China’s Domestic Security Spending: An Analysis of Available Data

China’s Domestic Security Spending: An Analysis of Available Data

On February 1, 2018, China’s Xinjiang Uyghur Autonomous Region (XUAR) revealed a stunning 92.8 percent increase in its domestic security spending: from 30.05 billion RMB in 2016 to 57.95 billion RMB in 2017 (Xinjiang Net, 3 February). Within a decade, this figure has increased nearly ten-fold, up from 5.45 billion RMB in 2007.

This most recent increase is arguably a direct result of the extreme securitization measures implemented by the region’s Party Secretary Chen Quanguo, who unleashed unprecedented police recruitment and police station construction drives (China Brief, 14 March 2017; China Brief, 21 September 2017). However, what is the context of these seemingly staggering figures? How does Xinjiang’s domestic security spending compare to per capita counts in other provinces, to China’s national average, or to other nations? Do XUAR spending increases reflect the built-up of a massive police state, or are they merely reflective of a necessary process of catching up, since China in general and its west in particular featured an under-resourced security apparatus in the early 2000s (China Policy Institute Analysis, February 14 2018)?

China’s Domestic Security and External Defense Spending

It is widely believed that China’s national domestic security budget ceased to be publicly available after 2013 (e.g. Reuters, 5 March 2014; The China Quarterly, December 2017; The China Journal, 30 October 2017). However, while full national figures are indeed no longer included in the Ministry of Finance annual spending and budget reports, they have been provided by the National Bureau of Statistics database (NBS, 1999-2016). The 2017 figure was then clandestinely hinted at in the Ministry of Finance budget report for the 13th National People’s Congress (NPC) (MoF NPC budget report, 5 March). It was not cited in full, but only shown as a percentage figure of total spending in a chart label. The accuracy of the resulting absolute number can be verified through comparison with 2016 spending, as well as the author’s 2017 estimate based on budget data from 18 provinces and regions. [1]

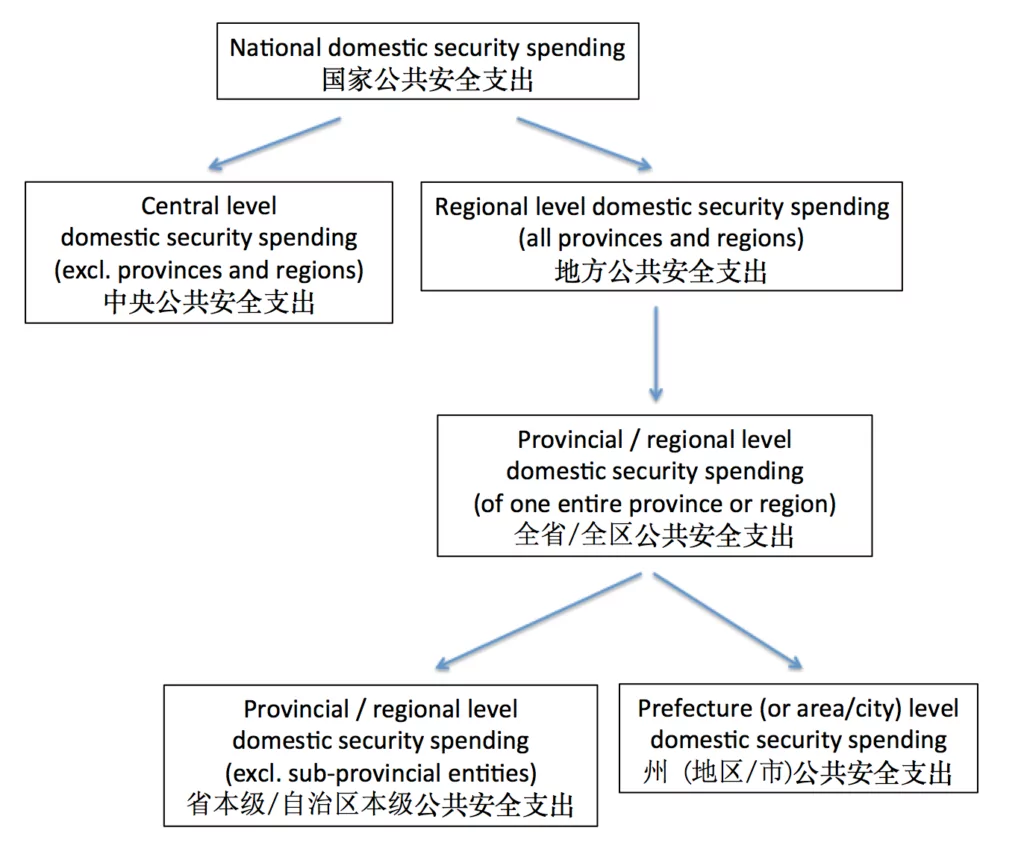

National domestic security spending (国家财政公共安全支出) can be broken down into central government spending (中央财政公共安全支出) and regional level spending (地方财政公共安全支出), with the latter representing to the sum of domestic security expenditures for all provinces and autonomous regions. [2] Reports on China’s domestic security budgets typically only cite the central government spending figure because it features in Ministry of Finance reports. This figure was also the one cited in the MoF NPC, while the full national spending figure was only shown as a share of total spending. The motivation for this is evident: central level spending is only a fraction (about one fifth) of the national figure.

The Chinese media has been exploiting Western uncertainties about the true extent of the nation’s domestic security spending. A recent CGTN news article criticizing an unnamed Western report that estimated the 2016 spending figure at US$26 billion as a speculative and “vague estimate” (CGTN, 8 February 2018). CGTN’s critique is deeply ironic. The full 2016 figure stood at US$175 billion, six times higher than the cited estimate. It then increased to US$197 billion in 2017. Even these numbers exclude billions of dollars spent on security-related urban management and surveillance technology initiatives. In addition, lower costs and wages render Chinese security capabilities much higher per dollar spent. On a Purchasing Power Parity (PPP) basis, China’s domestic security spending in 2017 was equivalent to about US$349 billion, more than double the United States’ estimated US$165 billion. [3]

In 2010, China’s national domestic security spending for the first time exceeded its spending on external defense by a small margin. By 2014, domestic security spending was only 0.8 percent higher than defense-related expenses. However, in 2016 this gap reached a record of 13 percent. Domestic security spending that year increased by 17.6 percent, the highest growth rate since 2008, and exceeded 1 trillion RMB for the first time. In contrast, the 7.5 percent increase in external defense spending was the lowest since 2008.

At the time of writing, full national spending figures on external defense were only available until 2016, while central level budget figures are available up to 2017 (Ministry of Finance, 24 March 2017). Consequently, the 2017 external defense figures have to be estimated. This is quite straightforward since nearly all spending occurs at the central government level (e.g. 97.7 percent in 2016). The 2017 central external defense budget planned for a 7.1 increase to 1,022,581 million RMB (Ministry of Finance, 24 March 2017). When applying this increase to the total 2016 external defense spending we can estimate the 2017 figure at approximately 1,046,000 million RMB. This means that in 2017, the margin between domestic security and external defense expenditures reached a record 18.6 percent.

| 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | |

| External defense | 355,491 | 417,876 | 495,110 | 533,337 | 602,791 | 669,192 | 741,062 | 828,950 | 908,784 | 976,584 | 1,046,000 (est.) |

| Domestic security | 348,616 | 405,976 | 474,409 | 551,770 | 630,427 | 711,159 | 778,593 | 835,723 | 937,996 | 1,103,198 | 1,240,000 |

| Dom. security as share of ext. defense | 98.1% | 97.2% | 95.8% | 103.5% | 104.6% | 106.3% | 105.1% | 100.8% | 103.2% | 113.0% | 118.6% (est.) |

Table 1. Spending in million RMB. Source (2007 to 2016): National Bureau of Statistics, National General Public Budget Expenditure. Source 2017 figure: MoF NPC budget report.

Regional Per Capita Spending Comparisons

China’s provinces and regions also do not consistently report the full extent of their domestic security budgets. As at the national level, provincial budgets and expenditures can be reported as full regional spending (全省 or 全区), or else as only provincial (省本级) or autonomous regional (自治区本级) level spending. The latter only includes spending that occurs at the central administrative level of a region or province, and excludes sub-provincial levels such as prefectures or “areas” (州 or 地区), or prefecture-level cities (地级市). The implication is that numerous regions only report current budget figures for a fraction of their total budget (Figure 1).

Figure 1. China’s budget structure by regional divisions

For example, the Tibet Autonomous Region (TAR) stopped reporting its full regional domestic security budget beginning with its 2016/17 spending and budget report. It now only provides the much lower budget figure for its regional level (自治区本级) spending (TAR government, 26 January 2017). Its 2017 figure was therefore estimated based on both budgeted and actual spending figures on the regional level together with five of its seven prefecture-level cities and regions. [4] Unfortunately, TAR prefectures and prefecture-level cities also do not consistently report domestic security figures.

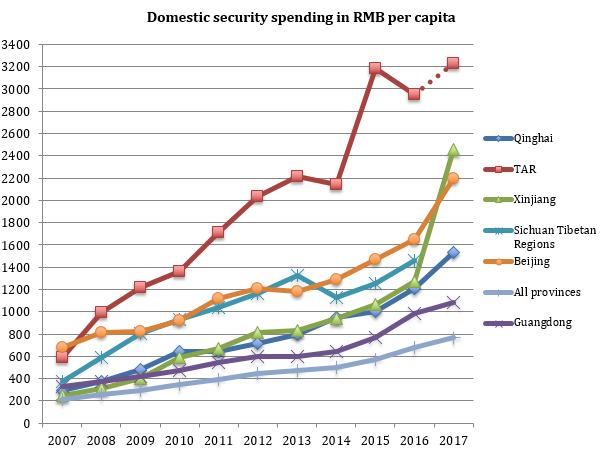

Per capita domestic security spending between varies greatly. Figure 2 shows that the TAR spends around three to five times more on domestic security than the average of all provinces and regions. Likewise, Xinjiang’s spending between 2014 and 2016 has been double that of the national regional average, and over triple in 2017.

Generally, increases in sensitive minority regions have been much greater (Figure 2). While domestic security spending across all provinces and regions rose by 215 percent between 2007 and 2016, Xinjiang’s grew by 411 percent, the TAR’s by 404 percent, and Qinghai Province’s by 316 percent (Qinghai’s population is 25 percent Tibetan). Spending in Sichuan Province increased by 234 percent, but spending in Sichuan’s two Tibetan Autonomous Prefectures, Ganzi and Aba, which have seen numerous self-immolations since 2008, grew by 295 percent.

Figure 2. Dotted lines pertain to estimates. Sichuan Tibetan Regions are Aba and Ganzi prefectures. Sources see [5].

Since 2008, the TAR has had the highest per capita domestic security expenditure of all provinces and regions. It took top place from Beijing, which competed for second-highest per capita figure with Sichuan’s Tibetan regions. Before 2009, Xinjiang’s per capita spending was just barely above the national average. However, by 2017, it had surpassed Beijing despite the latter’s 33 percent spending increase that year. In 2016, per capita domestic security expenses in Sichuan’s Tibetan regions were nearly three times higher than for Sichuan province as a whole. Notably, all four restive minority regions shown in Figure 2 have higher per capita domestic security spending figures than large and much wealthier cities such as Shanghai or Tianjin. Also of interest is that Guangdong has the highest per capita expenditures of all Chinese non-city regions besides the TAR and the XUAR, nearly three times above the rural and populous province of Henan.

| Region | 2016 | 2017 | Increase |

| United States | 3,160 (est.) | 3,220 (est.) | 2.0% (est.) |

| TAR | 2,890 | 3,137 (est.) | 9.3% (est.) |

| Xinjiang | 1,255 | 2,417 | 92.8% |

| Beijing | 1,651 | 2,191 | 32.7% |

| Russia | 2,170 (est.) | 2,060 (est.) | -4.8% (est.) |

| Sichuan Tibetan Regions | 1,450 | ||

| Qinghai | 1,197 | 1,519 | 26.9% |

| Shanghai | 1,393 | 1,471 | 5.6% |

| Tianjin | 1,136 | ||

| Guangdong | 969 | 1,065 | 9.9% |

| Zhejiang and Hainan | 928 | ||

| Inner Mongolia | 882 | ||

| Chongqing | 742 | ||

| Guizhou | 703 | 753 | 7.0% |

| Average of all provinces and regions | 672 | 763 | 13.5% |

| Yunnan | 615 | 721 | 17.1% |

| Gansu | 600 | 651 | 8.6% |

| Sichuan | 520 | ||

| Jiangxi | 499 | 560 | 12.2% |

| Hebei | 451 | 497 | 10.4% |

| Henan | 376 |

Table 2. Domestic security spending in RMB per capita for select regions. The average of all provinces and regions excludes central level spending. Sources and calculations see [6].

Regional Per Capita Comparisons Based on Purchasing Power Parity

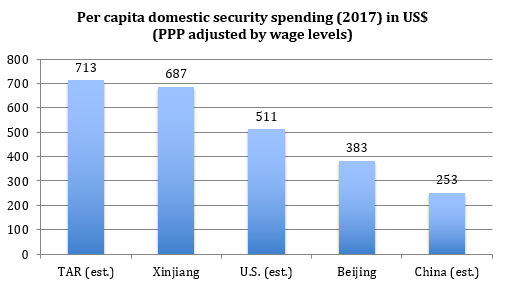

Incredibly, the TAR and Xinjiang are beginning to rival the per capita domestic security expenditures of the United States. [7] This is despite the fact that Chinese human resource and local security technology costs are far lower than in the West. This can be factored into the comparison by converting figures into their Purchasing Power Parity (PPP) equivalents. [8] PPP calculations have several limitations. They are not specifically designed for security expenditures, and they fail to reflect inter-provincial price differentials (e.g. Beijing being much more expensive than poorer provinces). We can compensate for this to some extent by adjusting Chinese regional figures using average wage levels. [9] Direct comparisons between countries, regions and cities are also difficult, since security expenses in strategic locations like Beijing or New York City typically exceed national per capita averages. Even so, they can provide general indications.

With these caveats in mind, the results show that per capita domestic security spending in restive Chinese minority regions is now higher than in the United States or Russia (Figure 3) by a fair margin. PPP-adjusted per capita spending in the TAR exceeded that of the United States by 37 percent in 2017; for Xinjiang, the figure was 32 percent.

Figure 3. For sources and calculations see [8] and [9].

Conclusions

During Hu Jintao’s second term as general party secretary (2007 to 2012), total national expenditures increased 51 percent faster than domestic security spending. During Xi Jinping’s current term (2013 to 2017), China’s domestic security spending grew 34 percent faster than total spending. In particular, security-related expenditures in sensitive regions such as Xinjiang and Tibet have risen so rapidly that they now exceed the United States average on a per capita PPP basis. As China continues to invest heavily in developing ever more advanced security technologies, every dollar spent on domestic security will experience further leverage.

These figures begin to reveal the cost of maintaining stability especially in restive minority regions. However, the full amount of such expenditures is likely higher than official domestic security budget figures, in some regions perhaps significantly higher. Between 2007-2008, China spent a higher percentage of its total budget on domestic security than in 2016-2017. But overall budget increases might perhaps be concealing other investments that are security-related in one way or another. A subsequent article will therefore investigate the true cost of stability maintenance in regions such as Xinjiang in more detail.

Adrian Zenz is researcher and PhD supervisor at the European School of Culture and Theology, Korntal, Germany. His research focus is on China’s ethnic policy and public recruitment in Tibet and Xinjiang. He is author of “Tibetanness under Threat” and co-edited “Mapping Amdo: Dynamics of Change”.

Notes

[1] A sample of 18 provinces and regions with available domestic spending (or in some instances budgeted) figures for 2017 posted an average increase of 11.9 percent compared to the previous year. The domestic security spending of these provinces and regions constituted 60 percent of all regional domestic security spending in 2016. In five instances, data were for budgeted figures, and in the other cases for actual spending. For a conservative estimate, Beijing and Xinjiang were only weighted at 50 percent of their spending figures, because their increases were likely exceptionally high (Xinjiang due to Chen Quanguo, Beijing as a result of hosting the 19th Communist Party Congress and the Belt and Road Summit). The central government budgeted a 5.5 percent rise in domestic security expenditures for 2017 (Ministry of Finance, 24 March 2017). Both central and regional spending figure resulted in a weighted average of 10.9 percent to approx. 1,223,000 million RMB. The actual reported figure stood at 1,240,000 million RMB. [2] This fact was verified by the author for domestic security spending data from 2016 by adding up regional figures. [3] For exchange rates and PPP calculations see [8]. For source and calculation of the U.S. figure see [6] and [7]. [4] The five cities/regions are Lhasa, Shannan, Shigatse, Chamdo and Ngari. Ngari’s figure pertains only to the prefecture-level (地区本级) figure. The estimated domestic spending increase rate of 9.3 percent was calculated by weighing prefectural growth rates by total prefectural budget/spending figures. [5] Source (2007 to 2016): National Bureau of Statistics, General Public Budget Expenditure tables for the provinces and regions shown. Source for 2017 figures are regional department of finance budget reports (final accounts). Source for population figures here: National Bureau of Statistics. In figure 2: per capita figures for 2007 to 2012 were calculated based on 2010 population figures, those for 2013 to 2017 based on 2015 population figures. In table 2, per capita figures are based on 2016 population figures. [6] Sources for 2016 figures: National Bureau of Statistics, Provincial Public Budget Expenditure on domestic security. Sources for 2017 figures: regional department of finance budget reports (final accounts or 2017 budget estimates). Population figures are from 2016, source: National Bureau of Statistics, year-end long-term resident population. Source for figures for the U.S. and Russia: Greitens, S. (2017), ‘Rethinking China’s Coercive Capacity’, The China Quarterly, pp.1-24. Greitens estimated the U.S. and Russia per capita figures for 2013 at US$489 and $393 respectively. U.S. 2016/17 figures were calculated based on an increase of 4 percent between 2013 and 2016, and a further 2 percent increase in 2017. This estimate is based on the Department of Homeland Security adjusted net discretionary budget authority figures (DHS 2013, 2017), and Department of Justice discretionary budget authority (DOJ 2013, 2017), and should be considered a rough approximation of total U.S. domestic security spending increases. Russia’s domestic security spending actually decreased between 2013 and 2017 (BOFIT, 25 August 2017). Source for population figures here: National Bureau of Statistics (2016 figures). [7] Chinese domestic security figures People’s Armed Police (PAP), public security organs, court system, judicial system, prosecutorial system and national security. U.S. figures (based on Greitens) include several federal departments, including the Department of Homeland Security and parts of the Department of Justice such as the Federal Bureau of Investigation and the Federal Bureau of Prisons, together with state and local spending on police, courts and prisons. Since China’s figures include the PAP, the National Guard budget was added to the U.S. figures. Even though the PAP plays a much more active policing role in e.g. Tibet and Xinjiang than the National Guard in the U.S., the latter is also responsible for ensuring domestic security. [8] China: RMB to US$ exchange rate of 6.3, 2017 PPP factor of 3.55 (2016 factor of 3.47). Russia: Ruble to US$ exchange rate of 56.4, PPP factor 24.5. Source: OECD PPP, 2000-2017. Source for population figures here: National Bureau of Statistics (2016 figures). [9] Adjustments are based on average wages (在岗职工年平均工资, 2016 figures). As a result, PPP factors were adjusted by 0.99 (Xinjiang), 1.24 (TAR) and 1.61 (Beijing). The author is grateful to Andrew Fischer for his helpful comments in regards to PPP estimates and various other sections of this article.