Demystifying ‘De-Risking’: Can the PRC Sell to Countries and Coerce Them at the Same Time?

Publication: China Brief Volume: 23 Issue: 14

By:

Introduction

With the rapid growth of its economic and diplomatic power, the People’s Republic of China (PRC) has cultivated diverse new connections with the societies of other states. These connections, most often deriving from economic activity, have given the PRC methods to influence the political directions of foreign countries. Network engagement through United Front Work and the Ministry of State Security, the influx of corrosive PRC capital, and predation of Chinese diasporic communities all find their origin through these channels of communication (Joske, 2022). This wide set of tactics is now loosely referred to as Chinese “foreign influence” or gray zone political warfare (IRSEM, 2021). Despite the notoriety of this issue, there remains little clarity about which connections with China actually lead to influence (Tiffert, 2020).

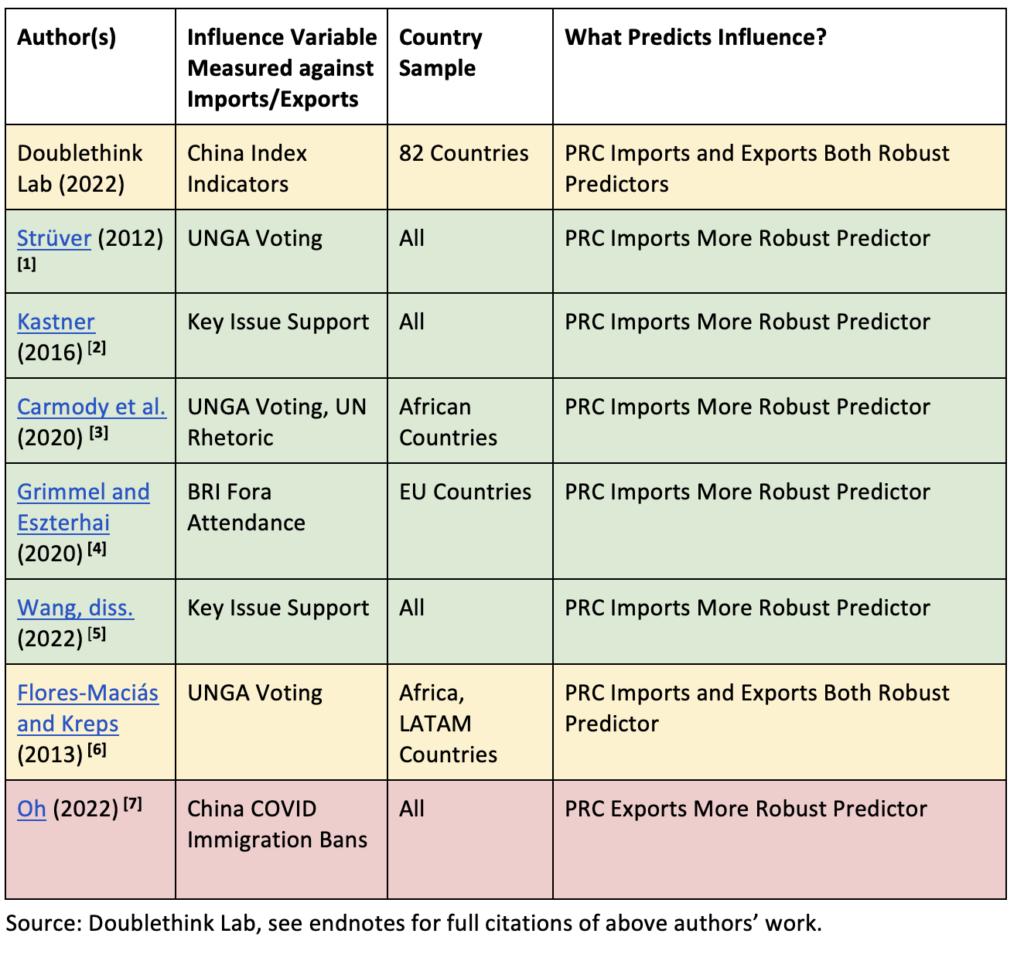

Meanwhile, the recent “de-risking” discourse of China policy centers on what kinds of economic linkages with the PRC create vulnerabilities. The de-risking debate in part refers to Beijing’s ability to leverage trade relations with other states to coerce them into favorable policy positions (Brookings Institution, 2023). To date, scholars have employed a variety of methods to test whether trade linkages actually predict the PRC’s influence in other states. A curious result of this research is that when scholars separate trade into imports and exports, the degree a country imports from China serves as a robust predictor of influence, equal to or exceeding the predictive power of exports to China. This result is rather counterintuitive, and generally outside the predictions of researchers. When theorizing the relationship between trade and influence, analysts usually focus on countries’ exports to China as a vector for Beijing’s leverage (Strüver, 2012).

Devising satisfying measures for the PRC’s influence in foreign countries is not easy. Identifying and assessing these methods represents a key stumbling block of the nascent PRC foreign influence field. When testing for Beijing’s influence, academics generally study the presence of decisions or outcomes in target countries favorable to the PRC. While some of these outcomes may be attributable to chance—or natural similarities between certain regimes and the PRC—researchers assume that a non-negligible proportion of these outcomes were stimulated by influence from PRC actors.

Researchers test for Beijing-friendly outcomes in several ways, from examining levels of agreement with China in UN General Assembly voting, to countries’ rhetorical positions on diplomatic issues considered to be of vital importance to Beijing (such as the genocide of Xinjiang Uyghurs) (Ma and Shen, 2022). “The China Index”, a PRC influence measurement tool developed by Doublethink Lab, examines influence effects across a broad spectrum that encompasses economic, diplomatic, and societal phenomena, among other factors (China Index, 2022). Each of these methods has been used to recreate the finding that high import volumes from China have a robust correlation with influence. Notably, Doublethink Lab finds imports and exports both constitute strong predictors of Chinese influence, depending on how trade is measured. The table below outlines the findings of relevant studies. However, despite broad agreement regarding the connection between PRC imports and influence, few satisfying explanations have emerged.

Where Lies the Power to Coerce?

When observers focus on the vulnerabilities that trade with China may pose to countries, they generally focus on the power of Beijing to wield trade as coercive leverage. The PRC has a history of cutting off the exports of countries from Norway to Mongolia to punish objectionable policies (European Parliament, 2022). Furthermore, influential thinkers on how trade begets interstate coercion, such as Albert Hirschman, encourage us to focus on one country’s exports to another as its source of vulnerability (Laurenceson, Zhou, and Pantle, 2020). The same focus on coercion—that draws observers towards exports—makes explaining the relationship between Chinese imports and influence so challenging. How can the PRC sell to countries and coerce them at the same time?

To be sure, the goods countries import from China, whether essential manufacturing intermediate goods or the rare earth metals required for electronics production, are vital to their economies and the costs would be devastating were that trade severed (United Daily News, 2022). Beijing has cut off the supply of critical rare earths to a country in one notable instance: to coerce Japan in 2010 over a territorial dispute (New York Times, 2010). Other instances of the PRC choking off what countries import from it are hard to find. For high import volumes to be a direct cause of countries accommodating Beijing’s interests, governments must genuinely believe that the PRC will embargo what it sells to them if they stray from Beijing’s demands. It is possible this consideration may deter countries from risking a trade war with China. However, with few cases of this kind of coercion, it is not immediately convincing that states fear that the PRC will no longer sell goods to them should they enact more everyday policies that are disadvantageous to Beijing.

Deficits and Dependency

While import trade in itself may be the source of Beijing’s influence over other states, it is also possible that high import volumes offer indirect routes for the PRC to exert coercive influence.

China’s economy is export-driven, and China consistently sells more than it buys from other states (OEC, 2023). Unsurprisingly, countries that import more from China tend to run trade deficits with the country. In the 82-country sample of Doublethink Lab’s China Index, 70 countries ran trade deficits with the PRC (the countries imported more than they exported to China). Of these 70 countries, 51 conducted trade deficits with the entire world. In any ordinary circumstances, the values of these currencies and, especially, the US dollar—the world’s medium currency of trade—would devalue against China’s renminbi. However, Beijing has long taken extensive and wildly successful measures to fix the value of its currency against the dollar, preserving a value of around 7 to 8 renminbi to the dollar for several decades (Mertens and Schultz, 2017). This outcome has been no easy victory, requiring the PRC to reinvest vast proportions of its profits into the world economy and foreign nations in the form of bond purchases, direct loans, and the acquisition of foreign currency and assets (Capiello and Ferrucci, 2008).

Only through these interventions has Beijing been able to prevent its currency from appreciating and thus protect its export-driven growth model, which hinges on countries having cheap access to renminbi. As a result, countries around the world have taken on large debts from the PRC or auctioned off their assets under a mutually-beneficial arrangement that allows them to keep buying China’s goods (Horn, Reinhart, and Trebesch, 2022). The cumbersome debt agreements that countries have entered into with China offer another plausible explanation for how high import volumes connect to influence. No shortage of research has examined how the PRC employs debt and investment to influence foreign states (Verhoeven, 2022). Beijing has employed debt negotiations around the world to obtain security benefits, from securing territory from Tajikistan to obtaining cheap oil supply from Ecuador (Facebook, 2020; Torres, 2020). Especially with developing countries—whose weaker credit ratings prevent them from issuing sovereign bonds—the terms for direct debt agreements that provide capital for imported Chinese goods are often opaque or confidential (Trebesch and Horn, 2021). It is not inconceivable that they could contain terms for foreign policy concessions that the PRC seeks.

The relationship between imports, debt, and PRC influence outcomes is presently understudied. In the coming months, Doublethink Lab will release a report examining these relationships in order to uncover the mechanisms by which imports lead to influence.

Conclusion: Imports from the PRC are not Without Side Effects

Whether the PRC import and influence relationship is explained by economic coercion or a more indirect process leveraging debt or investment, policymakers must factor import volumes from China into assessments regarding vulnerabilities to PRC influence. To be sure, policymakers are presently relitigating their countries’ dependencies on China’s imports due to concerns that trade could halt via newfound wars and pandemics. However, this analysis generally focuses on the economic damage that would occur were trade stopped by black-swan events, not on how imports fosters persistent PRC influence over countries’ societies, political systems, and diplomacy (CSIS, 2020). When exploring how Beijing can wield trade as leverage, observers must move beyond incomplete assessments focusing solely on exports to China and the ensuing potential for economic coercion. While economies have benefited greatly from the cheap capital and consumer goods offered by China, policymakers and business leaders alike should consider whether large import volumes from the PRC could be exposing their countries to Beijing’s influence. More research is forthcoming in this area, and with it governments around the world can better understand how to de-risk multifaceted trade relations with China.

Notes

[1] Strüver, Georg. “What Friends Are Made Of: Bilateral Linkages and Domestic Drivers of Foreign Policy Alignment with China.” German Institute of Global and Area Studies 209 (November 2012). https://www.jstor.org/stable/resrep07507.

[2] Kastner, Scott. “Buying Influence? Assessing the Political Effects of China’s International Trade.” Journal of Conflict Resolution 60, no. 6 (September 2016): 980-1007. https://www.jstor.org/stable/24755936.

[3] Carmody, Pádraig, Niheer Dasandi, and Slava Jankin Mikhaylov. “Supporting Information: Power Plays and Balancing Acts: The Paradoxical Effects of Chinese Trade on African Foreign Policy Positions” Political Studies 68, no. 1 (March 2020): 224-246. https://journals.sagepub.com/doi/suppl/10.1177/0032321719840962/suppl_file/PSX840962_Supplemental_material.pdf.

[4] Grimmel, Andreas and Viktor Eszterhai. “The Belt and Road Initiative and the Development of China’s Economic Statecraft: European Attitudes and Responses.” International Studies 57, no. 3 (May 2020): 223–239. https://doi.org/10.1177/0020881720925223.

[5] Wang, Yuelin. “Assessing China’s Economic and Political Power Play.” MA diss., Duke University, 2022. https://dukespace.lib.duke.edu/dspace/handle/10161/26887.

[6] Flores-Macías, Gustavo and Sarah Kreps. “The Foreign Policy Consequences of Trade: China’s Commercial Relations with Africa and Latin America, 1992–2006.” The Journal of Politics 75, no. 9 (April 2013): 357-371. https://doi.org/10.1017/s0022381613000066.

[7] Oh, Yoon Ah. “The Vulnerability Effect that Wasn’t: Trade Dependence and Entry Bans on China at the Beginning of the COVID-19 Pandemic.” Asian Survey 62, no. 4 (July/August 2022): 721-750. https://doi.org/10.1525/as.2022.1711062.