Financial Boss’s Fall Hints at Deleveraging’s Political Side

Publication: China Brief Volume: 18 Issue: 15

By:

Almost immediately after assuming office in 2012, CCP General Secretary Xi Jinping kicked off a brutal anti-corruption campaign whose stated goal was to curb rampant official self-dealing. However, most observers agree that, like many high-level PRC campaigns, Xi’s anti-corruption push was also a political purge, one that allowed him to sideline potential rivals, and to consolidate control to a degree unseen since Deng Xiaoping or Mao Zedong (China Brief, December 7 2015).

Students of PRC elite politics are accustomed to thinking of high-level CCP political campaigns as purges—this has been a common feature of such campaigns since the founding of the Chinese Communist Party (CCP)—and have developed a set of analytical tools to predict and explain the outcomes of such purges. Analysts who focus on PRC economic policy, on the other hand, do not typically frame their analysis in terms of ‘purges’, since the consensus view has long been that the Party does a relatively good job insulating its economic decisionmaking from political pressures. But it might be time for that to change. The PRC government’s current campaign to ‘deleverage’—or reduce excess credit—in the PRC economy has begun to take on noticeable purge-like characteristics (China Brief, July 10).

Upon reflection, there are obvious reasons to think that deleveraging campaign might result in purge-like outcomes. In China, the heavy hand of the state is present at almost every step of the borrowing and lending process; in a slowing economy where there is no longer a rising tide to lift all boats, decisions about who gets access to credit can be, quite literally, a matter of life or death for private businesses, state-owned enterprises, executives, and bureaucrats at every level of the party-state system. Everyone involved has every incentive to manipulate the system to protect their own interests and sideline rivals, using every means at their disposal.

A slowing PRC economy and the government’s determination to see deleveraging through both appear here to stay (Trivium, August 8). It may, therefore, be worthwhile for PRC economic analysts—as well as foreign businesspersons and investors—to familiarize themselves with the tools traditionally used by PRC political analysts to try to understand purge outcomes in the context of the PRC’s notoriously opaque politics. One recent case—the downfall of Huarong Asset Management (华融资产管理公司) and its former chairman Lai Xiaoming—may have opened cracks through which we can glimpse suggestions of the political, factional, and personal factors shaping the deleveraging purge.

Chairman of the Hoard

In April of this year, Lai Xiaomin (赖小民), who had served as Huarong’s chairman since 2009, was placed under investigation for corruption and breaches of party discipline (Dai1 Media, August 14) [1]. As has long been typical for officials caught up in purges, Lai’s life became fair game for reporters; his downfall quickly became the stuff of gossip fodder. News accounts crowed that the three tons of hard currency recovered from his home were a ‘reform-era record’, while other reports speculated eagerly that a second family he kept in Hong Kong —complete with a second wife and twins—made Lai the inspiration for a particularly corrupt character in a popular recent TV series about graft fighting (VOA Chinese, August 13; JRJ.com, April 21).

But media reports made clear that Lai was removed from his post for more than just personal corruption; most went out of their way to make him a poster boy for the kind of reckless business practices the deleveraging campaign is meant to stamp out. Among his missteps were providing generous financing to some of China’s most famously overextended borrowers—so-called ‘grey rhinos’ like HNA, Anbang, Hanenergy, and CEFC (SCMP, August 26)—and plowing large sums into corrupt, ill-advised real-estate deals (Dai1 Media, June 6). In these portrayals, Lai was precisely the kind of greedy, irresponsible executive whom regulators pushing deleveraging might want to target, to encourage other businesses to be more prudent in their borrowing and lending.

Regulators also hinted that Lai was removed from his position because he led his company too far afield from its original, core mission (Macropolo, September 4). Huarong is one of four asset management companies (AMCs) that were created in 1999 to dispose of the bad loans of China’s four largest state-run banks, in order to prepare those banks for eventual IPOs [1]. Over time, however, all four AMCs diversified away from the business of repackaging and reselling bad loans, moving into other areas such as real estate lending and stock broking. Regulators clearly felt that, rather than solving the problem of bad debt, the AMCs had begun to exacerbate it. Judging by statements from all four AMCs following Lai’s downfall, all of which pledged that the companies would shed their extraneous business lines and return to their core mission, regulators’ message was received loud and clear.

More than Meets the Eye?

Framed this way, Lai Xiaomin’s fate makes complete sense. Lai was clearly a corrupt, irresponsible executive, who drove his company to lend much more freely than he should have. If top economic regulators trying to rein in reckless lending needed someone to make an example of, they could hardly ask for a better candidate. It is an entirely plausible technocratic story about a venal businessman run afoul of well-designed economic policy.

However, there are reasons to doubt that technocratic story is the full story. For example: Why was Huarong penalized so harshly, while the other three AMCs were essentially let off with nothing but a warning?

One explanation might be that Lai Xiaoming’s personal corruption was especially egregious. But while his behavior was certainly shocking by the standards of ordinary individuals, rare is the observer of PRC financial markets who believes that it was particularly unusual among China’s financial elite.

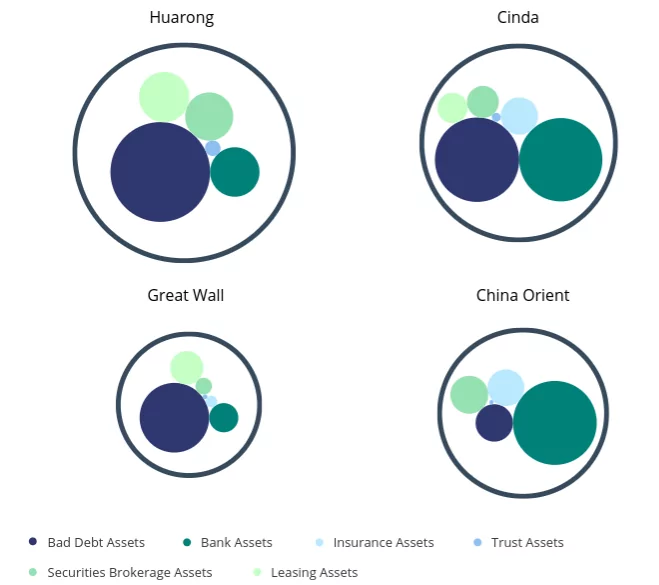

Another explanation might be that, in its rush to expand its business, Huarong’s lending was especially reckless, making it a tempting target for regulators looking to drive home a message about deleveraging. But there are reasons to doubt this explanation as well. The graphic below, reproduced with the kind permission of Dinny Mahon of Macropolo, shows the size of both Huarong’s core and ancillary business lines relative to its three AMC peers.

Figure 1: Size of each AMC’s financial subsidiaries by asset size, compared with distressed debt assets, at end-2017. Source: https://macropolo.org/cleanup_analysis/the-big-four-amcs/

The dark blue circles, “bad debt assets”, represent each AMC’s original, core bad debt business. The other circles represent new business lines beyond their core business. Huarong’s bad debt holdings are the largest of the four AMCs, and while while it does have somewhat larger leasing and securities brokerage holdings than the other three AMCs, both China Orient (中国东方资产管理公司) and Cinda (中国信达资产管理公司) have much larger holdings of bank assets. In other words, Huarong does not appear to have been especially reckless when compared with its peers, and indeed, seems to have stuck closer to its original mandate than any of them.

So why were Lai Xiaomin and his company singled out, while other AMCs were spared? Part 2 will make the case that the traditional tools used by students of PRC elite politics to understand purge outcomes offer several possible explanations. These tools include close examination of possible factional affiliation, official career paths, educational affiliations, and judicious evaluation of the Beijing rumor mill.

Matt Schrader is the editor of the Jamestown China Brief. Follow him on Twitter at @tombschrader.

Notes

[1] The author would like to thank Dai1 Media for the use of their subscription-only PRC-focused financial news service in the preparation of this story.

[2] Each of the four AMCs took over the bad loan book—and to some extent, the institutional DNA—of one of the four big state-owned banks. Huarong was created to manage the bad loans of Industrial and Commercial Bank of China, China’s largest bank. Each of the other three big banks—Bank of China, China Construction Bank, and Agricultural Bank of China—has its own corresponding AMC.