Sodium Supply Chain Emerges to Support Lithium Alternatives

Executive Summary:

- The Chinese government and the Qinghai Provincial Government have moved to regulate salt lakes since 2021 in order to explore the industrialization of these natural resources for new type energy products, such as sodium-ion batteries.

- Chinese companies such as China Minmetals have increasingly invested domestically to support this growing industry, through acquiring Qinghai Yanhu Industry and forming China Salt Lake Industrial Group.

- Internationally, Chinese companies have invested, or attempted to, in salt lakes and potash companies in Djibouti and Australia.

The People’s Republic of China (PRC) has emerged as the world’s largest producers of electric vehicles (EVs). In becoming the dominant global player, it has had to grapple with the high cost and low supply of raw lithium materials—critical inputs for the batteries that fuel most new energy vehicles. A lack of lithium deposits at home have led Chinese investors and mining companies to set up shop in countries including the Democratic Republic of Congo, Australia, and Zimbabwe, to extract and process the silvery metal. But as supply chains have become increasingly volatile due to tariffs, export bans, and host country legislation, Chinese policymakers and companies have started exploring alternatives to support the growth of the new energy storage industry.

One solution is sodium. In recent years, Chinese engineers have been testing sodium-based new-type energy storage technologies. In 2025, they deployed them for the first time. Chinese firms have also begun to focus their attention on the country’s salt lake industry, which is rich in sodium products but also offers opportunities to extract lithium and other materials.

Government Directives Have Supported Salt Lake Industrial Base

The 2021 “Outline of National Standardized Development” (国家标准化发展纲要) gave the initial signal that Beijing wanted to establish a “world-class salt lake industrial base” (世界级盐湖产业基地). Published by the National Development and Reform Commission (NDRC), the document strategized the standardization of green development. It specifically made calls to “promote the economical and intensive utilization of natural resources” (推进自然资源节约集约利用), “build a series of standards for unified investigation, registration, appraisal, evaluation and monitoring of natural resources” (构建自然资源统一调查、登记、评价、评估、监测等系列标准), and “study and formulate standards” (研究制定 … 标准) for green exploration and development of energy resources (NDRC, December 1, 2021).

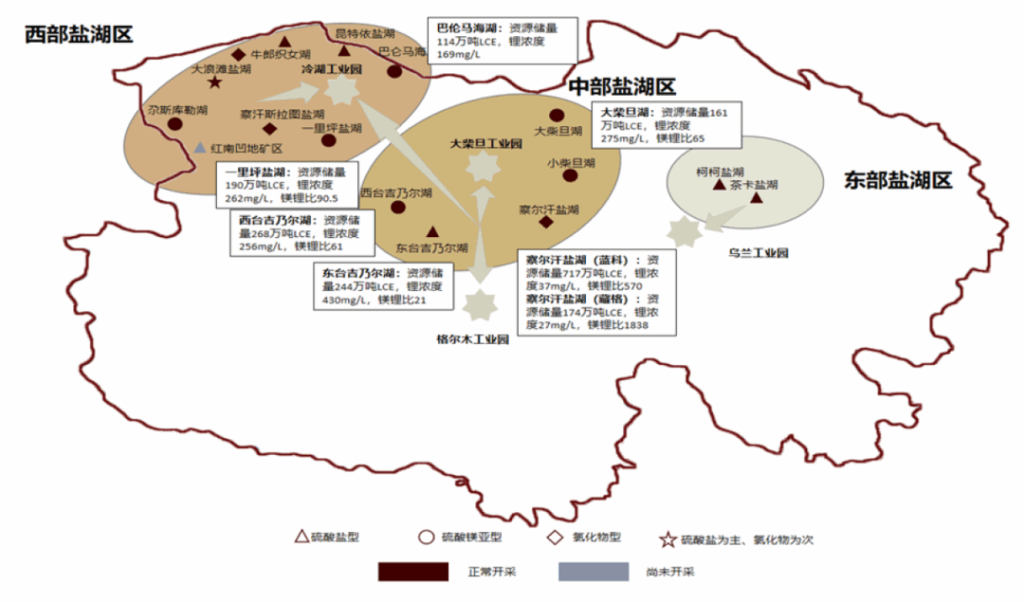

This central directive was followed by subnational policymaking and implementation. For instance, in April 2024, Qinghai, one of the country’s westernmost provinces and home to multiple salt lakes, issued an “Implementation Plan for Constructing a Standard System for a World-class Salt Lake Industrial Base” (世界级盐湖产业基地标准体系建设实施方案). While the plan specifically focuses on legal, policy, and engineering standards, it also outlines initiatives to “develop ‘Salt Lake +’” (发展“盐湖+”), which refers to cultivating industries such as new energy, new materials, and even tourism, around the province’s salt lakes. It also calls for the development of standards to evaluate “the high-quality development level of the industrial chain” (产业链高质量发展水平) as part of this process. The plan is being implemented by Qinghai’s Department of Industry and Information Technology (Qinghai Provincial Government, May 11, 2024).

The same month, Qinghai’s government issued a follow-up plan outlining key tasks entailed in the implementation plan. This second document laid out the opportunities but also the challenges that the province—one of the country’s poorest—faced: despite Qinghai’s abundant mineral resource deposits, its small-scale innovation and business system were barriers to advancement (Qinghai Provincial Government, May 28, 2024). The document therefore drew up a series of industry standards to help set the parameters for the emerging sector.

Domestic Turn To Salt Lake Extraction

Qinghai has been at the forefront of national efforts to produce lithium and sodium since at least 2016. That year, Chinese leader Xi Jinping visited the province on an inspection tour, which included paying a visit to Qarhan Salt Lake (Ministry of Ecology and Environment, August 31, 2016). Xi returned to Qinghai province five years later, where he urged local authorities to “accelerate the development of a world-class salt lake industrial base,” alongside focusing on industry and ecological conversation in the region (Xinhua, June 10, 2021).

Figure 1: Qinghai’s Main Salt Lake Resources

(Source: Cailianshe)

The province’s potential was underscored in September 2024 when state-owned China Minmetals Corporation (中国五矿集团) acquired Qinghai Yanhu Industry (青海盐湖工业). The former, one of the largest mining companies in the world, owns 38 mines globally, including Las Bambas in Peru and Ramu mine in Papua New Guinea (China Minmetals, accessed January 21). Qinghai Yanhu Industry, meanwhile, is a local firm whose operations have expanded from potash extraction to encompass chemical production and salt lake extraction, including products of potash fertilizer, lithium carbonate, and soda ash. The acquisition highlights the country’s growing interest in extracting domestic mineral resources at a time of greater international vulnerability. But it was just a smaller part of a larger initiative: China Salt Lake Industry.

The same month that China Minmetals officially acquired Qinghai Salt Lake Industry, it also officially established China Salt Lake Industrial Group (中国盐湖集团), a joint venture between Minmetals and Qinghai Province, in which Minmetals owns a majority (53 percent) stake. Xinhua coverage of the venture described it as “a significant step forward in the coordinated efforts between central and local governments to build a world-class salt lake industry powerhouse” (央地协同打造具有国际影响力的盐湖产业“航母”迈出了重要一步), and tied it to “enhancing national food security and resource and energy security” (提高国家粮食安全和资源能源安全) (Xinhua, February 8, 2025). This language was repeated in the company’s own press release, which also stated that the group’s production base “leads globally in large-scale lithium extraction technology from salt lakes,” and said that the venture would become “a driving force for high-end light metal materials” (China Minmetals, February 18, 2025). This is in keeping with Beijing’s broader framing of new energy supply chains as strategic infrastructure (China Brief, January 8).

These industry developments herald a shift in attention toward sodium extraction for the production of sodium-ion batteries. To date, most exploration and innovation of Qinghai’s salt lakes have focused on lithium, which Beijing has prioritized as part of its push to dominate the “new three” (新三样) green technologies (lithium-ion batteries, EVs, and solar cells). Chinese companies have already become global leaders in lithium battery production: the PRC holds more than 40 percent of global new-type energy-storage capacity, of which lithium batteries make up over 96 percent (National Energy Administration, July 31, 2025). In 2024, PRC exports of these batteries numbered just under four billion—more than $61 billion (UNCOMTRADE, accessed January 20).

The new focus on sodium is driven in part by material constraints: although the PRC dominates global lithium battery supply chains, its own deposits of the mineral are small. Sodium, by contrast, is highly abundant in the PRC’s salt lakes. In April 2024, Chinese battery maker CATL (宁德时代) announced its new battery, Naxtra, which it describes as “the world’s first mass-produced sodium-ion battery.” It links its genesis to lithium scarcity, noting that “with sodium’s inherent safety and abundant reserves, [Naxtra] efficiently reduces dependence on lithium resources and strengthens the foundation of new energy technologies, while promoting energy utilization from ‘single resource dependence’ to ‘energy freedom’” (CATL, April 21, 2025). Other Chinese companies have followed suit or pioneered similar technologies. EV companies and battery producers like Jiangling Motors Corporation (JMC; 江铃汽车), Xiamen Funano New Material Technology (Funan/Funano; 福纳新材料), and JAC Group (江汽集团) are moving from testing to production and adoption (Farasis Energy, December 29, 2023, Xinhua, January 6, 2024, Funan Technology, accessed January 7). [1]

The reorganization of Qinghai Salt Lake Industry under one of the world’s largest metal and mineral companies, coupled with the regulatory support for the burgeoning sodium industry, shows that policymakers increasingly feel pressured by international constraints to turn inward. This signal has been received by companies, who are moving to adopt new technologies in their products, and by provincial authorities, who seek to capitalize on central priorities by implementing national initiatives. This is not to say, however, that the PRC is not also looking overseas to build international sodium supply chains.

Securing International Supply Chains

The PRC has invested in a number of salt lakes and other sodium and potash-related ventures overseas. These international footholds are not as strong as those for critical minerals like lithium, cobalt, or copper, likely because Chinese companies do not face the same pressures to secure access to sodium as they do for those minerals.

In 2015, a joint venture of the overseas business department of the China Communications Construction Company (CCCC; 中国交通建设集团) and China Harbor Engineering Company (CHEC; 中国港湾) bought a 65 percent stake in the Djibouti Salt Investment Company (SIS; 吉布提鹽業投資公司), which grants the exclusive right to develop and extract salt resources from Lake Assal—the world’s largest salt reservoir—for 50 years (Sina, June 26, 2017; CCCC, December 22, 2017; AidData, 2025). In late 2025, additional agreements between the Djibouti government and Chinese companies were drawn up to boost further salt extraction (Dawan Africa, August 28, 2025).

Beyond setting up production overseas, the PRC is also expanding into strategic financing. In 2023, the Industrial and Commercial Bank of China (ICBC) directed over $60 million in financing to support the construction of the Mardie Salt and Potash mine in Australia, a project which will produce sodium chloride and sulphate of potash (AidData, 2025). No Chinese company has an equity stake in the project, though the funding is a signal of PRC efforts to support new and ambitious projects to extract mineral resources, and to extend control over global supply chains.

In 2025, Qinghai Salt Lake Industry, the same company acquired by China Minmetals, made a bid to become the controlling shareholder in Australia’s Highfield Resources, a mining company with flagship projects in Spain. Highfield Resources focuses on potash, mostly used as an agricultural fertilizer, but the potential transaction highlights the interest of major salt lake players and extractors in going overseas. Ultimately, however, the deal was scrapped in August 2025 (Yicai Global, August 18, 2025).

Conclusion

The PRC continues to innovate new technologies for energy storage and to gain access to the resources and materials that serve as critical inputs to those technologies. Recent actions to support an emerging global salt lake and sodium-ion battery industry signal a broader shift to secure supply chains. This is part of an international trend toward ensuring the resilience and robustness of supply chains, but it is also informed by Beijing’s view that critical technologies come under the umbrella of “comprehensive national security” (总体国家安全) (CCP Members Net, January 15). The overwhelming reliance of many new energy products on lithium batteries is a potential vulnerability: a large spike in demand could cause problems for the industry, while export controls, host country bans, and other chokepoints could cause a supply shock, and restrict the PRC’s ability to manufacture these key dual-use items.

The PRC’s bet on its domestic salt lake industry is thus a proactive business strategy, anticipating potential lithium supply chain turbulence. Boosting domestic production of lithium through its salt lakes would also ease potential shortages, though by how much remains uncertain. Chinese companies testing and producing sodium-ion batteries is a similar anticipatory move, designed to avoid the issues entailed by potential lithium shortages. Some companies have already begun to scale the technology; first in two-wheel vehicles like electric scooters, and now, looking to expand to energy storage, data centers, telecom base stations, underground mining, and construction vehicles (China Daily, June 3, 2025). Sodium may not offer the same efficiency and effectiveness as the more traditional lithium batteries, but they offer security of supply. As countries redefine critical mineral mining, Chinese companies—and the PRC government—will continue exploring and solidifying their plans to build a world-class salt lake industrial base.

Notes

[1] It is unclear from the company’s English-language website whether its English name is “Funan” or “Funano.” Both appear to be used (Funano, accessed January 22).