Strategic Snapshot: Russia’s Fracturing Economy

Strategic Snapshot: Russia’s Fracturing Economy

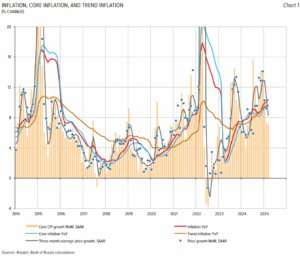

One of the weakest points in the survivability of President Vladimir Putin’s regime is the Russian economy. On April 24, Putin assured Russian business leaders that the country’s economic challenges are part of a planned “soft-landing” to curb inflation. The Consumer Price Index (CPI) in Russia has skyrocketed, up to 9.65 percent year on year in March. Putin admits that inflation, now at over 10 percent, is too high. This comes as Russia’s 1.9 percent annual GDP growth for January to February of this year is down from 4.3 percent last year. Moreover, non-seasonally adjusted GDP may have declined for the first time since the second quarter of 2022, after Russia’s full-scale invasion of Ukraine.

Russia’s wartime economy is undergoing reverse industrialization. High-tech sectors are giving way to labor-intensive, low-productivity industries as civilian parts of the economy are stagnating, and defense-related production is prioritized. Russia is experiencing persistent labor shortages, especially for skilled workers in technical fields. The Kremlin’s reforms of the education system to fill defense-sector vacancies have caused public concern over fairness and quality. Meanwhile, dependence on energy exports has become a liability as Western sanctions and infrastructural shortcomings have severely reduced revenues from oil and gas.

Russia’s war against Ukraine currently serves as a justification and a diversion for Putin in explaining the poor economic situation. Putin claims that the West is “seeking to fight us on the economic front” and “shutter [the Russian] economy.” In December last year, Putin claimed that the Russian economy was “growing despite everything, despite external threats and attempts to influence us.” Conversely, Putin has stated that Russia’s national defense should be top priority without “destroy[ing] our own economy” and that the “Russian economy has prevailed over the risks it faced” as “we had to respond literally on the fly, dealing with issues as they emerged.”

A true and sustainable peace settlement threatens Moscow’s ability to sustain domestic pressure and repel dissent against the Kremlin’s economic policies. Russia faces a narrowing set of options for sustainable growth. A genuine and durable peace agreement with Ukraine would not only reduce Russian military expenditures but also risk exposing Moscow’s economic mismanagement, potentially fueling dissent and undermining the political foundations of Putin’s war economy.

Click here to see the PDF version.

Selected Jamestown Analysis on Russia’s War Economy:

Russia Experiences Reverse Industrialization as Economy Deteriorates

Hlib Parfonov, March 4, 2025

Executive Summary:

- The Russian economy appears to be experiencing “reverse industrialization,” shifting from the development of high-technology industries to labor-intensive sectors. This trend is negatively impacting Russia’s industrial output and economic development.

- Russia’s industrial growth is uneven, with the military-industrial complex showing the most growth while civilian sectors stagnate. Russia’s ongoing full-scale invasion of Ukraine is draining the workforce, particularly as conscription is expanded.

- There are more job vacancies than skilled employees in Russia due to the surplus of graduates in subjects such as humanities and social sciences, and the shortage of technical and specialist graduates.

- Kremlin reforms that attempt to align the education system with labor market demands are raising concerns from students and families about fairness and the quality of training. These changes are reshaping Russia’s economic and social landscape in ways that may be difficult to reverse.

Rising Arctic Temperatures Threaten Russian Cities and Military Facilities in Far North

Paul Goble, March 4, 2025

Executive Summary:

- The Russian North is negatively impacted by climate change at a rate that is three times faster than in the south. The thawing permafrost, faltering infrastructure, and isolation of the population centers and military bases in Russia’s North place additional requirements on Moscow as it attempts to sustain Northern Sea Route activities and its own Arctic ambitions.

- This problem has grown worse since Russia’s full-scale invasion of Ukraine, which has forced Moscow to delay or cancel plans to repair and build more road and rail infrastructure in the North at a time when rivers in many parts of the region no longer freeze hard or long enough to serve as ice roads.

- These developments, in turn, have been exacerbated by the “Atlantification” of the Arctic, meaning Russia now faces greater competition, as the Arctic Ocean itself is ice-free longer each year, allowing foreign vessels to transit without relying on Russian icebreakers.

Russian Business Scheme to Circumvent Tariffs and Fund War

Ksenia Kirillova, January 27, 2025

Executive Summary:

- Moscow introduced a new accounting scheme enabling European buyers to pay for gas in rubles, circumventing U.S. sanctions and using intermediaries and currency exchanges to bypass restrictions.

- Russia has expanded its shadow fleet and increased its oil tanker capacity by 70 percent, helping it increase oil supplies to countries willing to buy it at prices higher than the price threshold set in the West.

- Russian companies are seizing assets, resources, and businesses, including mines and factories, in occupied Ukrainian regions, with profits fueling the war and raising war crime allegations.

Russian Arms Exports Collapse by 92 Percent as Military-Industrial Complex Fails

John C. K. Daly, January 15, 2025

Executive Summary:

- Russia’s arms exports dropped by 92 percent from 2021 to 2024 due to redirected resources for Ukraine, sanctions, inflation, and funding issues.

- The number of countries purchasing Russian arms has dropped dramatically. Major customers such as India have shown caution or shifted to competitors such as the People’s Republic of China.

- Russia has been promoting its Su-57E stealth fighter, emphasizing combat experience in Ukraine, but faces setbacks such as poor international sales and buyer reluctance. Despite challenges, Moscow is focusing on domestic contracts.

Russia Faces Increasing Troubles Financing its War Against Ukraine

Ksenia Kirillova, November 27, 2024

Executive Summary:

- Russia faces a severe economic crisis, with inflation rates significantly exceeding official figures. Efforts to combat inflation through high interest rates have slowed economic growth and investment, leading to risks of an economic downturn.

- The Kremlin is prioritizing war funding at the expense of economic stability, exacerbating inflation and underfunding crucial sectors such as healthcare and infrastructure. Social spending is disproportionately allocated to veterans and military needs, fueling public discontent.

- Russia is struggling with outdated military-industrial capacity and declining arms exports, highlighting the urgent need for modernization. This is difficult to achieve amid economic slowdown and resource reallocation to sustain the prolonged conflict in Ukraine.

Russia’s Fiscal Dependence on China Grows

John C. K. Daly, November 13, 2024

Executive Summary:

- As Western sanctions increasingly isolate Russia, it has become highly dependent on China for trade and economic support, particularly in energy exports sold at discounted prices.

- China has capitalized on Russia’s isolation by expanding its investments and economic influence within Russia, with Chinese companies increasing their share of Russian market participation. This economic relationship shows an imbalance, with China benefiting from favorable trade terms.

- Western sanctions and the war in Ukraine have deeply impacted Russia’s economy, as seen in the weakening ruble, increasing reliance on China, and signs of Russia potentially becoming a subordinate economic partner to China rather than an equal.

Arms Manufacturing in Russia in January–September 2024 Demonstrates No Growth

Pavel Luzin, November 4, 2024

Executive Summary:

- The Russian industrial output index comparing January–September 2024 to January–September 2023 is 104.4 percent, demonstrating economic growth when considering the data in rubles.

- The inflation of the ruble makes it seem as if the Russian military-industrial complex is growing. However, when considering these numbers by volume, there appears to be no significant growth since last year.

- Western sanctions have hindered Russia’s ability to produce arms and other essential products domestically, meaning Russia will likely increasingly depend on China, North Korea, Iran, and other authoritarian regimes to maintain its dwindling economy.

Russia Releases Proposed Military Budget for 2025

Pavel Luzin, October 3, 2024

Executive Summary:

- Moscow released the draft proposal for Russia’s federal budget for 2025 and 2026–2027, which shows that the national defense budget will increase significantly from previous years, especially in comparison to the period before its war against Ukraine.

- For 2023 and 2024, Russia’s military expenditures have not been clear, and data released shows that for both years, what Moscow actually spent was significantly higher than the previously planned budget.

- These increases mean Russia’s government must implement ever more expansionary monetary and fiscal policies to avoid an economic contraction in real terms. The primary purpose of the Kremlin’s planned budgeting today is to prevent a real decrease in Russia’s GDP for as long as possible.

Russia’s War Economy Wilts Under Sanctions as Measures Become More Targeted

Sergey Sukhankin, August 20, 2024

Executive Summary:

- Western sanctions, heavy losses in Ukraine, and short-sighted Kremlin policies have put serious strain on the Russian economy, even if Moscow has managed to weather the storm in some sectors.

- The Russian economy is grappling with significant structural issues, including dwindling economic reserves, labor shortages exacerbated by demographics, heavy war casualties, and mass emigration. High inflation and rampant corruption are also contributing to economic instability in Russia.

- Russia’s severe labor shortages, especially in sectors critical for the military, offer a strategic lever for Ukraine and the West. Heavy losses at the front could cause Moscow to consider mass mobilization, which will place further stress on the Russian labor market and probably would trigger another wave of emigration.

- More can be done to target Russia’s oil sector, as it remains the Kremlin’s main cash cow for funding the war. One option is to reconsider implementing a more stringent price cap, which Poland earlier proposed at $30 per barrel.

- Shining a light on widespread disdain for Moscow’s policies and interethnic tensions within Russia—particularly involving migrant workers and non-Russian ethnic groups—could be exploited to put more pressure on the Kremlin.

- The Kremlin’s focus on channeling more spending to the military-industrial complex has created an illusion of rapid economic growth. In reality, this spending has exacerbated economic problems that could lead Russia toward wider economic failures.

- Facilitating Ukraine’s pressure on Russian forces at the front and in Kursk as well as implementing expanded and more targeted sanctions are crucial to intensifying economic pressure in decimating Moscow’s ability to wage war.

Rostec’s Updated 2023 Financial Data Shows Decline in Revenue

Pavel Luzin, August 1, 2024

Executive Summary:

- Rostec, Russia’s state-owned military-industrial corporation, revised its financial data for 2023, initially presented in May, and handed over this new data to Russian President Vladimir Putin on July 30.

- The update shows a decrease in total revenue, arms manufacturing revenue, civil products revenue, and net profit, demonstrating the inflation of the original data presented, which made Rostec look more successful than it actually was.

- Rostec faces numerous structural obstacles to expansion, such as producing enough revenue to pay for a growing workforce and increase production. It is still unclear whether it will be able to overcome these obstacles in the foreseeable future.

Russia’s Arms Manufacturing in January–June 2024

Pavel Luzin, July 25, 2024

Executive Summary:

- Russia’s State Statistics Agency, Rosstat, reported increased growth in arms manufacturing industries during the first half of 2024. However, this growth is less impressive when considering physical manufacturing data as it is dependent on ruble prices.

- Russia was only able to increase the production of some components needed for arms manufacturing, meaning it would hardly be possible for Russia to significantly increase manufacturing without the corresponding increase in the production of necessary components.

- Russia’s military-industrial complex is not modernizing quickly enough to keep up with demand, meaning that Russia will not be capable of increasing arms production rates in the long term.

Workforce Shortages Plague Russian Arms Manufacturing

Pavel Luzin, June 27, 2024

Executive Summary:

- Russian Deputy Prime Minister Denis Manturov recently claimed that 520,000 workers have been added to the country’s military-industrial complex since the beginning of 2023, though he conceded that the sector is still facing a deficit of 160,000 employees.

- These estimates, however, misrepresent a complicated situation in properly replacing retired employees while hoping to maintain the size of the workforce. The deficit is likely more serious than Manturov admits.

- Problems in the workforce, especially in defense production, put limitations on arms manufacturing rates and compromise Moscow’s ability to maintain its war machine.

Russian Economy Stagnates Amid Claims of Growing Global Influence

Ksenia Kirillova, June 26, 2024

Executive Summary:

- Pro-Kremlin analysts increasingly insist that Moscow is becoming a leader in the next phase of global technological advancement and is moving toward the economy of the future. Some official statistics indicate otherwise.

- Russian production and technological development still depend heavily on foreign-made machine tools as well as Western software and technical know-how, which continue to be imported despite sanctions.

- The growth of Russia’s military expenditures and mobilization of the economy onto a war footing have laid the groundwork for years of stagnation and degradation in the domestic economy.

Tightening Sanctions Will Further Compromise Russia’s War-Torn Economy

Yuri Lapaiev, April 3, 2024

Executive Summary:

- The Kremlin is preparing to mobilize the Russian economy and population not only for the “long war” against Ukraine but also for a potential large-scale conflict with the West.

- Beyond providing Kyiv with the necessary arms and economic support, a more concerted effort to impede Moscow’s import of critical parts for military production is needed to weaken the Russian war machine.

- Enhanced control over the implementation and enforcement of the sanctions regime could limit or stop Russia’s weapons production altogether, reducing Moscow’s offensive potential.

Russian Economy Feels Bite of Attrition

Pavel K. Baev, February 12, 2024

Executive Summary:

- Russia’s economy benefited from increased military expenditures, but industrial production is stagnating as growth limits. Heavy prioritization of the defense industry is causing contractions in other sectors like consumer goods production.

- The Russian energy sector suffers from declining revenues, delayed projects, and challenges in the global market due to sanctions. Sanctions loopholes are being closed, complicating Russian efforts to circumvent restrictions and maintain its economic model.

- Ukraine’s victory against Russia hinges on economic ties and integration with Europe, which possesses superior industrial, technological, and scientific capabilities.

Kremlin Exaggerates Production of Russian Arms Manufacturing in 2023

Pavel Luzin, February 5, 2024

Executive Summary:

- Russia’s military-industrial complex showed only modest growth in 2023. The manufacturing output index’s increase does not reflect a proportional rise in actual production.

- The physical output of essential goods for arms manufacturing has revealed minimal growth over the past seven years. While some sectors expanded, overall, Russia lacks evidence of significantly increased production.

- The apparent growth in aircraft and spacecraft supplies should be attributed more to inflation than actual increased production. Russia’s arms manufacturing faces complexities and potential limitations due to production challenges.

Production Issues in Aircraft Industry Highlight Degradation of Russian Military-Industrial Complex

Pavel Luzin, January 29, 2024

Executive Summary:

- The United Aircraft Corporation (UAC) achieved a net profit of 6.1 billion rubles in the first half of 2023, compared to a net loss of 13.3 billion rubles loss during the same period in 2022.

- Increased UAC revenue and salaries were largely attributed to growing arms procurement spending and higher advance government payments, but the rise in wages failed to cover rampant inflation adequately.

- Moscow will struggle to sustain increased production despite the UAC’s reported 30-percent increase in tactical aviation production and 20-percent growth in Il-76 transport aircraft production—numbers that benefit from UAC starting at a low base of production.

Chinese Machine Tools Serve as Russia’s Safety Net

Pavel Luzin, January 22, 2024

Executive Summary:

- Russia’s industrial sector has become full dependent on China for machine tools and parts critical to arms manufacturing.

- Moscow’s war against Ukraine, Western sanctions, and the inability to fully realize import substitution efforts has exacerbated Russia’s dependence on China.

- That reality signals a new era in Russian-Chinese relations in which Beijing holds a dominant negotiating position that will likely last for years to come.

Russia’s Military-Industrial Complex Struggles With High Employee Turnover

Pavel Luzin, January 16, 2024

Executive Summary:

- Russia’s military-industrial complex remains constrained by a deepening shortage of skilled workers and engineers, an issue exacerbated by battlefield losses and demographic decline.

- Marginal employment growth in select sectors and productivity boosts in machine tool manufacturing are largely due to recovery from past declines and increased use of cheaper, imported components, not sustainable internal capacity.

- Moscow’s multibillion-ruble plan to replace foreign machine tool imports is implausible amid its shrinking labor pool. The Kremlin is resorting to migrant and prison labor, but these stopgaps will not restore previous production levels soon.

Despite Moscow’s Bravado, Russia Faces Mounting Problems With Oil and Gas Exports

Paul Goble, January 9, 2024

Executive Summary:

- Moscow has failed to replace lost Western energy markets. Infrastructure gaps, discount-driven sales to China and India, and costly transit fees severely undermine profits and limit export capacity.

- Inadequate shipbuilding capabilities, liquified natural gas (LNG) shortfalls, and shipping disruptions from Houthi attacks further erode Russia’s competitiveness in global energy markets, while delays in Arctic LNG projects expose serious logistical and financial weaknesses.

- Many Russians face heating shortages due to rising domestic gas prices amid inflation, fostering resentment over perceived national subordination to China and the burdens of Putin’s war economy.

Lagging Production of Machine Tools and Parts Plagues Russian Military-Industrial Complex

Pavel Luzin, December 4, 2023

Executive Summary:

- Western sanctions have severely restricted Russia’s access to advanced industrial equipment essential for arms production. Attempts to substitute these imports with domestic or Chinese alternatives fall short due to technological and human capital deficiencies.

- Russian firms lack the capacity and expertise to meet demand for machine tool production. Aging equipment, wear and tear, and underperforming suppliers highlight the systemic challenges in sustaining industrial output.

- Russia’s defense industry will likely suffer declining output, simplified weapon designs, and serial production delays, which are exacerbated by battlefield attrition and internal competition for scarce resources.

Russian Energy Industry Faces Looming Investment Crisis

Pavel K. Baev, December 4, 2023

Executive Summary:

- Russia’s absence from COP28 highlights its growing detachment from global climate policy. Sanctions, over-exploitation of reserves, and limited access to modern technology are undermining Moscow’s long-term energy production capabilities and international influence.

- Rosneft chief Igor Sechin’s criticism of tax hikes and tight monetary policy reflects deepening strains in Russia’s energy sector. Heavy military spending and unrealistic budget expectations are crowding out much-needed investment in oil and gas infrastructure.

- Flagship initiatives such as Vostok Oil face delays and environmental risks due to poor oversight and limited foreign partnerships. Reliance on shadow fleets and creative accounting reveal systemic instability in a sector once central to Russia’s geopolitical power.

Moscow Wants Russian Society to Pay for War in Ukraine

Sergey Sukhankin, Part One, April 12, 2023; Part Two, April 24, 2023

Executive Summary:

- Russia faces severe financial instability driven by sanctions and war expenditures. The 2023 budget deficit may exceed 4 trillion rubles, while regional and corporate revenues have drastically declined.

- Large Russian corporations, especially in resource-heavy sectors, are being coerced into paying a one-time quasi-windfall tax to fill budget gaps. In return, they may gain privileges such as relaxed capital controls or monopolistic advantages.

- The Kremlin is reviving central planning under the “Digital Gosplan.” The project, piloted in strategic sectors, seeks to reassert state dominance in economic decision-making amid sanctions and uncertainty.

- The Russian Finance Ministry is promoting “voluntary” long-term investment programs to tap household savings, a move viewed with skepticism due to past failures. Many Russians lack the financial security to participate, fueling public distrust and resistance.

- Moscow may resort to unpopular fiscal policies such as tax hikes and forced investments, which risk exacerbating public discontent and destabilizing domestic support for the war effort.