Kumtor Gold Mine Nationalism Issue Roils Kyrgyz Politics

Publication: Eurasia Daily Monitor Volume: 11 Issue: 1

By:

Since the December 1991 implosion of the Union of Soviet Socialist Republics (USSR), mineral extraction issues have risen to the forefront of post-Soviet Caucasian and Central Asian states, as newly independent countries have raced to exploit reserves previously underdeveloped by the Soviet administration in Moscow. Farther east, the foreign investment trend to develop indigenous reserves is advancing, albeit on a more minor scale, for example, with Uzbekistan ramping up natural gas production to sell to China. But Kyrgyzstan is unique; having no significant hydrocarbon reserves, it has instead exploited its mineralogical gold reserves since 1997.

However, there is now growing political pressure in Kyrgyzstan to revise the terms of the 2009 contract on use of the Kumtor gold mine with its operator, Canada’s Toronto-based Centerra Gold Inc. During earlier negotiations, Kyrgyzstan’s government and Centerra agreed to establish a joint venture to develop Kumtor, which would amalgamate the current operating companies “Kumtor Gold Company” and “KOC” and provide each side with a 50-percent stake in the venture. But on November 25, 2013, Kyrgyzstan’s Economy Minister Raman Sariyev told a press conference that the government would instead seek to increase its share to 67 percent, a move bitterly opposed by Centerra (Kapital, November 25, 2013). Sariyev added, “I do not know whether the Canadian side will agree to such conditions or not.”

The Kumtor area has a history of intermittent Soviet exploration dating back to the late 1920s. An initial reserve statement was issued by the USSR State Committee on Reserves in March 1990, but the Soviet government was too preoccupied with political events and a lack of advanced Western technology to begin exploiting the reserves prior to the collapse of the Soviet Union in December 1991.

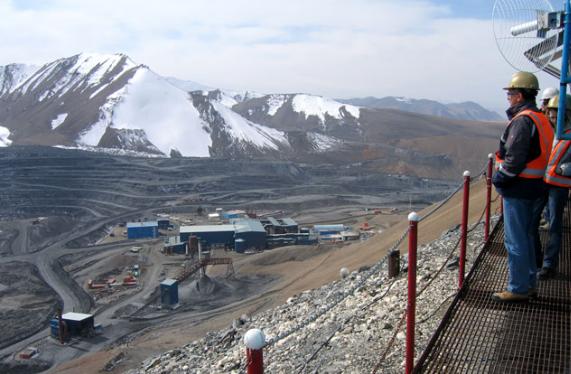

Located in Kyrgyzstan’s Dzheti-Oguz district, within the mountainous Tian Shan Metallogenic Belt at more than 14,000 feet above sea level, Kumtor is the second-highest gold mining operation in the world. From the beginning of industrial production in May 1997 to September 30, 2013, the Kumtor mine has produced about 8.9 million ounces, or 277.7 tons of gold (kumtor.kg/).

Kumtor is currently 100 percent owned by the Canadian mining company, Centerra Gold, through its wholly owned subsidiary, Kumtor Gold Co. (https://www.centerragold.com/operations/kumtor).

How important is Kumtor to the Kyrgyz Republic’s economy? Notably, the gold mine now accounts for up to a quarter of Kyrgyzstan’s GDP. This Central Asian republic has an estimated 430 tons of potentially recoverable gold, worth more than $105 billion at current prices. Furthermore, Minister of the Economy Sariyev stated, “If in 2014 Kumtor can produce 18 tons of gold, Kyrgyzstan will be able to sustain its economic growth” (https://www.24kg.org/economics/164623-temir-sariev-esli-v-2014-godu-laquokumtorraquo.html).

According to Kumtor’s operator, Canada’s Centerra Gold Inc. and its subsidiaries, Kumtor Gold Co. and Kumtor Operating Co., in the third quarter of 2013, Kumtor produced “2,808.3 kilograms [of gold] compared to 739.8 kilograms in the same quarter of 2012” (https://www.kumtor.kg/ru/operating-results-of-the-3rd-quarter-of-2013/).

Tensions stemming from the simmering dispute over the site as well as working conditions for its operation have been rising for some time. On May 28, 2013, thousands of protesters demanding the nationalization of Kumtor seized the Tamga electricity substation and cut off power to the facility (see EDM, June 6, 2013). The protesters demanded the nationalization of Kumtor and called for Centerra to build a more environmentally sensitive infrastructure as well as provide medical facilities and increased financial benefits for three local village inhabitants. The demonstrators repeatedly clashed with police. The authorities two days later declared a state of emergency around the mine as activists proclaimed, “Kumtor will either belong to us or stop its work.” On June 1, Kyrgyzstani Prime Minister Zhantoro Satybaldiyev visited the protesters and told them, “Kumtor must work. Kumtor is the future of Kyrgyzstan” (https://www.gov.kg/?p=22716).

Since then, Bishkek has attempted to play hardball with Centerra Gold over renegotiating the terms of its Kumtor contract. However, this has inspired criticism from several sources. On November 29, 2013, Kyrgyzstani Member of Parliament Zamir Bekboyev stated starkly at a session of the Ar-Namys parliamentary faction: “Kyrgyzstan cannot exist without Kumtor and [foreign assistance] grants” (https://www.24kg.org/parlament/166535-zamir-bekboev-bez-laquokumtoraraquo-i-grantov.html). Bekboyev added, “The Ministry of the Economy considers the rates of private enterprises as achievements of the whole country. It hopes to get profits from the work of invested plants. But these are private entrepreneurs’ achievements… We are ashamed to admit it, but we will not survive without foreign support and Kumtor” (https://www.tushtuk.kg/econom/6405_zamir_bekboev_bez_kumtora_i_grantov_kyirgyizstan_uje_jit_ne_mojet/).

In addition, if parliament’s proposed majority share nationalization of the Kumtor mine goes through, Bishkek “will have to pay the investor [Centerra] from $2 to 3 billion,” according to Eldar Tadzhibayev, the chairman of the Central Committee of the Mining and Metallurgical Trade Union of Kyrgyzstan Chairman (https://www.24kg.org/economics/165798-yeldar-tadzhibaev-pri-nacionalizacii.html).

Deputy chairman of the board of local gold producer Kyrgyzaltyn JSC, Kylychbek Shakirov, has also warned that Kumtor’s nationalization would damage Kyrgyzstan’s image as a business-friendly country abroad. Shakirov alleged that “not a single [foreign] company will work with an outcast” should the Kumtor gold mine be nationalized (https://eng.24.kg/community/2013/09/17/27979.html).

Finally, Kyrgyzstan is not the only potential gold source in Central Asia. Centerra Gold noted on its website, “The Tien Shan Metallogenic Belt [is] a major suture that traverses Central Asia, from Uzbekistan in the west through Tajikistan and the Kyrgyz Republic into northwestern China, a distance of more than 1,500 kilometers. A number of important mesothermal-type gold deposits occur along this belt including Muruntau, Zarmitan, Jilau and Kumtor” (https://www.centerragold.com/operations/kumtor).

Spurred into action by the November warnings of Kumtor’s impending nationalization, Centerra sought legal redress, filing 5–6 international arbitration claims against Kyrgyzstan and Kyrgyzaltyn for $2–3 billion, according to the Canadian firm’s head of its International Arbitration division, Matthew Sanders (https://eng.24.kg/community/2013/09/17/27979.html).

Centerra’s legal threat has evidently produced the desired effect. On December 24, Centerra Gold Inc. announced that it has reached a non-binding agreement with Kyrgyzstan’s government to exchange Bishkek’s 32.7-percent equity stake in the Canadian miner for a 50-percent ownership interest in the Kumtor mine itself. Centerra’s new 50-50 joint venture with the government will also commit the Canadian mining company to increasing its local presence in Kyrgyzstan by $100 million over the remaining life of the mine as well as increase the number of Kyrgyz nationals in management positions in the joint venture (https://www.theglobeandmail.com/report-on-business/industry-news/energy-and-resources/centerra-kyrgyzstan-reach-tentative-deal-on-kumtor-mine-ownership/article16097688/).

The draft deal is broadly similar to a previous agreement that Kyrgyzstan’s parliament had rejected, so it is unclear whether the latest terms would win legislative approval. Nevertheless, the threat of lawsuits, combined with plummeting gold prices, has resulted in a victory for Centerra, should the arrangement be finally ratified.