Understanding the Financial Picture Behind Ant’s IPO Suspension

Publication: China Brief Volume: 20 Issue: 22

By:

Introduction

Jack Ma’s good days have gone, at least for now. The IPO suspension of Chinese tech giant Alibaba’s Ant Group, merely two days before its scheduled dual listing on the Hong Kong and Shanghai stock exchanges drew global attention. Some argued that the IPO suspension represents Beijing’s humbling of a powerful company and its outspoken leader, asserting the authority of the state above all (Jing Daily, November 3; Nikkei Asia, November 18). Others viewed the suspension as a long-awaited regulatory crackdown, arguing that Ant functioned for too long as a quasi-bank under the guise of a technology company to dodge the scrutiny of financial regulations (Caixin, November 9; see also China Brief, December 8). The era of regulatory arbitrage appears to have ended, with China’s economic leadership beginning to respond to the reality that financial technology (fintech) corporations will shape the future of financial services. Yet much of the coverage surrounding the Ant IPO downfall overlooks the bigger picture of the Chinese financial system within which Ant was built. Accordingly, this article seeks to give some context to Ant’s rise and fall.

Banks’ Unique Position in the Chinese Financial System

Banks have long enjoyed a peculiar and significant position within the Chinese financial system. This is apparent in the case of the five largest banks, which include the Industrial & Commercial Bank of China (ICBC), the China Construction Bank, the Agricultural Bank of China, the People’s Bank of China, and the Bank of Communications. According to the economists Carl Walter and Fraser Howie, “these five banks hold 59 percent of all government bonds, 85 percent of all bills of People’s Bank of China, and 44 percent of all corporate obligations. They provide 32 percent of interbank and fixed-income funding for other banks and 76 percent for non-banks such as insurance and trust companies”.[1]

China’s other financial institutions (e.g. stock markets) have historically functioned as more of an afterthought, especially for the purposes of capital raising. Yang Kaisheng, member of the International Advisory Committee of the China Banking and Insurance Regulatory Commission (CBIRC) and former President of the ICBC, has said for almost a decade that corporate financing in China is predominantly focused on debt-based indirect financing—referring mainly to bank loans (Economic Daily, November 4; Tencent Finance (Weibo), November 12). In comparison, the proportion of direct equity financing—particularly from stock markets—is relatively low.

Historic and recent reforms show the outsize role that Chinese banks have played in the state financial system. In 1998, Premier Zhu Rongji’s government passed reforms to streamline central government departments, transforming the old industrial ministries into Western-style corporations with Chinese characteristics —now known as state owned enterprises (SOEs). As Walter and Howie have observed, although all SOEs are “owned” and managed by the State-owned Assets Supervision and Administration Commission (SASAC), China’s banks have been the historic exception to this reality, and in practice sit within the state’s organizational hierarchy as vice-ministerial entities.[2]

More than four decades after China’s opening-up and almost 20 years since its admission into the World Trade Organization (WTO), it is still frequently acknowledged that banking is one of China’s least accessible sectors and remains highly restricted to foreign capital. According to a report by the Chinese financial research firm EO Intelligence, as of the end of October 2019, foreign banks accounted for only 1.22 percent of the total assets of the Chinese banking industry, marking a decrease from a decade high of 1.90 percent. This number is remarkably low. For comparison purposes, foreign banks owed 19.20 percent of total banking assets in the U.S., 51.77 percent in the EU, 12.41 percent in Russia and 6.37 percent in India (EO Intelligence, May 2020).

Beijing’s limiting of foreign assets in the banking sector demonstrates its comparatively tighter rein on Chinese banks and its financial structure overall. For many years, China’s state-owned banking industry has remained relatively closed and secluded from the outside world. This began to change in 2020, when China began allowing full foreign ownership of more financial services companies (Asia Nikkei, July 23). New Stock Connect and Bond Connect programs also allowed foreign investors access to China’s domestic securities via Hong Kong (SCMP, September 6). These moves were partially made in response to China’s Phase One trade deal promises with the U.S. to open up its financial markets to foreign actors. But skeptics have warned that even with these reforms, steep barriers to entry remain for foreign firms hoping to gain access to China.

Beijing’s Control Over the Banking Industry: A Strength and a Weakness for the Chinese Economy

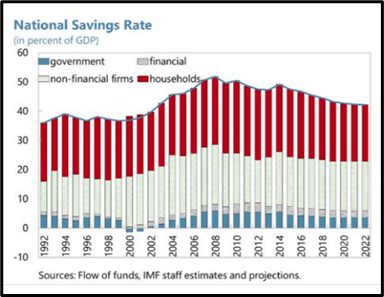

It is well known that one of the main causes for China’s decades-long economic miracle is high domestic investment. Beijing’s investment-stimulated economic growth model is dependent on its tight rein over the banking sector. Another factor for China’s growth is one of the highest national saving rates in the world, which means that, apart from government funding, Beijing has a surplus of public capital available for use. Zhou Xiaochuan, Vice Chairman of the Bo’ao Forum for Asia and Former President of the People’s Bank of China, recently commented that China’s GDP savings rate has been consistently higher than the global average rate of 26.5 percent over the past two decades (Economic Daily News, October 24). At the end of 2019, China’s savings rate was 44.6 percent. Before the Asian Financial Crisis (AFC) of 1997-1998, China’s savings rate was around 35 percent. After the AFC, it increased rapidly to 51.8 percent during the GFC (CEIC, undated). China’s high national savings rate also explains how it has been able to pledge more than $1 trillion in investments along the core diplomatic and economic policy Belt and Road Initiative (BRI), even though its per capita GDP is not high.[3] Put simply, Beijing has the money, and the drive to use it.

The downside of Beijing’s power over banks is that the central and local governments tell banks to loan to state-driven projects or SOEs by administrative fiat, without considering their future profits or repayment capabilities. This has caused a great many issues for the Chinese economy, which are acknowledged internally. For example, Premier Li Keqiang has said that banks should not favor SOEs and should treat all types of ownership enterprises equally (Gov.cn, September 29, 2018). Excessive government interventions repeatedly resulted in low investment returns, aggravating the distortion of the economic structure and exacerbating the systemic problems of overcapacity (China Brief: May 29, September 28).

More detrimentally, the lack of profits led to increased levels of domestic debt. In fact, China’s total debt reached 335 percent of GDP in the third quarter 2020, one of the highest among Asian emerging economies, according to the Institute of International Finance (SCMP, May 19). This is a strong indicator of the poor quality of its previous investments. Ma Guonan, a fellow at the Mercator Institute for China Studies, found that China had the fastest growing ratio of corporate debt to GDP in the world, and that its corporate debt rose by 65 percent following the 2008 global financial crisis.[4] A 2019 OECD working paper found that China’s SOEs account for over three quarters of its debt in 2017.[5] Chinese SOEs dependent on government subsidies or bank loans to stay alive are popularly called “zombie enterprises” even in official Chinese media (People’s Daily, January 4, 2016). Understandably, in 2019 the powerful National Development and Reform Commission (NDRC) issued a reform plan to speed up the improvement of the SOE exit system, promoting bankruptcy and the restructuring of state-owned zombies as part of a greater drive to decrease debt (NDRC, July 16, 2019).

To Beijing, the failure of political reform in the Soviet Union and its subsequent collapse remains an evergreen lesson. Maintaining political stability and keeping the party in power is unquestionably the most crucial aim of the Chinese government. The greatest lesson that China’s economic planners have learned might arguably be the potential for catastrophic consequences of highly leveraged economies, demonstrated by the experiences of other countries: the bursting of Japan’s equity and real estate bubble in 1989; the previously mentioned 1997 AFC caused by high foreign borrowing and “crony– capitalist relations between banks and business;” and the 2008 subprime mortgage crisis in the U.S. triggered by out of control lending and insufficient regulation, leading to the GFC. [6]

At the 2017 National Financial Work Conference, President Xi Jinping made his point clear that “financial stability is the basis of national stability, and deleveraging SOEs is the top of the top priorities.” Xi even went so far as to warn officials that they would be fired if they could not control debt while maintaining social stability, indicating the unparalleled significance of leverage issues (Xinhua, July 16, 2017). Current vice-premier Liu He, generally thought to be the man in charge of China’s economy, is thought to have commented more boldly (albeit cloaked under a veil of anonymity) that economic downturns or social unemployment were less risky for China’s overall economy than the state’s poor control over its highly leveraged assets (People’s Daily, May 9). China has continued its efforts to de-risk the financial industry even amid the COVID-19 pandemic this year. State media has announced that the number of peer-to-peer online lending institutions had been eradicated as of November, dropping from a high of 5,000 in mid-2017 following a two-year campaign to curb the unregulated industry (Xinhua, November 28). Recently, the Ministry of Finance also rejected the usage of special bonds as capital for public-private partnership projects, demonstrating its clear prioritization of de-leveraging financial risks over the pursuit of large-scale investment (PRC Ministry of Finance, October 28).

Ant’s Destiny

Ant Group, which operates the massive online payments platform Alipay, created a massive financial ecosystem that spans lending, investment, and insurance products and provides services to approximately 1.3 billion active annual users, the majority of whom come from China (TechCrunch, July 14). The majority of its loans are underwritten by other financial institutions, and as of June 30 this year it had partnerships with about 100 banks, including policy banks, state-owned banks, joint-stock banks, leading urban and rural commercial banks, and international banks operating in China (SCMP, October 27). Any observer would assume that it could only have flourished within such a tightly controlled and sensitive industry with direct backing from the top; indeed, Ant’s shareholders include top SOEs such as China’s national pension fund, China Development Bank and China International Capital Corporation (SSE, August 30).

These high-level ties could explain why Ant was able to perform as a bank but not be regulated like one. For several years, its most important source of income came from its microloan platform, which lent to consumers and small businesses. Ant’s leadership often described its role in the Chinese economy as being the capillaries that transferred funding to the extremities of the economy: small businesses and individuals. By contrast, state banks were the arteries of the economy that financed growth (SCMP, October 27). This metaphor shows why Beijing allowed the development of Ant, because it helped to solve at least three endemic problems within the Chinese economy.

The first solution that Ant provided was to promote the development of small and medium-sized enterprises (SMEs) and individuals, historically underserved by China’s traditional banks in favor of much larger SOEs. The second solution was to improve repayment efficiency of borrowers by employing big data and cutting-edge software to provide risk control technology, a crucial point driver for why Chinese banks chose to cooperate with Ant. Finally, Ant’s disruptive business pushed Chinese banks to overcome their institutional inertia and take steps towards self-reform. After having long monopolized the financial system, traditional banks have felt increased pressure to innovate and compete over the past few years, to the overall benefit of China’s financial system.

This should have been a win-win game for Ant, Beijing, SMEs, the banking industry, the Chinese people and the economy, but the bargain was predicated on one fact that Jack Ma overlooked in his speech at the Second Bund Finance Summit on October 24: Ant’s empire has only thrived at the political will of Beijing. At the summit, Ma openly criticized the risk-averse nature of China’s financial regulators and the global financial system overall as a “disease of the elderly.” He argued that traditional financial wisdom strangled innovation and that China’s relatively undeveloped financial system should be better described as “no system at all” (Singularity Financial (HK), October 26). Ma’s criticisms of China’s economic leadership overlooked how Ant had been explicitly permitted to develop within China’s tightly controlled financial system. Just over a week later, stock exchange regulators suspended the Ant Group IPO.

Conclusion

Speaking at the same summit where Jack Ma arguably set in motion Ant’s downfall, Chinese Vice President Wang Qishan stressed that of the three principles of security, liquidity, and efficiency which underpin the financial industry, security must be prioritized in order to avoid systemic financial risks, particularly during the Covid-19 period (Economic News Daily, October 24). Ma’s comments publicly contradicted the line from Beijing. No wonder that Ant was subsequently humbled by Beijing. Almost a week later after Ma’s speech, Vice Minister Liu He declared that Chinese regulators must treat fintech providers the same as banks at a meeting of the Financial Stability and Development Committee (Gov.cn, October 31). Ultimately, Beijing has decided that what it wants is a regulated Ant that fits in with the rest of its economic agenda, rather than a wildcard that runs roughshod over its careful planning. This allows Chinese banks to retain their ‘unique’ position within the financial system and Beijing to keep its tight control over the economy.

Jon (Yuan) Jiang is a PhD student in the Digital Media Research Centre at the Queensland University of Technology. He has a master’s degree in political science from Moscow State Institute of International Relations, and a bachelor’s degree in law from Shanghai University. He worked with ZTE Corporation as an account manager, and as a special correspondent with Asia Weekly and Pengpai News, all in Moscow. He has published extensively in South China Morning Post, The Diplomat, The National Interest, and the Jamestown Foundation China Brief, among others. He tweets at @jiangyuan528

Notes

[1] See: Carl Walter and Fraser Howie, Red Capitalism: The Fragile Financial Foundation of China’s Extraordinary Rise, Wiley, February 10, 2012.

[2] Ibid. Note that even though other large SOEs do not sit within the state’s organizational hierarchy as vice-ministerial entities like China’s state-owned banks do, their CEOs traditionally carry administrative ranks that put them within the state’s bureaucratic apparatus.

[3] Chinese investments along the BRI are often opaque and vaguely defined. Nevertheless, several western think tanks have established ongoing projects tracking the BRI. See: CSIS, “How Will the Belt and Road Initiative Advance China’s Interests,” undated, https://chinapower.csis.org/china-belt-and-road-initiative/; AEI, China Global Investment Tracker, undated, https://www.aei.org/china-global-investment-tracker/; MERICS Belt and Road Tracker, undated, https://merics.org/en/bri-tracker.

[4] See: Ma Guonan, “China’s high and rising corporate debt: examining drivers and risks,” MERICS, August 22, 2019, https://merics.org/en/report/chinas-high-and-rising-corporate-debt.

[5] Margit Molnar and Jiangyuan Lu, “State-Owned Firms Behind China’s Corporate Debt,” OECD, February 7, 2019, https://www.oecd.org/officialdocuments/publicdisplaydocumentpdf/?cote=ECO/WKP(2019)5&docLanguage=En.

[6] See: Thomas M. Orlik, China: The Bubble that Never Pops, Oxford University Press, June 22, 2020.