Money Alone Is Not Enough: The Future Of The China-Argentina Relationship

Money Alone Is Not Enough: The Future Of The China-Argentina Relationship

Observers assessed the outcome of the first round of Argentina’s presidential elections held on October 22 as good news for the Chinese government (VOA, October 26). Against the odds, Sergio Massa, the Peronist candidate and current minister of economy, emerged on top, despite his overseeing an annual inflation rate of almost 140 percent. Meanwhile, Javier Milei, the libertarian opposition candidate, took the second place (Yahoo Noticias, October 23). These two politicians will compete for the presidency in the second round of the election scheduled for November 19.

At first glance, the victory of Massa should be an encouraging sign for the People’s Republic of China (PRC) since it keeps open the possibility that the China-friendly Peronist party remains in government. However, a more granular analysis suggests two alternative outcomes: First, Milei is likely to be the eventual winner after the second round of voting, which would make the new occupant of the Casa Rosada (the Argentinian presidential palace) a politician who has called the PRC an “assassin” and who plans to freeze relations with Beijing. Second, if Massa wins the presidency, his more moderate Peronism is far from the Third-World foreign policy promoted by the outgoing president, Alberto Fernandez, and his vice-president and former president, Cristina Fernandez. Thus, regardless of the outcome of the presidential election, Beijing’s desires to increase political influence over Buenos Aires, which have focused particularly on its defense policy, are likely to be curtailed.

A decrease in political influence with Buenos Aires would deal a serious blow to the Chinese strategy in Latin America, in which Argentina plays a critical role. Argentina is the only large country in the region to join the Belt and Road Initiative (BRI). It also exports food, minerals, and oil needed by the Chinese industrial sector. Argentina’s expansive territory represents a natural platform to project power within South America and to the South Atlantic. Buenos Aires’s geopolitics makes it particularly attractive for Beijing, which is exploring opportunities to secure rights for a naval base on the west coast of Africa in order to gain access to the Atlantic. Argentina also forms a key part of PRC efforts to consolidate its hegemony over the Global South. Specifically, the PRC views Argentina as a counterbalance to Brazilian regional hegemony, which motivated China’s interest in Argentina joining the BRICS grouping of countries, against Brazilian opposition.

Economic Ties

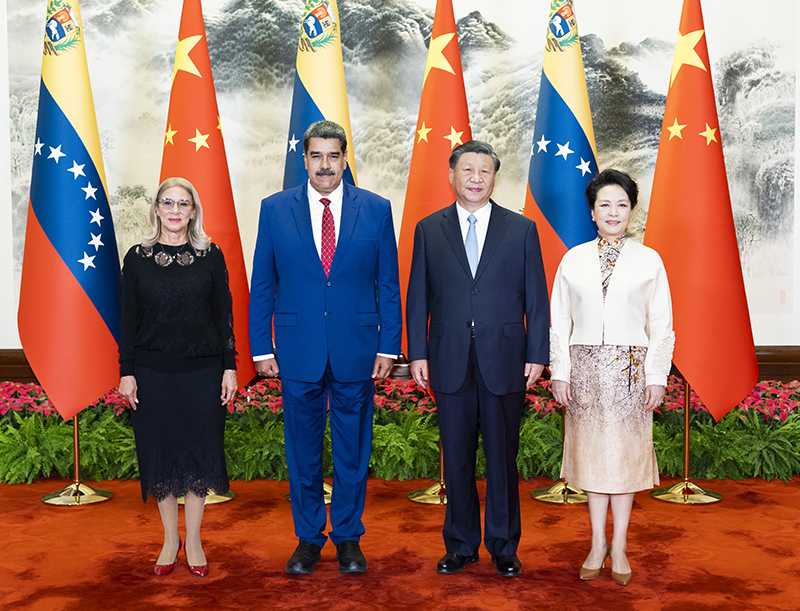

To gain influence over Argentina, the PRC has deployed its traditional playbook, moving the bilateral relationship through phases of ever-increasing involvement. In 2004, Argentina’s President Nestor Kirchner and General Secretary Hu Jintao (胡锦涛) signed an agreement of “Strategic Partnership” (People’s Daily, November 17, 2004). In 2014, President Cristina Fernandez and Xi Jinping (习近平) upgraded the relationship to the level of “Comprehensive Strategic Partnership” (FMPRC, February 5, 2015). The final step was in 2022, consisting of Argentina’s accession to the BRI. President Alberto Fernandez and Xi Jinping came to an agreement during a meeting on the sidelines of the Beijing Winter Olympics in February 2022 (Global Times, February 6, 2022).

Deep Chinese penetration into the Argentine economy accompanied these warming diplomatic ties. Beijing exploited Argentina’s increasing financial difficulties to gain privileged access to its market. A key step was the agreement for a currency swap between PRC and Argentinian national banks in 2009, under the Peronist administration of Cristina Fernandez. This financial arrangement functions as a line of credit, which has since reached $18 billion, allowing Sergio Massa to meet Argentina’s IMF debt payments and thereby avoiding a default, keeping his presidential aspirations alive (Bloomberg, October 18).

The PRC has also supported Chinese companies’ bids in Argentina for infrastructure projects with financing guarantees—an almost irresistible offer for a country with an extreme lack of capital and urgent infrastructure needs. These bids have made the PRC a key player in strategic sectors. They include: the rail industry, via the China Machinery Engineering Corporation’s overhaul and modernization of the Belgrano Cargas railway (Casa Rosada, October 15); riverine transport, through political pressure for CCCC Shanghai Dredging Co. to win the contract to manage the Parana-Paraguay waterway; the energy sector, with the agreement to build Atucha 3 nuclear reactor, and the building and exploitation of Cauchari Solar Plant; and the commodities sector, with the acquisition of Argentinian Lithea by China’s Ganfeng Lithium (Casa Rosada, October 15; TN, May 30; Reuters, July 11, 2022).

This economic engagement has generated some pushback. Beijing’s investments have incurred delays; Argentine manufacturers have raised concerns about unfair Chinese commercial practices; local environmentalist groups have protested against the impact of PRC-run projects; and security frictions have arisen over PRC distant water fishing vessels and their illegal fishing in South Americans waters (Infobae, March 29, 2021; Reuters, March 16, 2016). However, Chinese efforts to become an indispensable economic partner for Buenos Aires can be judged on balance as a success. Loans and investments have been accompanied by a dramatic increase in trade: In 2021, the PRC became Argentina’s second largest market after its neighbor Brazil, accounting for 8.28 percent of Argentinian exports and 19.93 percent of imports.

The relationship-building process on the Argentinian side has been led by the leftist faction of the Peronist party. Former president and current vice-president Cristina Fernandez has played a crucial role in some of the milestones of China-Argentina bilateral engagement, such as formalizing the currency swap deal and, more recently, Argentina’s agreement to join the BRI. However, Peronists have not been the sole political force promoting economic ties with the PRC: In May 2017, Mauricio Macri, the center-right president and predecessor to Alberto Fernandez, signed investment agreements with Xi Jinping tallying $15 billion (La Nacion, May 17, 2021).

Argentine Politics and Defense Cooperation

This apparent consensus among the Argentine political establishment about the importance of economic ties with the PRC hides deep misgivings and discord concerning political alignment with Beijing. While the left wing of the Peronist party has actively sought a strategic partnership with the PRC to counterbalance the United States and build international autonomy, the center-right opposition groups and the moderate sectors of Peronism prefer to limit Chinese engagement to the financial and commercial sectors. These differences are especially visible in defense cooperation.

Cristina Fernandez deployed a systematic effort to expand defense cooperation with the PRC during her presidency (2007–2015). In 2007, the two countries’ defense ministries signed a memorandum of understanding creating the Joint Commission of Defense, which has become a centerpiece of bilateral cooperation and touts five meetings to date, most recently in 2021 (Pagina 12, March 30, 2021). Building on the work of this commission, the Fernandez administration broadened cooperation, coordinating with China on military education and training, procurement, and base rights in Argentinian territory (Perfil, December 11, 2019).

Since 2021, Beijing has deployed various incentives to further increase defense cooperation with Buenos Aires. In the political domain, the PRC has consistently taken Argentina’s side in its conflict with the United Kingdom over the sovereignty of the Falkland/Malvinas Islands (China Daily, July 21). At the same time, it has provided military assistance, including equipment and education. In practical terms, this support has been very limited, consisting of two field hospitals and a few slots in Chinese military schools for Argentine officers. However, this cooperation stands in sharp contrast to that of several Western partners whose plans to provide military equipment to Argentina—particularly air assets—have clashed with persistent British diplomatic efforts to block any transfer of modern defense systems so long as their territorial dispute remains unsolved.

Cristina Fernandez also negotiated the purchase of a large package of Chinese weapons systems and aircraft, including 110 Norinco ZBL-09/VN1 armored personnel carriers (APCs), 5 P18 Corvettes, an Antarctic vessel, and planned to co-produce Changhe Z-11 helicopters (MercoPress, February 5, 2015). These projects were all cancelled or postponed by the subsequent administration. The purchase of APCs was ruled out and the corvettes were replaced by French-made offshore patrol vessels. The only Chinese equipment actually acquired was 4 Norinco WMZ-551B1 APCs, which have proved prone to breakdowns (Indodefensa, August 11, 2018). Thus, the Fernandez administration’s attempt to reduce Argentinian dependency on Western military equipment suppliers and replace them with PRC manufacturers was a total failure.

Quintuco Space Monitoring Station

A 2012 agreement to establish a space station in Quintuco, Neuquen province, represents a major concession to China by Argentina. The purpose of the facility is, according to the agreement, to support Chinese programs for exploring the Moon and Mars. Nevertheless, the civilian nature of the space monitoring station is disputed. [1] Quintuco’s facility is managed by the China Satellite Launch and Tracking Control General (CLTC), a body under the People’s Liberation Army’s Strategic Support Force. Though the number of Chinese personnel assigned to the base is small (nine individuals), all of them are military personnel and Argentine officials do not have control over their activities. The actual operations of the facility are performed remotely from the PRC, and the PLA’s detachment in Quintuco only performs maintenance and supervisory functions. Additionally, there are signs that its 16-story antenna has the capability to gather data about satellites, long-range missiles, and space vehicles. In short, Quintuco’s space base is a dual-use facility in formal as well as practical terms. The space monitoring station began operations in 2018, during the term of President Mauricio Macri (2015–2019). Despite dramatically slowing defense engagement with the PRC to a set of education and training activities with emphasis on peacekeeping operations, Macri faced legal obstacles and fears of economic reprisals which prevented his administration from terminating the agreement on the space monitoring station signed by President Cristina Fernandez.

Prospects for an expansion of Chinese-Argentine defense cooperation looked more promising once again with the return to power of the Peronist party in 2019, led by President Alberto Fernandez and now Vice-President Cristina Fernandez. The new government moved forward with two key procurement projects. Plans for the acquisition of Chinese Norinco ZBL-09/ VN1 APCs restarted, and this time involved the purchase of 209 vehicles for a figure close to $600 million to be paid over 12 years (Zona Militar, November 25, 2021). The PRC also offered the sale of 12 JF-17 Thunder fighter-bombers for $644 million, to be paid through a flexible financial arrangement across the same period. This would have been a strategic success for the Chinese arms industry, not only by providing high-tech weaponry to a country in the western hemisphere, but also by gaining a decisive influence over the Argentine Air Force. However, this is put into question by the impending end of President Fernandez’ term, and as things stand, China seeks to lose out to the United States in the deal (Eurasian Times, October 14).

The establishment of a new Chinese military enclave on Argentine territory was also discussed. This news was made public after the announcement by Gustavo Malella, the governor of Tierra del Fuego Province, who referenced a potential Chinese investment package to build a base in Ushuaia to support Beijing’s Antarctic operations (Polar Journal, February 6). Malella led “Forja,” a regional party closely allied to Cristina Fernandez and the Peronist left. His Chinese counterpart for these talks was Shuiping Tu, legal representative of HydroChina Corp (中国水电工程顾问) in Argentina and member of the Chinese Communist Party.

The State of Play

President Alberto Fernandez’s administration is coming to an end. As such, the chances for any of these projects to become reality are slight. In October, the US government approved the transfer of a package of F-16 multirole fighters operated by Denmark to Argentina. This gave the Argentine Air Force access to the United States’s preferred air platform, disincentivizing any potential deal to acquire the Chinese aircraft. At the same time, before Argentina’s National Congress, Sergio Massa rejected any Chinese involvement in the construction of infrastructure to support Argentine Antarctic activities in Ushuaia (Infobae, September 30, 2022).

Several factors explain the overall failure of attempts by the PRC to gain leverage on Buenos Aires’ defense apparatus. The Argentine armed forces are closely connected to the West in terms of military doctrine and equipment. For decades they have preferred Western weapons systems when they have been accessible and distrusted the acquisition of key assets such as the JF-17s which would tie them to the PRC or any other non-traditional supplier. Quality issues surrounding Chinese-made equipment have also reinforced this reluctance.

Chinese plans to penetrate the Argentine defense system have also been damaged by a broader concern with political influence. The calculation that economic weight can easily be transformed into political influence—a key principle in the Chinese approach to the relations with the Global South—has turned out to be much less straightforward than expected. Governments in Africa, Latin America, or the Middle East usually welcome foreign investment as long as it is not tied to political demands, and drag their feet or even openly oppose interference in sensitive sectors unless they come from a country perceived as politically friendly. This is also the case for Argentina: Even if its dire economic situation has made Buenos Aires increasingly dependent on Chinese financial support, the center-right government of President Macri ensured that Chinese loans and investments remained divorced from defense. The difference in policy witnessed under the administrations of Cristina Fernandez and Alberto Fernandez had less to do with the effectiveness of Beijing’s economic pressures than with the ideological preferences of the leftist faction of the Peronist party, which saw China as a valuable ally in its crusade to weaken the United States’ traditional links with Argentina’s armed forces.

Conclusion

If the historical trend holds and ideological preferences of the occupant of Casa Rosada are important in predicting the shape of Argentina-China relations, Beijing should not be optimistic going into the November election. Massa is well connected in Washington and has publicly rejected the establishment of a Chinese base in Ushuaia. His competitor Milei has publicly committed to cutting ties with the Chinese regime. Argentina may be a good test case for Xi Jinping and his advisers to understand that, sometimes, money is not enough.

Notes

[1] Online interview with former Argentinian government official, October 9th, 2023