Making Foreign Companies Serve China: Outsourcing Propaganda to Local Entities in the Czech Republic

Making Foreign Companies Serve China: Outsourcing Propaganda to Local Entities in the Czech Republic

Introduction

The fast build-up and equally sudden decline of Chinese influence in the Czech Republic offers an interesting case study of vulnerability and resilience in the newly democratic small states targeted by the united front operations of the Chinese Communist Party (CCP). [1] Recent revelations about a powerful Czech financial corporation manipulating public opinion in favor of the People’s Republic of China (PRC) demonstrate the complex dynamics between political and economic actors—both Chinese and local—and how private companies are being leveraged to spread pro-PRC propaganda (Aktuálně, December 10, 2019 / English translation).

The main vector of influence in the Czech Republic has been the PRC’s “economic diplomacy,” which downplays political differences and emphasizes the economic opportunities offered by closer relationships with China (Sinopsis, March 11, 2019; China Brief, May 9, 2019). In Central and Eastern Europe (CEE), it builds on promises of investments into local economies still lagging behind those in Western Europe. The promised investments may or may not materialize, but the economic enticement alone creates a conducive environment for the cooptation of local political and business elites in a manner similar to more traditional united front tactics (China Brief, May 9, 2019). Apart from the promised investments by Chinese companies, the reverse allure may consist of market access in China for local companies, which may then be manipulated into becoming propaganda echo chambers for the CCP. The Czech Republic offers examples of both of these phenomena.

Beijing’s “Economic Diplomacy” Derailed in the Czech Republic

A textbook example of elusive investment promises could be offered by the now notorious Chinese company CEFC (华信, Huaxin), hailed at one point by the Czech President Miloš Zeman as “the flagship of Chinese investment” in the country. Zeman was so enthralled by CEFC that he named the company’s colorful chairman Ye Jianming (叶简明) his honorary advisor in 2015—and has held Ye in that title even after he disappeared in early 2018, presumably to be investigated by CCP disciplinary organs for alleged corruption and other crimes (Sinopsis, February 8, 2018).

CEFC effectively dominated the bilateral relationship on the Chinese side from 2015 through early 2018, and embodied China’s economic diplomacy in the Czech Republic. When CEFC collapsed in 2018, its spectacular demise led to the disintegration of the PRC’s economic-based diplomacy as a whole: after the top executives of CEFC’s business and non-profit wings were arrested and disappeared in rapid succession in the United States and in China at the turn of 2018, the company was revealed as a giant fraud and quickly disintegrated (Caixin, March 1, 2018, Southseaconversations, March 29, 2018).

The company’s collapse shook the entire Czech-China relationship. Questions began to be asked about the wisdom of the post-2014 China policies, including in parts of the political establishment. At the same time, public figures previously engaged by CEFC (or by other means) started a rear-guard damage control campaign, trying to explain the whole issue away (Idnes, March 22, 2018). The public debate on China in the Czech Republic intensified and became closely intertwined with domestic politics.

Home Credit and the Huawei Warning

Significantly, the damage control effort for China’s image after the CEFC fiasco has been performed not only by politicians with close ties to the company—such as President Zeman—but also by a powerful Czech private corporation, the PPF. This is especially true for PPF’s consumer-loan division, called “Home Credit,” which has substantial business exposure in China. Home Credit had been, in the words of its CEO Jiří Šmejc, the “initiator” of the friendly turn in Czech foreign policy towards the PRC in 2013-2014 (Demagog.cz, undated).

Home Credit was rewarded with a national license for their consumer credit business in China, which became a major profit center for the whole PPF conglomerate (China Brief, May 9, 2019). Its massive exposure in China has led to ever more proactive steps to make sure that the Czech-PRC bilateral relationship remains strong and does not derail entirely. That has put the otherwise media-shy company right in the center of the brewing debate on China in the Czech Republic, following the collapse of the Zeman- and CEFC-led campaign of “economic diplomacy.”

Home Credit’s mother company PPF also owns several mobile network operators in CEE. In November 2018, it signed a memorandum of understanding (MoU) with Huawei on joint development of 5G (Lupa.cz, November 14, 2018). The ink had barely dried on this deal when the Czech cyber security agency NÚKIB issued an advisory warning in December 2018 against the adoption of Huawei equipment in the country’s critical telecommunications infrastructure (Govcert.cz, December 17, 2018).

Apart from the predictable protest by Zhang Jianmin (张建民), the PRC Ambassador in Prague, other assets were mobilized to push back against the warning (Sinopsis, December 28, 2018). On December 6, 2018, and then again on January 10, 2019, President Zeman took advantage of his regular TV talk show (held, incidentally, on one of the CEFC acquisitions, the rather idiosyncratic channel TV Barrandov) to defend Huawei—and to denounce not only the NÚKIB advisory, but also the Czech intelligence and security services in general, calling them obscure derogatory names (TV Barrandov, January 10, 2019). At the same time, he announced that the Czech government had already been informed about upcoming Chinese retaliatory measures (Idnes.cz, January 10, 2019).

The Czech government responded that it had no such information. Upon inquiry, it turned out that the only talk of possible Chinese retaliation took place during a meeting between Home Credit representatives and the then-Minister of Trade and Industry Marta Nováková, who was told that the company feared an adverse effect on its business interests in the PRC (České noviny, January 13, 2019). In all likelihood, this was the source of President Zeman’s dark warning on TV Barrandov.

Political Shifts in the Czech Republic

The municipal elections held in the Czech Republic in October 2018 voted in a number of politicians critical of the post-2014 pro-China policies. In January 2019, the newly elected municipal government of Prague voted to remove a clause in the sister-city agreement with Beijing that declared support for a “One China” policy—arguing that the agreement should stick to cultural and economic exchanges, rather than contested issues in international politics (Idnes.cz, January 14, 2018).

This move further aggravated mounting tensions in the Czech-PRC relationship, and demonstrated the level of disillusionment and skepticism in parts of the Czech political establishment after the collapse of “economic diplomacy” in the previous year. The heavy-handed response from Beijing, which cancelled several tours of Czech orchestras affiliated with the city of Prague, did nothing to calm the situation (Seznam, September 15, 2019). After Beijing refused to negotiate the clause’s removal, the whole sister-city agreement was scrapped in October 2019. Shortly afterwards, Prague announced it would upgrade its existing partnership with Taipei to a full sister-city status (Lidovky, December 2, 2019). Beijing responded by freezing all contacts between Prague and Shanghai, Prague’s other Chinese sister city (where the agreement didn’t include a One-China clause) (České noviny, January 14, 2020).

The fall 2018 elections also voted in one third of the Czech Senate (the upper house of the Parliament). Many of the newly elected senators have taken critical stances on Zeman’s China policy. Most active among them has been the Chair of the Committee on Foreign Policy and Security, Senator Pavel Fischer, who initiated throughout 2019 a series of hearings on the PRC’s influence in the country. After the NÚKIB advisory, in spring 2019 he invited PPF’s attention-averse majority owner, the richest person in the Czech Republic (and in all of CEE), the billionaire Petr Kellner, to explain PPF’s MoU with Huawei in front of the Senate’s Foreign Committee (iRozhlas, March 2019). Mr. Kellner declined, but later visited the Senate for a closed-door meeting with the upper house’s Chair, Mr. Kubera (České noviny, May 27, 2019).

A Czech Company “Rationalizing” the Debate on China

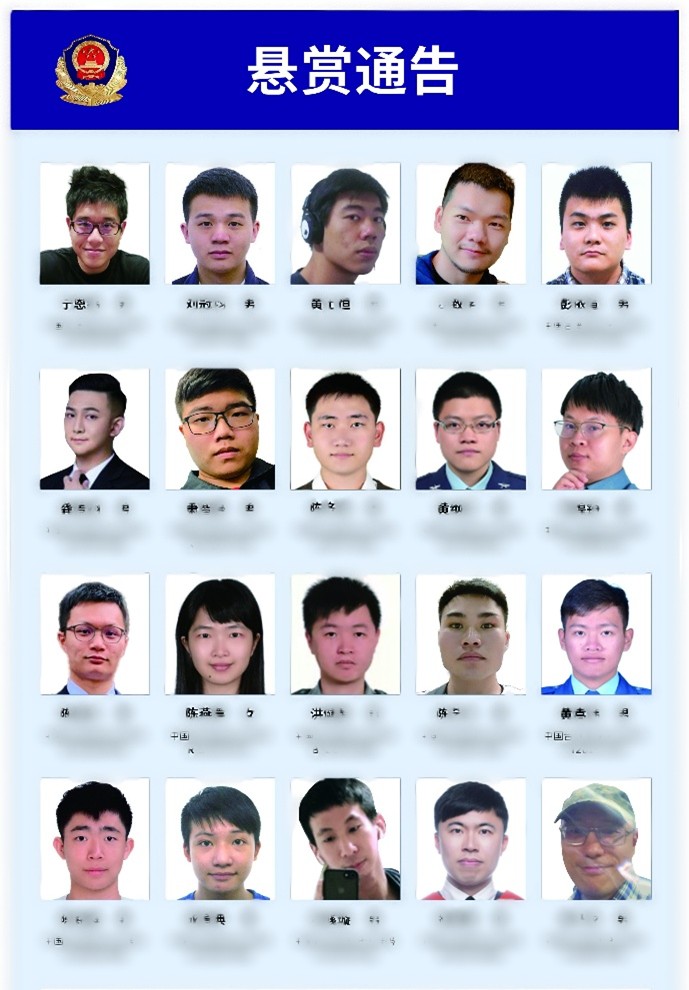

After a series of setbacks for Chinese interests, PPF and Home Credit realized in early 2019, according to their own later statement, that they had a significant public relations (PR) and political problem on their hands (iRozhlas, December 14, 2019). In April 2019 they hired a PR agency called C&B Reputation Management to “rationalize the debate on China” and “improve the Czech-China relationship.” What exactly that meant in practice became clear half a year later after a major exposé on the Czech news site Aktuálně. In December 2019, the website revealed internal C&B documents showing that the PR agency had been surreptitiously placing pro-Beijing content in mainstream Czech media, and even secretly ran its own media project called Sinoskop (see accompanying image) that posed as an “independent“ expert initiative (Aktuálně, December 10, 2019 / English translation).

Sinoskop was established in June 2019 (Sinoskop, June 10, 2019), apparently as a direct response to Project Sinopsis, a research and media outreach initiative of teachers and students at the Institute of East Asian Studies of Charles University in Prague. [2] Since 2016, Sinopsis has been producing both academic and media output generally critical of PRC policies and their impact in Central and Eastern Europe, and beyond. Sinopsis’ systematic analyses of the Czech-China relationship became a major irritant for Home Credit, which responded in October 2019 by serving the project with a cease-and-desist notice and threats of a lawsuit (HomeCredit, October 30, 2019).

The Home Credit-supported Sinoskop copied some aspects of Sinopsis activities (minus the academic research), but with a clear pro-Beijing slant. It presented itself as an independent initiative managed and funded by Vít Vojta, a Chinese language interpreter for Czech President Zeman and many of the business entities close to him (Aktuálně, May 2019). However, the documents revealed by Aktuálně showed otherwise. The PR agency hired by Home Credit micro-managed the project down to such details as preparing social media posts for both Sinoskop and Vít Vojta himself (Aktuálně, December 10, 2019 / English translation). The same agency apparently also secretly helped organize at least one “seminar” in the Czech Parliament nominally held by a prominent MP, which appeared to be designed to offset the hearings organized by Chairman Fischer in the Senate (Aktuálně, December 11, 2019). Mr. Fischer was also made subject to the agency’s “internal monitoring,” although the meaning of this was unclear (Deník N, December 17, 2019).

Even before the leaked C&B documents revealed Home Credit’s covert effort to manipulate public discourse—and specifically to counter Project Sinopsis activities—the company got embroiled in another controversy, the full meaning of which only became clear in the wake of later revelations. In October 2019, the company signed a “partnership agreement” with the rector (president) of Charles University in Prague, containing a peculiar clause that both sides “would refrain from damaging each other’s good name” (Smlouvy.gov.cz, September 30, 2019). Immediately, the clause raised concerns that it was meant to silence the company’s university-based critics, mainly Project Sinopsis (Seznam, October 8, 2019).

Home Credit vehemently denied that this was the intention, and quickly withdrew from the agreement in the face of several student petitions and academic senate resolutions calling for the agreement to be scrapped (Lidovky, October 10, 2019). Combined with the subsequent legal threats against Sinopsis, as well as the C&B revelations, the assumption that the partnership agreement was indeed an attempt to hit out at Sinopsis appears quite plausible.

These revelations are significant in that they show a powerful Czech financial conglomerate attempting to manipulate local discourse—not so much in its own corporate interest, but rather in the general interest of the PRC. The company seemingly ceased to make a clear distinction between its own and China’s positions, which suggests a very high degree of success for CCP united front cooptation tactics in the business world.

Conclusion: Laundering Propaganda by “Borrowing a Local Boat”

Following the collapse of CEFC-led “economic diplomacy” in 2018, the position of political players previously engaged by the Chinese company has been much weakened. In this changing political atmosphere, the most significant efforts at upholding the fast-deteriorating public image of the PRC have been led not by the coopted political elites, but rather by a powerful local financial conglomerate: PPF and its division Home Credit, with heavy business exposure in the Chinese market.

The company found itself on the PR defensive in early 2019, and responded with proactive measures, including both attacks against critics and efforts to improve the perception of China in domestic public discourse. Amazingly, the media campaign disclosed by Aktuálně didn’t appear designed to improve the image of the company itself, but rather that of the PRC. The media output sponsored by C&B hardly ever mentioned anything directly related to Home Credit itself; rather, they offered general, and largely positive, treatment of the PRC’s positions and policies (Aktuálně, December 2, 2019 / English translation).

In promoting the public image of the PRC in the Czech Republic, Home Credit effectively assumed a role more typical of the CCP’s own propaganda apparatus. This outsourcing of positive publicity onto local commercial entities with a business stake in China presents an interesting variation on the generally understood model of united front tactics. With the PRC’s continuing emphasis on “economic diplomacy” abroad, we will likely see many more examples of this innovation.

Martin Hála is a Sinologist with Charles University in Prague, and the founder and director of Sinopsis.cz, a project that provides analysis of China-related topics in Europe.

Notes

[1] For an overview of the concept of “united front work” as it relates to the Chinese Communist Party, see: Anne-Marie Brady, “On the Correct Use of Terms,” China Brief, May 9, 2019. http://jamestown.org/program/on-the-correct-use-of-terms-for-understanding-united-front-work/.

[2] Project Sinopsis was founded by the author of this article in 2016.