Russia Struggles to Develop New Joint Ventures with Mongolia

Publication: Eurasia Daily Monitor Volume: 7 Issue: 199

By:

The Kremlin has repeatedly pledged to implement sizable infrastructure development projects in Mongolia. However, new Russian projects in this neighboring state have tended to be slow to materialize. In an apparent bid to speed up joint projects, in early October Russia and Mongolia moved to solve the remaining debt problem. Both countries agreed to settle the $180 million debt connected with MongolRosTsvetmet, Russia’s Deputy Finance Minister, Dmitry Pankin, announced (Interfax, October 11). Pankin also said that both sides continued to discuss financial aspects of railway joint ventures.

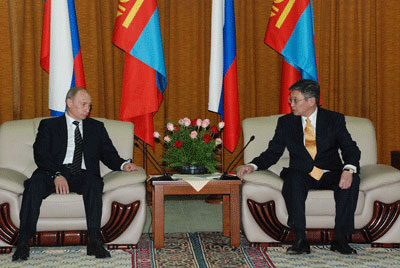

Moscow wrote off the bulk of Mongolia’s Soviet-era debt in 2003. Mongolia reportedly requested to write off $180 million in loans from Russia to MongolRosTsvetmet after 1991. However, Russian officials argued that the joint venture was sufficiently profitable to repay the debt. Since the Soviet Union’s collapse in 1991, bilateral economic relations were overshadowed by Mongolia’s huge Soviet-era debt to Russia. When the then President, Vladimir Putin, traveled to Mongolia in 2000, both sides pledged to solve the debt problem and develop economic ties. In December 2003, the Russian government agreed to write off almost all of Mongolia’s debt to Russia, once estimated at $11 billion.

During the Soviet era, the Mongolian economy heavily relied on massive Soviet loans and aid. More than 700 projects were implemented, including over 1,000-kilometers of roads. Erdenet copper mining, Ulaanbaatar Railway and MongolRosTsvetmet metal companies, three major joint ventures with Russia formed during the Soviet era, still produce about 20 percent of Mongolia’s GDP. Yet, even these flagship joint ventures apparently struggle to develop new projects. In December 2006, MongolRosTsvetmet and Russia’s Polymetal clinched a tentative deal to develop the Asgat gold deposit. However, the agreement sparked some domestic controversy and the Mongolian government had to cancel it in January 2007 (Interfax, October 6).

Russia remains one of Mongolia’s leading foreign trade partners. In the past several years, bilateral trade has been estimated at about $1 billion annually, and Russia has enjoyed a healthy surplus. Not surprisingly, Moscow has been keen to sustain its trade ties with Mongolia. The Russian Industry and Trade Chamber moved to create a new body, the Russia-Mongolia Business Council. The council is due to be formally inaugurated on November 3.

Earlier this year, Russia’s main electricity exporter, Inter RAO, extended its supply contract with Mongolia to 2015. Russia exports some 130 million kilowatt hours of electricity per year to Mongolia or about 8 percent of the country’s power consumption. Russian officials have urged expanding the bilateral energy partnership. Moscow intended to consider building power plants in Mongolia using local coal reserves so as to export electricity to China, Russian Energy Minister, Sergei Shmatko, argued in May 2009. However, Shmatko’s remarks are yet to be supported by any binding agreements (Interfax, November 1).

In May 2009, the Russian Railways (RZD) company agreed to set up a joint venture with Erdenes MGL and Mongolyn Tomor Zam to upgrade Mongolian railways and develop the Tavan-Tolgoi coal deposit and the Oyu-Tolgoi copper and gold mine. The Mongolian side was supposed to contribute mining licenses, while RZD pledged to build railway links to both deposits. RZD CEO, Vladimir Yakunin, said that RZD-led bilateral projects to develop Mongolia’s coal and copper mining infrastructure could reach $7 billion. However, in recent months, RZD has refrained from releasing any details concerning these projects.

The Mongolian government has long promised to support Russian investment in new projects to develop the country’s deposits, including Tavan Tolgoi in southern Mongolia. Major Russian companies have indicated interest in Mongolia’s Tavan Tolgoi coal deposit in the South Gobi region with estimated reserves of 5-6 billion tons. The Oyu Tolgoi field is estimated to contain up to 30 million tons of copper and about 32 million ounces of gold.

In May 2009, Russian Prime Minister, Vladimir Putin, traveled to Mongolia and promoted the creation of new major joint ventures to pursue infrastructure development projects. Putin also advocated joint uranium mining projects. Russia’s nuclear agency Rosatom and private companies have been interested in developing Mongolian uranium deposits. On October 6, Russia’s En+ Group indicated interest in uranium mining projects in Mongolia (Interfax, Reuters, October 6). Uranium deposits in northeastern Mongolia, including the Dornod and Eastern Gobi fields, are close to Russia’s largest uranium producer, the Priargunsky mines.

In March 2009, Rosatom and the Mongolian Nuclear Energy Agency signed an agreement on bilateral cooperation. Rosatom is understood to want the creation of a joint venture to develop uranium deposits in Mongolia. Moscow is also keen to sustain political contacts with Mongolia. In late October, a group of Russian lawmakers traveled to Mongolia to discuss bilateral economic ties. On October 26, the Russian mission met with Mongolia’s Prime Minister, Sukhbaatar Batbold, and discussed trade issues and specific economic plans such as railway projects and uranium mining. The mission was headed by Valery Maleyev, the Chairman of the Committee on Mongolia in the State Duma, the lower house of the Russian parliament (Montsame News Agency, October 26).

Officials in Moscow and Ulaanbaatar have long pledged to develop the bilateral economic partnership. However, the planned joint projects have appeared to be slow to materialize.