Six Months of Germany’s New China Strategy: Old Ways Die Hard

Publication: China Brief Volume: 23 Issue: 23

By:

On December 1, the first visa-free travelers entered China from a select group of mainly European countries: Germany, France, Italy, Spain, the Netherlands, and Malaysia (Xinhua, December 2). Expanding visa-free travel (for more than 72 hours) to these countries was arguably the most visible step of “opening up” from China since the inception of the Covid-19 pandemic. Yet it was a clear statement of opening only to favored partners. This will feel like vindication to Germany—the largest beneficiary country, and one which has been attempting to redefine its relationship with China since publishing a detailed new China strategy in July 2023. The strategy articulated Germany’s strongest concerns for the trajectory of Sino-German relations since reform and opening began in 1978. However, six months on, its impact has been limited by a wider lack of direction and unity in the German federal coalition.

China and Germany’s Long Trade Honeymoon

Sino-German relations experienced a long honeymoon period after the People’s Republic of China (PRC) embarked on its economic reform agenda in the late 1970s. The PRC cultivated new trading links to boost its growth, without committing to political liberalization, while Germany won a major export market, especially for its huge car industry. The key to making this a “win-win” partnership was the German neoliberal principle of “Wandel durch Handel” or “change through trade,” which held that commercial expansion would eventually lead to reform in China by empowering liberal business leaders to demand market (and eventually political) liberalization.

China is now Germany’s single largest trading partner, but the trading relationship is more complex than this headline statistic implies (Federal Bureau of Statistics, November 1). In particular, Chinese market limitations have led major German industrial players to invest heavily in local joint ventures, while smaller companies have struggled to establish a presence. Just four German companies—carmakers Volkswagen, BMW, and Daimler, and chemical giant BASF—made up 34 percent of all European FDI into China between 2018 and 2021 (Rhodium Group, September 14, 2022). Meanwhile, the direct balance of payments has shifted over time, reaching an annual trade deficit of €86 billion ($93 billion) in 2022 (Federal Bureau of Statistics, November 1).

This trade deficit is worse in key industries. For instance, Germany imported $3.6bn of rechargeable batteries from China in 2021, against $842m in exports to China. Similarly, Germany imported $1.69bn of photovoltaics from China, against just $111m in exports to China. These numbers in key emerging industrial sectors are trivial when compared with German exports to China of $31.4bn in automotive and automotive parts (UN Comtrade via CEPII, 2021). This makes for long-term conflict of interests in German business lobbying. Big industries with an established presence in China, especially automotive, have a strong stake to defend in trade relations, while emerging markets are losing out in the status quo. Indeed, German auto companies are invested to the extent of long dismissing their complicity in forced labor in Xinjiang—something that continues to this day, as the backlash to a recent audit of Volkswagen’s joint venture in the region indicates (Shanghai Daily, December 7; Reuters, December 13).

The New Government’s 2023 China Strategy

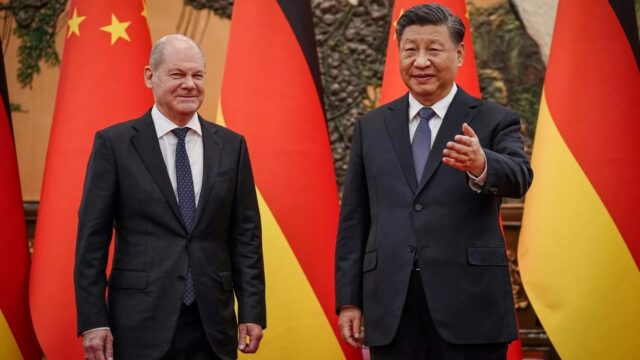

The current German coalition was formed in December 2021, by which time tensions over the disparity between trade flows, including a proposed new EU-China Comprehensive Agreement on Investment (CAI), and political repression typified by the 2020 Hong Kong crackdown, had developed into a broader crisis in EU-China relations. The government is led by the Social Democrats, with Olaf Scholz, a veteran of the centrist Merkel government that championed the CAI, as Chancellor. Their partners are the Free Democrats (free market liberals) and the Greens (more stridently challenging to China on human rights and security). The latter controls the Foreign Office under Annalena Baerbock.

Baerbock’s Foreign Office has spearheaded negotiating a more assertive China policy across government, publishing a new comprehensive 64-page China Strategy in July 2023. This document begins by acknowledging that “we need to change our approach on China” (Strategy on China of the Government of the Federal Republic of Germany, July 13). The framework mirrors that of the EU, designating China variously as “partner,” “competitor,” or “systemic rival” depending on the situation—an approach that offers flexibility and pragmatism where needed on global issues like climate change, but requires clear, detailed thinking in order to translate into coherent policy. This is perhaps inevitable given the highly open nature of the previous policy, and meets the strategic imperative to keep seeking cooperation on certain key issues. Nonetheless, it presents a challenge to Berlin (and Brussels), especially when stakeholders have divergent interests.

What unites the Strategy the most across these sometimes-disparate approaches is the EU itself. The most consistent tenet of the document is that “a successful approach to China requires Europe as a whole to bring its influence to bear.” Many of the most important parts of Germany’s strategic arsenal are articulated through EU policies. This is particularly visible in the trade policy dimensions of the Strategy, which focus heavily on trade defense tools managed by the European Commission, such as the Anti-Coercion Instrument and the Foreign Subsidies Regulation.

The Strategy’s drafting by committee has cost it clear direction at key points, however. For example, the document claims that “de-risking is urgently needed. However, we are not pursuing a decoupling of our economies.” It elaborates with further points, such as EU autonomy on critical technologies “from third countries that do not share our fundamental values.” But it remains reticent to acknowledge that at a certain level the difference between “de-risking” and “decoupling” is simply a question of where the pain of decoupling is a necessary trade-off against risks that are too important to ignore. Similarly, the Strategy argues that the Belt and Road Initiative aims to build a network of countries dependent on China, but simultaneously asserts that the German and European response ought not to require any “us-or-them decisions.”

Chinese observers have followed Germany’s positioning on these issues, with Cui Hongjian (崔洪建), the director of the Department for European Studies at Peking University’s China Institute for International Studies, characterizing the partner, competitor, rival paradigm as “fundamentally self-contradictory (自相矛盾)” in the Party-controlled news outlet the Global Times (Global Times, June 15). Following the publication of the Strategy, Xinhua went further, pushing a pseudonymous op-ed which both lambasted the German government—and particularly the Greens—as covertly “anti-China” but also insisted that there is no fundamental conflict of interest and that Germany could return to a more mutually beneficial arrangement (Xinhua, July 17). The piece also took aim at factional divisions within the government, praising Scholz for being “pragmatic and moderate” unlike the “radical” Greens. This shrill commentary complemented the MFA’s muted official response. At a press conference, spokesman Wang Wenbin (汪文斌) emphasized that Germany and China still have more consensus and common interests than divisions, albeit with a criticism that that the de-risking approach is to “swim against the tide of history (逆时代潮流而动)” (FMPRC, July 14).

Progress On the Strategy Disappoints

The events of the last six months suggest that Germany may be slower to change its approach to China in practice than the Strategy heralds. The most prominent case of this is the German response to the European Commission’s new probe into Chinese subsidies to the electric vehicle (EV) sector. Chinese subsidy abuse is noted in the new Strategy multiple times, alongside a consistent commitment to EU-level decision-making, especially on trade policy, which is led by the European Commission and not by individual countries. However, Germany has passively resisted taking any action on EV subsidies, partly due to its big auto players’ exposure to potential Chinese retaliation. The German car industry even lobbied against EU action while the EU-wide industry lobbied for it (EURACTIV, September 13). When the European Commission finally announced a formal investigation following sustained pressure from France, Scholz still held back from supporting the position, commenting to German business paper Wirtschaftswoche that he was “not really convinced” by the move, and even that “our economic model shouldn’t be based on or rely on protectionism” (Wirtschaftswoche, September 28). This was immediately picked up by the Global Times, which leaned on similar responses from parts of German industry and media to present a narrative of bottom-up opposition to “counter-productive” measures from the European Commission (Global Times, September 28).

Scholz’s prevarication somewhat undermines Brussels’ attempt to grip the challenge of separating “partner, competitor, and rival” in this crucial sector, while showing how the old status quo German approach is still limiting policy thinking. This is partly about working practices—Germany is not used to dealing with a partner that consistently does not play fair, as China has consistently done by subsidizing its industries to outcompete foreign firms until its indigenous champions are unassailable in the mature market. (This can be seen in the EV industry, but also batteries, photovoltaics, among others.) It is also about the material conflicts of interest between potential future industries and the big German companies with an established presence in China. The automotive players know they have everything to lose, exemplified by Mercedes-Benz CEO Ola Källenius that “for us, de-risking doesn’t mean reducing our presence in China but increasing it” (Financial Times, April 30). Chinese state media have made much of these comments, even arguing that present trade tensions show that the EU should allow Chinese companies more access to invest in Europe to balance the trade (China Daily December 7).

5G provides another representative challenge. In September, the German federal government proposed to further limit telecom operators’ use of Huawei technology in new 5G infrastructure (Reuters, September 20). This follows the Strategy’s aim of achieving “technological sovereignty.” It also follows accusations from elsewhere in Europe of sustained foot-dragging, where Germany—and Scholz in particular—has come to be perceived as someone who avoids making key decisions until they are unavoidable (EURACTIV, June 16). Here Germany provides a stark contrast from countries such as Estonia, Latvia, and Lithuania, all of whom have fully banned Huawei (EURACTIV, November 27). The German government appears willing to hedge its bets and neglect a common European position, in case other parties push for a tougher position than it (and German industry) are willing to adopt. In neither case does the German approach seem to have changed much from the controversial decision Scholz took just before the China Strategy was published to allow Chinese shipping giant COSCO to invest in critical port infrastructure, against open opposition from (Green) economic minister Robert Habeck (Politico, May 10).

Chinese commentary exhibits a calculated effort to sow division. Since the Strategy’s launch, it has maintained a consistently hostile position against Habeck and Baerbock, as well as European Commission President Ursula von der Leyen, while still praising Scholz as moderate and statesmanly (Global Times, August 19). Likewise, the move to allow a small number of European countries visa-free access (and very visibly not the United States, Canada, the United Kingdom, or China-skeptic EU countries such as Czechia and Lithuania) appears to be a calculated part of Beijing’s wider attempts to bilateralize its interactions with European countries and bypass the more assertive European Commission. On the other hand, China appears to be offering little deeper in terms of incentives, likely relying on entrenched attitudes and interests more than the promise of greater cooperation—an attitude vindicated by the German automotive lobby at the very least.

One error of some of this Chinese commentary is that it sometimes veers from praising German “moderation” into mistakenly thinking that the German government may be ready to support Chinese institutional initiatives. in November, the People’s Daily even published an “International Observer” column speculating that Germany might join the Belt and Road Initiative (People’s Daily, November 4). Some of this response appears rooted in deeper misapprehensions about German strategic culture. Jian Junbo (简军波) from Fudan University’s Centre for European Studies argued on December 7 that Germany “to some extent supports multi-polarization (一定程度上支持多极化),” similarly to other recent commentary from leading EU scholars like Cui Hongjian describing Germany as a potential revisionist power (Fudan Institute of International Studies, December 7; Global Times, June 15). This is a fundamental and rather revealing misreading of Germany’s position on “polarity” under the realist analytical lens prevalent in Chinese international relations. While German strategic language may indicate an openness to “multipolarity,” this is about Germany (and, even more importantly, the EU as a bloc) being able to take a different approach to the United States on particular issues while still cooperating in status quo institutions. It is not about revising the fundamental international order, as “multi-polarization” means to the PRC.

Conclusion

The German government’s launching of its China Strategy this summer showed that even the most reactive and cautious leaders in Germany’s government, up to Chancellor Olaf Scholz himself, recognize that Germany needs to take a new approach on China. However, the Strategy itself can only suggest potential measures—it is down to the government itself to act. In the last six months, the government has not shown which measures it is actually prepared to take.

Germany’s coalition partners are showing neither the ideological cohesion nor the political agility to maintain a united position on core policy priorities at present. This presages more strategic drift on China, in terms of both foot-dragging on implementation of the Strategy’s stronger suggestions, and in supporting more robust and cohesive action at the European level. In these circumstances, internal solidarity among the government’s coalition partners and externally with the European Commission and other Member States, will be essential to maintaining a credible policy, and avoiding the mistakes that Merkel’s government made in ignoring partners’ security concerns.