Arms Manufacturing in Russia: Q1 2024

Publication: Eurasia Daily Monitor Volume: 21 Issue: 65

By:

Executive Summary:

- Russia’s State Statistics Service’s (Rosstat) newly published data on the military-industrial complex in Q1 2024 demonstrates limitations for arms production.

- The increase in some manufactured goods is in part due to Russia evading sanctions to continue importing electronic devices, demonstrating its dependence on imported machine tools and components.

- The Russian military-industrial complex continues to experience a workforce deficit despite a moderate wage increase and exemption from military service, contributing to the current state of production rate.

Russia’s Federal State Statistics Service (Rosstat) published an update of the industrial data for January–March 2024. The manufacturing sector as a whole has not demonstrated any significant changes: its output index appears to be 108.8 percent of what it was in January–March 2023 but 82.9 percent compared to the Q4 of 2023. The manufacturing output index in industries related to the military sector in 2024, however, demonstrates an increasing dynamic compared to 2023: a 107.6 percent change in the production of chemical materials and chemical products; a 135.2 percent change in fabricated metal products, except machinery and equipment, production; a 142.4 percent chance in computer, electronic, and optical device production; and a 129.2 percent change in the production of other vehicles and equipment (Rosstat.gov.ru, April 24).

These indexes do not represent the actual situation of the Russian military-industrial complex regarding the physical number of manufactured arms. Russia still struggles to increase arms production rates sustainably and predictably. The low-base effect, however, has almost passed after the productivity decrease in 2022 (and sometimes even earlier). The workforce deficit has not been filled. The domestic assembly of products from imported components also has its objective limitations. Simultaneously, Russia is trying to widen the most challenging bottlenecks through new organizational approaches and investments, in addition to regular verbal interventions.

The available data on the physical amount of manufactured goods is fragmented, but it is possible to get a more detailed picture of general trends (Rosstat.gov.ru, accessed April 25, 2024):

| Q1 2024 | Q1 2023 | Q1 2022 | Q1 2021 | |

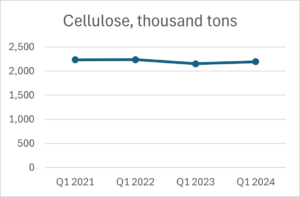

| Cellulose, thousand tons | 2,195 | 2,152 | 2,239 | 2,234 |

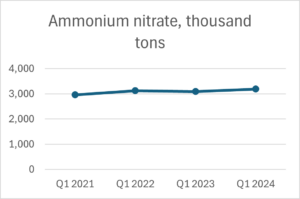

| Ammonium nitrate, thousand tons | 3,193 | 3,093 | 3,128 | 2,964 |

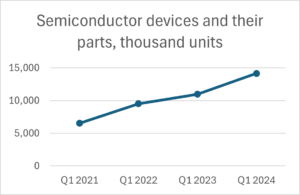

| Semiconductor devices and their parts, thousand units | 14,145 | 10,974 | 9,520 | 6,523 |

| Ferroalloys, thousand tons | 425 | 507 | 529 | 497 |

| Diesel engines of all types (except diesel engines for cars and trucks), units | 624 | 603 | 320 | 358 |

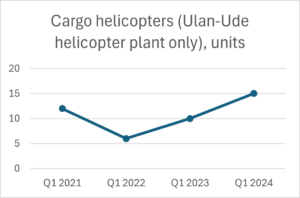

| Cargo helicopters (Ulan-Ude helicopter plant only), units | 15 | 10 | 6 | 12 |

The production of cellulose and ammonium nitrate needed for manufacturing explosives is relatively stable compared to the amount in 2021–2023. Evidence indicates, however, that Russia’s leadership is focusing on increasing the production of explosives, especially at the Kazan Gunpowder Plant, where the promised investment amount is 70 billion rubles (about $800 million), and at the Aleksin chemical plant. Even though Russia has yet to declare a crucial increase in production rates of artillery shells, the modernized facilities may provide Russia with the desirable increase in the foreseeable future (Newstula.ru, September 15, 2023; TASS, April 7; Rostec.ru, April 18).

The production of ferroalloys used for manufacturing armor and artillery decreased insignificantly. The production of civil cargo helicopters of the Mi-8 family was restored, however, after a decline in the previous two years. Additionally, the production of military versions of these helicopters likely still correlates to this trend (ATO.ru, March 23, 2018; Zhukvesti.ru, January 9).

Two categories demonstrate a crucial increase in the production rate of the Russian military-industrial complex. First, the manufacturing of semiconductor devices and their parts has grown 1.5 times since the early period of the Russian full-scale invasion of Ukraine. The explanation for this increase comes from the increased import of electronic components in 2022–2023 despite sanctions (Cnews.ru, January 29). The growing manufacturing of semiconductor devices and their parts relies not on the Russian import substitution efforts but exclusively on the final assembly of such devices from the imported components instead of the import of ready-to-use semiconductor devices, which held a crucial role in the Russian market before 2022.

Second, the manufacturing of different diesel engines, apart from diesel engines for cars and trucks, has almost doubled since the first quarter of 2022. The import of components and the increasing share of final assembly of such engines instead of the import of ready-to-use diesel engines explains this significant increase (Morvesti.ru, May 23, 2023).

Another factor is the continuing workforce deficit. In 2023, some Russian military-industrial companies increased their number of employees through a moderate 17–20 percent salary increase, which covered the rate of consumer inflation and guaranteed exemption from military service. This workforce increase, however, was also moderate and sometimes far from filling the open positions in factories. Moreover, the actual dynamic of employee turnover in the Russian military-industrial complex is unclear. For example, the workforce deficit on the Aviastar aircraft plant in Ulyanovsk was 2,500 workers as of January 2024 but appears not to be 3,500 as early as April 2024 (Rostec.ru, May 25, 2023; Rostec.ru, November 20, 2023; Ulpressa.ru, January 12; Romir.ru, January 22; Uacrussia.ru, March 1; Uacrussia.ru, April 8; Business-gazeta.ru, April 19). Consequently, some arms manufacturers try to use prisoners or even drafted soldiers to fill the workforce gap (TASS, March 26; RBC.ru, April 22).

The most advanced Russian military-industrial corporations, such as the state-owned United Engine Corporation, continue their long-term efforts toward implementing new organizational and managerial approaches, such as sliding working schedules, lean production, and developing an industrial internet. This should allow these corporations to increase production with the existing number of workers and without an accelerated increase in other costs. These approaches also have their objective limitations, considering Russia’s inevitable dependence on imported machine tools and components. These approaches, however, may contribute to arms manufacturing in Russia in 2024–2025 (Up-pro.ru, February 4, 2021; TASS, June 6, 2023; Aex.ru, April 10; Rostec.ru, April 18).