Xi’s Economic Deleveraging Campaign and the Limits of Credit Committees

Publication: China Brief Volume: 18 Issue: 12

By:

For well over a decade, the leaders of the Chinese Communist Party (CCP) have understood that excess lending by China’s state-directed banks to unproductive, state-linked companies could spark a future financial crisis. CCP General Secretary Xi Jinping has made the fight against excess leverage a centerpiece of his economic policy (China Brief, January 12), scoring notable initial successes.

The next steps will be harder. The PRC has accumulated so much debt within its economy, spread through a vast, constantly shifting constellation of intricately interlinked counterparties, that it may be impossible to know which thread, when pulled on, could cause things to unravel. To prevent panics, Beijing will need good information on where risks lie. But this information is inherently difficult to acquire, since the banks, companies, and local governments most in debt have the strongest incentive to hide the truth. Beijing has worked hard to address this problem, including widespread use of so-called ‘credit committees’ (债权人委员会).

But even these measures may not solve the more fundamental problem: that the PRC’s financial system is configured to direct money to companies and individuals with political connections, rather than those with entrepreneurial merit.

Addressing the Debt Emergency

The PRC has a debt emergency. In March, the Bank of International Settlements (BIS), a Switzerland-based organization sometimes referred to as the “central bank for central banks”, singled out the PRC, saying that its debt-to-GDP and debt service ratios placed it at high risk for a banking crisis (Bank of International Settlements, March 11). The CCP leadership has long recognized this problem; officials from Xi Jinping down have noted the problems that “overcapacity, bad loans, local government debt, a property bubble and illegal financing” could pose to future economic growth (People’s Daily, May 9 2016). Xi has called preventing and defusing financial risk one of the PRC’s three toughest, most important battles (Xinhua, April 2).

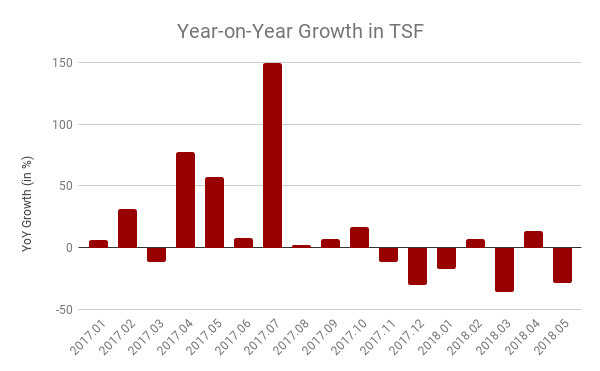

Conceptually, the solution is simple: Slow the pace of lending growth, cut capacity in inefficient legacy industries, and redirect lending into more efficient parts of the economy. Those are exactly the policies that Beijing has pursued. For example, following drastic regulatory intervention, growth in the sales of so-called ‘wealth management products’—one of the key ways PRC banks had channeled money into real estate and inefficient heavy industries—slowed to 1.69% in 2017, from 23.63% the year prior (China Banking News, February 7). Growth in total social financing—a broad measure of the amount of credit supplied to the real economy—has reversed after large increases in 1H 2017. BIS statistics also indicate that non-financial sector debt as a percentage of GDP peaked in Q3 2017, and began to decline thereafter (Bank of International Settlements).

Source: People’s Bank of China

At the same time, Xi’s team has targeted overcapacity in industries such as steel and concrete through their “supply-side structural reform” program, and tried to encourage banks to lend more to small and medium-sized businesses (Trivium China, April 16). The leadership has claimed success in cutting overcapacity. For example, the northern province of Hebei, home to much of China’s steel production, claims it scrapped 69.93 million tons worth of excess steel production capacity from 2013 to 2017 (Xinhua, January 25), an amount equivalent to approximately 8.4% of China’s total production for 2017. (By comparison, Japan, the world’s second largest producer of steel, manufactured 104.8 million tons of steel in total in 2017 [1].)

The Price of Interconnectedness

But these successes have also highlighted the fragility created by a long dependence on easy money, heavy industry, and construction. For example, as deleveraging has begun to bite, China’s largest property developers have seen their stock values plummet (Wall Street Journal, June 28). Developers’ woes underscore the fact that the deleveraging campaign is, fundamentally, a process that creates winners and losers. For Beijing, the process would ideally direct capital to firms that will use it more efficiently, while avoiding panics as the assets of the “losers” are unwound.

But China’s high degree of interlending makes panics difficult to avoid. Rather than putting borrowed money to productive use, too many state-owned enterprises (SOEs) and financial firms have become accustomed to borrowing only to re-lend the money to someone else [2]. Private businesses have their own version of the problem: Because China’s banks prefer to lend to SOEs, private companies often band together in lending syndicates to borrow, lend, and guarantee one another’s debts.

In both cases, interconnectedness can conceal sources of underlying risk, and increase the likelihood that one firm’s failure can sink many lenders [3]. Such interconnectedness has already resulted in small, localized panics, despite the fact that deleveraging has, to date, been relatively mild (SCMP, April 9 2017; Reuters, August 20, 2015). In each case, the companies involved were not large, and local governments used their influence over area companies and banks to call a halt to any potential panic.

If a larger company, one with a national footprint, were to confront a similar situation, Beijing would probably use the same playbook to tamp down any broader economic repercussions. But Zhongnanhai would prefer to avoid such panics in the first place. That is why, in the past two years, it has sought to vastly increase the amount of information available to central and local governments on firms’ borrowing and lending behaviors, so disaster can be headed off before it strikes.

A Clearer Picture?

One of the most important ways Beijing has sought to improve the information it receives is by forcing banks to be more transparent about their lending activities. For example, a rule issued last year by China’s top banking regulator required banks to report the underlying assets and liabilities of their wealth management products on a weekly basis (Shenzhen Daily, May 17 2017). This was but one of a slew of similar measures that targeted China’s “shadow banking” sector, a vast pool of lending by non-banking companies that private companies rely on for funding.

Even more ambitious than new regulations is the wide deployment of so-called ‘credit committees’. Although such committees—which bring together a firm’s creditors to discuss how to manage its obligations—are common outside of China, they are typically only used after a firm encounters borrowing problems. China has begun to employ them in a preemptive fashion, to get a full picture of firms’ liabilities, and to make it more difficult for overextended companies to play creditors off one another. China had 12,836 such committees at the end of 2017. That number is probably much higher now (Macropolo, June 25) [4].

Beating the System

The current deleveraging campaign, although more determined than previous attempts, is far from the first attempt to fix China’s debt problem. And while credit committees have expanded the state’s insight into PRC business activities to an unprecedented degree, even they may not get Beijing the information it needs to direct the economy where it wants to go. There are already signs that the current deleveraging campaign is having unwanted consequences.

Although one of the stated goals of the campaign is to level the playing field for dynamic, innovative private businesses, the opposite appears to be happening. Choking off shadow lending has hit private firms much harder than the state sector (Nikkei Asia Review, July 6). While profits have increased for SOEs in the industrial sector, those of private businesses in the same sector have fallen precipitously (Yiqin Fu, July 5).

Credit committees and regulatory crackdowns might help Beijing to forestall panics. But, at least so far, they do not appear to have been effective in solving a more fundamental problem: politically connected firms’ preferential access to credit. This problem is, arguably, inherent to the PRC’s political economy. And as long as it remains, it is difficult to see how the deleveraging campaign will succeed.

Matt Schrader is the editor of the Jamestown China Brief. Follow him on Twitter at @tombschrader.

Notes

[1] The source for these statistics is the World Steel Association:

https://www.worldsteel.org/media-centre/press-releases/2017/world-steel-in-figures-2017.html

[2] Since such re-lending by SOEs is illegal in China, proof of its existence is typically anecdotal rather than empirical. However, academics using firm-level data have been able to demonstrate circumstantially that re-lending by SOEs is widespread. See, for example, Du, Li, and Wang (2016).

[3] It is worth noting that complicated borrowing structures that obscured underlying sources of liability—so-called “collateralized debt obligations”—were one of the key contributors to the United States’ 2008 financial crisis.

[4] China has not yet reported the number of credit committees created nationally in 2017. But in those instances where province-level data is available, figures show a substantial increase in the number of credit committees for the first six months of 2018. For more, see the Macropolo article linked above.