets, then people will not buy stocks because of their earnings, but because they think they can sell them with higher prices to the next buyer, which is speculation and creates bubbles in the market.

In order to attract investors who invest in the fundamentals of the companies listed in China’s stock market rather than the ones who speculate at this high valuation level, the listed companies must substantially increase their earnings. Recently, the Chinese government rolled out its much anticipated plan to revamp the problem-ridden state-owned enterprises by releasing several important documents, with the first being “Directives of Deepening Reform of State-Owned Enterprises” (深化国有企业改革的指导意见) in which the party calls on the SOEs to “increase return on investment” (Xinhua Online, September 13).

Businesses in China follow the government’s orders closely. Most likely, if they cannot increase profits, they will show on paper that they have, which involving what accountants call “earnings management”—an act by the management of a company to manipulate earnings information to make it appear higher or lower, depending on the purpose.

A study of earnings manipulation across countries, with special attention to companies in China, shows that the overall level of earnings manipulation is high among the Chinese companies, and the highest as compared to companies in the U.S. and other developing countries. [1]

The following table presents the reported profit margins of listed and unlisted firms in the above countries. In general, unlisted firms should have a higher rate of return because it is more difficult to invest in them and they lack liquidity. Everything else being equal, investors of unlisted firms, who make the effort to overcome the difficulty of starting or investing in the firm, expect to earn a higher rate of return than simply buying stocks of listed firms in the secondary market. In other words, if listed firms have a higher return, all investors would just buy stocks instead of taking all the trouble and risk to invest directly in and run business. However, firms of most BRIC countries in the table defy the general belief and economic logic: unlisted firms in three BRIC countries reported lower profits than the listed firms—investing in the stock market appeared to be far more profitable than directly investing in and running an unlisted firm. [2] The gap between listed and unlisted is especially large for China: listed firms’ average reported profit is three times of that of unlisted firms. Something is not right in these figures. Additional research reveals that in China listed firms tend to use earnings manipulation to make earnings appear higher in order to attract investors and pump up the stock prices, and unlisted firms have an incentive to underreport earnings to reduce their tax payments.

|

Table 1: Profits of listed and unlisted firms from the BRIC countries and the U.S. in 2009 |

|||||

|

Listed firms |

Unlisted firms |

||||

|

number of firms |

average profit margin reported by firms |

number of firms |

average profit margin reported by firms |

Profit gap between listed and unlisted firms (%) |

|

|

Brazil |

340 |

11.90% |

4890 |

10.78% |

10% |

|

China |

2,301 |

12.06% |

178832 |

3.79% |

218% |

|

India |

3,589 |

8.61% |

8062 |

14.90% |

-42% |

|

Russia |

1,117 |

4.02% |

404771 |

2.90% |

39% |

|

U.S. |

4,703 |

-0.35% |

28938 |

5.52% |

-106% |

This phenomenon, observed during our study a few years ago, remains a major concern for investors in China. A useful way to assess profit misreporting is to plot a company’s reported profit against its cash flow. Generally, the amount of profits and the amount of cash flow a firm has should be closely correlated and should be close to equal—provided that the firm accurately reports profits. Another interesting and revealing feature is that while profit is a reported figure on paper and thus can be easily altered, stated cash flow, on the other hand, must have actual cash in the firm’s bank account (or its safe) to back it up and therefore is less easy to fake.

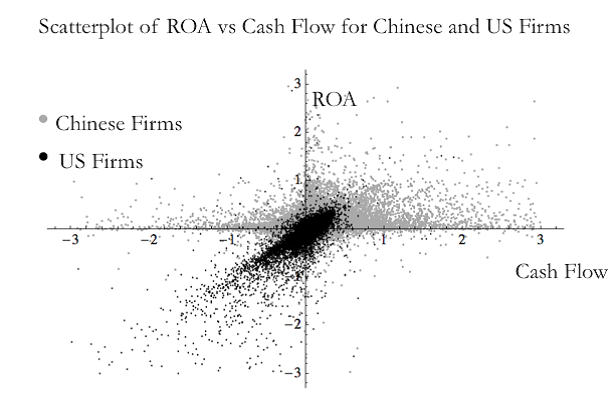

Under normal circumstances we expect the two variables to be highly correlated and the scatter plot of the variables to fall near the 45-degree line. As can be seen from the figure, the distribution of the U.S. firms (black dots) falls near the 45-degree line, whereas the distribution of the firms in China (gray dots) shows that profit (return on assets, or ROA) clusters around zero (mostly above zero) irrespective of the value of their corresponding cash flow. In other words, there is little correlation between the ROA and cash flow for the firms in China, once again suggesting evidence of profit manipulation.

See attached Image

Fig. 1. Cash Flow (CF) versus Return on Assets (ROA), China and U.S. This figure represents the relationship between Return on Assets (ROA) (profit/assets) and Cash Flow (CF) (cash flow/assets) for Chinese and U.S. firms.

Why do firms in China hide profits and losses and tend to cluster at the breakeven point by showing a tine profit? After some research and interviewing business people and accountants in China, we found that the reason is essentially a desire to avoid scrutiny by government officials. The evidence and interview responses we got can be summarized as: do not show high profits, because it will attract envy and unwanted attention. Do not show big losses either, for this also could trigger an audit. While hiding profit is more common everywhere, hiding losses may be particularly common in China. A Taiwanese businessman managing a company in China told us that the local tax officers simply did not believe that firms could have several years of losses: “if your firm keeps losing money, why keep operating it?” So firms adopt a strategy of not revealing much of anything. As the former Chinese President Jiang Zemin inadvertently revealed in a famous Hong Kong news conference: “Keep silent, make money” (闷声大发财, Wenxue City, December 23, 2013; YouTube).

The conclusion based on these simple statistics is that the quality of financial reporting by Chinese firms is low. As we know, trustworthy and accurate reporting of financial data is vital to the survival and growth of a stock market. So before the Chinese government orders the firms to increase their profit, the first and the most imperative effort it should make is to improve corporate governance and the quality of financial reporting of firms. This is a prerequisite for developing a healthy, sustainable stock market.

Although new Party directives on deepening reform of state-owned enterprises (SOEs) mention the need to further disclose firm operating and financial information, this section is not given high priority, being buried as the 22nd article of a 23-article section on reforms. The remainder of the document rather emphasizes the importance of strengthening party rule in SOEs (Xinhua, August 24). Emphasizing the prioritization of control over transparency, the Chinese government also issued a subsequent document entitled “Directives on the Upholding Party’s Leadership and Strengthening the Party’s Establishment during Deepening Reform of State-Owned Enterprises” (关于在深化国有企业改革中坚持党的领导加强党的建设的若干意见) (People’s Daily, September 21).

Unfortunately, those who do report economic facts are frequently persecuted for it. Strengthening the Party’s control of SOEs will not particularly help these firms improve information disclosure and reduce profit misreporting. Our findings on the patterns of rampant profit misreporting in China have several implications for policy makers as well as for investors and managers conducting business in China.

Manipulating profit biases the information transmitted by reported earnings, often leading investors to misallocate capital. Persistent and widespread profit misreporting in an economy may cause investors to lose confidence in corporate reports and ultimately in the local securities markets themselves. This could create a “lemons market” that not only misallocates society’s resources, but also creates a reluctance to invest in China’s capital markets. The Chinese government should make creditable efforts to improve the institutional environment. Specifically, the state should reform the incentive mechanisms for senior managers in the state-owned firms. Truthful reporting requires decreasing the motivation to manipulate earnings. This can be partly accomplished by clarifying the accounting standards and improving the enforcement of the tax laws. Secondly, the ongoing rule of law campaign should be used to promote more clear rules and reduce the fear factor. If executives hide profits and losses to avoid public attention for fear that they may be investigated for putatively illegal business activities, then the government should consider making policies that reduce the uncertainty regarding the legal environment. Decision-makers prefer bright lines and stability when it comes to legal issues. This will also level the playing field and decrease the need for firms to manipulate earnings in order to compete. Uncertainty increases the risk of business decisions, misallocates resources, discourages investment, and drives information underground.

Conclusion

While government reforms of state-owned enterprises certainly represent a step in the right direction, they are unlikely to change the culture of “transparency avoidance.” For investors, this analysis implies that first, they should be more cautious in basing their investment decisions on reported income when investing in Chinese firms, especially state-related firms. Second, as a practical matter, one should give more weight to cash flows than to earnings, since cash flows are harder to manipulate and easier to verify than profits. Third, investors should be cautious when forming joint ventures with local firms in China. Going into the market alone (i.e., establishing a wholly owned subsidiary) can substantially reduce the risk of local partners providing inaccurate financial information.

Shaomin Li is Eminent Scholar and Professor of International Business at Old Dominion University Strome College of Business. Seung Ho Park is Parkland Chair Professor of Strategy at China Europe International Business School.

Notes

1. Shaomin Li, Seung Ho Park, and Rosey Shuji Bao, “How Much Can We Trust the Financial Report? Earnings Management in Emerging Economies.” International Journal of Emerging Markets, 2014, 9 (1), pp. 33–53. Shaomin Li, David Selover, and Michael Stein, “‘Keep Silent, Make Money’: The institutional pattern of earnings manipulation in China.” Journal of Asian Economics, 2011, 22, pp. 369–382.

2. We realize that there is conjecture that the higher profits of listed firms may be due to the state policies that give preferential treatment to firms that perform better or are in the state-controlled industries. However, evidence from research and stock market performance data does not consistently support the conjecture.