Xi Seeks to Woo Foreign and Domestic Business

Publication: China Brief Volume: 25 Issue: 4

By:

Executive Summary:

- President Xi Jinping unveiled the “2025 Action Plan to Stabilize Foreign Investment” and met with leading entrepreneurs for the first time in seven years, in an effort to reinvigorate the private sector and court foreign investment.

- The plan seeks foreign investment in sectors Beijing sees as strategic, such as biotechnology, telecommunications, education, and healthcare.

- Xi’s photo opportunity with industry leaders seems intended to show that the country’s industrial policies are bearing fruit for favored firms who, while nominally private, have deep ties to the party-state.

The leadership of the People’s Republic of China (PRC) has taken advantage of U.S. President Donald Trump’s relatively measured approach to the Chinese Communist Party (CCP) regime by announcing moves to resuscitate pro-market policies. Trump has raised the possibility of a spring tête-à-tête with his counterpart, CCP General Secretary and commander-in-chief Xi Jinping. Washington also is yet to object to the PRC playing some role in ongoing Ukraine peace talks and to boost its influence in the European Union in general (Reuters, February 20; Associated Press, February 25). Additionally, the new President has slapped only a 10 percent tariff on PRC imports—lower than the 25 percent imposed on goods from Canada and Mexico and well below the “60 percent or higher” omnibus rate for PRC exports to the United States that Trump had threatened while running for office (The White House, February 1; CNN, February 4, 2024; USA Customs Clearance, February 10).

Plan to Attract Investment

In February, the PRC State Council unveiled a “2025 Action Plan to Stabilize Foreign Investment” (2025年稳外资行动方案) (Xinhua, February 10; People’s Daily, February 21). The plan aims to attract foreign capital and to persuade existing PRC-based firms to remain in the country. Its unveiling followed warning signs from the first two months of the year. The PRC Ministry of Commerce indicated in mid-February that only RMB 98 billion ($13 billion) in foreign direct investment (FDI) was used in January 2025, a 13 percent drop from the same period in 2024. The anemic start to the new year came after a plunge in FDI of over 27 percent in all of 2024 to RMB 830 billion ($110 billion)—the lowest figure since 2016 (Global Times, February 19; CNN, February 20).

The new Action Plan is geared toward encouraging investment in sectors including biotechnology, telecommunications, education, and healthcare. While close to 60,000 foreign-invested enterprises were established in the country last year, big-name multinationals and Western firms with cutting-edge technology are eschewing the PRC or downsizing their operations. This is in part due to efforts by the Western alliance—which includes the United States, Canada, Japan, South Korea, and Australia—to decouple the PRC’s high-tech industries from global supply chains.

Key areas in the 20-point plan include pledges to allow foreign-invested enterprises to gain access to credit from domestic banks, to set up “investment companies” (投资性公司), and to form more joint ventures with domestic firms in strategic sectors. The incentives also comprise expanding showcase schemes to provide preferential policies to foreign-invested enterprises in certain sectors. Vaguely defined, “pilot free trade zones” (试验区) will open to accommodate the specific needs of multinationals. Particular attention is paid to the “orderly opening up of the biomedical sector” (推动生物医药领域有序开放). Certain agricultural sectors, such as animal husbandry, will also accept foreign capital for the first time since Deng announced his policy of reform and opening almost five decades ago.

Caveats are warranted, however, and could handicap this novel phase of opening up to outside investment. First, some of the pledges regarding market access for foreign-invested enterprises’ market access are less generous even than those made upon the country’s accession to the World Trade Organization in 2001. Those earlier pledges included allowing foreign companies to partake in financial sectors such as banking, insurance, and asset management. Foreign-invested enterprises were exempt from the adverse impact of interest rate fluctuations in Chinese banks and were able to secure better interest rates from PRC financial institutions, as well as largely having immunity from foreign-exchange controls imposed by PRC banking authorities (Brookings Institution, May 9, 2001; China Brief, July 24, 2001; IMF, September 2002).

Similar—and in some cases more generous—policies for foreign-invested enterprises were already applied within the 21 free trade zones set up in as many cities and administrative regions between 2013 and 2023. However, pledges that foreign investors in these zones would have access to liberalized foreign-exchange policies as well as more flexible interest-rate arrangements remain unfulfilled. Nor have promises that products from overseas firms based in these zones can have broader domestic distribution rights come to pass.

A group of experts under Shandong Province’s commerce department has pinpointed four potential stumbling blocks to the plan’s success. First, the free trade zones will not be immune to geopolitical risks. Second, policymakers cannot just rely on “top-level design” (顶层设置). While certain units and personalities at the top of the party have adopted a highly positive approach to the zones, ministerial and mid-level administrators often fail to implement policies in ways that enhance the innovative potential of the free trade zones. Third, the number of zones is too small to have sufficient positive spillover effects to the broader economy. This is especially the case in the more underdeveloped west, where there are only five across 12 provinces. Finally, the zones have failed to attract large sums of investment, something that is partially reflected by the fact that 19 of the 21 zones have not expanded since they were introduced (FDI China, February 28, 2023; Xinhua, August 2, 2023; Shandong Pilot Free Trade Zone, September 20, 2023; C.i. Process, January 3).

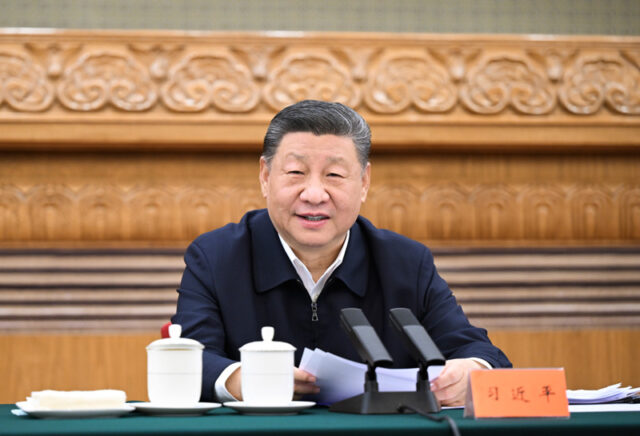

Xi Chairs Symposium With Business Leaders

Xi has also sought to reassure the business community by convening a “symposium” (座谈会) with leaders from the “private” (minying; 民营) sector (Xinhua, February 17). The symposium was the first time in seven years that Xi has so explicitly courted such enterprises, though he did not specify what dispensations will be given in such key areas as securing affordable credit and government assistance in finding buyers in foreign countries. Xi did not signal any major policy shifts for the non-state sector, indicating that the country’s development path will continue to rely on industrial policy funneling resources to strategic sectors and star enterprises, as well as strict guidance for key state-owned firms. Xi claimed that “in the new era and on the new journey, our country’s social productivity will unceasingly increase” (新时代新征程,我国社会生产力将不断跃升) (Xinhua, February 18).

While nominally private, most of the firms represented at the symposium continue to rely on close ties with the party-state apparatus, especially by benefitting from industrial policies and acquiescing to other requirements. Frequently, they will solicit investments from members of the CCP’s big clans or receive preferential treatment when borrowing from state banks (Hoover Institution, September 7, 2023; CNA, September 6, 2024). For example, Huawei, which was singled out for praise by Xi, has deep ties to the party and the military (though its claims to be an “independent company” whose shares are owned by its employees). Also on hand was Jack Ma of Alibaba, as well as the owners and CEOs of other tech giants such as Tencent, Xiaomi, and Wang Chuanfu (王传福), the founder and CEO of BYD, best known for its electric vehicles that outperformed Tesla on the world market in 2024 (Sina Finance, January 7; 163, January 7; X/@hungjng69679118, February 17; Huawei, n.d.).

Xi’s photo op with these industry leaders seems intended to show that the country’s industrial policies are bearing fruit for favored firms. However, it comes as Xi’s team is working to ensure that these quasi-minying firms are under ever-tighter control by the Party. In recent years, authorities have enlarged the size and power of the party cells within these enterprises under the pretext of enhancing “party building” (党的建设). Most CEOs of these firms also double as secretaries of the policy-setting party cell of their units, other members of such cells are appointed by the CCP’s Organization Department. These individuals can exercise powers similar to those of board directors in Western firms (CSIS, January 31, 2023; All-China Federation of Industry and Commerce, March 27, 2024; People’s Daily, February 21). Moreover, struggles in the broader economy are unlikely to persuade investors that the recent symposium signals any real change. Hundreds of apparently successful minying firms have been subject to harassment by police and tax collectors. At a time when local-level administrations are saddled with debt totaling more than RMB 60 trillion ($8.2 trillion), public security and taxation departments are determined to force these firms to cough up profits and even, according to some reports, unpaid taxes going back decades (Voice of America, November 5, 2024; New York Times Chinese Edition, November 26, 2024).

Conclusion

The conservative Xi leadership is wary of being held hostage by multinationals, and so is unwilling to lower restrictions on their access the PRC’s domestic market. The ongoing technological slugfest between the PRC and a coalition of advanced economies, including the United States, Germany, the Netherlands, Japan, South Korea, and Taiwan, has contributed to rising nationalism in Chinese society. Some foreign countries have updated travel advisories warning their citizens of the dangers of doing business or traveling as tourists in the PRC (University of Michigan, October 17, 2024; U.S. Department of State, November 27, 2024). President Trump may have expressed eagerness to maintain channels of communication with President Xi, but Beijing’s pledge of a new deal to the nation’s non-state sectors and promises of further opening to multinationals and foreign investors are unlikely to boost the nation’s spiraling economy.