Japan Looks to Central Asia for Strategic Resources

Publication: Eurasia Daily Monitor Volume: 9 Issue: 215

By:

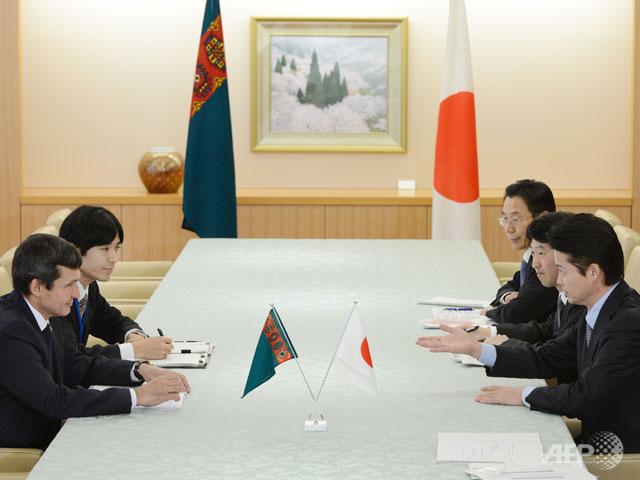

On November 10, Japan announced it would provide $700 million to the resource-rich Central Asian countries for exploitation of oil, gas and rare earths minerals (REM). The announcement was made at the fourth meeting of foreign ministers representing member-states of the “Central-Asia plus Japan” Dialogue initiative, which was launched in 2004 to promote trade and security in the Eurasian region. Participants of the gathering focused the discussion on ways to promote intra-regional cooperation on trade, investment and security in broader Central Asia (www.vz.ru, November 11).

The level of financial commitment is significant and indicates Japan’s keen interest in boosting its longer-term strategic presence and advancing security in the resource-rich Central Asian region amid its simmering tensions with a rising China and ahead of the pull-out by coalition forces from war-torn Afghanistan. Central Asia is emerging as focus of Japan’s efforts to address issues of access to strategic resources, regional security, and China’s restrictions on REM exports.

Japan views its declared financial contribution as facilitating its existing and future economic plans in Central Asia. In Kazakhstan, Japanese companies have already invested in the Kashagan oil deposit and energy projects in the Caspian Sea. They have also pursued nuclear energy cooperation with Kazakhstan, which in 2009 became the world’s largest uranium producer. Japanese companies Sumitomo Shoji and Kepko, along with Kazakhstan’s Kazatomprom, are developing the Zapadny Munkuduk uranium deposit, the production of which, in 2010, was planned to meet ten percent of Japan’s annual uranium needs. Japanese firms have also participated in the construction and remodelling of oil-processing plants in Uzbekistan (www.vz.ru, November 11; see EDM, August 2, 2010).

The issue of access to resources is a pressing one for Tokyo. Japan is known to depend heavily on strategic resources from other countries, including from China—widely perceived as a nationalistic power pursuing an ambitious resource-acquisition strategy worldwide. This particularly concerns imports of REMs, strategic resources that are critical to Japan’s high-tech industry and to its ability to compete in high-tech markets globally. Any severe disruptions in inflows of REMs could undermine Japan’s high-tech industry given the country’s prominence in the production and export of advanced products (www.ensec.org, November 21).

REMs are used for civilian and military purposes to manufacture products such as computers, hybrid cars, smart phones, tanks, precision bombs, radars, and rockets, among other items (www.japandailypress.com, November 13; www.vz.ru, November 11).

Probably not coincidentally, Tokyo’s announced pledge amount to Central Asia is nearly equal to the value of Japan’s lost REM imports from China, with which it spars over the disputed Senkaku/Diaoyu Islands. China’s REM exports to Japan fell by 11.5 percent this year—a drop of $702 million from last year. The decrease in exports is attributed to China’s cautious approach to exploitation of its strategic resources, Beijing’s restrictions on exports over concerns about excessive production and impact on the environment, as well as its strained relations with Japan over the disputed islands (www.aif.ru, www.vz.ru, November 11; www.japandailypress.com, October 31).

A third of the world’s proven REM reserves is concentrated in China, which exports up to 95 percent of the world’s REM supply. China is also using four-fifths of its production for its own needs and is reportedly racing to become a net importer of REMs by 2014. Prior to its dispute with Beijing, Tokyo relied on China for up to 90 percent of its REM supply (www.japandailypress.com, November 13; www.vz.ru, November 11; www.universalnewswires.com, November 2).

In 2010, Beijing reduced export quotas for its REM resources by a whopping 40 percent, citing irresponsible exploitation of its reserves. The measure, which occurred amid a territorial dispute between Tokyo and Beijing, led to a decrease in China’s exports to Japan and prompted Tokyo to look to Central Asia for REM supplies (www.thenational.ae, October 31, 2010). Japan has since announced plans to draw 50 percent of its REM supplies from countries other than China by 2013 (www.japandailypress.com, November 13; www.vz.ru, November 11). Japan views Central Asia, rich in rare earths and energy resources, as a critical source of strategic resources.

This December, a joint Japanese-Kazakhstani Summit Atom Rare Earth Company (SARECO) plans to extract REM in Stepnagorsk, Kazakhstan. The enterprise aims to recover 1,500 tons of REMs annually, which is equivalent to 7.5 percent of Japan’s annual demand, and then expand the production to up to 6,000 tons per year by 2017. “This is an iconic cooperative project between Japan and Kazakhstan,” Japanese Deputy Minister of Economy, Trade and Industry Yosuke Kondo stated (www.tengrinews.kz, November 11; www.centralasiaonline.com, November 3; www.universalnewswires.com, November 2). Japan also hopes that it will be able to import up to 20 tons of dysprosium annually, which would satisfy three percent of Japan’s demand for this rare element. Central Asian countries contain vast deposits of uranium, whose tailings are rich in such rare earths as dysprosium and neodymium (www.ensec.org, November 21).

Several complications await Japanese firms as they expand into Central Asian markets, particularly in the area of REM extraction. These include technological barriers and lack of regulations required for efficient and environmentally friendly extraction (www.ensec.org, November 21). Japan is also likely to face stiff competition over the region’s energy and uranium resources. It is only a matter of time before regional countries open their REM deposits to extraction by Chinese firms, especially since China is expected to become a net importer of REM. China is already believed to be importing REM supplies from Vietnam (www.ensec.org, November 21) and may yet come to the Central Asian market as it enjoys an expanding economic presence in the region, particularly in its vast energy sector.

By expanding its access to energy and other high-value resources in Central Asia, Japan will be able to reduce dependence on China for strategic commodities critical to its high-tech manufacturing sector and contribute to Central Asian security and stabilization of Afghanistan. It will also become a more “weighty” actor in the Central Asian region, where it will inevitably compete and cooperate with other players, such as Russia, China, India, the United States, the European Union, Turkey, Iran and Pakistan, all of which are pursuing long-term economic interests in broader Eurasia.