Azerbaijan–PRC Cooperation and the Strategic Consolidation of the Middle Corridor

Publication: Eurasia Daily Monitor Volume: 22 Issue:

By:

Executive Summary:

- Azerbaijan has pursued proactive diplomacy to strengthen its role as a transit hub since the beginning of Russia’s war against Ukraine in 2022, especially with the People’s Republic of China (PRC).

- Transit through Azerbaijan offers a sanction-free, resilient, and stable environment to facilitate overland PRC-Europe trade through the Middle Corridor, as seen already through the significant increase in freight traffic from the PRC to Azerbaijan.

- The construction of the newly dubbed Trump Route for International Peace and Prosperity (TRIPP), connecting Azerbaijan with its Nakhchivan exclave through Armenia, presents new opportunities to attract PRC investment and technological expertise for rail and port infrastructure.

Since Russia’s war against Ukraine began in 2022, Azerbaijan has pursued proactive diplomacy to engage a wide range of stakeholders and strengthen its transit role along the Trans-Caspian International Transport Route—commonly known as the Middle Corridor (see EDM, May 8, 2024, April 23). One of the key partners in this effort is the People’s Republic of China (PRC), as Baku seeks to cooperate in developing the Middle Corridor and solidifying its position as a regional transit hub (see EDM, May 1). This growing cooperation is not driven by Azerbaijan alone. The PRC itself has strong incentives to deepen engagement with Baku.

The PRC’s interest is shaped largely by Eurasia’s geopolitical volatility. The Israel-Iran conflict has increased uncertainty along transport routes through Iran, while expanding sanctions on Russia have discouraged companies from relying on the Northern Corridor. These dynamics have further elevated Azerbaijan’s strategic importance for the PRC.

Amid disruptions in both the northern and southern corridors, Azerbaijan has emerged as a critical logistics hub, offering a sanction-free, resilient, and stable environment to facilitate overland trade between the PRC and Europe through the Middle Corridor (see EDM, January 28). One reflection of the deepening cooperation can be seen in the rising number of block trains Azerbaijan has received from the PRC. In 2024, the country handled 287 block trains carrying more than 36,000 twenty-foot equivalent units (TEUs). In 2025, there has been an upward trend, with 199 block trains arriving between January and June alone, and projections suggesting the figure will exceed 400 by the end of the year. In addition to this, Azerbaijan Railways and China State Railway Group agreed to raise freight traffic on the Baku–Tbilisi–Kars line to as many as 10 trains a day, targeting to turn the Middle Corridor into a high-capacity artery between East and West (AnewZ, July 10; Caliber.az, July 25).

Azerbaijan’s cooperation with the PRC in the transport sector rests on two key factors. The first is attracting more cargo and improving operational efficiency along the Middle Corridor to further elevate its importance within Eurasia’s transport network. The second is easing logistical bottlenecks in the corridor by partnering directly with Beijing.

On the first front, Azerbaijan has actively engaged with major PRC ports across different regions. A notable outcome is the memorandum of understanding signed between Azerbaijan Railways CJSC (ADY) and Xi’an Free Trade Port Construction and Operation (Xi’an Port). Chinese coverage, however, refers to the Chinese partner in the deal as being Xi’an International Port Group (西安国际港集团), a separate but related entity. The agreement outlines cooperation in railway transport and transit, while also enabling the launch of a container yard with an annual handling capacity of 20,000 TEUs. Azerbaijan has gained access to Xi’an Port’s operating system, creating a more direct and integrated link between the PRC’s inland transport hub and the Middle Corridor (News.az, July 11).

By anchoring its logistics network in Xi’an—a central hub for PRC–Europe rail traffic—Azerbaijan is positioning itself not only as a transit country but also as a strategic partner in the PRC’s broader connectivity agenda. This integration reduces transaction costs, enhances predictability, and makes the Middle Corridor more competitive against alternative routes. In the long run, it could attract greater investment from PRC logistics and manufacturing companies, further embedding Azerbaijan into the PRC’s Eurasian transport strategy.

Beyond Xi’an, Azerbaijan has also expanded its cooperation with other key PRC ports. It signed a contract with Qingdao Port and is in discussions to establish a regular rail service along the Lianyungang–Baku route. This strategic diversification effort is not a coincidence. While Xi’an functions as a major consolidation hub for inland PRC cargo, Qingdao and Lianyungang rank among the world’s largest maritime ports with direct sea access (Azernews, April 17, 2024; Caspian News, January 14).

Their inclusion allows Azerbaijan to tap into a far broader cargo base—encompassing not only PRC exports but also maritime flows from South Korea, Japan, and other Southeast Asian economies. By integrating these maritime gateways, Azerbaijan aims to position the Middle Corridor as a competitive land-sea alternative for East Asian goods bound for Europe, offering a faster and more resilient option compared to the longer maritime route through the Suez Canal.

Azerbaijan has also deepened cooperation with the PRC to ease logistical challenges. A notable example is the tripartite agreement between Azerbaijan, Kazakhstan, and the PRC to establish an intermodal cargo terminal at the Port of Alat. The new terminal will synchronize railway and ferry schedules, directly reducing delays caused by transshipment bottlenecks, scheduling conflicts, and operational handoffs. This project is expected to boost container traffic by making the Middle Corridor faster, more reliable, and cost-effective (see EDM, August 12, 2021, April 23; The Times of Central Asia, November 12, 2024).

In parallel, Azerbaijan is tackling capacity constraints on its domestic rail network through a strategic agreement with CRRC, the PRC’s leading rail manufacturer, to procure seven new locomotives and spare parts. A second phase will expand this acquisition with 14 additional mainline locomotives. This investment ensures sufficient traction power to accommodate the rising freight volumes generated by the corridor’s growth. The new locomotives will strengthen Azerbaijan’s capacity not only along the East–West axis of the Middle Corridor but also on the North–South transport route (Report News Agency, April 29).

Azerbaijan’s multifaceted approach to cooperation with the PRC is designed to strengthen its position as a key transit country in East–West trade while optimizing the long-term efficiency and capacity of the Middle Corridor. Recent developments suggest this cooperation is likely to deepen further, particularly in light of broader regional diplomatic shifts.

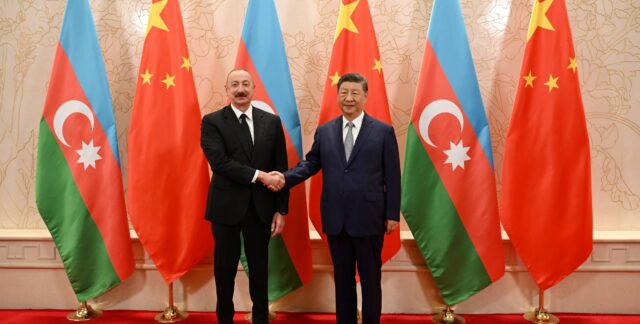

On August 8, Armenian Prime Minister Nikol Pashinyan and Azerbaijani President Ilham Aliyev signed new strategic agreements with the United States, followed by a joint declaration committing both countries to a peaceful resolution of their decades-long dispute (see EDM, August 12; see Strategic Snapshot, August 13). A central element of this agreement is the mutual recognition of borders and the creation of a new transit corridor linking Azerbaijan proper to its exclave of Nakhchivan through southern Armenia (Azernews, August 14).

This project, branded the Trump Route for International Peace and Prosperity (TRIPP), will be managed by a U.S.-backed consortium under a 99-year mandate. Stretching from Türkiye in the west to the Caspian Sea in the east, the TRIPP offers an additional South Caucasus transit branch that complements the existing Georgia route (see EDM, September 3, 8). The diversification of routes aligns closely with PRC interests, as it reduces geopolitical risk and increases the resilience of supply chains (Azernews, August 14).

For Azerbaijan, the TRIPP presents new opportunities to attract PRC investment and technological expertise for rail and port infrastructure, enabling it to handle more diversified cargo flows. For the PRC, it strengthens logistics flexibility and enhances the Middle Corridor’s appeal as an alternative to the Northern Corridor transiting Russia, and enhances transit links to aid the PRC in avoiding maritime trade networks that are policed by the United States and allied navies (see China Brief, June 21, 2024).

While cargo growth and logistical efficiency remain the main drivers of Azerbaijan–PRC transport cooperation, the evolving geopolitical landscape could further amplify their partnership. By adding new transit routes, Azerbaijan not only consolidates its hub status but also integrates the South Caucasus more deeply into global logistics chains—where the PRC is set to play a central role.