Rare-Earth Reserves in Central Asia Sparking Intense Geopolitical Competition

Publication: Eurasia Daily Monitor Volume: 21 Issue: 91

By:

Executive Summary:

- The enormous rare-earth mineral reserves in Central Asia are intensifying geopolitical competition among China, the West, and Russia and have been complicated by their competing agendas.

- Beijing wants to develop a monopoly on rare earths, the United States and the European Union want to break that by limiting the growth of Chinese influence, and Russia wants to keep both China happy and the West out.

- Some are already calling this competition the “Great Game of the 21st century,” which elevates Central Asia’s importance internationally, reorders geopolitical relations, and challenges domestic arrangements in the region.

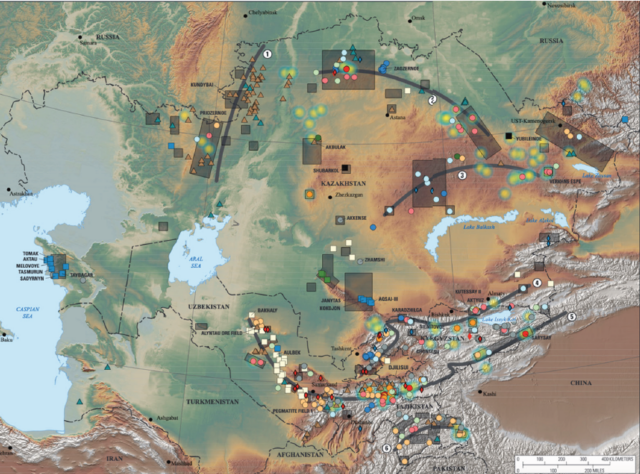

The seven countries of Central Asia—Kazakhstan, Kyrgyzstan, Tajikistan, Turkmenistan, and Uzbekistan, plus Afghanistan and Mongolia—have some of the largest but mostly untapped reserves of rare-earth minerals in the world. While this has long been known, three developments over the past several years have dramatically increased the importance of these reserves (Data.gov, October 29, 2023; Usgs.gov, accessed June 13). First, the increasing role of rare earths in modern technology and their role in the clean energy transition have brought them to the center of international attention (The Diplomat, December 15, 2023; Golosameriki.com, January 24; International Energy Agency, accessed June 13). Second, China, long the major processor and supplier of rare earths for Western firms, decided to reduce or even cut off such supplies in the wake of Moscow’s expanded invasion of Ukraine and the Western sanctions that followed. That decision has forced the West to look for alternative sources, with a focus on Central Asia (Asia Times, March 15, 2023; ASIA-Plus, April 11). Third, the Central Asian countries themselves have seen the West’s involvement in this sector as key to their hopes of further reducing Russian control while preventing Beijing from replacing Moscow as the paramount power in the region (Euractiv, November 18, 2022; The Times of Central Asia, March 14).

All the governments in Central Asia are interested in developing their rare-earth sectors as a supplement to or even replacement for the earnings they have received from the sale of oil and gas in the past. However, as was the case with the petroleum industry, none of these countries have the resources to do so on their own and consequently have been forced to turn to outside powers for money (Golosameriki.com, January 24). That has set off a diplomatic game involving the Central Asian states and, most prominently, China, Russia, and the West. This competition has intensified to the point that some are now calling it the “Great Game of the 21st century,” a reference to the competition between Russia and Great Britain for influence in Central Asia two centuries ago (Forbes.kz, April 8; Eurasia Today, April 11). While apt as an indication of this competition’s importance, the new Great Game involves a very different and much larger group of participants, not least of all the countries of the region itself. (On the activities of the Central Asian countries in this sector, Inform.kz, January 25; ASIA-Plus, June 4; see EDM; Kazlenta.kz, June 12.)

The current environment makes the role of the outside powers critical. All have dispatched increasingly senior officials to the region over the past year and invited representatives of the Central Asian states to their capitals to discuss the development of rare-earth metals in the region. Perhaps most striking is how much the agendas of the three major outsiders differ—something that makes their competition especially complicated and somewhat difficult to follow.

The retreat of Russian power and the traditional Western focus almost exclusively on oil and gas have opened the space for China to move in on rare-earth elements. Beijing has taken the lead, especially in Kyrgyzstan and Tajikistan, where it controls almost all the leases of rare-earth mining, which is fully consistent with its desire to dominate rare-earth markets. China can use this growing influence not only to project power in Central Asia but also against its other geopolitical competitors in the region. At times, however, Beijing has acted precipitously and generated opposition in Central Asia that it might have avoided had it behaved more cautiously (Eurasianet, September 11, 2014; UN Trade and Development, accessed June 13). Moreover, and certainly more significant, Chinese actions have driven the West to respond in an area it had largely ignored.

Now, the European Union, the United Kingdom, and Western allies (e.g., South Korea) have dramatically expanded their attention to this issue as well as their diplomatic activities, with the expert communities having issued major reports (International Tax and Investment Center, December 2023). Diplomats and senior officials are increasingly visiting the region or hosting Central Asian leaders in the capitals, and all are mentioning rare earths in Central Asia in their basic foreign policy documents, which few did before 2022 (Vakulchuk, “Central Asia Is a Missing Link in Analyses of Critical Materials for the Global Clean Energy Transition,” 2021; Whitehouse.gov, September 21, 2023; ASIA-Plus, June 4). In response, China has been compelled to do much the same (ASIA-Plus, April 11).

Russia, too, is very much involved in this struggle but is divided as far as its agenda is concerned. On the one hand, Moscow welcomes Chinese involvement in Central Asia’s rare-earth sector to limit Western influence in the region. On the other hand, the Kremlin fears that the addition of new participants in the rare-earth market will push down prices—something that would cost the Russian economy enormous sums (TASS, June 6). For the time being, the Kremlin is focused in Central Asia, as it is at home, on the development of oil and gas because it believes the West’s pursuit of rare earths is part of Western “neo-colonialism” directed against Moscow’s interests (Vzglyad, June 11). This means the Kremlin is not entirely thrilled with Beijing’s efforts either. Moscow is sending mixed signals designed to avoid offending China while seeking to limit the growth of the rare-earth sector in Central Asia. This mixed message is unlikely to find many takers within the region, especially if the West comes through with investments.

The competition for energy resources in the region gives the Central Asian governments opportunities to play one outside country against another, though it also opens their countries to some real dangers. Some of those threats come from outside the region. China or Russia could adopt a more aggressive form of intervention if either Beijing or Moscow sees its influence slipping further. The most serious threats, however, are likely to come from within the region and even within the individual countries themselves. The development of rare-earth metals will not be even across the region. Thus, that process will create classes of winners and losers that differ significantly from those in the oil and gas industry. The rise of the rare-earth sector will also affect the balance of power within existing elites and between the central governments and the regions where such metals are concentrated. This will likely trigger instability and challenges to the central governments, especially in Tajikistan but also in most of the others. If any of those threats arise, the benefits of the rare-earth boom will pale compared to its costs—a reality that all the participants in this new but very different Great Game will have to keep in mind.