The Enemy of My Friend Remains My Friend: China’s Ukraine Dilemma

Publication: China Brief Volume: 22 Issue: 11

By:

Introduction

State media in China remains equivocal about the level of destruction and mayhem caused by the Russian invasion of Ukraine. However, the Chinese government has stated it will meet the challenge of overcoming strained global supplies resulting from the conflict, and has emphasized that the nation’s food security will be ensured (People’s Daily, June 2; China News Service, May 27). Nevertheless, given Ukraine’s position as a global agricultural supplier, China has not fully appreciated the scope of the problem.

At a broader level, the war is a litmus test for China’s ability to navigate geopolitical troubles along the Belt and Road Initiative (BRI). Thus far, the conflict has underscored the difficulties facing China in moving beyond convenient cordialities to play the role of a benign ‘balancer’ in global politics. In its relationships with Moscow and Kyiv, Beijing is entangled financially with both sides. Furthermore, China is now exposed to secondary sanctions due to its economic entanglement with Russia. At the same time, its investments, construction projects and supply chains that traverse Ukraine risk destruction as the war drags on.

The Strategic Perils of Not Picking Sides: “An Objective and Impartial Position”

For much of the last decade, China has cultivated its bilateral relationship with Ukraine, increasing its trade in goods, supplying (unspectacular, but still relevant) investment, and undertaking construction projects to develop industry and infrastructure. This pattern of cooperation between Beijing and Kyiv continued unfettered, even as tensions between Russia – another crucial BRI partner – and Ukraine intensified. Not even the annexation of Crimea in 2014, or the initial war in Donbas altered Beijing’s political ‘agnosticism’ concerning the divisions emerging within the ranks of its partners along the BRI’s winding – and troublesome – path to the European Union. In an effort to sustain its economic and strategic efforts in the region, Beijing professed neutrality in the conflicts among its partners.

Nonetheless, the scale and intensity of the current Russia-Ukraine war has deeply challenged this tenet of Chinese foreign policy. Outright political assistance to Russia in its act of aggression toward an independent and sovereign state would make Beijing an accomplice in Moscow’s invasion, triggering reprisals from the international community (including key BRI partners) and, thus, negatively impact business. On the other hand, a circumstantial decoupling from Russia would lead to the deliberate estrangement of a vital BRI partner, cause troubles in Central Asia and precipitate difficulties in ensuring steady and affordable energy supply.

Beijing is thus caught between an (economic) rock and a (geopolitical) hard place, keeping its stance of assumed ‘neutrality’, while sending myriad contradictory messages. Furthermore, the People’s Republic of China (PRC) government’s creation of distinct narratives on the Ukraine War for internal domestic consumption and for the larger global audience, have increased the confusion around China’s position and intentions. At the beginning of the invasion, the official line was that the PRC “advocates respecting and safeguarding the sovereignty and territorial integrity of all countries”, this being “equally applicable to the Ukraine issue”, but simultaneously declared the need to respect Russia’s “legitimate security appeals” concerning NATO’s eastward expansion (PRC Ministry of Foreign Affairs (FMPRC), February 26). Later messaging failed to shed further light on this issue. In terms of internal consumption, an overarching leitmotif of various hawkish press outlets such as PLA Daily or the People’s Daily, in their respective pen named pieces by “Jun Sheng” (钧声) and “Zhong Sheng” (钟声), is to denounce the U.S. and NATO for “provoking” or “escalating” the conflict for their own benefit (PLA Daily, April 28; People’s Daily, April 7).

On the international scene, Beijing has taken a different approach, but has similarly obfuscated the main issue, which is the actual invasion of Ukraine by Russia. Chinese officials continue to promulgate a diffuse narrative about “upholding an objective and impartial position” on the matter and claim that “China always stands on the side of peace” stating that “a fundamental solution is to accommodate the legitimate security concerns of all relevant parties” (FMPRC, April 1, April 6).

At a strategic level, China’s tacit endorsement of its Russian partner provides little additional structural advantage aside from discounted prices for oil, gas and coal. In fact, lending support to Russia may actually damage the PRC’s geostrategic position, as it reinforces Western, particularly transatlantic unity, thereby bringing Europe and the U.S. closer on an ever-increasing range of issue. For China, the situation could worsen further, should Putin’s regime collapse or an armistice is reached that sidelines Beijing. In such a scenario, China would face a coherent Western bloc while tied to a partner that lacks either sufficient leverage on the global scene or the necessary purchasing power to absorb Chinese exports

The equivocal positions taken by China have already negatively impacted its relations with both NATO and the European Union. In April, NATO Secretary General Jens Stoltenberg stated that Beijing “has been unwilling to condemn Russia’s aggression and has joined Moscow in questioning the right of nations to choose their own path” (NATO Press Conference, April 5). The EU’s High Representative for Foreign Affairs and Security Policy Josep Borrell declared: “in practice, Beijing’s attitude has been one of pro-Russian neutrality. China does not condone Russia’s behaviour […] but it does support Russia’s justifications of the war” (EEAS, April 6).

Trade (at Risk): Iron, Grain and Weapons

Even if growing international impatience with China’s ambiguous refusal to take a decisive stance has generated some reputational damage across key BRI constituencies, the costs of this stance are hardly insurmountable at present. Nonetheless, China is experiencing a more tangible kind of loss, which is the disintegration of much of its previously expansive economic footprint in Ukraine. The China-Ukraine relationship has been carefully constructed over the years and is integral to supply chains in fundamental sectors, such as grains and agricultural products, iron ore and military equipment.

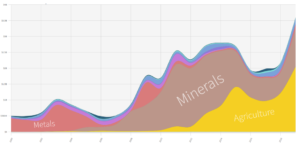

The China-Ukraine relationship attained increased significance in the last years of the 2000s, during Viktor Yuskchenko’s presidency and Viktor Yanukovych’s time as Prime Minister and later continuing during the latter’s mandate as the head of state. During that time significant increases in export volumes occurred. Ukraine’s exports to China rose constantly in the 2010s, reaching a peak of $7.26 billion in 2020, during the COVID pandemic (Observatory of Economic Complexity).

Bilateral trade might seem fairly irrelevant given China’s overall trade volume, but China imports several strategically important goods from Ukraine. In theory, some of these imports – such as agricultural products and iron ore – are fungible, but the remaining volumes on the international markets are insufficient to meet global demand if the Ukrainian supply is excluded. This is especially the case in the short- and medium-term. China can devise new logistical arrangements for agricultural imports, but they are likely to be costlier due to Ukraine’s importance to the global food market. For example, China imports 20 percent of its total cereals from Ukraine including 70 percent of its corn and 60 percent of its sunflower seed oil (UN Comtrade, 2019). Over the past half-decade, China deepened its reliance on Ukrainian corn imports in order to diversify away from dependence on U.S. supplies due to the trade war with Washington and concerns over food security (China Brief, January 28).

Figure 1 – Ukraine’s Exports to China

Switching food suppliers in a limited global market that is highly exposed to uncontrollable natural phenomena is no easy feat. Furthermore, competition for limited goods is intensified by export limitations and interdictions by producer countries concerned about ensuring their own food security (IFPRI, April 13). Moreover, existing investments in port terminals and local silos are hard to replicate swiftly elsewhere. Thus, significant inconveniences are to be expected by China in this sector if the Russian blockade of the Black Sea gateways continues to block Kyiv from proceeding with its exports.

For example, COFCO International, a Chinese food processing and trading company, maintains its third most critical global operation in Ukraine (after those in Brazil and Argentina); manages its own port terminal in Mykolayiv, four grain silos along the Dnieper; and operates a sunflower seed crushing plant near Mariupol (COFCO International, August 5, 2021). The latter installation had already been reported as damaged by Russian shelling, while the port terminal is under blockade, rendering it inoperable (Bloomberg, April 5).

At the same time, for the last several decades, cooperation between China and Ukraine in the military industry demonstrated that Beijing was hedging its bets in relations with Moscow and limiting its dependence on the supply of Russian technology. Starting with the landmark acquisition of the Ukrainian aircraft-carrier Varyag (purchased in 1998), refitted and launched as the Liaoning by the PLA Navy, the relation has been steady over the years, with Ukraine as the third largest weapons supplier to the PRC after Russia and France.

In recent years, military exports from Ukraine to China have included gas turbines for Chinese destroyers (such as the DT-59, sold with licence and becoming UGT-25000 and QC-280); “Bizon” landing craft; Kolchuga sensor systems, aircraft turbofan engines, tank diesel engines and several Il-78 transport planes (SIPRI, Trade Registers, 2022). As a result, Ukraine was a steady and reliable supplier of key defense technology to China. In addition to continuing to increase its domestic capacity to develop indigenous alternatives, China will need to find different means to procure key dual us or military technology, particularly as Russia’s (increasingly limited) offerings are tainted by sanctions, with a potential for retaliation if Beijing enhances cooperation in this particular sector.

Investments (Lost): Ports, Roads and Economic Footprints

In addition to the bilateral trade ties that are imperiled by Russia’s invasion of Ukraine, another dimension of long-term economic connection on the brink of being physically destroyed or immensely devalued are China’s indirect and direct investments in Ukraine, as well as Chinese companies’ extensive construction business in Ukraine.

Ukraine has attracted very little Chinese foreign direct investment (FDI). Beijing’s share of total FDI stock in falls far below 1% (for comparison, EU countries maintain a 72% share) totalling only $111 million at the end of 2021 (National Bank of Ukraine, International Investment Position, December 31, 2021). However, when looking beyond the macroeconomic dimension, the picture looks slightly different. Many Chinese companies that operate and invest in Ukraine are registered in other jurisdictions and make use of their regional hubs in Europe or Central Asia in order to acquire shares or entire businesses. Therefore, Beijing’s private presence and level of FDI is considerably higher than that reflected in official statistics, given special investment vehicles proceeding through proxy jurisdictions and tax havens. Chinese state-owned enterprises have also won lucrative contracts in Ukraine for public infrastructure projects (roads, port terminals, railways, metro lines, power stations) and private industrial plants, which are worth over $7 billion since 2011(American Enterprise Institute, CGIT, 2022). For example, in 2017, China Road and Bridge Corporation began building a road to connect the port cities of Odessa and Mykolaiv (EIU, March 22, 2018). That same year, the city of Kyiv awarded a consortium of Chinese companies the contract to develop a fourth subway line. Moreover, in 2018, China Harbor Engineering Company completed a project to deepen the harbor of Ukraine’s largest international sea port, Yuzhny (Xinhua, January 31, 2018).

As many of the aforementioned projects are financed through credit agreements offered by Chinese banks, they are not without long-term strings attached. As a result, Beijing’s actual losses go beyond merely the immediate financial damages, but extend to Beijing seeing its entire economic footprint in Ukraine evaporate, along with its political influence.

Conclusion and Outlook: Friends in Need (After the War)

In the larger picture, Russia’s war of aggression is a “spoiler” for Beijing’s self-professed foreign policy principles based on respect for sovereignty, territorial integrity and non-intervention in third states’ internal affairs, as well as its long-stated opposition to “unilateral measures.” However, Beijing finds itself in the worst of both worlds with its contorted and ambiguous public message of not condemning the invasion, despite the attack on Ukraine amounting to an obliteration of every tenet of its rule book for international diplomacy.

China derives only modest material benefits from its existing relationship with Russia, primarily cheaper oil and gas, commodities whose price, even at a discount, is now much higher than before the war. However, Beijing has sacrificed considerable international standing with its refusal to criticize Russia. Complete disengagement, which is portrayed as “neutrality,” is unfeasible for a major world power like China, and has resulted in a loss of political and economic influence.

At the same time, nobody in Kyiv will soon forget which partnership mattered during the war and which was simply a paper dragon. When the war ends, a clearer delineation of geopolitical blocs will have taken shape, irrespective of Beijing’s arguments to the contrary. And Ukraine will be even less inclined to play any role in advancing BRI, particularly given EU and U.S. objections to the initiative.

In the long run, China’s inconclusive position may well prove a stumbling block to the BRI’s designs. Given China’s passivity on Ukraine, participant countries may begin to hedge their security (and political) bets as little backing can be expected from China, which may not even be able to play the role of a constructive mediator in the event of a conflict. In addition to the war’s effective elimination of Ukraine as a key link in the BRI, the risk of sanctions damages economic relationships that are crucial for China’s economy. Structural changes in the international system often accelerate in a crisis when an aspiring world-power has the opportunity to heighten its position. However, in the case of the current crisis, China has chosen to play on the margins for all the world to see and acknowledge.

Horia Ciurtin serves as an independent consultant in the field of international investment law & political risk. He is also an Expert at the New Strategy Center (Bucharest, Romania), a Research Fellow for the European Federation for Investment Law and Arbitration (Brussels, Belgium), and External PhD Researcher at the Amsterdam Center for International Law (Amsterdam, Netherlands). Moreover, in the field of international commercial arbitration, he features on the list of arbitrators of the CAA International Arbitration Centre (CAAI) – Hong Kong branch. He recently published the study entitled “Squaring the Circle: The (Improbable) Quest for Strategic Equilibrium in Turkish-Russian Relations”, New Strategy Center, April 2022. Contact him at h.a.ciurtin@uva.nl.