Ukraine to Keep Cutting Russian Gas Import in 2013

Publication: Eurasia Daily Monitor Volume: 9 Issue: 169

By:

Ukraine has indicated that a cut in Russian natural gas purchases will be deeper next year than expected thus far, to 24.5 billion cubic meters (bcm). This means that Ukrainian gas imports from Russia will be below contractual volumes for the third year in a row, for which Ukraine may be punished according to the take-or-pay clause in the 2009 contract between Gazprom and the national oil and gas company Naftohaz Ukrainy. Ukraine cuts gas imports saying that it cannot afford to pay the prices set by Russia, but Moscow insists that Kyiv can expect price cuts only if it joins the Russian-led customs union.

Ukrainian Energy Minister Yury Boyko announced on September 13 that Naftohaz’s order for Gazprom’s gas for next year amounted to 24.5 bcm. This would be ten percent less than Naftohaz is going to import from Russia this year, Boyko added (Interfax-Ukraine, September 13). More precisely, this will be 9.3 percent less than this year if Naftohaz imports 27 bcm of gas in 2012 as Kyiv said earlier it would. However, Boyko noted at a forum in Yalta on September 15 that Naftohaz intended to buy even less than 27 bcm this year. He added, tongue-in-cheek, that Russia did not voice any objections (Interfax-Ukraine, September 15). Naftohaz bought slightly more than 40 bcm of gas from Gazprom last year, compared to the 42 bcm it has to buy according to the 2009 contract so as not to pay penalties.

Boyko’s statements must anger Gazprom, which has been insisting that Ukraine should increase gas purchases in order to pump more gas into its underground storage facilities for the winter. Otherwise, Gazprom argues, it will be difficult to ensure uninterrupted deliveries to customers in the European Union. This past June, when the Ukrainian government approved the national gas balance for this year, local news agencies cited Gazprom chief Alexei Miller as saying that Ukraine asked for 27 bcm of gas for each of the years 2012 and 2013 (see EDM, July 10). Now it turns out that Kyiv wants to buy even less.

Kyiv has indicated several times that while Ukraine would keep cutting Russian gas imports, Russia should start paying Ukraine for using its underground gas storage reservoirs for maintaining pressure in the Europe-bound gas pipelines when gas consumption peaks in winter time. Moscow has thus far ignored this claim. At the same time, Moscow is entitled to sue Naftohaz for importing less gas than prescribed by the contract. However, Kyiv apparently believes it can fire back with a countersuit against Gazprom for overcharging, especially in light of the recent EU anti-monopoly probe against Gazprom (Kommersant-Ukraine, September 17).

Ukrainian Prime Minister Mykola Azarov claimed, addressing a forum in Yalta this past weekend, that in 15 years’ time Ukraine would have enough gas of its own (Interfax-Ukraine, September 15). This is in line with the optimistic national draft energy strategy compiled by the energy ministry, according to which gas imports should be cut to as little as 5 bcm by 2030. And Kyiv hints that even this little amount might be imported from Azerbaijan or Qatar rather than Russia. Ukraine has already started to take steps in that direction. Visiting Turkish Prime Minister Recep Tayyip Erdogan reportedly agreed to allow tankers loaded with LNG for Ukraine to pass through the Turkish straits (zn.ua, September 14).

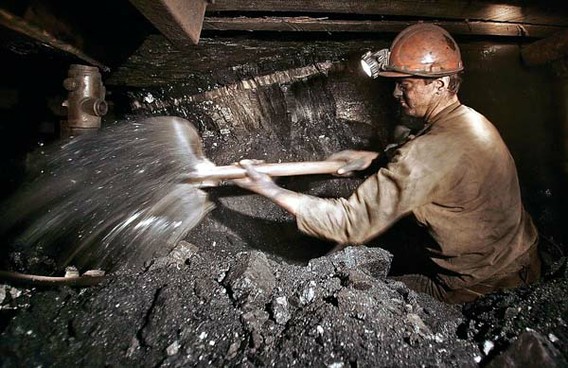

Meanwhile, domestic gas consumption was cut by seven percent and gas imports by 39 percent year on year in January–July, according to official statistics. The cut in gas consumption cannot be attributed to decrease in industrial demand, which is the largest gas consuming sector in the country. Ukraine has experienced an economic slowdown this past year, but is still not in a recession. In fact, Ukraine’s industrial output rose slightly—0.2 percent year on year—in January–July (ukrstat.gov.ua, August 17). This rate of gas import decline is less impressive than the 50 percent reported for January–May, which may be due to Ukraine hurrying to buy more gas for storage ahead of an expected increase in the Russian gas price in the fourth quarter of this year. Ukraine increased domestic gas output only by one percent in January–July, but coal extraction was up five percent, which bodes well for the government’s plan to partially replace gas with coal in power and heating generation. This past July, Ukraine received a $3.7 billion loan from China for replacing gas with coal at co-generation and heating plants, and the government plans for four state-owned co-generation plants to soon abandon gas in favor of coal (Kommersant-Ukraine, August 27).

At the same time, Kyiv does not abandon hope that it can persuade Moscow to cut gas prices. Azarov complained at the Yalta forum that Russia—while saying that bilateral relations should be built on equality and good neighborliness—has been “strangling” Ukraine with high gas prices (Ukrainska Pravda, September 15). However, Russia does not change its stance that concessions on gas are possible only in exchange for political concessions from Ukraine. Russian Deputy Prime Minister Arkady Dvorkovich said in Yalta that Ukraine should think about joining the customs union of Russia, Belarus and Kazakhstan if it wants a gas price cut. But Yanukovych, who also attended the forum in Yalta, remained entirely noncommittal (Interfax-Ukraine, September 15). Meanwhile, winter is just three months away.