Kazakhstan Increases Railway Capacity Along Trans-Caspian International Transport Route

Kazakhstan Increases Railway Capacity Along Trans-Caspian International Transport Route

Executive Summary:

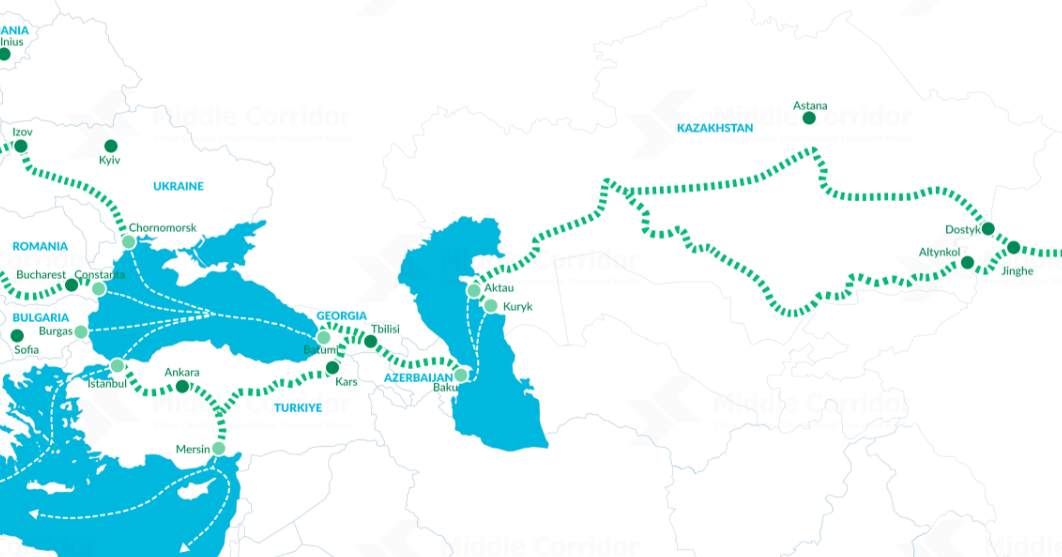

- Kazakhstan is expanding rail cargo capacity on the Trans-Caspian International Transport Route (TITR), which uses Kazakhstan to bypass Russian infrastructure between the People’s Republic of China (PRC) and Europe.

- Major investments, including a second Dostyk-Moiynty rail track and over 1,300 miles of new lines, support Kazakhstan’s growing role in PRC-Europe trade routes.

- Enhanced rail investments are boosting Kazakhstan’s exports, particularly grain, to the PRC and beyond, reflecting Kazakhstan’s broader “multi-vector” foreign policy, which aims to increase Kazakhstan’s prosperity and influence through trade.

One of the most noticeable, if underreported, outcomes of Russian President Vladimir Putin’s war against Ukraine has been the discreet efforts of most post-Soviet states to loosen their ties with Russia. This is particularly evident in Kazakhstan, which shares a 4,721-mile-long border with Russia and an eastern frontier of 1,180 miles with the People’s Republic of China (PRC). In 2024, bilateral trade between Russia and the PRC totaled $27.8 billion, while trade between Kazakhstan and the PRC was $43.8 billion. Kazakhstan’s government is focusing on projects to deepen its economic ties with the PRC. These projects primarily focus on infrastructure, ranging from railways to pipelines. As a transit country, Kazakhstan has become increasingly integral to the China Railway Express (CRE) train routes, which have facilitated the transportation of goods from the PRC to Europe primarily via Russia through the “Northern Corridor” since 2011 (see EDM, October 25, 2022, January 28).

In late 2022, Kazakhstan Temir Zholy (KTZh), the country’s national railway, began building a second track on the 520-mile (837-kilometer) Dostyk-Moiynty railway section, from the Chinese border, to facilitate rail traffic with the PRC (Samruk-Kazyna, accessed June 9). Kazakh President Kassym-Jomart Tokayev made this decision with the support of the Samruk-Kazyna Sovereign Wealth Fund and regional akimats—heads of local government in Kazakhstan—who labeled the move “very important” for Kazakhstan’s transport and transit capacity. Traffic along the second tracks on this route is anticipated to start this month (Kazakhstan Railways, May 26).

Kazakh Prime Minister Alikhan Smailov participated in the ceremony to launch the new project via teleconference, emphasizing that facilitating rail traffic with the PRC is an integral part of Kazakhstan’s “Strong Regions—Driver of Country Development” project (Prime Minister of Kazakhstan, November 17, 2022). During the last five years, the volume of goods transported through Kazakhstan increased by 440 percent. From January to October 2022, the trade volume exceeded 74 billion ton-kilometers, representing an 11 percent increase over the same period in 2021 (Prime Minister of Kazakhstan, November 17, 2022).

The construction of a second track along the Dostyk-Moiynty section is not Astana’s only investment in better rail infrastructure. In December 2023, the Kazakh government announced a plan to build more than 1,300 miles (808 kilometers) of additional rail tracks throughout Kazakhstan by 2027 (TASS, December 20, 2023). According to KTZh, construction of the Dostyk-Moiynty railway began in early 2023. Since then, KTZh has prepared more than 8.2 million cubic meters of earth, laid more than 497 miles (800 kilometers) of railway track, modernized 32 stations, and built 92 bridges to increase the throughput capacity of the section. KTZh also modernized power supply and communication systems and introduced a domestic train traffic control system (Telegram/@PR_KTZh, May 29, 2024).

Since 2022, Putin’s war against Ukraine has disrupted the PRC’s Europe-bound rail traffic, shifting a significant portion of it southwards through the Trans-Caspian International Transport Route (TITR), or Middle Corridor (see EDM, October 25, 2022, January 28). The TITR is the shortest route by rail between the PRC and Europe, crossing Kazakhstan to avoid sanctions-hobbled Russia entirely. Sanctions imposed after Russia’s full-scale invasion of Ukraine threatened to close many traditional routes for European and PRC goods through Russia, creating new incentives for the PRC to use the Middle Corridor (see EDM, April 19, August 4, 2022, July 17, October 28, 2024, April 23).

Boosting TITR traffic is a major impetus behind KTZh’s decision to build a second track along the Dostyk-Moiynty railway section. KTZh projects that the improvement will increase the throughput of the segment fivefold from 12 to 60 pairs of trains per day (Sputnik Kazakhstan, May 30, 2024).

Beyond the Dostyk-Moiynty railway section, KTZh has other major infrastructure projects connecting Kazakhstan to the PRC. These include a new railway line bypassing the former capital of Almaty’s transport hub, which was built during the Soviet era, and a new Darbaza-Maktaaral railway line in the southern part of the country. The southern Darbaza-Maktaaral route will become part of the most convenient and shortest route between the central part of the country and Turkmenistan, as well as Iran. A Kazakh terminal has already been built and is in operation in the PRC’s Xi’an dry port in the Shaanxi province. One-third of container trains exported from the PRC to Europe via Kazakhstan originate at the Xi’an dry port, and 40 percent of the port’s imported cargo travels through Kazakhstan (Tengrinews, October 22, 2024). Beyond increasing Kazakhstan’s Xi’an dry port terminal transit capacity along the TITR by a factor of 20, the Kazakh terminal at Xi’an reduces delivery times from the PRC to Azerbaijan to 11 days and from the PRC to Georgia to 14 days (Tengrinews, October 22, 2024).

Planning for the TITR began a decade ago, stemming from a December 2015 decision by Ukraine and the PRC to transport cargo along the Silk Road, bypassing Russia (Gazeta.ru, February 2, 2016). In mid-December 2015, the first train departed from the PRC’s Xinjiang capital of Ürümqi, traveling through Kazakhstan’s Dostyk to the port of Aktau, using a roll on–roll off (ro-ro) ferry to cross the Caspian to Azerbaijan’s Alat port. The train, carrying a modest 21 twenty-foot equivalent unit (TEU) containers, then proceeded west through Azerbaijan to Georgia’s Batumi Black Sea port, from where it was delivered by ferry to Istanbul (Gazeta.ru, December 29, 2015). The voyage uncovered several difficulties, including cumbersome customs regulations, logistics company disputes, inefficient gauge transfer stations, and erratic ro-ro ferry services. The transshipment of containers in four ports resulted in a significant increase in transportation costs (Gazeta.ru, December 29, 2015). Despite these problems, the heads of the railway administrations of Kazakhstan, Azerbaijan, and Georgia signed documents establishing the “Association of the Trans-Caspian International Transport Route” in October 2016 (Izvestiya, October 13, 2016).

The new route presented a dilemma for Russia, as it could not openly oppose the TITR without coming into conflict with the PRC. Instead, Russia continued to promote the advantages of using the Trans-Siberian railway to transport PRC cargo to Europe (see EDM, September 5, 2024). While TITR proponents promoted swifter delivery times than maritime shipments and the advantages of avoiding Russia, logistical obstacles prevented significant use of the route until Putin’s full-scale invasion of Ukraine in February 2022 created a dramatic surge in interest in transport routes bypassing Russia.

In 2024, Kazakhstan and the PRC openly declared their intention to develop a railway route bypassing Russia, undoubtedly unsettling the Kremlin (Xinhua, July 3, 2024). During a July 2024 state visit to Astana, where PRC President Xi Jinping also attended the 24th Meeting of the Council of Heads of State of the Shanghai Cooperation Organization, Xi stated that he was prepared to work with Tokayev to jointly build a more substantive and dynamic relationship between the PRC and Kazakhstan. Xi emphasized the need to build a shared future and inject more energy into the region’s development and stability (Xinhua, July 3, 2024). Xi and Tokayev then participated in the launch of cargo deliveries along the TITR, which Tokayev officially announced on his Telegram channel press service (Telegram/aqorda_resmi, July 3, 2024). During the ceremony, Tokayev noted that the TITR would contribute to the development of transport and logistics in Eurasia. Both countries are actively cooperating in the implementation of new joint projects, including the construction of a third railway checkpoint at Ayagoz-Bakhty, aimed at keeping up with the increasing railway freight traffic between the PRC and Kazakhstan, which rose by 22 percent in 2023 (RuNews24, July 3, 2024).

The number of TITR trains going through Kazakhstan is steadily growing. Prior to the joint Xi-Tokayev declaration, PRC Railways subsidiary CR-Ürümqi showed an 8.2 percent year-on-year increase in shipments along TITR in the period January–June 2024, reaching 7,746 trains (Vgudok, August 28, 2024). According to data from the Baku International Sea Trade Port in Alat, in 2024 Baku’s total cargo turnover was 7.6 million tons, with TEU container traffic rising by 73 percent, from 310 block trains transiting the Middle Corridor, with an additional 40 block trains January 2025 (Caliber.Az, March 15).

In pursuing its “multi-vector” foreign policy and seeking to mollify its northern neighbor, Kazakhstan is also upgrading its rail links to Russia. KTZh, in conjunction with Russia’s state-owned Russian Railways (RZD) (Rossiiskie Zheleznie Dorogi, Российские железные дороги), has begun upgrading five of their nine bilateral rail junctions at Semiglavyi Mar, Orsk, Iletsk, Kartaly, and Kurkamys, increasing their throughput capacity by 20 percent. Kazakhstan is also expanding its Saryagash junction with Uzbekistan, increasing the facility’s capacity by 12 percent (ElDala.kz, April 2).

The proliferation of PRC-Europe routes via Kazakhstan will undoubtedly continue. Kazakhstan’s increased rail facilities have also allowed the country to increase its exports to the PRC. Since 2020, Kazakhstan’s overall cargo traffic with the PRC via rail has increased by 48 percent to 32 million tons annually, with exports increasing by 25 percent to 13.7 million tons (ElDala.kz, May 28). The greatest growth in the last five years has been in grain transportation. Since 2020, Kazakh grain exports to the PRC have more than doubled from 700,000 tons to 1.8 million tons (ElDala.kz, May 28).

Beyond the PRC, Kazakhstan has introduced transport subsidies to stimulate further wheat exports to find markets for growing harvests. Transport subsidies have made it possible to deliver Kazakh grain to distant new markets. On May 13, Agriculture Minister Aidarbek Saparov told journalists:

We are opening new markets. We sent 60,000 tons of wheat to Morocco, and now we are planning a second batch of 60,000 tons. We are also planning to send 15,000 tons to Vietnam. Yesterday, we sent the first batch to the United Arab Emirates (ElDala.kz, May 13).

Export volumes to traditional markets for Kazakh grain, including Afghanistan and Uzbekistan, are also growing. According to KTZh, in the first four months of 2025, Kazakh grain exports increased by 60 percent compared to the same period last year, reaching 3.7 million tons (ElDala.kz, May 13). Kazakhstan has big plans for the TITR. Tokayev, on May 30, told participants at the Central Asia-Italy summit:

By developing the Trans-Caspian international transport route, our countries are essentially reviving the ancient Silk Road on a new basis. Last year, the volume of container traffic on the Kazakhstan section of this corridor increased by 62 percent, amounting to 4.5 million tons. Within three years, we aim to double this figure (Kazinform, May 30).

Central Asian governments increasingly view Russia as a threat to regional stability, sovereignty, and territorial integrity (see EDM, September 19, 2022). Despite Russia’s traditional domination of Eurasia, Putin’s war against Ukraine is decreasing Central Asian confidence in Russia as a political and economic partner.

Kazakhstan, sandwiched between Russia and the PRC, appears to favor its peaceful multi-vector foreign policy to safeguard its sovereignty and improve its economy through international trade. Expansion of its transit potential with the PRC is thus essential for Kazakhstan. Since Xi’s 2013 announcement of the PRC’s “One Belt, One Road” (OBOR) program in Astana, the volume of container traffic between the PRC and Europe has increased 100-fold from 7,600 in 2013 to 897,000 TEU in 2023 (Tengrinews, October 22, 2024). Notably, half of the total volume of cargo delivered by rail from the PRC to Europe now passes through Kazakhstan.

On May 25, 2024, the PRC launched its 90,000th freight train from the Xi’an port to Małaszewicze, Poland, marking a significant milestone in the CRE freight train services under OBOR. CRE freight trains now reach 223 cities in 25 European countries and over 100 cities in 11 Asian countries, a lucrative transport network featuring increased Kazakh involvement (The EurAsian Times, July 8, 2024).

Russia is suffering under increased international sanctions as Putin pursues his seemingly interminable war against Ukraine. It is a small wonder, then, that Kazakhstan has chosen direct cooperation with the PRC over suffering collateral damage from reliance on Russian trade.