Russia’s Fiscal Dependence on China Grows

Publication: Eurasia Daily Monitor Volume: 21 Issue: 165

By:

Executive Summary:

- As Western sanctions increasingly isolate Russia, it has become highly dependent on China for trade and economic support, particularly in energy exports sold at discounted prices.

- China has capitalized on Russia’s isolation by expanding its investments and economic influence within Russia, with Chinese companies increasing their share of Russian market participation. This economic relationship shows an imbalance, with China benefiting from favorable trade terms.

- Western sanctions and the war in Ukraine have deeply impacted Russia’s economy, as seen in the weakening ruble, increasing reliance on China, and signs of Russia potentially becoming a subordinate economic partner to China rather than an equal.

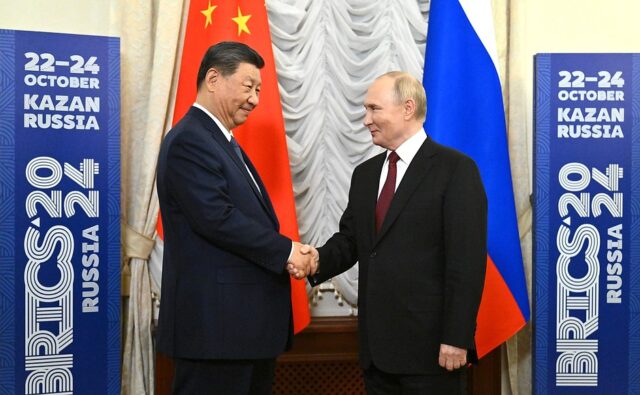

At the recent 16th BRICS (a loose political-economic grouping originally consisting of Brazil, Russia, India, China, and later South Africa) summit in Kazan on October 22–24, Russian President Vladimir Putin praised the accord between the attendees. While the Russian media trumpeted the summit as proof that Western sanctions imposed after Russia’s 2022 invasion of Ukraine are ineffective, the Russian economy is suffering, with bilateral trade with China increasingly important. This disparity led to an extraordinary exchange between Putin and the media covering the summit when a Sky News Arabia journalist asked, “Does Russia feel to some extent like a junior partner in light of the ongoing dynamics between China and the United States?” The “junior partner” comment rankled Putin. After replying that the bilateral relationship was unique, Putin added, “Our relationship with the People’s Republic of China is based on equality and mutual respect for each other’s interests. … We genuinely listen to one another” (Kremlin.ru, October 18). Beyond Russian claims of global importance and ritual denunciations of Western (and the dollar’s) economic dominance, the summit was ultimately little more than a glorified photo-op. China is Russia’s increasingly essential ally in ameliorating the sanctions’ deepening impact on Russia’s economy. By the end of 2022, Russia had become one of the most dependent economies on China, second only to North Korea (RBC, November 15, 2022). Before the start of Russia’s war in Ukraine, China accounted for a quarter of all imports to Russia, but nine months after the full-scale invasion began, China’s share of Russian imports had risen to 40 percent, and it now buys the majority of Russian energy exports at discounted prices (The Moscow Times, November 15, 2022). As Russia becomes more isolated on the international stage, its reliance on China will continue to rise, and Beijing will continue to take advantage of the opportunity to exploit Russian weakness for its own gain.

Even as many Chinese companies remain wary of secondary US sanctions, Chinese investors are increasingly investing in the Russian economy. Since the beginning of 2024, compared to 2023, the number of companies with Chinese co-owners in Russia grew 32 percent. The share of Chinese businesses among new company registrations increased from 13 percent in 2021 to 34 percent in 2024, and the approximately 200 new registrations per month in 2024 increased by 400 percent more than in 2021. This surge brought China to first place among foreign participants in the Russian market, almost a third ahead of Belarusian entrepreneurs who had previously led in 2023 (SPARK-Interfax, October 3).

Russia’s European energy export market losses after the beginning of the war raised China’s profile as an increasingly important market despite payments being lower than in Europe. According to Chinese foreign trade data, in 2022, China was purchasing Russian crude oil at a rate 16–17 percent cheaper than Russian exports to other countries (RBC, November 15, 2022). Chinese customs reported on November 7 that Russian-Chinese trade from January to October 2022 increased by 33 percent, compared to the same period in 2021, to a record $153.9 billion (RBC, November 7, 2022).

China is also receiving significant discounts on Russian natural gas imports. According to a recent Russian Ministry of Economic Development forecast of the country’s socio-economic development prepared in September, Russian gas supplies to China through the Power of Siberia pipeline will continue at a significant discount. In 2025, China’s average natural gas price will be $261 per thousand cubic meters (tcm), which is 35 percent lower than current prices in Europe ($402 per tcm on the London Intercontinental Exchange). For other countries not in the Commonwealth of Independent States, Russian gas will cost $340 per tcm. According to the Ministry of Economic Development, the current 23 percent discount for China will increase annually, eventually reaching 30 percent (The Moscow Times, September 12).

Notably, the number of sanctions imposed upon Russia by Western countries since it began its war in Ukraine has been steadily rising. Russian Deputy Foreign Minister Aleksandr Pankin recently informed a Federation Council meeting that “about 20,000 various restrictive sanctions have already been imposed on Russia” before adding, “Actually, they cannot be called sanctions because sanctions are a legitimate measure introduced by the [UN] Security Council, while these are unilateral restrictive measures” (TASS, July 29 ).

While the Russian government has steadfastly maintained that the sanctions have limited impact, even Putin has acknowledged their deleterious effects. On October 28, Putin began a meeting on economic issues by telling participants, “I want to note that difficulties and imbalances remain in the economy. They are primarily caused by the difficult conditions in which we are building up the country’s industrial, agricultural, and financial potential. These are external sanctions and our own structural restrictions” (TASS, October 28).

Completing Russia’s grim picture, last month, the ruble continued to weaken against the dollar, euro, and yuan due to volatile oil prices, reduced mandatory foreign currency sales by exporters, and increased foreign currency demand. In October, the Russian currency lost about four percent against the dollar (the exchange rate of approximately 97 rubles to one dollar), one percent against the euro (around 105 rubles), and three percent against the yuan (around 13.6 rubles), with analysts predicting a possible exchange rate of 100 rubles per dollar by year-end (Rossiyskaya Gazeta, October 29).

Putting an optimistic spin on economic data is a common practice of governments worldwide, particularly if the reality is somewhat less impressive. Despite the BRICS photo-ops, Russian dependency on China can only deepen as Putin continues his aggression and sanctions intensify, weakening Putin’s assertions of an “equal” relationship. If such downward trends continue, exacerbated by the money-pit the war has become amid tightening sanctions, Russia may eventually slip from being China’s “junior partner” to essentially a “colony,” despite the Kremlin’s assertions (see EDM, April 17, September 30).