China’s Strategic Recalibration in Burma

Publication: China Brief Volume: 13 Issue: 9

By:

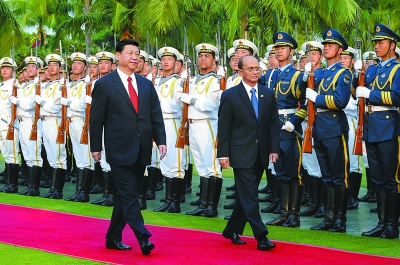

When Chinese President Xi Jinping met with his Burmese counterpart U. Thein Sein in Sanya on April 5, the usual sunny platitudes about enhancing “all-round cooperation” were dampened by veiled references to the threat of Western encroachment in the Southeast Asian country and the rocky road Chinese companies are now facing there (South China Morning Post, April 7; Ministry of Foreign Affairs, April 6).

China’s unease at the state of one of its most important bilateral relationships should come as no surprise. Since Burma began embracing reform and openness in 2011, Beijing has seen its traditional dominance steadily erode. Concurrently China feels that its interests are threatened as Western countries enter the fray while the increasingly vocal population turns against it (“Burma and China: The Beginning of the End of Business as Usual?” China Brief, November 30, 2011). Some Chinese officials now openly admit they initially massively underestimated the democratic turn in the country and overestimated their own influence there (The Irrawaddy, April 9).

In response, over the past few months, China has embarked on a strategic recalibration campaign in Burma. By revising its diplomatic approach, increasing its leverage in the ethnic conflicts the government in Naypyidaw is facing and adjusting to the changing business landscape, Beijing is seeking to use its resources and influence to adapt to a fast reforming Burma in order to preserve its critical interests there in the coming years.

China and Burma often refer to their ties as a paukphaw (sibling) relationship, which conveys both its deep and asymmetric nature. Burma was the first non-socialist country to establish ties with the People’s Republic of China in 1949, and then Chinese premier minister Zhou Enlai and his Burma counterpart U Nu enjoyed a close relationship (The Irrawaddy, April 10). Relations soured in the 1960s when Beijing supported communist rebels in Burma, but they improved quickly after the military junta seized power in 1988. Faced with Western sanctions, an impoverished Burma increasingly turned to China for support, and Beijing obliged as border trade officially opened in 1988 and military assistance began in 1989. Over the past few decades, China has emerged as Burma’s largest foreign investor and trading partner, and both sides inked a comprehensive strategic partnership in 2011 during then-President Hu Jintao’s first meeting with President Thein Sein (Xinhua, May 27, 2011).

China’s currently has several important interests in Burma. First and foremost, China desires stability in its 2,200km border with Burma which is both frequently plagued by ethnic conflict, drug trafficking and HIV/AIDS and also hosts the multi-billion dollar border trade critical to its southwestern Yunnan province as well as the over two million estimated Chinese nationals in Burma. Second, Beijing wants to protect its lucrative investments in Burma. China alone accounts for nearly half of Burma’s foreign direct investment and more than a quarter of its trade, with Chinese companies involved primarily in the country’s extractive and hydropower sectors critical to Beijing’s development (China Daily, January 16). Third, China views Burma as significant geopolitically, because it is a gateway to the Indian Ocean, thereby mitigating Beijing’s overreliance on the Straits of Malacca. The ultimate prize in this regard is a $2.5 billion, 800-kilometer Sino-Burma oil and gas pipeline project from the west coast of Burma into China, which is expected to start pumping gas on May 31. This pipeline should reduce China’s dependence on the Straits of Malacca by one third and cut 1,200 kilometers off the normal route through the Straits, across the South China Sea and up the coast to Chinese ports (China Daily, January 22). Lastly, Burma is also a vital partner within the Association of Southeast Asian Nations (ASEAN), and Beijing has looked to it for support on regional issues like the South China Sea and joint patrols along the Mekong River (“China Pushes on South China Sea, ASEAN Unity Collapses,” China Brief, August 3, 2012; “Mekong Murders Spur Beijing to Push New Security Cooperation,” China Brief, November 11, 2011).

Each of these four key interests has been directly threatened since Burma’s reformist turn in 2011. Billion-dollar infrastructure projects backed by Beijing, like the Myitsone dam and the Letpadaung copper mine, have been suspended due to rising anti-Chinese sentiment among opposition parties and the public at large, spooking some firms and causing Chinese foreign direct investment into Burma to plummet by nearly 90 percent last year. Stronger U.S.-Burma ties—as evidenced by the gradual lifting of sanctions and Naypyidaw’s participation in the Cobra Gold military exercises this year—have reinforced Chinese fears about Washington’s desire to contain it (The Irrawaddy, April 9). Meanwhile, the Kachin conflict flaring in northern Burma has been a growing border stability concern for Beijing with artillery shells landing inside China earlier this year leading to strong rebukes from the government (Ministry of Foreign Affairs, January 18).

In light of these setbacks and their impact on its strategic interests, China has been recalibrating its strategy in Burma over the past few months. First, Beijing has made some important personnel shuffles in the last few weeks, which indicate a shift in its diplomatic approach. On March 11, Beijing appointed retired 71-year-old Vice Foreign Minister Wang Yingfan as its first ever special envoy for Asian affairs, with a specific mandate to prioritize Burma because “there have been too many issues recently” (China Daily, March 12). Wang has since been meeting opposition politicians and civil society groups as well as speaking with unprecedented candor about the need for Beijing to reform its image in Burma as part of a broader effort to diversify China’s relationships there (The Irrawaddy, March 18). Beijing also replaced its ambassador to Burma, Li Junhua with Yang Houlan, an experienced Asia hand who presented his credentials to President Thein Sein on March 29 in Naypyidaw (Xinhua, March 29). Some say Yang’s appointment is designed to signal a new Chinese strategy to engage with the reforms happening in Burma after years of failure under his predecessor Li (The Irrawaddy, March 22).

Second, China has adopted a more aggressive approach to dealing with the ethnic groups waging rebellions against Naypyidaw to increase its leverage in Burma relative to other players. On the one hand, after shying away from such a role for years, Beijing played an unprecedented role in facilitating peace talks between Naypyidaw and the Kachin Independence Organization (KIO) in February, partly to preempt potential efforts by the United States to otherwise do so (Asia-Pacific Bulletin, February 20). China has since hosted two rounds of talks since then, and Beijing has sent senior officials and played a major role in both. Some reports suggest the third round of negotiations were postponed earlier this month because China leaned on the Kachin rebels to decline the meeting, fearing potential involvement from the United Nations, Britain and the United States and desiring a stronger tripartite role for itself which would constitute interference in Burma’s internal affairs (The China Post, April 17; Eleven Burma, April 10).

As a stick to accompany the economic carrots it has used to entice the Burmese government, Beijing also has supported certain ethnic-based rebel groups to further its security interests. In a clear example, despite vociferous Chinese denials, observers have noted that Beijing has scaled up its secret military assistance to the United Wa State Army (UWSA)—the largest rebel group in Burma. While analysts have long suspected that China unofficially has been supplying weapons to the UWSA, Jane’s Intelligence Review suggested in a December report that new, larger transfers—which include surface-to-air missiles and, for the first time, 12 armored vehicles known as “tank destroyers”—were designed to prevent Naypyidaw from launching a full-blown military offensive there against Burma’s most powerful ethnic militia, which could spill over into Chinese territory as the Kachin case clearly illustrated (Voice of America, January 25).

Third, despite recent setbacks, Chinese companies are demonstrating their capacity to adapt to Burma’s changing political climate. Big Chinese firms—e.g. China National Petroleum Corporation, which is in charge of Beijing’s prized oil and gas pipelines—are now trying to invest more in helping local communities build hospitals, schools and other facilities (Financial Times, April 16). Companies also are launching public relations campaigns to improve their image. Since controversy erupted over the Letpadaung copper mine near Monywa in central Myanmar, the usually low-profile Wanbao Mining Ltd. has initiated an intense lobbying initiative. These steps have even included taking risks such as allowing interviews with Western media outlets featuring its president Chen Defang (Wall Street Journal, March 25). Bidding strategies are also shifting as demonstrated by China Mobile uncharacteristically teaming up with Vodafone to bid jointly for Burma’s lucrative telecom licenses (South China Morning Post, April 5).

Chinese firms clearly are receiving encouragement from Beijing in their efforts. China’s newly-installed special envoy for Asian affairs Wang Yingfan has attempted to help stem local discontent in Burma by repeatedly admitting that Chinese firms need to improve their weak public relations record and that some of the concerns Naypyidaw has about specific infrastructure projects are well-founded (The Irrawaddy, March 18; Eleven Burma, March 17). Meanwhile, on March 1, the Ministry of Commerce and Ministry of Environmental Protection jointly released new guidelines to help Chinese firms engage in corporate social responsibility in overseas markets like Burma amid growing criticism they had received on that score (China Daily, March 1).

China hopes that its strategic recalibration in Burma will grant it greater leverage to protect its vital interests and prepares it for a much more competitive landscape there. The effort, however, also has its limits. More engaging diplomats and marginal improvements in corporate social responsibility may not be sufficient to reverse the fierce anti-Chinese sentiment already stoked by specific infrastructure projects and Beijing’s chosen role in Burma. The same Chinese fears over increased Western involvement in Burma, which partly prompted its policy review could also lead to serious tensions in the bilateral relationship, further alienating Naypyidaw and pushing it even closer to other actors including the United States. Beijing’s more aggressive role with respect to sensitive issues like ethnic rebel groups in Burma will likely buy it less, not more influence in Naypyidaw as China is seen as an increasingly untrustworthy partner interfering in internal affairs.

While it is too early to assess the prospects for China’s strategic recalibration in Burma, one thing is clear. After some initial missteps, Beijing has regained its footing in Burma and is adapting shrewdly to the new environment. Those prematurely writing China off should take note. With so much at stake in Burma, Beijing is not going down without a fight no matter the odds.