Georgia’s Anaklia Port and PRC Infrastructure Strategy

Georgia’s Anaklia Port and PRC Infrastructure Strategy

Executive Summary:

- The acquisition of a 49 percent stake in a Georgian port by a state-backed consortium advances the PRC’s global port strategy—the PRC currently owns stakes in over 90 ports). As Xi Jinping has stated, “to become rich, one must first build ports.”

- A new port at Anaklia will contribute an additional node to the Middle Corridor (or Trans-Caspian International Transport Route), allowing trade to bypass both the Northern Corridor, which transits through Russia and Belarus, and traditional maritime routes through the Strait of Malacca and the Red Sea—both current geopolitical hotspots.

- The agreement reflects Georgia’s increasing turn away from the West, while an earlier decision from a US firm to pass on the opportunity to develop the port reflects the United States’ lack of serious competition to the PRC in developing infrastructure across the world.

On May 29, the Georgian Minister of Economy and Sustainable Development, Levan Davitashvili, announced that a consortium of firms from the People’s Republic of China (PRC) and Singapore would construct the new deep-sea port of Anaklia, located in western Georgia on the Black Sea (Agenda.ge, May 29). A restricted tender for the construction of the port was announced in 2023. Although a Swiss-Singaporean consortium, Terminal Investment Limited Holding S.A. (TiL), was also shortlisted, only the PRC group ended up following through with the tender process (Ministry of Economy and Sustainable Development of Georgia (MESDG); March 2, September 20, 2023).

Anaklia is located at a strategically important location along the Black Sea and would join Georgia’s four pre-existing ports: Poti, Batumi, Kulevi, and Supsa. Poti currently serves as the country’s busiest port, handling about 80 percent of its container traffic (APM Terminals, accessed June 4), but Anaklia Port might offer the opportunity to compete with other ports along the Black Sea—a region that has been impacted heavily by recent geopolitical tensions. This latest investment will advance PRC interests, including greater regional connectivity amid Russia’s preoccupation with its war in Ukraine, and its wider strategy to construct ports globally.

Anaklia Port and the New Investment Deal

Initial plans to construct the port at Anaklia first emerged in the early 2010s, but the development has been marred by multiple mishaps. In the early stages of planning in 2016, Anaklia Development Consortium (ADC)—composed of TBC Holding from Georgia and the US-based Conti Group—was awarded the tender to exclusively “construct, develop, and operate” the port (Anaklia Development Consortium; accessed June 4, October 3, 2016; Civil.ge, accessed June 4; ). SSA Marine, a US company headquartered in Seattle, was also selected as a terminal operator. In 2019 however, soon after the awarding of the contract to ADC, the project came to a halt. A corruption investigation into TBC’s owners ultimately led to criminal charges (Transparency International Georgia, February 16, 2019). Consequently, Conti Group abandoned its 42 percent stake in ADC. Now, almost five years later, the Georgian government is eager to move ahead with the development and construction of the port.

The PRC’s interest in Anaklia Port is also not new. In 2018, Georgian officials met with interested investors, the China Railway International Group (CRECGI; 中铁国际集团), and discussions with the then-PRC ambassador on the port investment and creation of a free industrial zone followed (MESDG; July 2, 2018, September 1, 2018). Last year, Minister Davitashvili shared that an official concession and partnership agreement will be negotiated following the announcement of the winning tender. The Georgian government—either directly or via a state-owned company—is expected to hold a 51 percent ownership stake in the Port of Anaklia, while the foreign company will hold a minority stake of 49 percent. Construction is planned to start upon the conclusion of the private partner agreement, after which operations are expected to commence within three years (MESDG; February 2, 2023).

That the majority state-owned China Communications Construction Company (CCCC) has successfully bid to construct the port highlights the PRC’s sustained interest in infrastructure development throughout the region. The earlier withdrawal of US firms from the project also indicates how the United States is ceding ground across the globe in this area. It is notable that CCCC has been on the US Bureau of Industry and Security Entity List since December 2020 due to enabling the PRC “to reclaim and militarize disputed outposts in the South China Sea, which has been detrimental to US national security” (Federal Register, December 22, 2020). This also reflects broader trends in the current Georgian government’s geopolitical orientation away from the West.

Growing PRC–Georgia Partnership

Tbilisi awarding CCCC the contract to construct the port in Anaklia highlights a decade-long trend of growing partnership between the PRC and Georgia. While the two countries have maintained a bilateral relationship for over three decades, it was not until 2013 that the relationship began to strengthen. On December 1, 2016, Georgia officially joined the Belt and Road Initiative (BRI) (Green FDC, accessed June 19).

In 2015, Georgia’s Ministry of Economy initiated a Free Trade Agreement between the two countries following the publication of a joint feasibility study (UIBE & PMC Research Center, August, 2015). At the time of the study, Georgia’s top total trading partners were mostly regional neighbors, such as Turkey (17.2 percent), Azerbaijan (10.3 percent), and Russia (7.4 percent), though the PRC was already its fourth largest trading partner, accounting for 7.3 percent. An agreement was officially signed on May 13, 2017, between former Georgian First Deputy Prime Minister and Minister of Finance Dimitry Kumsishvili and then-PRC Minister of Commerce Zhong Shan (钟山). It officially came into effect on January 1, 2018 (MOFCOM, May 15, 2017.

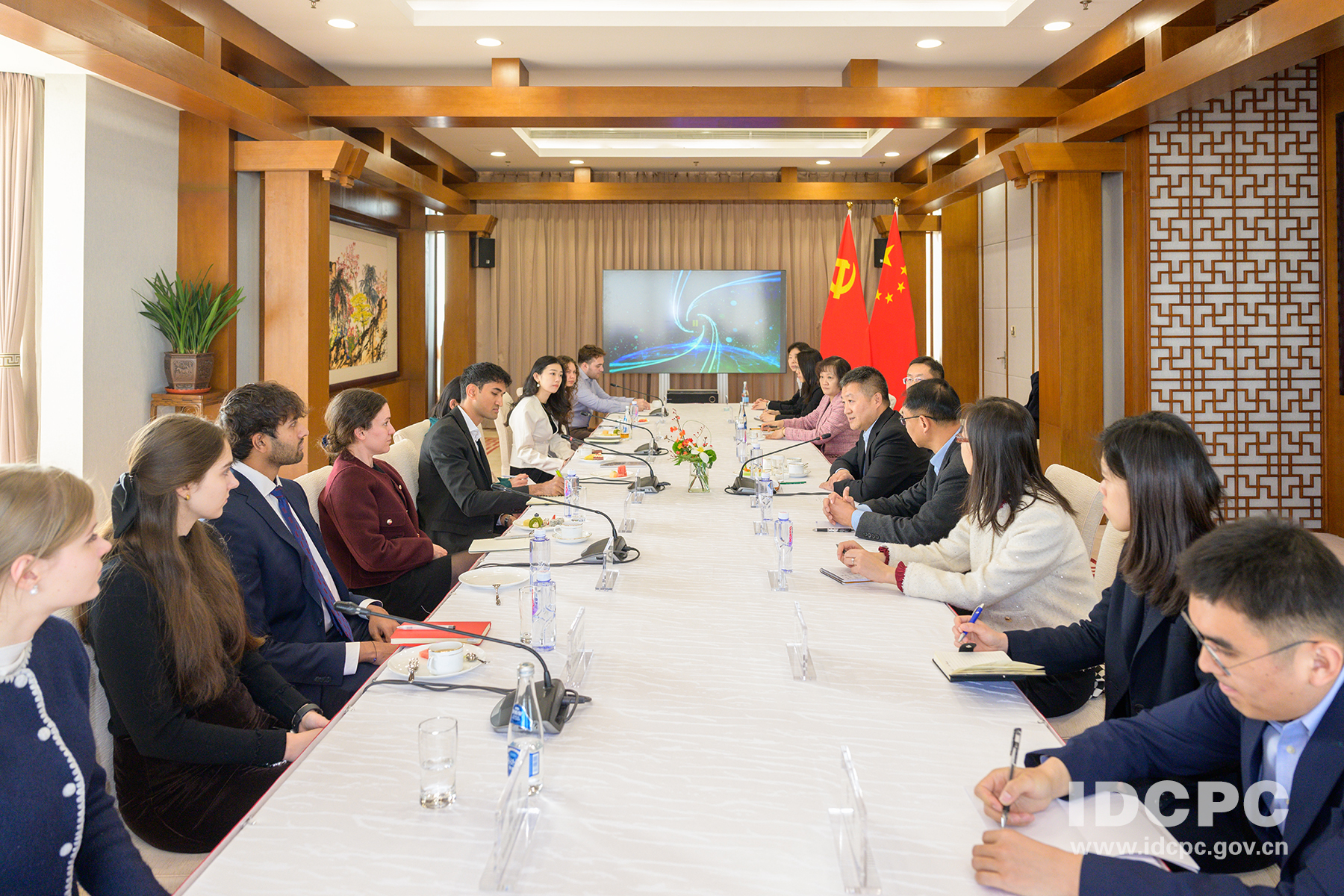

In 2023, the PRC–Georgia relationship was further cemented through the signing of an official strategic partnership (战略伙伴关系) following then-prime minister Irakli Garibashvili’s meeting with Xi that July (MFA, July 28, 2023). Three days later, Garibashvili also met with Premier Li Qiang (李强) to ratify the partnership, which saw both countries share a “commitment to expanding cooperation in the political, economic, and cultural fields, strengthening collaboration in international affairs, deepening bilateral relations, and safeguarding regional and world peace, stability, and development together” (Embassy of the PRC in Georgia, August 7, 2023).

The most recent development came in April when the two countries signed a visa exemption agreement allowing Georgian citizens to enter the PRC without a visa for up to 30 days (MFA of Georgia, April 10). This exemption officially entered into effect on May 28 amid a period of domestic instability surrounding foreign interference and influence in the Georgian domestic landscape (Civil.ge, May 28).

Also of note is Georgia’s new On Transparency on Foreign Influence legislation, which was signed into law by Speaker of the Georgian Parliament Shalva Papuashvili, after it was initially vetoed by President Salome Zurabishvili (Jurist News, June 3; MATSNE, June 3, 2024). This new legislation will create a registry of foreign agents including “media and non-profit organizations that receive more than 20 percent of their funding from abroad, with possible repercussions for non-compliance” (Jurist News, June 3). While this law specifically addressed the civil society landscape in Georgia, its effects have not yet carried over to scrutiny into foreign companies and foreign investments within the Georgian economy (see Eurasia Daily Monitor; April 24, May 1, May 13, May 22; Terrorism Monitor, December 15, 2023). As this law is widely understood as part of a broader orientation in Georgian politics away from the United States and the European Union, it is unlikely that PRC investments in the country will be impacted, however. If anything, they may well increase in the coming years.

PRC Strategic Interest in Regional Connectivity and Ports

Two strategic interests are at play for the PRC both in Georgia and in the greater Central Asia and South Caucasus region. These are greater regional connectivity amid Russia’s preoccupation with its war in Ukraine, and the PRC’s interest in constructing ports globally.

The PRC’s interest in Georgia constitutes part of a wider focus on deepening economic and transport integration with the wider region. The Middle Corridor (MC) is key to this strategy. Also known as the Trans–Caspian International Transport Route (TITR), the MC is a route linking the PRC to Europe and the rest of the world via Kazakhstan, the Caspian Sea, Azerbaijan, Georgia, and then either the Black Sea or Turkey.

TITR offers an alternative to both the Northern Corridor, which transits Russia and Belarus, and traditional maritime routes through the Strait of Malacca and the Red Sea. It has become more popular in recent years as the former has been slowed by Russia’s ongoing invasion of Ukraine and the latter have faced security challenges, as witnessed during the ongoing Red Sea Crisis (EDM; March 14, August 4, 2022; TM, December 15, 2023). TITR’s potential is yet to be realized amid multiple operational constraints leading to long transit times. Nevertheless, a 2023 World Bank study found that its trade volumes are expected to triple by 2030 and that in the immediate response to Russia’s full-scale invasion of Ukraine, container traffic “increased by 33 percent in 2022 compared to 2021” (World Bank, November 2023).

The PRC has invested in transportation and maritime infrastructure all along TITR. In October 2023, PRC and Kazakh government officials and companies signed 30 documents on intergovernmental cooperation to develop TITR, including “building the Tacheng–Ayagoz railway line, constructing a third railway checkpoint between Kazakhstan and the PRC, and establishing border terminal facilities” (The Astana Times, October 27, 2023). In Azerbaijan, Beijing gave more than three million dollars’ worth of equipment to the Baku International Sea Trade Port Assistance Project (Aiddata, accessed June 4). Anaklia Port will also further enhance its positions as an attractive alternative route, with the help of the Chinese–Singaporean consortium.

The PRC’s maritime and commercial port chain (商业港口链) strategy now sees PRC companies invested in over 92 port projects across the globe, of which Anaklia is the most recent (CFR, November 6, 2023). These companies are already invested in the region through the Ukrainian Port of Odesa, also situated on the coastline of the Black Sea, and Kumport in Turkey, which opens maritime commerce up to the Aegean Sea. But these ports have taken place and shape all across the globe, in a PRC bid to secure strategic strongpoints at major maritime chokepoints and sea lines of communication (SLOCs) (see China Brief, March 2019).

Back in 2017, PRC President Xi Jinping articulated his belief that ports enrich the prosperity of both the PRC and its partner countries, saying that “to become rich, one must first build ports (要想富也要先建港)” (81.cn, May 29, 2024). This accords with the PRC’s vision of “[building] a world of common prosperity through win-win cooperation (人类命运共同体,就是 … 合作共赢),” described in a recently published white paper on the topic (gov.cn, September 23, 2023). While the PRC sees port-building projects like Anaklia Port as mutually beneficial infrastructure initiatives, these projects also empower the PRC to exert its economic influence abroad through the management of global cargo flows and port terminals (International Security, April 1, 2022).

PRC-built and managed ports have seen varying degrees of success, however. While Greece’s Piraeus Port has been turned around from bankruptcy since its change in ownership to PRC state-owned enterprise COSCO, a financing debacle at Hambantota Port in Sri Lanka led to China Merchant Ports (招商局控股港口) acquiring a concession over the port through a 99-year lease (World Cargo News, April 2), initially constructed by CCCC’s subsidiary China Harbor Engineering Company (中国港湾工程). The Georgian government’s awarding of the tender will at last allow the construction of Anaklia Port to move forward almost a decade after its inception, but the success of the port remains yet to be determined.

Conclusion

Anaklia Port, once complete, will become a vital part of the Middle Corridor, improving regional connectivity within Central Asia and the South Caucasus—and also with the PRC. One remaining sticking point, however, is the nature of the port partnership and concession agreement, which is yet to be finalized but will see the PRC-led consortium hold a minority stake of 49 percent. CCCC’s stake makes it a junior partner to the Georgian government, but it still constitutes a substantial contribution toward the port’s construction and eventual management. Such a stake is not atypical, as only 13 of 92 port projects globally have a majority Chinese ownership stake (Council on Foreign Relations, November 6, 2023). Yet this allows CCCC—and the PRC state that lies behind it—to realize its two strategic interests of expanding regional connectivity and partnerships and advancing its global commercial port chain.

As regional coordination for the MC accelerates, it is likely that the PRC will continue its investment and assistance in maximizing the potential of the MC. While the PRC and Russia share a ‘no-limits’ partnership, Russia’s reaction to its neighbor’s growing influence and power within the former Soviet Union is unclear. This is an acute consideration for Anaklia, which lies near the border with the Russian-occupied territory of Abkhazia. As US companies have previously invested in the Anaklia Port project, the renewed development of MC projects also reinvigorates the opportunities for other foreign stakeholders to invest in the transportation route. This would diversify foreign investments and influence in TITR while also strengthening partnerships and trade in Central Asia and the South Caucasus.