‘From Chancay to Shanghai’: Peru’s Strategic Role in PRC Maritime Strategy

Publication: China Brief Volume: 24 Issue: 6

By:

Executive Summary:

- Majority ownership by state-owned Cosco Shipping, and involvement of companies like ZPMC which is closely linked to China’s Military-Civil Fusion strategy, raises concerns about the dual-use nature of infrastructure projects and potential military implications.

- The PRC has become Peru’s main trading partner and investor, exerting significant influence over strategic sectors like energy, mining, and construction, thereby amplifying security concerns.

- Chancay megaport in Peru signifies a major shift in the region’s trade and infrastructure dynamics. President Xi Jinping’s upcoming visit underscores the strategic importance attached to this project.

- The megaport mostly welcomed in Peru, where it will boost the country’s trade capabilities, create thousands of jobs, and improve its status as a regional hub.

- Chancay megaport exemplifies China’s broader strategy of acquiring ports globally to enhance trade dominance and military presence, posing long-term challenges for regional security and stability.

In late January 2024, Peru officially announced that President Xi Jinping of the Peoples Republic of China (PRC) would visit to participate in the APEC summit. Xi’s visit will also include the opening ceremony of the first phase of the Chancay megaport (Larepublica.pe, January 23). Peru’s President Dina Boluarte has emphasized the port as part of the country’s involvement in the Belt and Road Initiative (BRI). This has been extensively discussed in bilateral communications and is likely to result in new projects to enhance the construction of international trade infrastructure (Andina.pe, November 16, 2023).

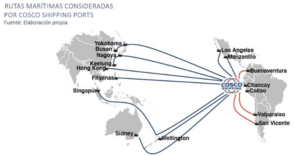

The Chancay megaport is set to begin operations later this year (Andina.pe, December 28, 2023). The port, in which PRC state-owned Cosco Shipping Ports Limited (中遠海運港口有限公司) has a 60 percent stake (the other 40 percent is owned by local firm Volcan Compañía Minera), is located 80 kilometers from Metropolitan Lima, and is expected to cost over $3.5 billion to complete (COSCO, January 23, 2019). The benefits to Peru in terms of increased trade and job creation will have a positive effects on perceptions and the creation of a major artery between the broader LAC region and Asia (chiefly through the Shanghai Port) will strengthen commercial ties. In the words of PRC Ambassador to Peru Song Yang (宋揚), “China is betting on Chancay to become the Shanghai of Peru,” in turn transforming the landscape for the region’s shipping and trade networks (Cechap.up.edu.pe, October, 2022). However, the economic benefits also come with security risks, both to Peru, but also to the extent that the port constitutes an additional and significant node in the PRC’s global maritime strategy.

PRC–Peru Economic Ties

The most significant recent upgrade in bilateral ties came in 2009, when the two countries signed a free trade agreement (Fta.mofcom.gov.cn, May 9, 2009). The PRC is now Peru’s main trading partner and largest investor, with more than $13 billion flowing into the local economy over the course of two decades and 18,000 jobs being created across 32 major projects (Infobae.com, October 10, 2023).

The PRC now has significant stakes in strategic sectors of Peru’s economy. Last year, China Southern Power Grid International (中国南方电网) acquired two Peruvian assets from Italian energy company Enel for $2.9 billion (Enel, April 7, 2023). The PRC now de facto controls almost the entire Peruvian electricity grid. PRC firms are also heavily involved in Peru’s financial, mining (the Río Blanco mines), and construction sectors. In the latter, such businesses are involved in Pampa de Pongo (one of the largest iron ore projects in Peru), and the Amazon Waterway (la Hidrovía amazónica) (Infobae.com, October 10, 2023). Chancay megaport, however, puts bilateral relations on a qualitatively new level. Peru is now a critical node for BRI and, in Ambassador Song’s words, the “most important logistics center on the coast of the Pacific” (Portalportuario.cl, October 24, 2022).

Local mainstream business and political-diplomatic elite are fully supportive of the venture. For instance, Minister of Economy and Finances Alex Contreras has claimed that the PRC’s investments—particularly in seaport infrastructure—creates the potential for Peru to emerge as “the port power of Latin America” (Gob.pe, January 24, 2023). The combination of the PRC’s strengths in building logistical networks and supply chain mechanisms with LAC countries and its worsening ties with Argentina could put Peru on track to becoming (alongside Brazil and Chile) one of the PRC’s top three strategic regional trade partners (Oxford Business Group, June 19, 2023).

Chancay Port’s Strategic Importance Beyond Peru

Chancay is a deep-water port. When complete, it will be able to host the world’s largest cargo ships with a maximum capacity of up to more than 18,000 containers each—and by extension many naval vessels too (CFR, November 6, 2023). Cargo will then have direct access to the Pan-American Highway that unites North and South America (Larepublica.pe, September 9, 2022). It will also provide a boost to the port of Callao (as of now Peru’s main seaport and the main airport).

The port will have two main economic effects. First, it will be transformative for Peru’s position in global trade. Increased exports of copper, grains, and other commodities will help to improve the country’s general macro-economic climate, create up to 1,500 jobs directly and 7,500 indirectly (Andina.pe, January 11; Larepublica.pe, September 9, 2022). Second, it will reduce shipping time by a third for PRC-based producers down to 23 days (Andina.pe, December 28, 2023). This will in turn reduce costs. As Minister Contreras has noted: “Not only Peru can export its own products, but also become the exports center for Brazil, Bolivia, Ecuador, Chile, and other countries.” He heralded a coming “productivity shock,” hinting at the possibility of consolidation of the Chancay-Callao axis, which would be transformative for Peru’s development (Andina.pe, January 12).

Brazil is also increasingly interested in the development. The BRICS country would benefit from this trade route (Ensegundos.com.pa, January 19). Brazil’s ambassador to Peru, Clemente Baena Suárez, recently stated that the Brazilian side will be seeking prompt solutions to logistical, sanitary, and administrative obstacles in the border area near Peru to facilitate the travel of Brazilian trucks to Chancay in particular. He also noted that “[Brazilian companies] are happy that it will be possible to ship their goods to Asia without having to go through the Panama Canal” (Sohu.com, January 22). Agricultural exports increasingly underpin many Latin American economies, and Brazil’s in particular, with most destined for the PRC, leading to possible dependency dynamics and the vulnerabilities that come with it. Today, the sector accounts for a quarter of Brazil’s GDP, up from 18 percent in 2014. 70 percent of the country’s soybean exports were shipped to the PRC in 2023 (Financial Times, March 10).

Chancay: Concerns, Issues, and Criticism

Domestic and foreign voices of discontent about the port are present and audible, even if most Peruvians appear supportive. There are three main constituencies for these voices: United States security experts, grassroots Peruvian community and environmental groups, and neighboring Chile’s business community.

Local Concerns

Some groups in Peru oppose the port due to environmental risks and the prospects of displacement of local residents. These concerns have been voiced by, among others, the Environmental Surveillance Committee of the Santa Rosa Chancay Wetland and the Association in Defense of Housing and Environment of Chancay (Dialogo-americas.com, March 16, 2022). Yet, local authorities have not shared or addressed these concerns. Local activists and investigative journalists have also documented multiple “irregularities or omissions [and] manipulations” that took place during the building of the first stage of the Chancay Multipurpose Port Terminal (Infobae.com, September 28, 2023). These include technological-engineering mistakes that resulted in the disappearance of nearly 200 meters of local beach area, which poses risks to the local residential area; and the “poor measurement of the registration of toxic dust” due to construction activities.

In neighboring Chile, the business community feels ill at ease. The megaport challenges Chile’s place in regional trade networks and some believe it could lead to the marginalization of Chilean facilities (Rumbominero.com, September 27, 2022; Dfsud.com, March 25, 2022). Former Chilean president Eduardo Frei has even spoken out to criticize the port (VOA, August 28, 2023). Chancay megaport might also exacerbate Chinese illegal, unregulated, and unreported fishing in the region. Every year, nearly 600 Chinese fishing vessels fish illegally in and around Peru, Ecuador, and Argentina. The town of Chancay is a key fishing village, but local fishermen may be deprived of their livelihoods due to the presence of Chinese vessels (New York Times, September 26, 2022). The Peruvian government is nevertheless committed to the project and is eager to welcome further PRC initiatives in trade and infrastructure development.

Security Concerns

United States has expressed concerns over the PRC’s growing influence in the region. Gen. Laura Richardson, head of US Southern Command recently warned that the PRC is “on the 20-yard line, in the red zone to our homeland” (Newsweek.com, October 5, 2023). Within the region, Daniel Pou, director of the Citizen Security Data Analysis Center of the Dominican Republic, has asserted that Beijing’s port infrastructure are “pieces of its economic, political, and military expansion strategy, to become the great global hoarder of raw materials, especially the resources of Latin America.” He argues the investments “carry a marked seal of military hegemony” (Dialogo-americas.com, January 23, 2023). Leland Lazarus, associate director of National Security at the Florida International University’s Jack Gordon Institute for Public Policy, concurs with this view, arguing that “one of the most concerning trends is how certain Chinese SOE ports … are allegedly being altered to serve Chinese military purposes … [the PLA Navy] could surveil and potentially deny US naval and commercial ships transiting major bodies of water,” due to COSCO’s majority ownership. [2]

On a technical level, one cause for concern is the involvement of Shanghai Zhenhua Heavy Industries Co., Ltd. (ZPMC) (ZPMC, December 28, 2023). ZPMC is the world’s premier builder of cranes for port terminals. The company was designated a “single champion (单项冠军企业)” in 2018—a program designed to cultivate manufacturing enterprises in key links in the industrial chain to help “accelerate the advancement of new-type industrialisation” (MIIT, August 29, 2023). The White House has recently expressed concern that ZPMC cranes constitute 80 percent of cranes in US ports (The White House, February 21). ZPMC has denied that it poses any risks, but its own statements contradict this. An article on the “party-building work” section of ZPMC’s website from the People’s Daily makes the case that companies such as ZPMC should:

“stand on the height of integrating the overall situation of the strategy for the great rejuvenation of the Chinese nation and the great changes that the world has not seen in a hundred years, integrating the two major situations at home and abroad, and the two major events of development and security, and give full play to the advantages of huge amounts of data and rich application scenarios to promote the deep fusion of digital technology and the real economy, empower the transformation and upgrading of traditional industries, and give rise to new industries, new forms and new modes, so as to continuously make China’s digital economy stronger, better, and bigger” (ZPMC, October 28, 2021).

More directly, a 2017 interview saw ZPMC’s Chairman Zhu Lianyu (朱连宇) say:

“The report of the 19th National Congress mentioned that ‘we should form a pattern of in-depth development of military-civil fusion,’ and Zhenhua immediately set up a leading group and a working group for military-civil fusion, and we are comprehensively analyzing the army’s industrial chain, and analyzing which ones are more relevant to Zhenhua Heavy Industry. In fact, Zhenhua and the military have already had some cases of cooperation, in addition, if the army needs to divest some subsidiary functions, where to divest? I think Zhenhua should take responsibility at this time. This new combination may not only be able to better meet the needs of the military in the future, but also provide great support for Zhenhua to expand some of the civilian business” (Huanqiu, December 19, 2017).

Chancay megaport, through COSCO’s ownership and ZPMC’s involvement, is thus closely linked to the PRC’s Military-Civil Fusion development strategy. The incorporation of COSCO as a limited company in early 2016 was praised by the Hubei Military-Civil Fusion Development Committee (HBJMRH, February 23, 2016). Both companies attended a 2020 forum on “National ocean strategy,” which one speaker said was “aimed at forming an atmosphere of civil-military co-construction to safeguard the country’s maritime rights and interests, and realising the synergistic innovation of civil-military science and technology” (SJTU, December 11, 2020). A 2019 paper in Cyberspace Military-Civil Fusion magazine details an “intelligent ocean” strategy that integrates military strategy with commercial shipping, vast data resources, sensors and monitoring, and the BRI (SECRSS, April 9, 2019).

The leverage the PRC state holds on account of this is growing at an alarming rate. The state-supported National Public Information Platform for Transportation and Logistics (LOGINK; 全国物流公共信息平台) aggregates data along the lines of the magazine article above, provides the most comprehensive picture available of global logistics activities, and represents a powerful tool to monitor and shape the international logistics market and increase foreign strategic dependency on the PRC (Baker Institute, April 25, 2023). The PRC’s Ministry of Transport has promoted the platform overseas, and publicly available documents suggest that the PRC government has access to all the data collected (CEEC, June 15, 2018). This imposes considerable vulnerabilities and dangers for other countries, which are likely to be exploited—RC cyber-attacks have already successfully targeted US critical infrastructure and Australian ports (Carnegie, February 28).

Conclusion

Peru is likely to acquire a qualitatively new role in the hierarchy of the PRC’s strategic priorities in the LAC macro-region once Chancay megaport commences operations. This, along with the revival of other regional logistics infrastructure initiatives, will further PRC influence in the region, where 21 countries have signed on to over 192 BRI-related infrastructure projects. There is little scope for its presence to reduce in the years ahead (Larepublica.pe, November 7, 2023). Acquiring ports is a crucial aspect of the PRC’s strategy. PRC firms have also acquired stakes in other ports in the region, such as Paranaguá on Brazil’s Atlantic coast, which is currently Latin America’s biggest port (Espanol.cgtn.com, May 23, 2022). Eight other seaports in Central America have Chinese stakeholders. Given the PRC’s stated strategy of enhancing its dominant grip on global trade and logistics, as well as to provide avenues for a greater military presence overseas, Chancay megaport is a reminder that many of the PRC’s overseas investments are often conceived and executed with dual-use motivations in mind.

Notes

[1] For more on Sendero Luminoso’s links to the CPP, see Julia Lovell, Maoism: A Global History, Vintage: 2020. pp 306–346. See also Lurgio Gavilán Sánchez, When Rains Became Floods: A Child Soldier’s Story, Duke University Press, 2015.

[2] Written interview with the author, February 17, 2024