A Chinese Starlink? PRC Views on Building a Satellite Internet Megaconstellation

Publication: China Brief Volume: 21 Issue: 20

By:

Introduction

Billions of people around the world depend on the internet each day to make government, commercial, or personal transactions, and millions more users are being added each year. However, high-speed, reliable, and affordable internet services are not yet accessible to everyone. As Zhang Monan, a researcher at the China Center for International Economic Exchanges’ Belt and Road research group, assesses, developing countries’ dearth of internet infrastructure constitutes a “digital divide” separating them from the global high-tech economy (Economic Daily, August 19).

Most of the world’s internet traffic travels through fiber-optic cables, which achieve economies of scale in urban areas but are expensive to lay in less populated regions. Some of the demand for internet services in remote regions and from mobile platforms (such as aircraft and ships) is met by satellites in high-altitude geostationary and medium Earth orbits, but their services are costly and their latency (the time required for a signal to travel between a satellite and Earth) is high.

The advent of broadband internet from satellites in low Earth orbit (LEO) stands to fill the gap in terrestrial communications and overcome weaknesses in existing satellite internet services. In recent years, Western commercial space companies including SpaceX, OneWeb, and Amazon have unveiled plans to deploy tens of thousands of satellites in low-altitude megaconstellations (Deloitte, February 19, 2020). Unlike previous satellite internet services, these new constellations are being constructed at much lower altitudes—and in much greater numbers—to reduce signal latency and enable applications with rapid ping rates, such as online gaming and drone flights. Since 2018, SpaceX has taken the lead in the rollout of its own constellation, Starlink. With reusable Falcon 9 Rockets deploying dozens of Starlink satellites in a single trip, SpaceX has sent nearly 1,800 of the constellation’s satellites into orbit as of September this year (SpaceFlight Now, September 14).

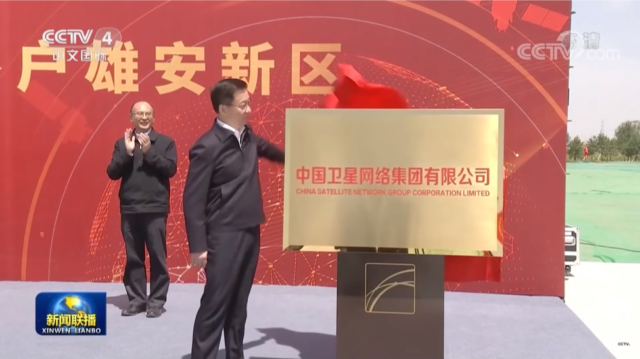

More recently, China has also signaled its intention to deploy LEO satellite internet at scale. On April 26, a meeting was held in Beijing to mark the establishment of China Satellite Network Group Co. Ltd. (中国卫星网络集团有限公司), a vice-ministerial state-owned enterprise (SOE) that will oversee the construction of a satellite internet megaconstellation (Xinhua, April 29; SASAC, April 29). Headquartered in Hebei Province’s Xiong’an New Area, the new SOE will manage the planning and operations of “Guowang” (国网), a network of sub-constellations that may eventually comprise as many as 12,992 satellites in LEO (CCTV, April 29). The megaconstellation will fold in the much smaller, partially deployed Hongyun and Hongyan communications satellite constellations of the state-owned China Aerospace Science and Industry Corporation (CASIC) and China Aerospace Science and Technology Corporation (CASC), respectively. It is unclear what other companies may participate in the construction and launch of Guowang satellites.

While little is yet known about China Satellite Network Group or Guowang, China’s space proponents are optimistic about LEO satellite internet’s potential to drive domestic economic growth and support the Chinese military’s communications infrastructure. At the same time, some Chinese writings express concerns about China’s ability to compete with Western commercial space companies in areas including technological capabilities and access to necessary space resources. This article examines Chinese views about the opportunities and challenges of satellite internet development and concludes with several areas to watch as China moves forward with the megaconstellation’s deployment.

China’s Expectations for Satellite Internet

Chinese state media and aerospace industry leaders foresee rapid growth in China’s satellite internet market over the next decade. Science & Technology Daily claimed the domestic satellite internet market could reach 100 billion Chinese yuan (about $15.5 billion) in value by 2030, an estimate based on figures from the financial services provider Guotai Junan Securities (Science & Technology Daily, September 15, 2020). Liu Baiqi, CEO of the private Chinese space launch firm Galactic Energy, cited the same figure in a July 2021 Xinhua interview, adding that the global satellite internet market was expected to be worth as much as $45.4 billion (about 293 billion CNY) by the end of the decade (Xinhua, July 19, 2021). Taken together, these figures imply that some Chinese space proponents expect China to have seized about a third of the global market share for satellite internet by 2030.

Members of China’s space industry highlight the importance of national-level policy support for the anticipated expansion of the domestic satellite internet industry. Satellite internet was elevated to a top development priority in April 2020 when the National Development and Reform Commission’s (NDRC) designated it as a type of “new infrastructure” (NDRC, April 20, 2020). Ge Yujun, president of CASC subsidiary China Spacesat, said in an April 2021 interview that this policy adjustment would drive “the rapid development of the entire satellite manufacturing and satellite applications industry” (Pengpai Xinwen, April 19). One sign of the policy trickling down to local government can be seen in Guangdong’s 14th Five-Year Plan for high-quality manufacturing, which makes satellite technology the main development target of the province’s “future industry” (Southern Daily, August 13).

The groundswell of interest in satellite internet is partially due to growing needs for connectivity in sparsely populated parts of China and in countries along China’s Belt and Road Initiative. Zhang Xue, an analyst affiliated with CASIC’s Beijing Aerospace Intelligence and Information Research Institute, said that China’s expanding overseas interests have driven requirements for “global, real-time, seamless information support.”[1] Mao Xiaofeng, a department vice-head at the state-owned satellite communications provider China Satcom, said that satellite internet would complement terrestrial internet networks (4G, 5G, etc.) to overcome connection difficulties in areas like “civilian aircraft, mountains, grasslands, deserts, and islands” (Southern Daily, August 13, 2021). In one related initiative focused on commercial airliners, China Eastern Airlines, China Telecom, and the industrial investment company Shanghai Juneyao jointly established KDlink Technology Co., Ltd (空地互联网络科技股份有限公司) in December 2020 with an eye toward developing in-flight Wifi services on flights operated by China Eastern and Juneyao Airlines (Economic Daily, August 21, 2021).

Chinese military and defense industry-affiliated experts also draw attention to the dual-use nature of the satellite internet megaconstellations currently under construction and highlight their potential to augment C4ISR capabilities. Chen Yunlei, an academic at PLA National Defense University, claims that the military use of civilian satellite internet services is only a matter of time, noting that this type of “new information infrastructure” has “extremely important military value.”[2] Chen predicts that the “inevitable” future integration of satellite internet with technologies like 5G and IoT would transform battlefield network information systems toward a “space-ground integrated three-dimensional structure.” Cognizant that China is behind US companies like SpaceX in terms of satellite deployment, a 2021 article in the CASC journal Aerospace China urges that China continue to track developments in other countries’ LEO satellite internet development that could be used by foreign militaries to “win great battlefield advantage.”[3]

As a whole, China’s space infrastructure development adopts an explicitly civil-military integration approach. Chinese authorities seek to integrate nominally military, government, and commercial assets to forge a “communications, navigation, and remote sensing space infrastructure system” capable of “global coverage and highly efficient operations” by 2035 (Xinhua, March 13, 2021). Satellite internet’s ability to contribute toward this objective will depend on Guowang’s ability to meet military requirements, which could be situationally dependent. Wang Quanping and Liu Xin—experts at the Beijing Institute of Aerospace Technology and the PLA Strategic Support Force’s Aerospace Engineering University—call on China to develop LEO satellite internet constellations that can flexibly adapt to “military-civilian fusion application scenarios.” They recommend, for example, that future constellations incorporate “software-defined satellites” that can be quickly adjusted and updated according to variable user requirements.[4]

Obstacles to China’s Satellite Internet Development

Chinese analysts identify several potential barriers to the rollout of a home-grown LEO megaconstellation. One recurring issue highlighted in Chinese writings is a self-perceived lack of critical satellite construction and launch technologies that would enable constellations to be deployed quickly, in large numbers, and at low costs. Wang Quanping and Liu Xin, for example, point to a lack of reusable launch vehicle technology and high-speed satellite manufacturing technology as the two biggest obstacles standing in China’s path to large-scale LEO satellite deployment. They point out that Chinese companies currently cannot compete with Western firms like SpaceX, whose proven reusable rocket technology and highly standardized satellite production have paved the way for low-cost constellation deployment.[5]

A second concern underscored in Chinese writings is that the space resources required for China’s LEO satellites to operate—namely, frequency bands and orbital slots—are scarce and quickly being acquired by other countries. China Defense Daily, for one, laments that the International Telecommunications Union, which is responsible for allocating satellite frequencies and orbitals, assigns these space resources on a “first come, first served” basis. The article points out that US companies like SpaceX have taken the lead in requesting frequency bands and orbital slots for their own megaconstellations, thereby limiting the resources available to latecomer countries (China Defense Daily, August 11, 2020). Chen Yunlei warns that US satellite internet constellations’ absorption of scarce satellite orbitals, which have “high value” in “both military and economic affairs,” will “lead to the long-term occupation and sealing off of LEO, constraining other countries’ use of space resources.”[6] Some Chinese analysts argue that China should exert diplomatic influence to amend the ITU’s resource allocation procedures and ensure China’s access to desired space resources. Zhang Xue, for example, suggests that China should seek to change the ITU’s “first come, first served” rules for frequency band and orbital track allocation, arguing that the status quo is not in line with the “fair use” of space resources under international law.[7]

Third, Chinese media and analysts raise questions about multinational deconfliction of in-orbit satellites and potential environmental consequences as China, the US, and other countries deploy megaconstellations in LEO. Xinhua, for example, reporting on SpaceX’s launch of Starlink satellites, casts doubts on the company’s ability to avoid causing “space congestion” or producing “space junk” (Xinhua, May 24, 2019). Various state-run media, including Science & Technology Daily, have highlighted interference to ground-based astronomical observation caused by initial deployments of Starlink satellites and implied the problem could only continue to grow as other companies and countries built their own constellations. Chen Yunlei of the PLA National Defense University asserts that a large quantity of LEO satellite internet satellites obstructing surface optical observation equipment and producing space debris constitute “security concerns for outer space in the future.”[8]

Conclusion

Few specifics about China’s Guowang satellite internet megaconstellation have been released from authoritative Chinese sources to date, but several preliminary conclusions can be drawn from the existing information and the views of Chinese subject matter experts. First, China’s development of LEO satellite internet services is likely to be extremely costly unless several technological breakthroughs are achieved in the near term. Past Chinese launches have demonstrated the capability to send multiple satellites into orbit on a single rocket. However, unlike SpaceX’s Falcon 9, which can carry dozens of satellites at a time, Chinese rockets have generally only carried a few satellites per launch. The ability to shorten and optimize satellite production and launch cycles will also be necessary in order to drive down costs. As Li Yinsong, vice chairman of the Shenzhen Institute of Communications, put it: “China is a great power in terms of its space and telecommunications industries. The technological difficulty of developing satellite internet is not great—the critical point is for companies to find ways to lower costs of satellite internet construction” (Southern Daily, August 13, 2021).

Second, the Chinese space program’s dual-use nature and China’s national strategy of civil-military integration suggest that Guowang could either be routinely used for military purposes or mobilized to support PLA operations at a time of need. A viable LEO satellite internet capability could improve the speed and coverage of Chinese military communications in distant or sparsely populated theaters, particularly in support of aircraft or ships operating outside the First Island Chain. At the same time, if China seeks to sell satellite internet services outside mainland China, it would likely aim to downplay Guowang’s military affiliation, in light of the difficulties of other PLA-linked Chinese information and communications technology companies, such as Huawei, in expanding product and service lines abroad.

Finally, ambitious plans by China, the US, and other countries to rapidly introduce tens of thousands of communications satellites into LEO over the next decade add urgency to the need for international cooperation in areas including space debris and space traffic management. The US-China political relationship is currently strained, and the US and its allies have various restrictions on space-related interactions with China, but exploring ways to ensure the day-to-day safety of all countries’ satellites could be a mutually beneficial endeavor that great powers pursue.

Brian Waidelich is a Research Scientist at the China and Indo-Pacific Security Affairs Division of CNA, a nonprofit research and analysis organization located in Arlington, VA. His research interests include politics and security in East Asia, with a focus on maritime and space issues involving China and Japan. This work represents his own views and should not be regarded as representing the opinions of either CNA or its sponsors.

Notes

[1] Zhang Xue (张雪), “A Brief Analysis of Outer Space Governance from Starlink” (Cong “Xinglian” Jihua Qiantan Waikong Zhili; 从“星链”计划浅谈外空治理), Aerospace China (Zhongguo Hangtian; 中国航天), no. 9 (2020): 52.

[2] Chen Yunlei (陈云雷), Li Xianglong (李向龙), Wang Xinxin (王鑫鑫), “Research on the Trend and Influence of US Satellite Internet Military Applications” (Meiguo Weixing Hulianwang Junshi Yingyong Qushi Ji Qi Yingxiang Yanjiu; 美国卫星互联网军事应用趋势及其影响研究), Aerodynamic Missile Journal (Feihang Daodan; 飞航导弹), no. 2 (2021): 82.

[3] Li Lu (李陆), Guo Lili (郭莉丽), and Wang Keke (王克克), “Analysis on Military Application of Starlink Constellation” (“Xinglian” Xingzuo De Junshi Yingyong Fenxi; “星链”星座的军事应用分析), Aerospace China (Zhongguo Hangtian; 中国航天), no. 5 (2021): 39-40.

[4] Wang Quanping (王全平), Liu Xin (刘欣), Yi Chunlun (衣春轮), and Zhang Hongli (张洪礼), “Research on Foreign Development of New LEO Satellite Constellation and Potential Military Applications” (Guowai Xinxing Digui Weixing Xingzuo Fazhan Ji Qi Qianzai Junshi Yingyong Yanjiu; 国外新型低轨卫星星座发展及其潜在军事应用研究), Tactical Missile Technology (Zhanshu Daodan Jishu; 战术导弹技术), no. 3 (2021): 67-74.

[5] Wang Quanping et al., “Research on Foreign Development of New LEO Satellite Constellation and Potential Military Applications,” 73.

[6] Chen Yunlei et al., “Research on the Trend and Influence of US Satellite Internet Military Applications,” 86-87.

[7] Zhang Xue, “A Brief Analysis of Outer Space Governance from Starlink,” 52.

[8] Chen Yunlei et al., “Research on the Trend and Influence of US Satellite Internet Military Applications,” 82-87.