Global Supply Chains, Economic Decoupling, and U.S.-China Relations, Part 1: The View from the United States

Global Supply Chains, Economic Decoupling, and U.S.-China Relations, Part 1: The View from the United States

Editor’s Note:

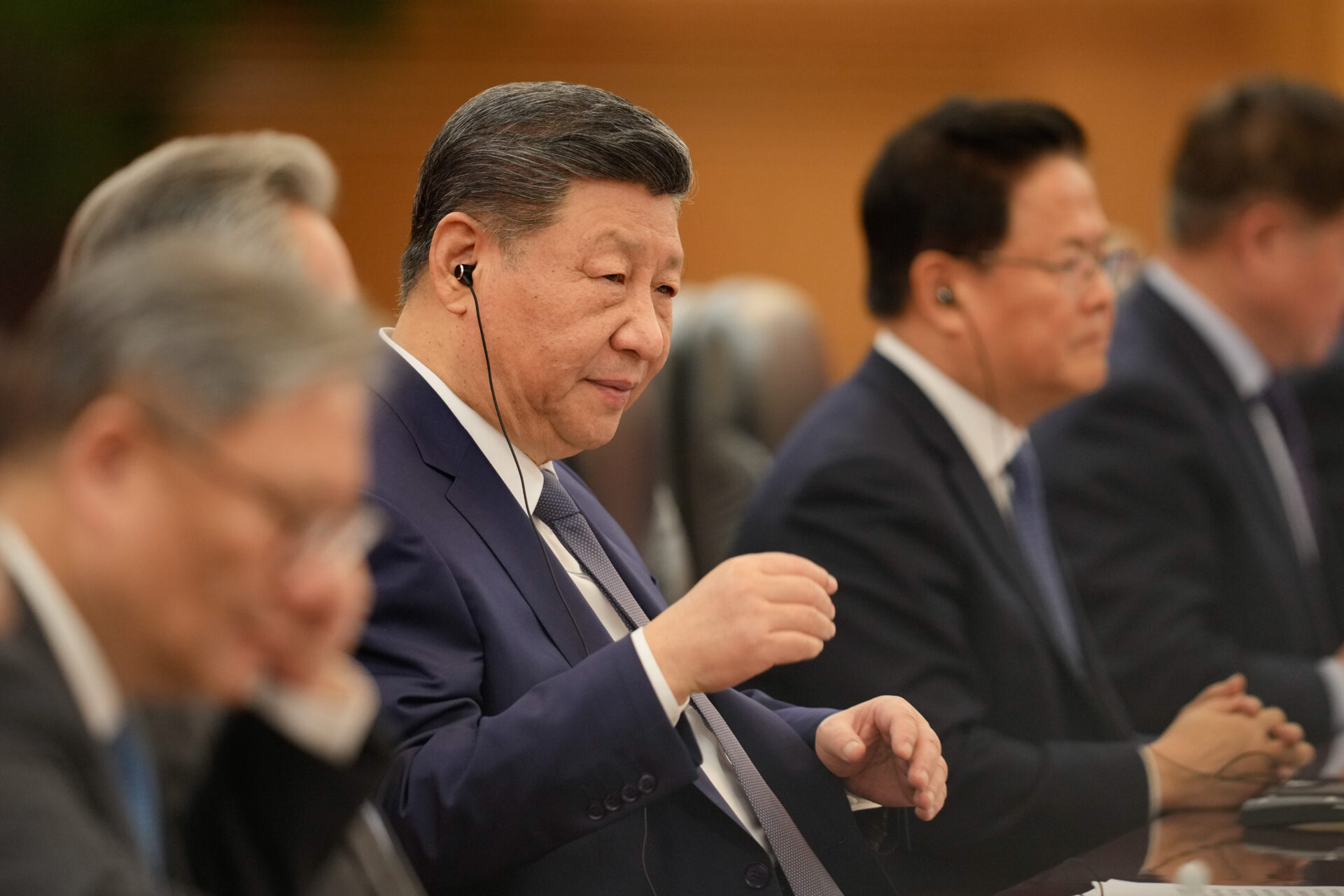

A series of trade disputes between the United States and China (frequently termed a “trade war” between the two sides) commenced in January 2018, with a series of import tariffs levied on Chinese goods by the U.S. government, followed by retaliatory tariffs issued on American products by the Chinese government. (For two previous China Brief discussions of some of these issues, see: “Xi Reasserts Control Over PRC Politics as Trade War Deepens,” September 19, 2018; and “What Derailed the U.S.-China Trade Talks?” May 29, 2019.) Although a limited “phase one” deal was signed between the two sides in January, many contentious issues remain unresolved.

The trade disputes of the past two years have revived discussion of a controversial topic: the extent to which foreign governments and companies could or should pursue economic “decoupling” from China, and the extent to which they should consider measures to relocate manufacturing and supply chains out of China. In this first part of a two-part article series, analysts Ashley Feng and Sagatom Saha consider some of the complex issues associated with potential decoupling—focusing both on U.S. government policies, and the considerations faced by U.S. companies that source production in China. The second part of this series, to appear in our next issue, will focus on policy issues surrounding economic decoupling in China itself.

Introduction: The “Trade War” and U.S.-China Economic Decoupling

The trade war has defined the current adversarial relationship between the United States and the People’s Republic of China (PRC). While President Donald J. Trump has at times openly expressed admiration for Chinese Communist Party (CCP) General Secretary Xi Jinping, his administration has pursued policies consistent with economic and technological decoupling. These policies include reforms that strengthen the Committee on Foreign Investment in the United States (CFIUS); greater usage of the export control system, especially the Entity List; and threatening the use of the International Emergency Economic Powers Act (IEEPA) to force U.S. companies back to the United States. These policies, taken to their logical end, would see the secular decoupling of the U.S. and Chinese economies and the rerouting of the global supply chains that bind them.

The interim trade deal has done seemingly little to change the structural economic conflict between Beijing and Washington. If economic decoupling came to pass, it would portend a sweeping reorientation of the global economy that many analysts regard as lying outside the bounds of conventional analysis. Yet some Trump administration officials, such as Director of Trade and Manufacturing Policy Peter Navarro, have promoted economic decoupling as their desired aim (SCMP, June 20, 2018; Forbes, December 3, 2019). President Trump himself has “ordered” American companies to look for alternative suppliers outside of China, or to return production to the United States (Twitter, August 23, 2019).

The Trump Administration’s trade and investment restrictions have not been limited to U.S. companies—they also include pressuring third-party countries and foreign companies to abide by U.S. restrictions. Chinese companies are also relocating their manufacturing capabilities abroad—in part because of secular economic trends, but U.S. actions are accelerating the process. Simply put, sustained U.S. policies on China can encourage economic decoupling, but only if global economic trends continue to cooperate. Those policies are nascent, but could likely become a structural feature of the U.S.-China economic relationship—especially since a harder stance towards China has gained traction among both major parties. This has been demonstrated by widespread criticism of Chinese trade practices in both parties, and in bipartisan votes on legislation antagonistic to Beijing, such as the Hong Kong Democracy and Human Rights Act or the UIGHUR Act (see further below).

The Trump Administration has pursued a three-pronged approach in breaking down economic supply-chain links: 1) escalating tariffs, which discourages bilateral trade; 2) imposing investment restrictions and export controls that punish tech transfers; and 3) issuing threats to U.S. firms that do business in China under the IEEPA. These current policies preview what could become a new orientation in U.S. policy towards China, regardless of who leads the United States at the beginning of next year.

Tit-For-Tat Tariffs

Escalating, reciprocal tariffs have been the weapon of choice for both the CCP and the Trump Administration throughout the trade war. Beijing’s average tariff rate on U.S. exports rose from 8 percent in January 2018 to a high of 21.1 percent last year, before falling to 20.3 percent as the phase one deal went into effect. Similarly, Washington’s average tariff rate jumped from 3.1 percent to 21 percent, before falling to 19.3 percent in the same time period (PIIE, February 14). The role that tariffs play in an all-out decoupling push would be relatively straightforward: U.S. tariffs targeted at China would make domestic production—or more likely, non-Chinese foreign production of tariffed goods—relatively less expensive. However, such a scenario has yet to unfold. In the American Chamber of Commerce in China’s annual business climate survey, less than one out of every five companies reported that they have moved, or are planning to move, capacity out of China (AMCHAM China, 2020). However, sustained higher tariffs across another administration might have a more potent effect.

Executive Power and Financial Markets

President Trump, despite his populist style of tweeting, has leveraged few of the executive powers that would allow him to more aggressively pursue decoupling. Last August, the president cited the IEEPA to claim the authority to force all American businesses to leave China (Twitter, August 23, 2019). The law, which was designed to punish and isolate rogue states and terrorist groups, has never been exercised in such a manner; but the legislation as written grants President Trump the ability to declare a national emergency (after nominal consultation with Congress) that would prevent financial transfers to China. Congress would have no authority of its own to terminate such a declaration without a veto-proof, two-thirds majority in each chamber (U.S. Treasury Department, undated). Trump has yet to formally invoke IEEPA for this purpose, and if he were to do so, the executive order would likely be challenged in the courts. The current Supreme Court has generally taken an expansive view of executive authority, but it would be difficult to predict its decision in such a theoretical court challenge.

Further, the Trump Administration has yet to significantly limit Chinese firms’ access to America’s deep capital markets. As of February 2019, 156 Chinese companies—including 11 state-owned firms—were listed on the three major U.S. exchanges, for a combined market capitalization of $1.2 trillion (USCC, February 25). The Trump Administration has reportedly considered delisting Chinese firms from U.S. stock exchanges, and a bipartisan group of legislators has introduced legislation that would compel Chinese firms listed on American exchanges to provide access to audits and other oversight mechanisms, or else face delisting (Reuters, September 27, 2019). Growing evidence indicates structural challenges for U.S. regulators tasked with oversight of Chinese companies seeking capital in the United States. The U.S. Securities and Exchange Commission and the Public Company Accounting Oversight Board (PCAOB), which oversees audits of publicly traded firms, has singled out China-based companies as the greatest challenge their inspectors face—in part because 95 percent of the firms that refuse to have their auditing documents reviewed by U.S. authorities have auditors based in mainland China or Hong Kong (SCMP, July 16, 2019).

Trump Administration officials have also floated the prospect of limiting the inclusion of Chinese companies in stock indexes to cut U.S. portfolio investment flows to China, but such moves are often touted as unfeasible (Bloomberg, September 27, 2019). Nevertheless, pointed moves that would force Chinese firms to open their books, or else limit their access to U.S. capital altogether, would reduce the overall economic links between the two countries.

CFIUS Reform and Export Controls

Congress has also played a large role in promoting greater scrutiny of global economic and financial flows, especially those involved in U.S.-China trade. In 2018, Congress passed the Foreign Investment Risk Review Modernization Act (FIRRMA) and the Export Control Reform Act (ECRA). FIRRMA expanded the jurisdiction and processes of the CFIUS, an interagency body that screens investments in the United States on national security grounds (U.S. Treasury Department, August 2018). For its part, ECRA codified the Export Administration Regulations and directed the Department of Commerce’s Bureau of Industry and Security (BIS) to define emerging and foundational technologies (Congress.gov, April 2018). The BIS definitions of these new types of technologies feed back into the criteria that CFIUS will use to screen foreign investments.

Since these two pieces of legislation have passed, both the Trump Administration and Congress have drastically increased the use of the CFIUS and the export control regime to affect supply chains and financial flows. Since FIRRMA passed, Chinese investment in the United States has dropped nearly 60 percent from $29 billion in 2017 to $5 billion in 2018 (Rhodium Group, May 2019). Over the past three years, the Trump Administration has also increasingly either blocked Chinese companies from investing in U.S. businesses, or forced them to divest: for example, preventing Broadcom from investing in Qualcomm—both companies that develop semiconductors, which could fall under the category of emerging technologies (SCMP, March 13, 2018).

The Trump administration also forced a Tencent-backed Chinese company to divest from PatientsLikeMe, a company that helps people find those with similar health conditions (O’Melveny & Myers, March 9); and Beijing Kunlun to divest from the dating app Grindr (TechCrunch, March 6). Both CFIUS decisions were based on protecting users’ personally identifiable information, in a demonstration of the expanding definition of national security that the Trump administration has used to block investments between the United States and China. This trend has continued in the administration’s decision earlier this month to force another Chinese company to divest from StayNTouch, a U.S. hotel software company (White House, March 6).

Congress has passed the Hong Kong Democracy and Human Rights Act of 2019, which mandates that the U.S. State Department report annually to Congress on “whether Hong Kong continues to warrant treatment under United States law in the same manner as United States laws were applied to Hong Kong before July 1, 1997” in regards to political rights and personal freedoms; and similarly requires the Department of Commerce to report on export control policy as it pertains to Hong Kong, including whether the territory is being used for shipment of military dual-use items or surveillance equipment (Congress.gov, November 27, 2019). The UIGHUR Act calls for the identification and restriction of exports of items that contribute to the surveillance of Uighurs, and applies sanctions to PRC government officials that have participated in the suppression and internment of Uighur Muslims (Congress.gov, December 3, 2019). Simply put, Congress is increasingly comfortable prioritizing foreign policy objectives at the expense of U.S.-China economic links.

U.S. Pressure Applied Abroad

Under the expanded authorities provided by Congress, CFIUS has been moving to disrupt investments not just in the United States, but abroad as well. As part of the FIRRMA reforms, CFIUS now maintains a “whitelist” of trusted countries, whose companies face less scrutiny than those from countries not on the list. When the FIRRMA regulations came out at the end of January 2020, only the United Kingdom, Australia, and Canada were added onto the whitelist for a two-year probationary period. However, in light of the United Kingdom’s recent decision to let Huawei bid to build its 5G network, four U.S. senators have introduced the Protecting Americans From Foreign Investors Compromised by the Chinese Communist Party Act of 2020. This legislation threatens to remove the UK from the whitelist by adding a clause that would prevent CFIUS from adding a country onto its whitelist if that country’s telecommunications equipment were installed by a “foreign adversary” (Senate.gov, 2020).

Similarly, the expanding use of export controls by Congress and the administration against PRC actors has disrupted supply chains. Since the beginning of the Trump Administration, BIS has added Huawei and sixty-eight of its subsidiaries for allegedly violating the U.S. sanctions regime on Iran; twenty-eight PRC entities for human rights violations in Xinjiang; four entities for enabling technology transfer for military use in the PRC, and five entities for possible military end-use of technology exports to the PRC (Federal Register, August 21, 2019; October 9, 2019; August 14, 2019; and June 24, 2019). The addition of Huawei and its subsidiaries onto the Entity List, in particular, has compelled U.S. companies to reroute their manufacturing capabilities for critical technologies abroad to avoid the U.S. export control regime (NY Times, June 25, 2019).

Conclusion

The emerging geopolitical competition between the United States and China has forced Washington to come to the same conclusion that Beijing reached years ago: self-sufficiency in critical technologies is a non-negotiable element of national security. As the competition continues to escalate, private businesses and supply chains will remain caught in the middle. While the Trump Administration’s coercive economic actions have had limited effectiveness, they will meet macroeconomic trends in the United States and China that are pushing the two countries farther apart—as the second part of this article will explore.

Ashley Feng is a research associate in the energy, economics, and security program at the Center for a New American Security. She can be found on Twitter @afeng79.

Sagatom Saha is an independent energy policy analyst based in Washington, D.C. His writing has appeared in Foreign Affairs, Defense One, Fortune, Scientific American, and other publications. He is on Twitter @sagatomsaha.