PRC Positions Brazil as Regional Hub in a New Latin American Order

PRC Positions Brazil as Regional Hub in a New Latin American Order

Executive Summary:

- Brazil, a strategic partner to the People’s Republic of China (PRC), is taking a co-leading role in shaping a regional economic order decoupled from U.S.-centric trade and financial norms.

- The most consequential outcome of President Lula’s recent visit to Beijing was the signing of a comprehensive financial integration package encompassing settlement, currency swap lines, market access, and shared digital infrastructure design.

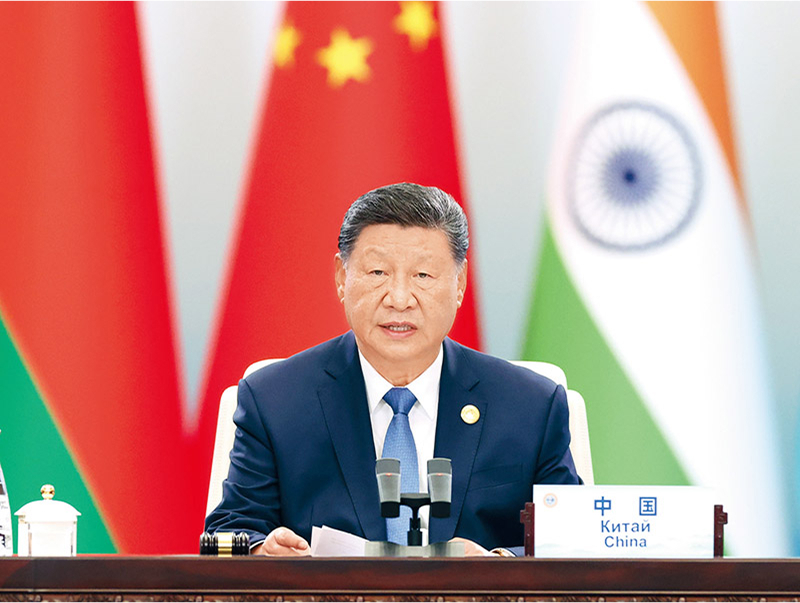

- Lula was in town for the Fourth Ministerial Conference of the China-CELAC Forum along with other leaders and ministers from the Community of Latin American and Caribbean States (CELAC). In his speech at the forum, President Xi Jinping signaled a drive to expand the PRC’s presence in Latin America through coordinated infrastructure investment, economic integration, and political alignment.

- New security cooperation agreements signed with Brazil may intersect with U.S. regional drug enforcement efforts and suggest a future in which Beijing could gain procedural influence over how security and surveillance are administered in partner states.

The People’s Republic of China (PRC) is moving rapidly to build parallel economic and financial systems with Global South partners. Nowhere is this more evident than in Latin America. The Fourth Ministerial Conference of the China-CELAC Forum, held in May between the PRC and the Community of Latin American and Caribbean States (CELAC), saw PRC officials advance a layered agenda of economic integration, infrastructure development, and local currency settlement—positioning the region as both a commercial outlet and a geopolitical hedge. CELAC is a 33-member regional bloc that explicitly excludes the United States and Canada.

Brazil sits at the center of the PRC’s strategy. President Lula da Silva’s state visit to Beijing, which coincided with the CELAC meetings, resulted in over 20 bilateral cooperation agreements and three major joint statements. The PRC is now positioning Brazil as its most important regional partner and as an anchor for advancing renminbi (RMB)-based financial integration and alternative development financing. A headline agreement between the two countries’ central banks renewed a RMB 190 billion ($26 billion) swap line. It also lay the groundwork for other mechanisms which parallel arrangements the PRC has expanded with Russia and select One Belt One Road partners.

Forum Signals Region-Wide, Cross-Domain Buildout

Held on May 13–14, the latest China-CELAC Forum marked the most comprehensive articulation to date of the PRC’s ambitions in the Western Hemisphere. At its core was the release of a new China-CELAC Joint Action Plan for 2025–2027, a sweeping blueprint for economic, technological, and political cooperation across more than 50 domains (Xinhua, May 14).

Framed as a celebration of South-South solidarity and historical friendship, President Xi Jinping’s keynote speech reveals a clear strategic ambition to institutionalize the PRC’s presence in Latin America through sustained political engagement, market access, infrastructure funding, and elite exchanges (Xinhua, May 13). The goal is to construct a durable, multidimensional framework for long-term integration, positioning the PRC as a systemic alternative to U.S. influence in the region.

The PRC’s economic offering to CELAC countries is expansive, blending concessional finance with commercial incentives. Central to this package is an RMB 66 billion ($9.2 billion) credit line to support a range of “development projects” (发展工程). The plan also encourages Chinese firms to expand direct investment in Latin America and commits to increasing imports of “high-quality” (高质量) products (Xinhua, May 13).

To ease capital mobilization and encourage local participation, the action plan called for deepened cooperation with Latin American development banks, exploration of an equity investment cooperation fund, and stronger roles for import/export credit agencies. Notably, the PRC proposed a “Panda Bonds” (熊猫债券) seminar, signaling interest in RMB-denominated debt issuance across the region. This complements ongoing efforts to reduce reliance on the U.S. dollar—a theme present throughout the PRC’s recent engagements with the BRICS countries and other Global South groupings, though not explicitly detailed in the CELAC documentation.

Beijing continues to frame infrastructure as a dual vehicle for development and geopolitical alignment. Under the action plan, the PRC will expand cooperation on transport infrastructure and operational capacity. One priority is the joint construction of “friendly ports” (友好港) tied to sister-city arrangements, along with new commercial air routes and flight agreements. These initiatives follow the precedent set by Chancay Port in Peru, a landmark project that Xi cited as a model for land-sea integration between Asia and Latin America (China Brief, March 15, 2024).

Beijing is also keen to explore opportunities in key commodity and industrial sectors, positioning itself as a co-developer of critical resources and industrial ecosystems. The plan outlines cooperation in the energy transition, advanced energy storage, and earth sciences-based resource exploration, alongside a proposal to train geoscience talent in the PRC. The PRC is also promoting integration across communications infrastructure, AI applications, cloud computing, and big data, with potential spillover into standards-setting. In agriculture, the plan lays out mechanisms for trade expansion, food security coordination, and joint research and development of agricultural technologies.

Security cooperation pledges will raise flags in Washington. The PRC has offered law enforcement training for CELAC member states alongside equipment assistance and capacity-building in cybersecurity, counterterrorism, anti-corruption, and transnational crime. One major step is the proposed creation of community emergency response team (CERT) liaison mechanisms; in other words, institutional links between national cybersecurity organs. If implemented, these could serve as the backbone for a shared digital security architecture. The plan also proposes bilateral cooperation on issues like illegal arms and gold trafficking, human trafficking, and wildlife crimes—areas that may intersect with U.S. regional drug enforcement efforts. This all points to a future where the PRC could gain procedural influence over how security and surveillance are administered in partner states.

PRC and Brazil Cement Strategic Partnership and Financial Integration

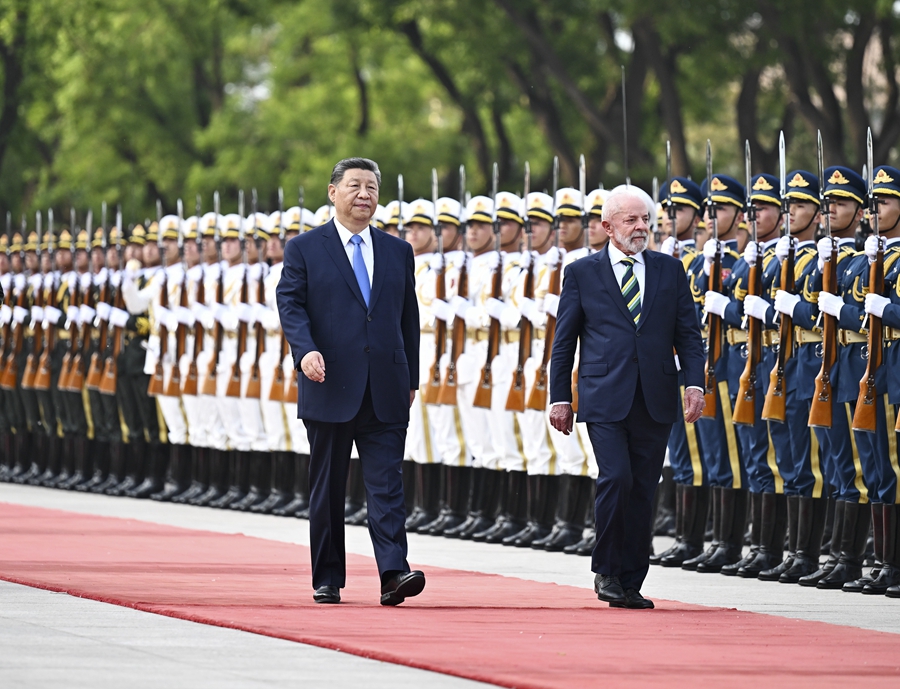

The PRC used Brazilian President Lula’s state visit to significantly upgrade ties. The bilateral meeting, held May 13 at the Great Hall of the People, underscored a formalized vision for a “China-Brazil community of common destiny” (巴中命运共同体). Xi described Brazil as a strategic partner in co-leading the Global South’s response to geopolitical fragmentation, while Lula emphasized their “indestructible” (坚不可摧) relationship and criticized excessive tariffs and protectionism as growth barriers. The two men also committed to integrating China’s One Belt One Road initiative with Brazil’s major domestic plans and identified a wide range of sectors for deepening cooperation (Xinhua, May 13, [1], [2]). [1]

The most consequential outcome of Lula’s visit was the signing of a comprehensive financial integration package between the PBOC and Brazil’s key financial authorities (PBOC, May 13). Governor Pan Gongsheng (潘功胜) and his counterpart, Governor Gabriel Galipolo, signed two major accords: the “Memorandum of Understanding on Financial Strategic Cooperation” (金融战略合作谅解备忘录) and the renewal of the “RMB/Real Bilateral Currency Swap Agreement” (续签双边本币互换协议). These agreements mark another step toward systemic financial integration, encompassing settlement, currency swap lines, market access, and shared digital infrastructure design.

The renewed currency swap line, valued at RMB 190 billion ($26 billion) and valid for five years, aims to expand local currency use in bilateral trade and provide liquidity support for financial markets in both countries. Beyond liquidity, the memorandum commits both central banks to a broad agenda: improving the financial investment environment, supporting institutional investors, enhancing interoperability of market infrastructure, and linking fast payment systems and cross-border QR code payments. These technical steps are the backbone of an emerging framework for RMB settlement infrastructure in Latin America, setting up mechanisms for currency zone integration outside the U.S. dollar-based system.

Complementing this, the two central banks signed a separate agreement on financial intelligence exchange and cooperation on combatting financial crime. A third agreement between the PBOC and Brazil’s Ministry of Finance will extend strategic cooperation into development finance and global monetary governance, including collaboration under the China-Brazil Sustainable Development and Capacity Cooperation Fund and joint positions on international financial system reform.

The PRC-Brazil joint statements also confirmed shared positions on global governance reform. They reaffirmed opposition to unilateral sanctions and trade coercion, endorsed WTO reform, and supported expanding developing-country representation in the United Nations Security Council and international financial institutions. On the Ukraine conflict, they reiterated support for Russia–Ukraine dialogue and announced the launch of a “Friends of Peace” group at the UN to elevate Global South mediation voices (Xinhua, May 13).

Conclusion

The PRC views its bilateral alignment with Brazil as a model for “inclusive” (包容) multipolar order-building—one that may become a bellwether for how it intends to expand its model to Latin America. In the context of the PRC’s agreements made at the CELAC forum, Brazil is emerging as a co-architect of an evolving regional economic order in which trade, investment, and standards-setting can evolve independently of U.S.-centric financial and institutional frameworks. The PRC’s approach brings capital and connectivity but also reinforces a resource-extractive growth model, raises sovereign debt exposure, and intensifies geopolitical alignment pressures.

These developments may remain in an early stage of implementation, but they constitute significant potential to reshape capital flows, industrial patterns, and financial governance across the hemisphere. The latest agreements elevate financial cooperation to a policy-coordinated, infrastructure-linked, and politically supported strategic relationship. This gives Beijing a scalable model for deeper currency integration and market interconnectivity with other Global South partners—particularly those, like Brazil, seeking to hedge against dependence on Western capital and financial markets.

Notes

[1] Brazil’s domestic plans include the Accelerated Growth Plan, New Industrial Plan, Ecological Transformation Plan, and South American Integration Route. The areas identified for deeper cooperation include energy transformation, semiconductors, aerospace, AI, and the bioeconomy, as well as agricultural innovation and food security. Both governments also emphasized expanding trade in sustainable minerals, civil aviation, and the digital economy, with a stated intent to improve supply chain cooperation.