China’s Engagement with Peru: An Increasingly Strategic Relationship

Publication: China Brief Volume: 11 Issue: 21

By:

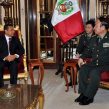

In the first weeks of November 2011, a series of independent events in the diplomatic, economic and security domains highlight how the new Peruvian government of Ollanta Humala is using the previous governments’ initiatives to become a key partner for China in Latin America, deepen that relationship and take it in important new directions. November began with a visit to Peru by Vice Chairman of the Central Military Commission Guo Boxiong to Peru, signing two important cooperation accords involving arms and training. Meanwhile, Peru’s capital Lima, which hosted the 2008 APEC summit, was preparing to host hundreds of Asian and Latin American businessmen at the Fifth Annual China-Latin America Business Summit. Simultaneously, President Humala left for the 2011 APEC summit in Honolulu, which will include a publicly announced meeting with Chinese President Hu Jintao.

The relationship between Peru and China is essentially a story about Chinese access to primary products and Peru’s physical position as a gateway from Asia to the markets of Brazil and other countries of the southern cone. It is also a relationship that is becoming increasingly important for both countries and behind its apparent simplicity are social and political dynamics, which could propel it in a number of directions. Such scenarios include the diversification of productive engagement, devolution into a client state dependent on Chinese loans and investments—as seen in nearby Venezuela and Ecuador—or a breakdown of the relationship with recriminations amidst expanding hostility and social conflict in Peru itself (For the Venezuelan example, see "China’s Cautious Economic and Strategic Gamble in Venezuela," China Brief, September 30).

In economic terms, Peru’s relationship with China indeed is dominated by efforts by Chinese companies to acquire metals through both purchases on commodity markets, and direct investments in the country. Trade statistics show four products responsible for 83 percent of Peruvian exports to China: copper (and related products), iron, lead and fishmeal (Andina, October 6). In Peru itself, in search of secure supplies of such materials, Chinese companies have invested $1.2 billion to acquire rights to mines, and have announced plans to invest almost $11 billion more in coming years to exploit the assets that they have acquired. Such investment is, however, concentrated in a small number of major projects which may or may not happen in the announced fashion.

Virtually all Chinese investment in Peru is encompassed by five projects: (1) an announced $1.2 billion investment by the Chinese firm Shougang to expand its mine at Marcona in the province of Ica; (2) a $2.2 billion investment by China Aluminum Corporation (Chinalco) to develop the Toromocho mine in the Junin region; (3) a $1.44 billion investment by China Minmetals and the Zijin Mining Group in the Rio Blanco mine in Piura; (4) a $2.5 billion investment by Jiangxi Copper to develop the Galeno mine in Cajamarca; and (5) a plan still in a more preliminary stage for the Chinese firm Nanjinzhao to invest $2.5 billion develop a mineral field at Pampa de Pongo (Andina, August 4). When all publicly announced national and international investment in Peru’s mining sector is considered, almost a quarter of all such anticipated investment come from these Chinese projects. The figure could rise with acquisitions of other Peruvian mining interests by Chinese companies—particularly if the new Humala administration begins to take actions that convince Western mining companies to leave Peru, creating an opportunity for Chinese companies to fill the void (Andina, July 29).

Beyond mining, Chinese companies also play a key role in Peru’s other two major primary product sectors. Although no Chinese company is a major operator in the oil and gas sector, China National Petroleum Company (CNPC) in 2003 acquired a 45 percent stake in PlusPetrol Norte—currently a major player in multiple Peruvian oil and gas projects ("Peru," Energy Information Administration, April 2011). In agriculture, the Hong Kong-based China Fisheries Group progressively has expanded its fishing quota in Peru through over $400 million in small acquisitions of fishing fleets and coastal processing facilities—the most recent of which came this month.

Commodity purchases and investments by Chinese companies in the aforementioned sectors have made China an increasingly important export destination for Peru. Indeed, during the global economic crisis of 2007-2008, sustained demand from China helped the Peruvian economy compensate for the falloff in demand from traditional partners such as the United States. Thanks to the expansion of commodity exports to China and boosted by high, sustained international commodity prices, China surpassed the United States as Peru’s principal trading partner by the third quarter of 2011.

Looking at a relationship from a Chinese rather than a Peruvian perspective, it is also important to note Peru’s importance to China as a market for Chinese companies seeking to move up the value-added chain and as a point of access to other markets in the region. With respect to Peru itself, although the nation’s 29.5 million people and $275 billion GDP are only one among many mid-sized markets in the region, the importance of countries such as Peru increases as traditional markets for Chinese products such as the United States and Europe remain stagnant. Moreover, the concentration of middle-class consumers in the greater capital region of Lima represents an important opportunity for sectors for Chinese companies—including automotive, consumer electronic, computer, and telecommunication firms—looking to expand.

With respect to geography, Peru’s physical location on the Pacific side of Latin America has given the nation a special link to Asia since the Spanish colonial period. Under Spanish rule, Lima, was not only a political capital, but a major commercial hub and key to the limited quantities of trans-pacific trade then occurring. Later, with the economic and political collapse of China at the end of the 19th Century, Lima became a key destination for Chinese immigrants, giving Peru today one the largest concentration of ethnic Chinese in Latin America. In 1998, propelled by its geography and historic ties to the region, Peru become the third and last Latin American nation accepted into the Asia-Pacific Economic Cooperation forum, although others such as Colombia and Ecuador have tried unsuccessfully to join in recent years. In 2008, the Alan Garcia administration leveraged this membership to host the annual APEC summit and thus showcase its role as a potential nexus for commercial relations between Latin America and China. At the summit, Peru also announced the conclusion of a free trade agreement with China, signed in 2009, through which it hoped to further strengthen its position in this regard, following on the heels of the FTA that Peru’s sometimes rival Chile signed with China in 2006.

Peru also has sought to promote its role as a hub for commerce with Asia by building physical infrastructure linking its Pacific-coast ports to the Amazon Basin. The first such project, completed in December 2010, was the “Bi-oceanico Sur,” linking the Peruvian port of Ilo to the Brazilian Amazon Basin, allowing Chinese consumer products and intermediate goods to more economically reach Brazilian interior cities such as Manaus, or vice versa. Peru almost has completed a parallel corridor across the north of the country from the Port of Paita and is contemplating a central corridor from the port of Callao south of its capital city of Lima. The latter however faces obstacles because of the need to cross an environmentally protected area (El Comercio, April 25).

In addition, Peru’s geographic position also makes it relevant to efforts by other South American countries to expand their own commercial relations with China. The corridor currently under construction that will link Brazil to the Ecuadoran port of Manta, for example, crosses Peruvian territory as is also the case with a corridor from Bolivia that will reach the Pacific coast at the Peruvian port of Ilo, where La Paz has duty-free access by past agreement between the two countries. Beyond these road connections, Peru’s expanding commerce with China is also driving the transformation of its new privatized port infrastructure, including a new mineral dock in the port of Callao, as well as improvements and expansion of capacity at the port of Paita, in the north, and Tacna and Ilo in the south, among others (Andina, July 27).

Another key part of Peru’s bid to expand its business with China—and to serve as a key hub for other nations in the region seeking to do so—has been the nation’s development of an intellectual infrastructure for doing business with Asia and Asian companies. This has included the expansion of China-oriented language and business programs, such as those at the prestigious University of Lima, as well as the private university “La Catolica.” China and Peru also established six Confucius Institutes for the study of Chinese language and culture—more than any other country in Latin America [1]. Peru’s position has also benefitted from the efforts of government and private-industry groups to promote its trade with China, including activities of the Peru-China Chamber of Commerce (CAPECHI), ProInversion and PromPeru.

While Peru’s relationship with China has been primarily economic in character, it also has a modest security component. In 2010, Peru almost became the first nation in Latin America to purchase armored vehicles from China. The procurement of Chinese MBT-2000 tanks, which had been displayed in a military parade in Lima in 2010 was cancelled only because of the inability to resolve problems with the Ukrainian supplier of engines for the vehicles (El Comercio, April 25). Nor was this the first contemplated purchase of Chinese equipment. In 1993, the Peruvian National Police purchased five Chinese Y-12 light transport aircraft, and in 1995, the Ministry of Defense purchased Chinese tractors and heavy equipment for its engineering units, although the government has been disappointed with the reliability of the equipment in both cases. In 2007, the Peruvian National Police (PNP) almost purchased several hundred Chinese police cars via the Korean company Daewoo, although in the end, the deal was cancelled and the surrounding scandal forced the resignation of the minister responsible for the purchase.

Peru and China also have had a significant volume of military-to-military contacts in recent years, at all levels. In November 2010, a Chinese delegation led by the Chief of Staff of the Chinese General Staff General Chen Bingde traveled to Lima to conduct a bilateral humanitarian exercise with Peru, including delivery of a mobile field hospital to the 1st Brigade of the Peruvian Special Forces. The event represented the first bilateral exercise between the PLA and a Latin American country, although the PLA has had a presence in the multilateral peacekeeping force in Haiti, MINUSTAH, since September 2004. Most recently, in November 2011, the Vice-President of China’s Central Military Commission, General Guo Boxiong visited Peru with an agenda that included, among other issues, the signing of two military cooperation agreements, including the possible transfer of training, engineering vehicles and mobile hospital equipment (Andina, November 2). Military-to-military contacts also continue at lower levels with visits by two to three Peruvian military officers to Chinese institutions each year, including the PLA National Defense University in Beijing, as well as to lower-level institutes in Nanjing and other parts of the country.

The most serious issues that China is likely to face in Peru will arise from the growing physical presence of its companies and projects in the country, including security of its people and operations, and the protection of its investments.

Although Chinese companies are attempting to learn from past mistakes and adapt to the Peruvian environment, to date, they have experienced difficulties with virtually every major project that they have initiated in the country. Since the Chinese firm Shougang acquired the iron mine at Marcona in 1993, for example, the mine has been beset by strikes and fights with the government over compliance with promised investments and Peruvian labor and environmental laws. In the most recent such incident to date, in September 2011, the political and economic significance of the strike prompted Peru’s Vice President Marisol Espinoza to personally take the complaints of the workers before the Peruvian National Congress (Andina, September 8). Beyond Shougang, China Aluminum Corporation (Chinalco), which acquired rights to the Toromocho mine when it purchased Peru Copper in 2007, has had difficulties in taking the project forward due to dissatisfaction of local residents regarding its handling of the required relocation of the town of Morococha, which is on top of the mine site. Additionally, at the Rio Blanco site, the Zijin group and China Minmetals have had their own problems with the local population, stemming in part from the proximity of the mine to one of Peru’s principal sites for the growth of poppies for illicit heroin production. The problems have included violent protests and the mysterious murders of two locals in the town of Huancabamba.

An increasing challenge associated with labor difficulties and other forms of unrest is the physical protection of Chinese mining operations. Violent incidents elsewhere have affected Chinese firms, such as clashes in Tarapoa Ecuador in November 2006 and Orellana Ecuador in June 2007. Taken with the violence in Bagua, Peru, involving disputes over the activities of others in Peru’s extractive sector that are similar to what Chinese companies are now doing, these incidents suggest Chinese firms eventually are likely to encounter even more serious security problems in the future. In preparing for such challenges, Chinese firms are hampered by their caution in working directly with Latin American military and police forces, due to concerns about local and U.S. perceptions. In this context, the relatively limited experience of Chinese firms in integrating local private security forces into their operations raises the dual risk that such security forces will either be ineffective, or conversely, will react to an attack in a way that inflames the situation.

A great deal of China’s position in Peru is likely to be defined in the coming six months to a year, as the new Humala regime in Peru addresses challenges presented by the Chinese presence in the country and explores associated opportunities. On one hand, President Humala built much of his political support base around the rights of the economically marginalized peoples of Peru’s long neglected mountain and jungle regions. His key constituency probably will apply pressure to protect their interests in fights with miners, oil companies, and other multinationals—whether Chinese or of other origin. On the other hand, Humala also will be tempted to follow the model adopted by Hugo Chavez in Venezuela and Rafael Correa in Ecuador of using Chinese loans and investments as a substitute for Western capital, particularly if other policies of his administration begin to push Western investors out of Peru.

To date, the indications of which course Humala will pursue has been mixed. With respect to economic issues of importance to the Chinese, Humala has, to date, pursued a cautious course that appears modeled after the pragmatism of Brazil’s former president Lula. Publicly, Humala has embraced engagement with China, including a possible trip to China in early 2012. With respect to mining, Humala has convinced the Chinese to renegotiate their royalties, increasing revenues to the State, While Chinese firms have thus far accepted the demands of the new administration, they are likely waiting to see whether their acquiescence has bought peace with the new administration, or whether such demands are only the beginning of a larger problem.

Reciprocally, the Chinese have only begun to move forward with their investments in Peru. If the conflicts seen to date with companies such as Shougang prove typical, it will be an open question whether the internal political costs of broadening Chinese loans and investments in Peru is something that President Humala will be able to pay.

Notes:

- “Confucius Institutes Around the Globe,” University of Nebraska-Lincoln, https://confuciusinstitute.unl.edu/institutes.shtml#Peru, accessed November 8, 2011.