Beijing Deepens Footprint in Central Asia

Executive Summary:

- The People’s Republic of China’s (PRC) influence in Central Asia is growing, and it presents a greater challenge to Russia, the traditional regional hegemon, through multilateral summits such as the Shanghai Cooperation Organization (SCO) and the China–Central Asia Summit.

- PRC–Central Asia cooperation is strongest in the economic sectors in which Beijing excels, such as energy, transport, and mining, with $25 billion worth of agreements being signed at the June summit.

- While the SCO Summit provided the PRC with the opportunity to present itself as a global leader, the China–Central Asia Summit produced more concrete results.

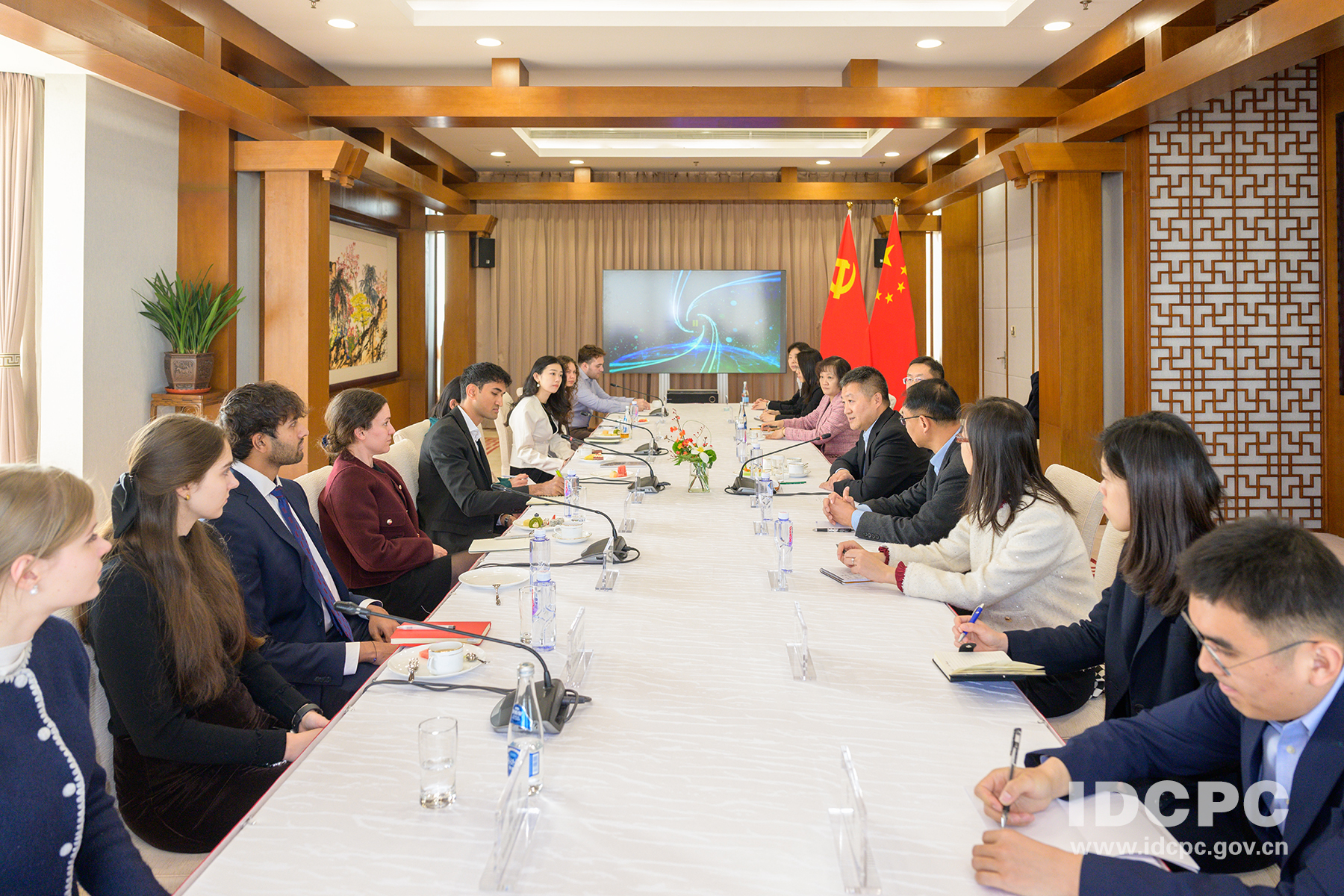

In the last week of September, the People’s Republic of China (PRC) and Uzbekistan held the latest iteration of an annual bilateral trade and investment forum in Tashkent. A large delegation of companies from Shenzhen participated, many for the first time. Products such as commercial drones are in high demand in Central Asia, according to reporting from state-owned media outlet the Hong Kong Commercial Daily. This reporting frames the forum as a “concrete measure” (具體舉措) to solidify outcomes from both the second China–Central Asia Summit that took place in Kazakhstan in June and the Shanghai Cooperation Organization (SCO) Summit that concluded in Tianjin on September 1 (China Brief, September 5; Hong Kong Commercial Daily, September 26).

The two summits were a reminder of the PRC’s deepening ties with the five Central Asian states of Kazakhstan, Kyrgyzstan, Tajikistan, Turkmenistan, and Uzbekistan. They also showcased Beijing’s growing geopolitical clout in a strategically important part of the world where Russia’s influence is waning. The SCO Summit saw the PRC’s vision of multipolarity gaining at least rhetorical acceptance across the former Soviet republics, all of whom endorsed President Xi Jinping’s new Global Governance Initiative (全球治理倡议). The summit in Kazakhstan delivered more substantive wins for the PRC, with economic cooperation agreements signed in the energy sector, focusing in particular on green technologies (The Astana Times, June 17). These extend the growing engagement kickstarted by the One Belt One Road (OBOR) initiative that Xi first announced in 2013.

Beijing’s Leadership on Display at Regional Summits

SCO Summit

Under Xi, the SCO has become an increasingly important vector for the construction of an alternative international system centered on Beijing. Speaking at the organization’s 25th summit in Tianjin, Xi implicitly criticized the trade and security policies of the United States. He critiqued “Cold War mentality, bloc confrontation, and bullying practices” (反对冷战思维、阵营对抗和霸凌行径) and instead called for the construction of a “more just and equitable global governance system” (更加公正合理的全球治理体系) (Xinhua, September 1). This criticism remained consistent with Xi’s speech in 2023, and with other SCO statements dating back to the organization’s founding in 2001 (Xinhua, July 4, 2023; China Brief, September 5).

The most significant outcome of the summit was the decision to establish a new development bank (Shanghai Academy of Social Sciences, September 11). Details about the bank are still scant. Xi Jinping has said that it should be established as soon as possible, and that its purpose will be to facilitate economic cooperation among member states and provide stronger support for their security (HK01, September 1). Coming roughly a decade after the establishment of the Beijing-led Asian Infrastructure Investment Bank (AIIB)—and about the same length of time after the idea for an SCO development bank was first proposed—this new institution could cement PRC leadership in regional development finance. When the idea was initially proposed in 2010, some member states objected, citing the organization’s priority of promoting regional security. Xu Feibiao (徐飞彪), a researcher at the China Institutes of Contemporary International Relations (a leading think tank under the PRC’s Ministry of State Security), argues that the change in calculus has been spurred by the West’s “weaponizing” (武器化) of the U.S. dollar to “pressure adversaries” (敲打对手) and by the Trump administration’s unilateral and protectionist trade policies (Workers Daily, September 5).

China–Central Asia Summit

The second China–Central Asia Summit, held in Kazakhstan in June, was narrower in scope than the SCO Summit. In some ways, Beijing used it in the same way as a vehicle to push an anti-Western agenda. In a keynote speech, Xi said that Central Asia had always been the “priority direction” (优先方向) of the PRC’s neighborhood diplomacy. He also reiterated support for Central Asian countries “playing a bigger role in international affairs” (发挥更大作用) and “opposing hegemonism and power politics” (反对霸权主义和强权政治) (Xinhua, June 17).

In terms of concrete outcomes, however, it was significant. Beijing signed 58 agreements totaling nearly $25 billion with its five partner governments, according to local media reports (The Astana Times, June 17). Sectors in which Beijing excels featured prominently, including energy, transport, and mining. Comprehensive energy cooperation was a particular focus. Beijing appears to be expanding beyond its traditional investment in the region’s fossil fuels to court Central Asia as a strategic partner in raw materials, nuclear, and renewables, “expanding cooperation across the entire energy supply chain” (扩大能源全产业链合作) (Ministry of Foreign Affairs [MFA], June 18).

PRC and Central Asian firms signed several new energy deals during the forum. The state-owned China Southern Power Grid (中国南方电网) signed a memorandum with Kazakh partners to jointly develop projects in high-voltage direct current (HVDC) transmission, digital energy solutions, and pumped-hydro energy storage. Kazakhstan also signed a power purchase agreement with China Energy Overseas Investment (Hong Kong) (中能建海外投資香港) to supply electricity generated by the firm’s plant in the Turkistan Region. Another project will see stakeholders including China Energy International (中国国际能源), Shanghai Jiaotong University, and local Kazakh entities collaborate on hydrogen technologies and research and development initiatives (The Astana Times, June 16).

The focus on energy cooperation illustrates the PRC’s determination to become a paramount player in renewables and nuclear energy. The latter ambition puts the PRC in competition with the historical regional hegemon Russia—also its close strategic partner—while the former illustrates a desire to address excess capacity problems at home, which is consistent with OBOR’s raison d’être. Renewables are also integral to the PRC’s industrial upgrade and are one of the sectors targeted in its Made in China 2025 blueprint to dominate high-technology manufacturing (State Council, May 8, 2015). PRC firms with significant renewable energy capabilities see strong potential in Central Asia, where countries friendly to Beijing are seeking to leverage their abundant natural resources to generate economic growth and upgrade industries.

One Belt One Road Remains Pillar of Cooperation

In the first half of 2025, the five Central Asian countries attracted more OBOR investment—$25 billion—than any other part of the world except Africa. Kazakhstan attracted $23 billion—almost all of that investment. Of that money, $7.5 billion is for copper and $12 billion is for a green aluminum project (Green Finance and Development Center, July 17). The copper investment follows a June 2024 agreement between the two countries to build one of Central Asia’s most advanced copper smelting facilities by the end of 2028 (Eurasia Daily Monitor [EDM], April 3).

The aluminum project is led by the Chinese conglomerate East Hope Group (东方希望). It is part of a plan to establish a vertically integrated green aluminum supply chain in the country that will create 10,000 jobs and align with national development goals, according to state media in Kazakhstan. In a statement, Kazakh Prime Minister Olzhas Bektenov lauded the project as “a unique initiative” that will contribute to the country’s industrial development (The Astana Times, June 9). East Hope CEO Liu Yongxing (刘永行) positioned the investment under the OBOR initiative, noting that Kazakhstan plays an important role as a logistics center in Eurasia (Kazinform, June 9).

Separate from the summit, the PRC is also deepening its presence in Kazakhstan’s energy sector through investments in tungsten mines and nuclear facilities. A $300 million investment in the country’s Bukuta tungsten mine by Jiangxi Copper Group (江西铜业) will account for 10 percent of global tungsten concentrate production, according to forecasts by Goalfore Advisory (国复咨询). Goalfore believes that Jiangxi Copper may be using the mine in part to circumvent anti-dumping duties imposed by the European Union on PRC tungsten products (Goalfore Advisory, July 14). Kazakhstan’s third nuclear energy plant will now be led by China National Nuclear Corporation (中国核工业集团), according to an announcement in August by Kazakh First Deputy Prime Minister Roman Sklyar. The firm previously had won the contract for Kazakhstan’s second nuclear power plant. Kazakhstan hopes that the new facility will help offset its growing electricity deficit, which reached 5.7 billion kilowatt hours in January 2025, up over 100 percent from 2.4 billion kWh a year earlier (The Times of Central Asia, August 1). With the PRC stepping up its involvement in Kazakhstan’s nuclear sector, Astana will become more dependent on Beijing, yet will also diversify its sources of atomic energy, which traditionally have been provided by Russia. This move is part of a shift in Kazakhstan’s diplomacy under President Kassym-Jomart Tokayev from broad multivector diplomacy to a more strategically minded, neutral approach to foreign affairs (EDM, July 9).

The PRC and Russia Compete in Central Asia

The PRC’s move into Kazakhstan’s nuclear energy sector is only one example of how its growing presence in Central Asia puts it in competition with Russia. Moscow remains the principal security partner in the region, conducting regular military exercises with Kazakhstan and Uzbekistan, cooperating on defense-industrial development, and supplying most of both countries’ imported arms. It also maintains close ties with local security forces and is capable of interfering in the region’s internal affairs through the post-Soviet Collective Security Treaty Organization (CSTO) (EDM, February 26, 2024).

Russia is ceding influence to the PRC on the economic and technological fronts. Beijing is the largest trading partner for four of the five Central Asian states, with Tajikistan the only exception. Even on more sensitive areas of cooperation, such as nuclear energy, Russia is losing ground. Astana awarded its first nuclear power plant project to Russia’s Rosatom in June and held the groundbreaking ceremony in early August. But the second and third facilities will both be built by Chinese partners. This makes sense, given that Russian energy companies face the risk of Western sanctions over Moscow’s ongoing invasion of Ukraine (The Astana Times, August 4; Xinhua, August 9). The resulting boost to Beijing’s influence in the region indicates the downstream effects of engaging in a costly conflict, even one taking place thousands of miles from Central Asia.

The PRC and Russia have managed to maintain close relations. But this “no-limits” partnership continues to be constrained by strategic caution, regional rivalry, and the need to manage external economic blowback (China Brief, May 14). The two Eurasian powers’ interests in the Central Asia occasionally align. For instance, both have a stake in countering separatist and terrorist threats that could impact their investments, and both seek to prevent the Central Asian states from tilting toward the West. But Russia’s tolerance for PRC encroachment in its traditional sphere of influence likely extends only so long as Beijing supports Russia in its war.

Conclusion

Developments in 2025 indicate that PRC–Central Asia ties are deepening. Beijing sees the five countries as key nodes its OBOR framework and in multilateral institutions it is using to remold the international system. Growing influence along economic, infrastructural, ideological, and strategic lines are boosting Beijing’s ambitions of dominating the Eurasian landmass. By positioning itself as the leading technological and industrial partner for the region and offering valuable collaboration in energy and other attractive investments, PRC influence will continue to grow.

Unlike in other parts of the developing world, the PRC’s growing presence in Central Asia has not faced international pushback or concern from Western policymakers. This may be attributed in part to the autocratic nature of most of the Central Asian regimes, which are largely keen to benefit from the PRC’s offerings. Absent a significant geopolitical shift, Central Asia is likely to remain receptive to the PRC’s growing presence, undergirded by the economic, technological, and diplomatic benefits its countries believe they can derive from partnering with Beijing.