Managing the Chiang-Chen Talks in Cross-Strait Relations

Publication: China Brief Volume: 10 Issue: 2

By:

In June 2008, negotiations between the semi-official Straits Exchange Foundation (SEF) in Taiwan—which manages ongoing cross-Strait negotiations—and its Chinese counterpart, the Association for Relations Across the Taiwan Strait (ARATS), resumed after 15 years of suspension. The resumption of negotiations was spearheaded by the first visit of ARATS Chairman Chen Yunlin to Taiwan in November 2008. Since then the two sides have had four meetings, which served as the centerpiece of an escalating debate in Taiwan that has widened the political chasms within Taiwanese society over how the government should handle the resumption of cross-Strait negotiations.

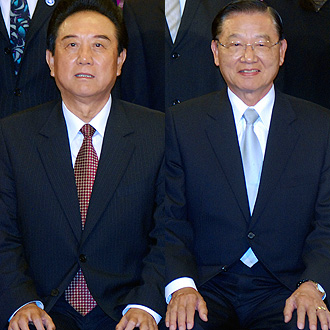

Against the backdrop of the global financial crisis, President Ma Ying-jeou’s flagging approval rating (at 33 percent approval rating) has galvanized the former ruling party, Democratic Progressive Party (DPP), and fueled growing public concerns over the impact of the administration’s eagerness to court Beijing (United Daily News [Taiwan], December 25, 2009). While the talks between SEF Chairman Chiang Ping-kun and ARATS Chairman Chen Yunlin have been perceived as a source of calm in a tumultuous global environment—indeed through the reduction of tension across the Strait—the simmering debate within Taiwan over the details of the ongoing talks warrants closer U.S. scrutiny. Any change in the cross-Strait equation could have a profound long-term strategic impact on the region.

Increasing Human Exchanges and Direct Flights

When Ma Ying-jeou was inaugurated as president of Taiwan, he immediately approved orders to increase direct air links between Taiwan and China from weekend chartered flights (July 4 – December 14, 2008) to weekday and weekend charter flights (December 15, 2008 – August 30, 2009) across the Taiwan Strait, as well as regular flight arrangements beginning on August 31, 2009. Similarly, the DPP had also tried to expedite the convenience of traveling arrangements between Taiwan and China through the Macao dialogue [1] (aomen moshi) with China in 2005-2007, but Beijing did not want to reward the former administration under Chen Shui-bian. While a majority of people in Taiwan support regulated direct air links across the Taiwan Strait, the deal was cast negatively as a "Chinese domestic flight arrangement" because foreign carriers were excluded from operating between two sides of the Taiwan Strait [2]. The agreements signed between Chiang and Chen in November 2008 on aviation routes, direct sea transportation links and postal services herald the arrival of the “major three links” era across the Taiwan Strait.

An average of six public opinion polls conducted from August 2008 to December 2009 by Taiwan’s Mainland Affairs Council (MAC)—a cabinet-level administrative agency under the Executive Yuan—indicates that around 33 percent of respondents worried that cross-Strait exchanges were being pushed ahead too fast compared to 42 percent who believe the pace was just right [3]. These polls indicate that a significant division among Taiwanese people along party lines has become more evident since the resumption of talks. For example, ARATS Chairman Chen Yunlin was wined and dined by leaders of the KMT, People First Party, other pro-unification associations and corporate representatives, while DPP supporters took to the streets and besieged the hotel where Chen was staying (Taipei Times, November 7, 2008). Chen Yunlin is still not able to travel to southern Taiwan—which is traditionally a DPP political stronghold.

After the third Chiang-Chen meeting, which was held in Nanjing, China in April 2009, the two sides agreed to increase regular cross-Strait flights from 108 to 270 per week, connecting Taiwan with 27 Chinese cities such as Beijing, Shanghai, Guangzhou, Amoy, Hangzhou, Shenzhen and Ningbo. Effective in August 2009, airline carriers from both sides have maintained daily regular flights. Yet, only 58.5 percent of seats were booked from August 31 to September 20, 2009 (Liberty Times [Taiwan], October 18, 2009). Some airline companies were forced to discontinue or curtail some cross-Strait flights due to a lack of sufficient passengers and profits (Wen Wei Pao [Hong Kong], September 9, 2009; Liberty Times [Taiwan], October 18, 2009). In 2009, the annual number of Chinese tourists traveling to the island was about 600,000 (China Daily [Beijing], January 2, 2010). In fact, the average daily numbers of 1,660 fall far behind the figures of 3,000 per day, which was an estimate touted by the Ma government (Mainland Affairs Council News Release, No. 24, April 22, 2009).

As one of its remedies for the economic downturn, the Ma administration made the prediction in May 2009 that if 3,000 Chinese tourists visited Taiwan per day, it could boost the island economy’s annual economic growth rate by 0.40 percent. Even though this figure lagged behind the projected stimulus of other fiscal measures such as issuing consumption vouchers (0.66 percent), expanding public construction project investment (0.65 percent), and pushing forth renovation of cities and stimulating private sector investment (0.51 percent) [4], the Ma administration clearly had very high expectations of the economic benefits from inbound Chinese tourists.

Yet, Beijing has used the droves of Chinese tourists as a political and economic tool to warn Taipei about pursuing any antagonistic policies, for example, not to hurt “Chinese feelings” over the issue of nationalism or to avoid associating with so-called “separatist forces” in Xinjiang and Tibet. For instance, Beijing urged Chinese tourists to bypass the major port-city in southern Taiwan, Kaohsiung, after the city’s DPP mayor, Chen Chu, invited the Dalai Lama to visit the city in early September 2009 and permitted the screening of the documentary movie, “The 10 Conditions of Love,” which is about the life of the exiled Uyghur political dissident Rebiya Kadeer (China Post, October 16, 2009). The Ma government, however, rejected Kadeer’s entry visa on the grounds that it would endanger Taiwan’s "national interest” (New York Times, October 7, 2009; Taipei Times, October 22, 2009).

With increasing human exchanges, Chinese white-collar elites such as corporate employees and university students have also increased their presence in Taiwan since May 2008 (Global Vision Monthly, May 2009). In addition to creating economic opportunities for local businesses in Taiwan, an influx of Chinese tourists also creates a host of security challenges to Taiwan. In May 2009, an alleged Chinese tourist, Ma Zhongfei, was spotted taking pictures inside a restricted military compound in downtown Taipei where the Information and Electronic Warfare Command is located (Taipei Times, May 27, 2009, China Times, October 17, 2009). China is also constantly conducting cyber espionage against Taiwan by attacking secure computer systems and networks (2009 National Defense Report, Taipei: Ministry of National Defense, 2009)

Chinese Investment and Further Economic Integration

For more than two decades since the opening up of cross-Strait relations, Taiwan has had one-way investment in Mainland China, which was concentrated in the Pearl River Delta and Yangtze River Delta. Taiwan’s economy, however, has been suffering from a net capital outflow since the early 1990s as Taiwanese investors have been wiring money out of the island and pouring capital into the People’s Republic of China (PRC). While it is a widely held belief that Taiwan’s businesspeople have invested more than $100 billion in China from 1991 to 2009, Taiwan’s official figure only showed $78.1 billion [5]. To improve the economic performance of Taiwan after the global financial storm, the Ma government is understandably anxious to attract Chinese investment in Taiwan.

In the third Chiang-Chen talks, Taiwan and China signed an Agreement on Cross Strait Financial Cooperation. In June 2009, Taiwan’s Ministry of Economic Affairs (MOEA) set up the “Regulations Governing Permission for People from the Mainland Area to Invest in Taiwan” to provide rules for Chinese investment. Under the regulations, individuals, legal persons (juristic), organizations and institutions that wish to hold shares or capital in a company or enterprise in Taiwan can obtain permission from the MOEA. The Taiwanese government prohibits investment from Chinese enterprises that have military shareholders in order to secure the island’s national security and economic development. In August 2009, the MOEA declared the first group of items open to Chinese investment, including 64 items in the manufacturing industry, 117 in the service industry, and 11 in public construction [6]. To help implement the Cross-Strait Financial Cooperation Agreement, a memorandum of understanding (MOU) on cross-Strait banking supervision with Beijing was signed on November 16, 2009 by the two sides’ respective financial regulatory agencies [7]. Beginning with the implementation of the MOU on January 16, 2010, China’s qualified domestic institutional investors (QDIIs) can now enter the Taiwanese stock market with their target on Taiwanese blue-chip companies (Taipei Times, January 18, 2010).

Before the regulations on Chinese investment in Taiwan were adopted, the PRC’s state-owned carrier China Mobile decided to buy a 12 percent stake in Taiwan’s Far EasTone, one of Taiwan’s three largest telecommunications operators, for $529 million (Forbes, April 30, 2009). In October 2009, a Hong-Kong-based financial services firm, Primus Financial Holdings Limited, succeeded in a bid to acquire Taiwan-based Nan Shan Life Insurance Company, the total assets of which exceeds $46 billion and serves more than 4 million life insurance policyholders in Taiwan (New York Times, October 13, 2009). Allegations that the company was backed by Chinese capital highlighted concerns that the Chinese-government may penetrate into different business sectors under the guise of Hong Kong, Macao, or overseas investments, making it difficult for the Taiwanese government to track down every transaction. To complicate the Taiwanese government’s review process, Primus Financial Holdings sold 30 percent of its acquired stake in Nan Shan Life Insurance Company to Taiwan’s Chinatrust Financial Holding one month later in November 2009 (Taipei Times, November 19, 2009).

To the surprise of many observers, SEF and ARATS negotiators, apparently under instruction from their respective governments, decided to shelve an agreement on double taxation that was planned in the fourth round of cross-Strait talks in December 2009 (China Post, December 22, 2009). The sudden change may stem from the concern of Taiwanese investors about the accounting practices, tax payments, and other legal affairs across the Taiwan Strait. Yet, both sides signed the Agreement on Cooperation of Agricultural Product Quarantine and Inspection, Agreement on Cooperation in Respect of Standards, Metrology, Inspection and Accreditation, and Agreement on Cooperation in Respect of Fishing Crew Affairs. In the fifth round of Chiang-Chen talks scheduled in the first half of 2010, the Economic Cooperation Framework Agreement (ECFA), and a pact on the protection of intellectual property rights between Taiwan and China are expected to be signed (Liberty Times, December 23, 2009; See "Cross-Strait Matrix: The Economic Cooperation Framework Agreement," China Brief, May 27, 2009).

Security Concerns

While the Taiwan Strait is experiencing the most rapid and dramatic thaw in 60 years, cross-Strait political, economic, military and psychological imbalances are increasing. China’s policies toward Taiwan are sophisticated and cannot be underestimated; for one, Beijing has enormous resources available to implement this goal and for the most part believes that time is on its side.

The opposition DPP has sounded the alarm bells over the possible security implications of Chinese investment in Taiwan. DPP lawmakers argue that the consequences of Chinese investment in the banking and telecommunications sector are particularly dire for Taiwan’s predicament. The DPP chairperson, Tsai Ing-wen, stated that allowing Chinese investments in infrastructure projects like airports and harbors would compromise national security (China Post, July 2, 2009). Soon after the Hong Kong-based Primus purchased Taiwan’s Nan Shan Life Insurance Company, the DPP immediately urged the Taiwanese Financial Supervisory Commission (FSC) to examine whether that Hong Kong company is financed with Chinese government capital (Taiwan News, October 15, 2009).

Cross-Strait relations are moving ahead quickly, with 12 agreements signed between the two sides in just 18 months (June 2008 – December 2009). The KMT-dominated legislature, however, has not been able to provide effective oversight, while the opposition DPP is busy coping with its own internal problems, particularly in distancing itself from former President Chen Shui-bian and his alleged corruption charges. Yet, the Legislative Yuan—Taiwan’s parliament—is not able to exercise its oversight authority over those 12 cross-Strait agreements, which stands in sharp relief to its move to revise regulations to ban imports of ground beef and bovine offal from the U.S. in January 2010 (China Post, January 6, 2010).

Conclusion

President Ma has improved Taiwan’s relations with China only through dramatic changes to the China-policies implemented by his predecessor, Chen Shui-bian. At the same time, Ma has tried to assure the United States of a surprise-free relationship and is striving to rebuild trust between Taipei and Washington. While the Clinton administration could not get a good grasp on the cross-Strait envoys’ dialogues from 1991-1995 due to the discussion’s sparse and confidential nature, the Obama administration appears eager to gain a clear understanding of the ongoing cross-Strait talks in light of the rapid pace of a cross-Strait détente and the lack of transparency in details of the negotiations that are being carried out through multiple channels.

After four rounds of Chiang-Chen talks, Taipei and Beijing were able to achieve a thaw in cross-Strait relations by focusing on functional matters, which was predicated on the KMT’s acceptance of the so-called “92 Consensus.” In doing so, President Ma paved the way for cross-Strait negotiations to move from low politics, or economic and functional issues, to political issues such as a cross-Strait peace agreement including military confidence-building measures (CBMs) and Taiwan’s diplomatic space, which have already been discussed by experts in track two channels. Yet, given its non-transparent nature, it remains to be seen whether the Chiang-Chen talk will continue to serve as the main vehicle for constructing a political framework for peaceful reunification. Compared to the KMT-CCP détente, rapprochement between the KMT and the DPP, if not easier, is far more urgent. Without it, peace and stability across the Taiwan Strait will be as fragile as a house built on sand.

Notes

1. The DPP government claimed that both Taipei and Beijing agreed to set aside the "one China" dispute, and started negotiating in Macao on cross-Strait functional matters after the issuance of the Anti-Secession Law in 2005. The talks, known as the “Macao Model,” included private sector representatives and government officials from both sides of the Taiwan Strait. Taipei and Beijing also used the channel to negotiate agricultural cooperation and financial liberalization; See https://big5.xinhuanet.com/gate/big5/news.xinhuanet.com/tw/2008-06/12/content_8354759.htm.

2. Chang Hsien-chao, “The Negotiation Results and Political Effects of the Second Chiang-Chen Talk,” November 21, 2008, Peace Forum, Taiwan Thinktank, https://www.peaceforum.org.tw./%2Fself_store%2F7%2Fself_attach%2FThe_Second_Chiang-Chen_Talks_%28by_Hsien-chao_Chang%29.pdf.

3. Compiled from MAC public opinion polls, cited in https://www.mac.gov.tw/ct.asp?xItem=44457&CtNode=5617&mp=1.

4. Former Vice Premier Chiu Cheng-hsiung’s Report at Academia Sinica, Taipei, September 14, 2009.

5. “Taiwan Investment in Mainland China,” cited in https://www.mac.gov.tw/public/Attachment/912189424798.pdf.

6. “Taiwan Opens 192 Items to Mainland Chinese Investment,” August 20, 2009, cited in https://investintaiwan.nat.gov.tw/en/news/200908/2009082002.html.

7. ““The Memorandum of Understanding (MOU) on Cross-Straits Banking Supervision Cooperation was Signed,” November 16, 2009, in www.cbrc.gov.cn/english/home/jsp/docView. jsp?docID.