Russia’s Kurganmashzavod Factory Data Shows the Limits of BMP-3 Production Rates

Publication: Eurasia Daily Monitor Volume: 21 Issue: 110

By:

Executive Summary:

- A recent report from the Royal United Services Institute shows data on the production rates of Russian arms, including the manufacturing of BMP-3 armored vehicles from the Kurganmashzavod (KMZ) manufacturing company, the only producer of this vehicle.

- Despite increasing employees, working hours, and machine tools, there is no evidence that the BMP-3 production rate changed in 2024, meaning Russia cannot sufficiently restock its army.

- Russia’s long war and the continuing degradation of its economy are evident in the state of its military-industrial complex, which is increasingly unable to keep up with demand.

The Royal United Services Institute, one of the United Kingdom’s leading think tanks, recently published a report on the production rates of some Russian arms. Among other data, the report includes information about the manufacturing of BMP-3 armored vehicles by the Kurganmashzavod (KMZ) manufacturing company, a Russian state corporation Rostec subsidiary. This is the only manufacturer of this type of armored vehicle. 463 vehicles were produced in 2023: 100 in Q1, 108 in Q2, 120 in Q3, and 135 in Q4 (RUSI, June 26). Attempted verification of this assessment shows that this production rate is possible if it includes repaired or overhauled BMP-3s alongside newly manufactured vehicles. Adjusting for this, the actual production rate of new BMP-3s may be assessed as no more than 200 vehicles in 2023. The number of armored vehicles that KMZ overhauled in 2023, however, is unclear. The production rate will likely not change much in 2024, though this assessment may be revised as new data appears.

On the eve of the full-scale invasion of Ukraine, Russia had approximately 760 BMP-3s in service, according to the International Institute for Strategic Studies. This number had decreased to approximately 460 BMP-3 by the start of 2024. Additionally, the confirmed losses of BMP-3s from February 24, 2022, to January 1, 2024, were 344 vehicles. These losses currently amount to 510 vehicles (Oryxspioenkop.com, February 24, 2022; IISS, accessed July 18). That means the BMP-3 production rates in 2022–2023 would not have been able to compensate for the losses of these vehicles. The inconsistencies in the production rate of Russia’s military-industrial complex give insight into the real state of the Russian economy amid its war in Ukraine.

Between 2015 and 2021, the average annual production rate of BMP-3s was approximately 70–100 vehicles, and the average yearly rate of BMP-3 overhaul was about 50 vehicles (Bmpd.livejournal.com, November 14, 2019). However, the highest production rate of BMP-3s took place in the 1990s when export contracts allowed KMZ to produce up to 250 vehicles a year (Kommersant, December 4, 2001; Militaryrussia.ru, September 24, 2013; Cbonds.info, accessed July 18).

According to official releases, KMZ supplied the same number of BMP-3s in Q1 2023 as in 2019. In the first half of 2023, it supplied almost the same number of armored vehicles as in 2022. By September 2023, the production rate had tripled compared to the pre-2022 period. However, it should be noted that there is a difference between “supplied” and “produced” BMP-3s because there is always a time gap between the actual manufacturing and supply. Moreover, KMZ confirms that the newly manufactured and overhauled BMP-3s are counted together in supplies. Consequently, if the production rate had really tripled, 210–300 BMP-3s a year would have been manufactured, which would have surpassed the average production rate of the 1990s (Rostec, May 4, 2023; Kikonline.ru, July 11, 2023; Kikonline.ru, September 6, 2023; Kikonline.ru, September 8, 2023; Kikonline.ru, May 16).

The increase in BMP-3 manufacturing must correspond with an increase in the workforce, work time, and modernization of production lines. In 2019, 7,500 employees worked at the factory, most of whom usually worked 40-hour weeks, while 97 percent of KMZ’s 8,500 machine tools were depreciated. In 2021, however, KMZ’s workforce had increased to 9,000 employees and the company had purchased 38 advanced metal-working centers. In 2023, it employed more than 3,000 additional workers, bringing the total number of employees up to 12,000 (it seems none has retired from the factory) who would have to work 68-hour weeks. As a result, the number of working hours would have increased by 2.27 times, from 360,000 a week to 816,000 a week. Notably, KMZ has a comparable number of employees, 11,000–12,000, in the 1990s (Kikonline.ru, February 16, 2021; Spec-technika.ru, November 29, 2023; Kurganobl.ru, February 6; Adm.gov86.org, accessed July 18, 2024).

KMZ acquired 250 new machine tools in 2023 and anticipates getting 350 more in 2024. Together, these 600 new machine tools would equal 7 percent of the factory’s total. However, the deputy head of KMZ noted that about 10 percent of the factory’s total number of machine tools may have needed to be replaced since 2019 (Kikonline.ru, May 16).

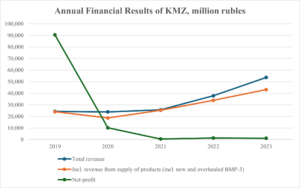

Table 1 provides an overview of KMZ’s financial results from the last five years:

Table 1: Annual financial results of KMZ, million rubles (USD million)

| 2023 | 2022 | 2021 | 2020 | 2019 | |

| Total revenue | 53,630 (630) | 37,831 (552) | 25,721 (349) | 23,860 (331) | 24,392 (377) |

| Incl. revenue from supply of products (incl. new and overhauled BMP-3) | 43,150 (507) | 33,913 (495) | 25,294 (343) | 18,667 (259) | 24,045 (372) |

| Net-profit | 1,094 (13) | 1,365 (20) | 519 (7) | 10,169 (141) | 90,399* (1398) |

* KMZ became a subsidiary of Rostec in 2019 after years of financial troubles, and Rostec invested billions in the factory’s economic recovery. This financial aid is displayed as KMZ’s net profit.

Even though revenue in 2023 was 41.8 percent higher than in 2022, production costs appeared to be 45.5 percent higher during the same period. In other words, costs plus inflation was higher than the growth of armored vehicle procurement (E-disclosure.ru, accessed July 18, 2024).

Considering the circumstances, it is unlikely that KMZ was able to triple the production rate of BMP-3s. In theory, in 2023, KMZ could have doubled the production rate and produced no more than 200 new BMP-3, in addition to overhauled or repaired armored BMP-3 vehicles. As for the production rate in 2024, no solid evidence exists that it has changed.

The production rate of UTD-29 engines for BMP-3, which is produced by industrial and transport diesel engine manufacturer Barnaultransmash, was 77 per month in 2023–totalling 924 for the year. Since UTD-29 engines have relatively low reliability, the Russian army and foreign users of BMP-3s regularly need replacement engines. As a result, even if KMZ could produce several hundred BMP-3s each year, it would be impossible for the Russian military to maintain them due to a shortfall in replacement engines (Omsk.vamto.mil.ru, December 28, 2021; RIA Novosti, November 7, 2022; Ap22.ru, April 7, 2023). Russia’s military-industrial complex is feeling the effects of the long war, and it is only a matter of time before the Russian economy reaches a point of no return.