Disposing of “Zombies”: Why the Reform of Non-Performing State-Owned Enterprises Has Gotten Even Harder

Publication: China Brief Volume: 20 Issue: 5

By:

Introduction

Normally at this time of year, the Chinese Communist Party (CCP) and the People’s Republic of China (PRC) government would be holding the large plenary meetings known as the “Two Sessions” (两会, lianghui). China watchers would be monitoring these meetings to assess whether and how the CCP is achieving its 2020 goal of achieving a “moderately prosperous society” (小康社会, xiaokang shehui). However, the COVID-19 outbreak (China Brief, multiple dates) has not only halted key meetings (National People’s Congress, February 27), but has also put into question many of China’s economic goals. This includes key goals discussed at the Central Economic Work Conference (CEWC) held in December 2019, which focused on “three categories of risk: financial, environmental, and external” and “identified six areas of priority for China’s 2020 economic policy agenda” (China Brief, December 31, 2019).

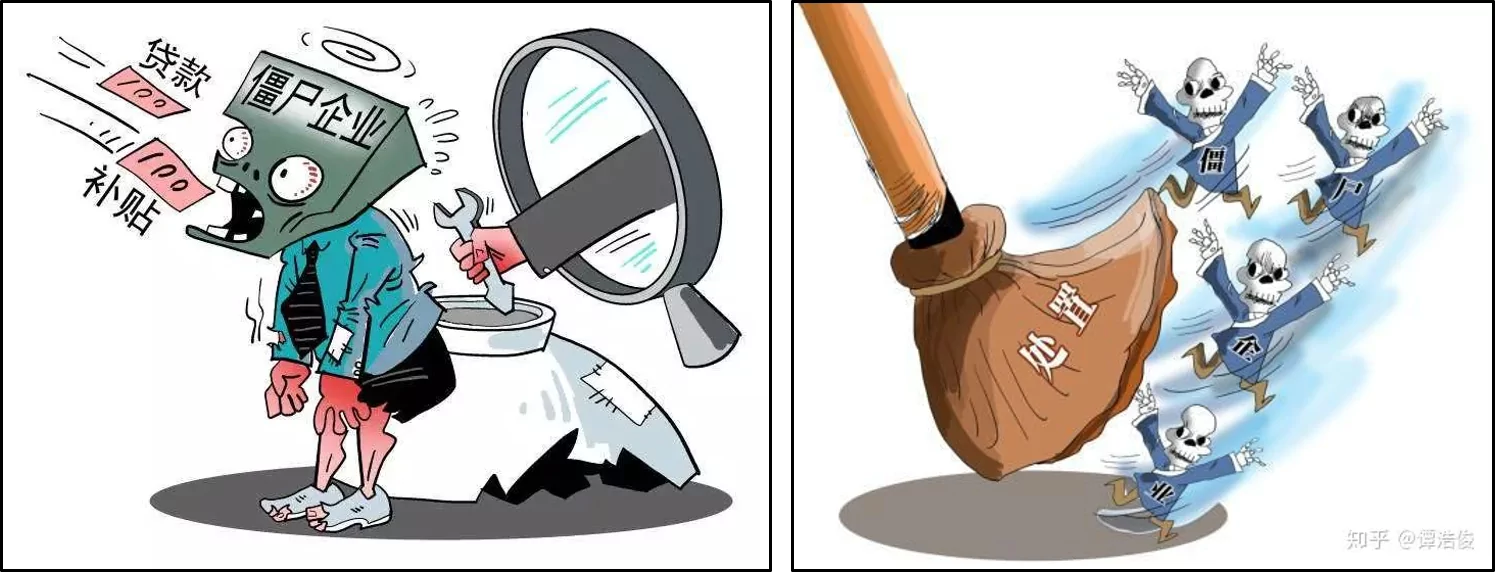

The 2019 CEWC meetings identified at least 10 distinct issues to be pursued in order to move China on the path towards a more balanced economy (Xinhua, December 12, 2019). This article will focus on one aspect of China’s efforts to achieve “high-quality development” (高质量发展, gao zhiliang fazhan): the dismantling of “zombie firms” (僵尸企业, jiangshi qiye). CCP efforts to deal with non-performing and debt-ridden “zombies” has been an ongoing effort since at least 2015. The inclusion of policies to reduce non-performing state-owned enterprises (SOEs) in the economy follows official guidance set forth in 2016, and several policy actions taken since.

First, this article will discuss what “zombie firms” are, and why they are a drag on the economy; second, it will summarize the key policies intended to dismantle zombie firms. It will then examine why zombie firms are so difficult to dismantle, and conclude by noting that the COVID-19 outbreak and the resulting economic losses due to quarantines are likely to further disrupt the ability of provincial governments to deal with non-performing firms and accumulating debt. As a result of these factors, zombie firms are likely to linger for some time to come.

Zeroing in on Zombies, Part I: What is a Zombie Firm?

Zombie companies are not unique to the Chinese economy. The term “zombie firm” grew out of stagnation in the Japanese economy in the 1990s, and was used to describe non-performing enterprises reliant upon unsustainable lending practices. Economist Takeo Hoshi wrote about this phenomenon in the context of delays to the restructuring of Japanese banks in the 1990s. Along with co-authors Ricardo Caballero and Anil Kashyap, these economists describe how “unprofitable borrowers” were kept alive, and how “the banks allowed them to distort competition throughout the rest of the economy.” [1]

In China, there has been long-standing cooperation between banks and SOEs, and since 2007 the amount of debt has been increasing. As stated by Nicholas Lardy of the Peterson Institute for International Economics (PIIE), “China’s problem is not so much a high aggregate level of domestic debt but the misallocation of credit to a subset of the least efficient, loss-making state firms” (i.e., zombie SOEs). [2] In China, “the State Council defines zombies as companies that suffer three consecutive years of losses.” According to firm-level analysis from the mid-2000s, it is possible that approximately “15 percent of all industrial firms should be classified as zombies and that state-owned enterprises had the highest proportion of zombies.” [3]

Zeroing in on Zombies, Part 2: Policies to Reduce Zombies

As the Chinese government sought to reduce excess capacity in 2016, zombie firms became a focus of effort. The 2016 National People’s Congress (NPC) work report identified the problem of dismantling zombie firms as a necessary step to reduce overcapacity and improve business performance. To address “zombie enterprises” the work report stated that the government needed to “proactively yet prudently” deal with the firms through “mergers, reorganizations, debt restructurings, and bankruptcy liquidations” (PRC 2016 Government Work Report, March 5, 2016).

Mergers and acquisitions are one method for altering the structure of non-performing firms, but doing so runs the risk of allowing firms “to operate indefinitely while generating returns far below the social cost of capital.” [4] As such, bankruptcy may be a more effective means of dealing with the drag on the economy that zombie firms create—and indeed, bankruptcy cases in China have increased “roughly fivefold between 2015 and 2018.” However, many bankruptcies have not been completed because of “the power of banks, local governments, and the political connections of the zombie enterprises themselves” (PIIE, August 23, 2019).

In late 2018, the PRC National Development Reform Commission (NDRC), along with several other ministries, issued the “Notice on Steps to Deal with Zombie Firms and Dispose of Enterprise Overcapacity.” The regulations for reducing these firms—known better by their shorthand as “clearance orders” (出清令, chuqing ling)—describe “disposal” (处置, chuzhi) principles, methods, scope, sequencing, and time limits. Many of the principles and methods outlined in this regulation are consistent with earlier calls to deal with zombies, albeit with somewhat more detail. The NDRC order also states that “all disposal work should be completed by the end of 2020” (原则上应在2020年底前完成全部处置工作, yuanze shang ying zai 2020 niandiqian wancheng quanbu chuzhi gongzuo) (NDRC, December 4, 2018).

In 2019, the State Council announced another series of market reforms, and one component of the effort highlighted the need to “perfect state-owned enterprise reform mechanisms.” Given the lack of progress on clearing away zombie firms, the 2019 guidance stated that “all relevant parties must not hinder the exit” (各相关方不得以任何方式阻碍其推出, gexiang guanshi bude yi renhe fanshi zu’ai qi tuichu) of these zombie enterprises, and noted that government offices should not use subsidies (补贴, butie) to keep these firms alive (PRC State Council, July 16, 2019).

Zombie Longevity: Why Are Zombies So Hard to Kill?

Zombie firms are difficult to dismantle for two main reasons: concerns over employment and implementation challenges. These two challenges are related but distinct, and tend to further compound the difficulties of dismantling zombie firms—especially in provinces reliant on heavy industry. The 2016 NPC work report explicitly called for “addressing the overcapacity in the steel, coal, and other industries” (NPC, March 17, 2016). Altering the economic fundamentals of localities with a heavy reliance on the natural resource sector will not be easy. “Innovative, high-quality” development is a moving target (CEWC, December 12, 2019), and firms that have long relied on local finance for their existence may not have the right personnel, resources, or incentives to shift to a new operating paradigm.

In terms of employment, dismantling zombie firms is difficult because there is a human cost. Firms remain open to provide local employment, and local officials do not want laid-off workers unemployed because of concerns about “social stability” (社会稳定, shehui wending). If zombie firms are non-performing and need to be shut down, as the national-level “clearance order” policy indicates, then employees lose jobs—and given current economic realities, jobs may not be readily available in those same locations. Spatial mismatch (the technical term for the problem of workers not residing in the same locations as jobs) will only be further exacerbated by quarantines and travel restrictions related to the COVID-19 outbreak (China File, February 26). Given the importance of “social stability” in CCP economic planning (China Brief, March 22, 2019; China Brief, December 31, 2019), local officials will want to reduce stability risks as much as possible.

In terms of implementation, there are at least three interrelated challenges. According to a February 2019 Xinhua article, the problems for government officials include: problems with starting the process, enacting the measures to dispose of firms, and then eventually exiting from the implementation measures. The article describes some of the difficulties faced in dismantling zombie enterprises in the coal and steel sectors of Shaanxi, Henan, Hebei, and Heilongjiang Provinces, but asserts continued strong “support for structural adjustment policies” (扶持结构调整政策, fuchi jiegou tiaozheng zhengce) on the part of the government (Xinhua, February 1, 2019).

The central government wants to speed up “survival of the fittest” (优胜劣汰, yousheng lietai) for SOEs (Xinhua, February 1, 2019), but this policy rests on the premise that at least some firms are salvageable. Those firms with the strongest entrenched interests will most certainly use their connections to stay alive rather than shift resources to potentially more productive uses. [5] However, evaluating the zombie clearance process requires data and this has been difficult to verify. Data on local debt in China is, to quote one economist, “like a mystery wrapped inside of an enigma”—and “neither the Chinese authorities nor investors have a uniform way of defining local government debt [and therefore] there are no comprehensive records or reliable data” (BNP Paribas, undated).

Conclusion

At the end of 2020, we can assume that PRC official announcements will claim that many, if not all, of the Central Economic Work Conference goals announced in December 2019 were successfully achieved. During his New Year’s Day speech in January, Xi Jinping already announced that, in 2020, China “will finish building a moderately prosperous society in all respects and realize the first centenary goal” of China’s revival under the CCP (Xi Jinping, December 31, 2019). What is less clear is to what extent debt will have been reduced; whether non-performing firms will truly have been closed down; or how the economic effects of COVID-19 will play out for the remainder of 2020. In fact, given the current challenges facing the Chinese national and provincial leadership, it is unclear whether dismantling non-performing zombie firms will even remain a priority. Thus, many of those zombie enterprises that have made it this long are likely to endure—decaying and undead, but persistently present and hungry for financial support.

April A. Herlevi examines China’s political economy and foreign economic policy using multi-method approaches to educate and inform policymakers and scholars. Dr. Herlevi earned her PhD in international relations and comparative politics from the University of Virginia. She currently serves as a research scientist at CNA, a nonprofit research organization in Arlington, Virginia. This work represents her own views, and should not be regarded as representing the opinions of either CNA or its sponsors. See more of her work at: https://herlevi.weebly.com/.

Notes

[1] Ricardo Caballero, Takeo Hoshi, and Anil Kashyap, “Zombie Lending and Depressed Restructuring in Japan,” American Economic Review (Volume 98, No. 5), 2008.

[2] Nicholas R. Lardy, The State Strikes Back: The End of Economic Reform in China? (Washington, DC: Peterson Institute for International Economics, 2019), p. 22.

[3] Ibid., p. 113. Note that Lardy’s quote on this point is based on analysis by: Tan Yuyan, Yiping Huang, and Wing Thye Woo, “Zombie Firms and the Crowding-Out of Private Investment in China,” Asian Economic Papers, 2016, Volume 15, No. 3: 32-55.

[4] Lardy, The State Strikes Back, p. 117.

[5] Ibid., p. 117.