China’s Growing Economic Power in Uzbekistan

China’s Growing Economic Power in Uzbekistan

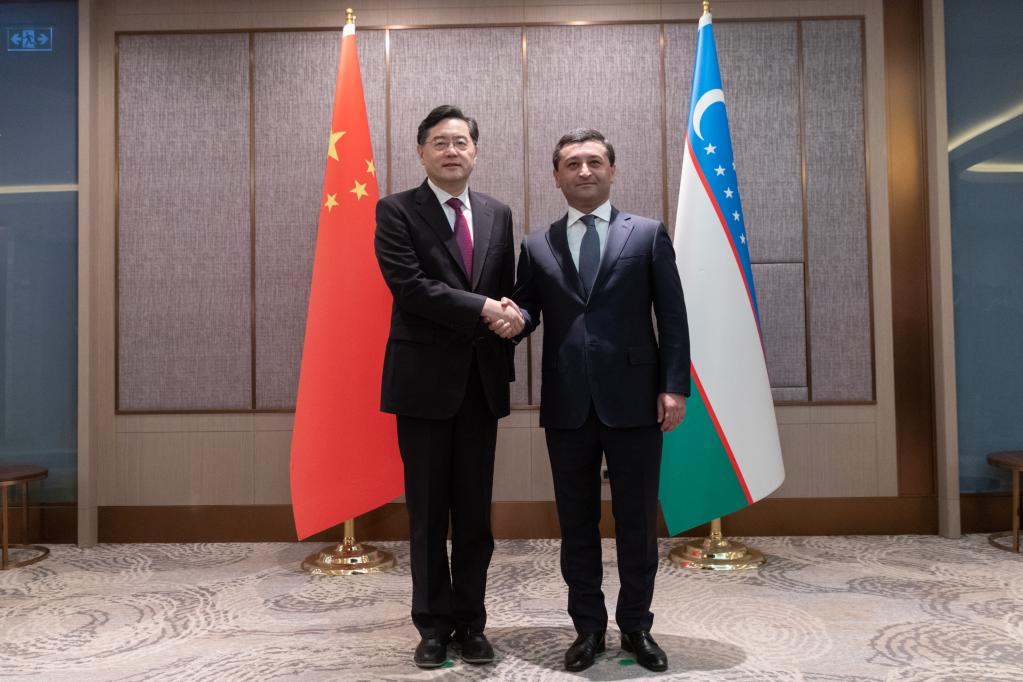

Against the backdrop of the Russo-Ukrainian war and fluctuating relations between Kazakhstan and Russia, Uzbekistan is gaining strategic importance for China as a potential stable emerging market in Central Asia. As a result, Beijing has made more concerted efforts to expand its soft power throughout the country (Eurasianet, March 22). Since the beginning of the war, Chinese investment in Uzbekistan has been steadily growing. Two sectors in particular, the automotive and green energy sectors, reflect Beijing’s overall growing economic power in the region.

In the automotive sector, Chinese car brands have been expanding their market share as Russian companies are retreating from the region due to Western sanctions (Eurasianet, October 31, 2022). Furthermore, more affordable and environmentally friendly Chinese brands are attracting the attention of Uzbekistani consumers in increasing numbers. In 2022, Uzbekistan imported automobiles from 34 foreign countries, with China accounting for the largest share at 11,159 cars. In this industry, China plays a particularly important role for Uzbekistan, especially in the context of importing hybrid and electric vehicles. In January 2023, Uzbekistan imported 389 electric vehicles, with Chinese cars accounting for 346 of them (Stat.uz, February 3; Kun.uz, March 7)

In addition to imports, Uzbekistan has signed agreements with various Chinese companies to attract investment and localize production. Recently, the main examples of the growing presence of Chinese brands in Uzbekistan were the agreement signed between UzAuto Motors and Chinese car manufacturer BYD Auto and the contract agreed to by Asaka Motors International and EXEED to organize car production in Uzbekistan (Tashkent Times, August 22, 2022; Uzdaily.com, January 9). In addition, Uzbekistani company Roodell has started assembling models from the Chinese company Chery at the ADM-Jizzakh plant located in the Jizzakh Free Economic Zone in eastern Uzbekistan (Trend.az, September 1, 2022)

Green energy is another area in which Chinese companies are becoming increasingly active. During the winter of 2022, gas shortages and an energy crisis caused many problems in Uzbekistan, forcing thousands of industrial workers into temporary layoffs. In this context, Tashkent began to look for alternative energy sources, especially green energy sources, with the industry experiencing a significant increase in the flow of Chinese investment. In 2022, the bid was selected from Chinese companies GD Power Development and PowerChina for the construction of photovoltaic (solar) plants in Namangan. In February 2023, Uzbekistan signed two agreements with Energy China and Huaneng Renewables for the construction of solar photovoltaic and photoelectric power plants, respectively (Kun.uz, December 16, 2022; Tashkent Times, February 15; Uzdaily.com, February 20).

In addition, China plans to build a solar panel production plant in Fergana in eastern Uzbekistan. Not surprisingly, Chinese companies prefer to invest in regions where energy demand is growing, such as the Namangan and Fergana regions, where electricity demand has increased by 40 percent (UzReport, February 23; Kun.uz, February 1). Even if China does not play a role as an investor, it plays a key role as an exporter of critical equipment. For example, China is supplying turbines and generators for the construction of the Zarafshan Wind Farm being built by United Arab Emirates state-owned company Masdar in the Navoi region of Uzbekistan. In particular, the decree signed by Uzbekistani President Shavkat Mirziyoyev on accelerating the introduction of renewable energy and energy-saving technologies in 2023 will most likely promote the further participation of Chinese companies in Uzbekistan’s green energy sector, as Beijing plays a central role in providing these technologies to the world (Kun.uz, January 1; Tashkent Times, February 17).

Chinese investments in Uzbekistan’s automotive and green energy sectors are a continuation of recent changes in Beijing’s strategy toward Central Asia. In the words of Chinese President Xi Jinping, Beijing has a “grandiose plan” for the region (see EDM, April 10). In this, China is shifting investment priorities from developing infrastructure to manufacturing in hopes of reducing anti-Chinese sentiments in the Central Asian states (see EDM, October 28, 2021) In this context, cooperation in the automotive sector can pave the way for the localization of manufactured products—such as the production of engines, electric motors and car batteries—thus accelerating industrialization in Uzbekistan and creating new jobs.

Increased investments in the green energy sector will also help Uzbekistan reduce air pollution, save gas and reduce the effectiveness of Moscow’s pressure on Tashkent to import more Russian gas. This in turn will help create more jobs and localize production for this industry as well, which will ease the transition from agriculture to higher-value and higher-paying sectors of the Uzbekistani economy. Of course, investments also bolster the further expansion of China’s economic power in Uzbekistan and increase its competitiveness with regional rivals—something Tashkent will have to keep an eye on.

Yet, despite China’s changing investment strategy and its positive contribution to the Uzbekistani economy, certain concerns are growing about China and its increased investments in Uzbekistan. For example, Wave 10 of the Central Asia Barometer (CAB) survey, which was conducted in November and December 2021, posed the question: “How confident are you that China’s investment in our country will improve our country’s energy and infrastructure?” For Uzbekistan, 74 percent of respondents said they had a “great deal” or “some confidence” in Chinese investments, while 13 percent said they had “little or no confidence.” However, when the same question was asked in Wave 12 of the CAB survey, which was conducted in November and December 2022, 67 percent of respondents said they had a “great deal” or “some confidence” in Chinese investments, while 21 percent said they had “little or no confidence” (Central Asia Barometer, December 12, 2021, December 12, 2022). Comparatively, the differences in the survey results clearly reflect decreasing public confidence in Chinese investment.

Another key question in the CAB survey was how respondents in Uzbekistan generally felt about China. In Wave 10, while 44 percent of respondents had “very favorable” or “somewhat favorable” feelings about China, 33 percent held “somewhat unfavorable” or “very unfavorable” sentiments. In Wave 12, while 31 percent of respondents had “very favorable” or “somewhat favorable” feelings, 55 percent of respondents held “unfavorable” and “very unfavorable” sentiments. Again, the differences in the survey results clearly demonstrates Uzbekistani society’s increased wariness regarding China (Central Asia Barometer, December 12, 2021, December 12, 2022).

In sum, China’s economic influence in Uzbekistan continues to grow, especially in the green energy and automotive sectors. Yet, despite Beijing’s changing investment strategy and promised positive impact on Uzbekistan’s development, opinion polls show a growing concern about China at the grassroots level. This factor may not affect Beijing’s economic engagement in the short term, as the Uzbekistani population holds much more favorable views toward Chinese investment as compared to the strong anti-Chinese sentiments in Kazakhstan and Kyrgyzstan. However, if the Uzbekistani public’s view of China continues to trend downward in the medium to long term, it will pose serious challenges for Beijing in expanding its economic influence in Uzbekistan, as has been the case in Kazakhstan and Kyrgyzstan.