Non-Strategic Rivals Undermine the Strategic Nabucco Project

Non-Strategic Rivals Undermine the Strategic Nabucco Project

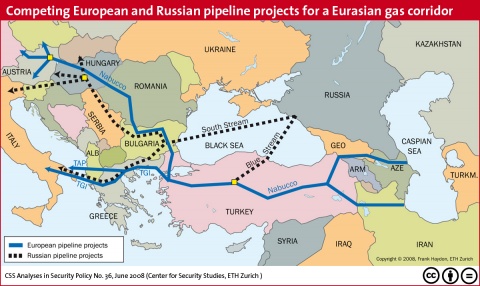

The ITGI (Interconnector Turkey-Greece-Italy) and TAP (Trans-Adriatic Pipeline), with planned capacities at 10 billion cubic meters (bcm) annually for each, require no further sourcing beyond Azerbaijan’s Shah Deniz field, Phase Two. Both ITGI and TAP are headed for southeastern Italy. The Nabucco project, however, is planned for 31 bcm annually, with its first stage at 10 bcm per year relying entirely on Shah Deniz Phase Two. Once it materializes, this large-capacity pipeline is expected to open the way for Turkmen gas to flow via Azerbaijan, aggregating the two countries’ export volumes to central Europe (“Three Pipeline Consortiums Compete Over Access To Azerbaijani Gas,” EDM, August 18).

From a European perspective, and in light of the EU’s energy policy priorities, ITGI and TAP are non-strategic projects. Their capacities are modest, their market destinations peripheral, and their role is very limited in terms of competing against Gazprom. From the same perspective and compared again with their Nabucco rival, ITGI and TAP may even be termed anti-strategic. If built, they would divert Caspian gas away from central European countries, for which Nabucco means diversification from Gazprom’s monopoly. ITGI and TAP, however, are targeting the Italian and nearby markets, which receive gas from multiple suppliers, and are also directly accessible to liquefied natural gas, unlike the landlocked central European countries. ITGI and TAP are strategically irrelevant in terms of access to Central Asian gas, with downright negative implications if either one preempts or delays Nabucco – the only project with adequate capacity for Turkmen gas.

ITGI and TAP are corporate business projects in their own right, forced into a zero-sum contest against Nabucco and against each other. This situation reflects high demand for Caspian gas and its limited availability to Europe after a wasted decade. The current European Commission, however, prioritizes access to Caspian gas from Turkmenistan and Azerbaijan through the Nabucco project.

ITGI (Interconnector Turkey-Greece-Italy) is a joint project of Italian Edison and Greek state-controlled Desfa/Depa, for transportation of Azerbaijani gas. Edison would purchase the gas for its Italian electricity-generating plants, and Greece for the economic development of its poor western districts. The ITGI route would: use Turkey’s existing pipelines, upgrading the worn-out portions; use the completed Turkey-Greece interconnector, with a capacity of 11 bcm per year; build a new pipeline, east-west across Greece; and lay the Greece-Italy interconnector, Poseidon Pipeline, with a capacity of 8 bcm annually, on the seabed of the Ionian Sea. All this implies that Greece would lift off 3 bcm annually while 8 bcm would move onward to Italy. The consortium proposes to complete this route to southeastern Italy by 2017, correlated with the start of Shah Deniz Phase Two in Azerbaijan.

The Italian-Greek consortium also proposes to build a Greece-Bulgaria interconnector, with a capacity of 3 bcm per year, in partnership with Bulgarian Energy Holding. The preliminary design work has just been commissioned (Sofia Novinite, Trend, August 11). Greece’s commitment to ITGI implies a loss of confidence in the prospects of Gazprom’s South Stream project. Desfa/Depa, the national gas trader and pipeline system operator of Greece, is scheduled for privatization by 2012, under the terms of the EU’s and IMF’s financial rescue of the country. The State Oil Company of Azerbaijan considers bidding for a stake in Desfa/Depa (Trend, July 15, August 5).

ITGI has received a boost from the PFC Energy consultancy, timed to the October 1 deadline by which Nabucco, TAP, and ITGI are expected to submit rival proposals to Azerbaijan. According to this consultancy, ITGI is the only project that can realistically be implemented before 2020 to transport Azerbaijani gas to Europe, in accordance with production schedules and volume availability in Azerbaijan. According to the same consultancy, a larger pipeline project, similar in scale to Nabucco, or a series of pipelines with a Nabucco-like interconnector in the Balkans, could be implemented after ITGI and after 2020, as larger gas volumes become available (PFC Energy, “Europe’s Southern Corridor: What Shape Will It Take?” www.pfcenergy.com and Trend, August 5).

On that assessment, ITGI looks like a Nabucco-stopper or outright Nabucco-killer, as long as gas supplies are confined to Azerbaijani production, without Turkmen inputs. The European Commission, however, is working with Azerbaijan and Turkmenistan to develop Nabucco for its strategic value.

TAP (Trans-Adriatic Pipeline) is a project of Norway’s Statoil and the Elektrizitaetsgesellschaft Laufenburg (EGL of Switzerland) with 42.5 percent each, and E.ON Ruhrgas with 15 percent of the shares. The German minority shareholder is a late add-on, as EU anchor for TAP’s non-EU stakeholders. TAP proposes to access those same 10 bcm of Azerbaijani gas annually, using Turkey’s existing pipelines (as would the Italian-Greek joint venture – see above) into Greece; build a new pipeline across Greece and Albania to the Adriatic coast; build a storage site in Albania; and lay a pipeline on the Adriatic seabed from Albania to southeastern Italy. Part of the volume would reach Switzerland, whether by direct transportation or through swaps.

Greece was never enthusiastic about TAP because of Albania’s involvement in this project, whereas Greece’s own Desfa/Depa is a stakeholder in the Poseidon project (see above), rival to TAP. Perhaps as an incentive to Greece, TAP partners now propose to build a longer pipeline on Greece’s territory, starting from East Macedonia/Thrace, instead of starting from Central Macedonia as previously proposed (Financial Times, August 8).

TAP is sprouting new proposals for an interconnector pipeline along the Adriatic coast, to run from Albania via Montenegro and Bosnia into Croatia. This interconnector with an annual capacity of 5 bcm could draw “Caspian” (Azerbaijani?) gas from the TAP pipeline to supply those countries. The TAP consortium has signed memorandums of understanding with each of them (TAP press releases, July 21).

Swiss Energy and Ecology Minister, Doris Leuthard, most recently told her Turkish counterpart, Taner Yildiz, that accessing Azerbaijani gas through TAP is an important goal of Swiss energy policy. Yildiz replied that the decision is entirely up to Azerbaijan (news.az citing Anatolia news agency, August 11). However, the Swiss Foreign Minister, Micheline Calmy-Rey, plays a lead role urging Turkey to open its border with Armenia unconditionally, without the quid-pro-quo of Armenian troop withdrawal from Azerbaijan’s inner districts. Such proposals alienate Azerbaijan and have in any case failed in Turkey thus far.