Star Hostage: TSMC, China’s Drive to Conquer Taiwan, and the Race to Win AI Superiority

Star Hostage: TSMC, China’s Drive to Conquer Taiwan, and the Race to Win AI Superiority

Executive Summary:

- Talent flows uncovered between Taiwan Semiconductor Manufacturing Company’s (TSMC) operations in the People’s Republic of China (PRC) and several sanctioned PRC firms constitute risks to the company’s position at the leading edge of the global chip industry.

- TSMC’s transition to encompass other parts of the value chain, ostensibly to avoid monopoly concerns, exacerbates these risks.

- If TSMC cedes its dominance, the deterrent effect of Taiwan’s “silicon shield” would be greatly reduced. It could also affect Washington’s support for Taiwan.

- The company has begun to diversify by setting up fabrication plants in the United States in an effort that has been encouraged by its main customers, including Western tech giants such as Apple and Nvidia.

Taiwan Semiconductor Manufacturing Company (TSMC), one of the most important firms globally, is evolving. In a quarterly earnings call last summer, the company announced a shift to a new “Foundry 2.0” model. This will see the company expand from its traditional wheelhouse of fabricating semiconductors to encompass packaging, testing, mask-making, and other parts of the value chain (TSMC, July 18, 2024). This shift comes with risks, as it is not guaranteed to be executed successfully.

The need to evolve was made clear on January 27, when U.S. President Donald Trump suggested imposing tariffs on imported chips to force manufacturing to return to the United States (C-SPAN, January 27). In response, Taiwan’s government stated that the current situation was “a win-win business model for Taiwan and U.S. industries” (Reuters, January 28; CNA, January 28).

TSMC has already begun diversifying, setting up plants in the United States and elsewhere. Much of this has less to do with the United States than with the People’s Republic of China (PRC). Under the leadership of Xi Jinping, the PRC has insisted on a path of potentially violent unification with Taiwan, which could jeopardize the company’s ability to operate. Therefore, TSMC has pursued diversification as a hedging strategy, a course of action that is also encouraged by its primary customers.

TSMC is a key target for the PRC. Xi Jinping has, in recent years, begun to pivot the country toward an economic model that focuses on achieving dominance in several key technologies that he sees as crucial for achieving “Chinese-style modernization (中国式现代化)” and the country’s “great rejuvenation (伟大复兴).” Advanced semiconductor manufacturing is one such technology, and Beijing has a long history of engaging in various means—both licit and illicit—to acquire the technologies it wants (China Brief, December 6).

TSMC’s Revolving Door With Sanctioned PRC Firms

TSMC has a little-explored vulnerability that could reduce its current lead over PRC competitors. A flow of talent exists between the several fabrication plants (“fabs”) the company maintains in the PRC and those of leading PRC firms, as a database compiled by the authors shows (see Appendix below). Some of the PRC firms are sanctioned by the U.S. Department of the Treasury for violating export controls or providing technology to the People’s Liberation Army (PLA), while others are on the U.S. Department of Commerce Entity List.

Several foreign and Taiwanese semiconductor manufacturers have established a presence in the PRC to gain access to its growing market. Starting with Motorola in the 1990s, On Semiconductor, Intel, Samsung, SK Hynix, and UMC have built fabs in cities such as Leshan, Shenzhen, Suzhou, Xi’an, Dalian, Chengdu, and Xiamen (Semiconductor Industry Overview, May 13, 2023).

Among these, TSMC’s fabs appear to be the most resilient and advanced. The company’s Fab 10 in Shanghai is its older front-end plant, producing 200mm wafers. In Nanjing, Fab 16 began producing 300mm wafers at the 16nm node in mid-2018. The latter is one of the most advanced lines in the PRC. Though TSMC does not release figures regarding its “success rate” (the percentage of usable chips per wafer), Fab 16’s rapid startup and steep ramping up of production indicate excellent commercial viability (EE Focus, May 31, 2018; EETimes Taiwan, November 1, 2018).

Perhaps because of TSMC’s high-quality advanced manufacturing, there appears to be a significant movement of engineers and support personnel between TSMC’s PRC fabs and those owned by PRC firms, including ones serving sanctioned entities. Such talent traffic between tech companies is not unusual, but TSMC’s status as one of the two most sophisticated chip manufacturers in the PRC makes it significant to the the country’s advances in semiconductor technology.

A limited examination of profiles on MaiMai.cn (脉脉), a PRC-based platform similar in structure and purpose to LinkedIn, shows significant personnel turnover between TSMC and Huawei (Maimai, accessed January 28). Even without a MaiMai paid account, which requires a PRC phone number and credit card, we could observe dozens of former TSMC specialists and experts employed at Huawei in technical roles like R&D engineering, etching, photolithography, and yield engineering. The Appendix attached to this article displays some of the findings. Also apparent in the talent marketplace is that former Huawei HR recruiters, such as Sun Yichao (孙艺超), are working at TSMC China and possibly orchestrating a pipeline of talented engineers and specialists between the two firms.

Former TSMC engineers and technical experts can also be found at several other leading PRC firms under U.S. government sanctions. These include Changxin Memory Technologies Inc. (CXMT; 长鑫存储技术), Yangtze Memory Technology Co. (YMTC; 长江存储科技), Advanced Micro-Fabrication Equipment (AMEC; 中微半导体设备), and SiEn Integrated Circuit (芯恩(青岛)集成电路). (Although AMEC was removed from the list of “Entities Identified as Chinese Military Companies Operating in the United States,” in late December 2024, it remains on the Department of Commerce’s Entity List.)

Some former TSMC China employees on LinkedIn and Maimai list their current location as Hangzhou, Zhejiang Province, but leave their current employer unlisted or private. Hangzhou is home to the PRC-funded Hangzhou’s Chengxi Science and Technology Innovation Corridor (城西科创大走廊), a special development zone in Zhejiang Province funded and endorsed by the Ministry of Science and Technology, where dozens of defense-linked technology companies are nurtured and subsidized (Hangzhou CCP Municipal Committee, undated).

State-operated umbrella organizations in Hangzhou, like Zhijiang Laboratory (之江实验室), host recruiting events with the explicitly stated goal of bringing “High-Level Talent (高层次人才)” (that is, ethnic Chinese who worked in or completed advanced degrees in sensitive STEM-related fields) back to the mainland. In a typical event to recruit such talent, Zhijiang Labs hosted the 2024 AI Computing Postdoctoral Academic Exchange Summit (2024年“智能计算”博士后学术交流活动) at its headquarters in Hangzhou over three days in late August. The event, organized jointly by the PRC Ministry of Human Resources, the Zhejiang Provincial Department of Human Resources and Social Security, and Zhijiang Laboratory, had the theme “Intelligent Computing Driving Tech Innovation (智能计算推动科技创新).” Many such events are held each year within the PRC specifically targeting ethnic Chinese students and ethnic Chinese employees working and studying abroad for recruitment into special development zones (Zhijiang Labs, July 10, 2024; October 13, 2024; Hangzhou Human Resources Bureau, undated).

Besides rank-and-file engineers from TSMC migrating to sanctioned PRC entities, there are multiple cases where former high-level TSMC employees left positions in Taiwan to work or do business in the PRC. Notably, Lin Zhengxun (林政勋), a photolithography and etching expert with over 25 years of experience at TSMC and California-based Lam Research, became CEO of Anhui Xinquan Semiconductor (安徽芯泉半导体) in June 2024. The company is an industrial manufacturer in Anhui province that appears to specialize in semiconductor refrigeration applications and etching chemicals for semiconductor manufacture (LinkedIn, accessed January 28). Another prominent example is Zhang Rujing (张汝京), the engineer who founded SMIC (中芯国际), the PRC’s answer to TSMC. Zhang was a former senior TSMC employee who left Taiwan for the mainland in 2000, bringing know-how that led to successful lawsuits by TSMC in 2003, 2006, and 2009 for patent infringement and theft of trade secrets (Jiemian News, May 8, 2019; Ts’aihsun Magazine, February 5, 2020).

Additional Risks Restructuring, PRC Threats

Beyond ceding crucial information and skills to competitors in the PRC via personnel movements, TSMC faces two additional risks. First, if TSMC were to stumble in its attempt to expand into other parts of the value chain, detailed below, a slowdown in technology advancement worldwide could ensue, caused by a dwindling chip supply and steep price increases on their products. This would negatively impact the company’s fortunes as well as those of its customers. Second, in the event of a war over Taiwan, TSMC’s fabs would be damaged, perhaps irreparably, which would also severely affect the global supply of leading-edge chips.

‘Foundry 2.0’: An Ambitious Gamble

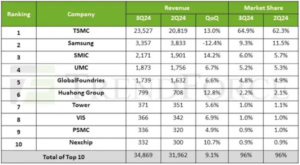

TSMC operates in a competitive semiconductor foundry market with many other players. However, some have posited that the firm acts like a monopoly because it dominates the fabrication of the most advanced chips, the 3nm premier versions of which were all booked in advance by Apple in 2023 (PCGamer.com, August 10, 2023; Sina Finance, September 19, 2024) Chris Miller, author of the 2022 book Chip War, the Fight for the World’s Most Critical Technology, has said that the company is “right to be concerned about antitrust issues” (American Economic Liberties Project, February 6, 2024; April 8, 2024; Washington Times, January 12). TSMC currently holds 62 percent of the revenue in the global semiconductor foundry market, a share that is expected to grow to 66 percent by 2025 (IDC, December 12, 2024; FTC, undated). Its closest competitor, Samsung, commands only about 11.5 percent of market revenue. Intel Foundry Services did not make the top ten in revenue for 2024 (EE News Europe, December 9, 2024).

Life at the cutting edge is a different story. TSMC is dominant, with a market share of 70–80 percent in 5nm technology, expected to exceed 90 percent for 3nm, covering as customers nearly all major players such as Apple and Nvidia (Trendforce, April 8, 2024). As a whole, Taiwan accounts for 18 percent of global semiconductor manufacturing capacity and 92 percent of the world’s most advanced semiconductors. [2] Artificial intelligence (AI) drives growth in this market as demand soars to fabricate the component chips within each advanced GPU, including the device core and the high bandwidth memory chips needed to support it (Nvidia H100 Datasheet, undated).

Figure 1: Top Ten Foundries by Revenue and Market Share in Third Quarter 2024 ($ millions)

(Source: TrendForce, December 5, 2024) [2]

Taiwan’s dominance, and that of TSMC, has attracted much attention. If TSMC suddenly became unavailable, all its customers would be stuck in limbo and unable to ship products to customers. If high-end production were a separate market, more observers might be uttering “monopoly” than hitherto.

TSMC’s position nevertheless continues to strengthen as the semiconductor business undergoes significant changes. Its competitors remain wedded to the traditional “Foundry 1.0” model pioneered by TSMC in the 1980s. This model limits operations to a fab (aka the “front end”) producing semiconductor wafers and shipping them to other firms for “back-end” assembly and testing. TSMC’s recent shift to pioneering the “Foundry 2.0” model seems aimed at mitigating criticism that it is a monopoly. It has only a small footprint outside of its fabs, so its market share as a more diversified chip maker is forecast to drop from around 60 percent to about 28 percent in the next few years. Ironically, this could in fact strengthen its market position as a one-stop shop for customers (Tom’s Hardware, July 19, 2024; Business Korea, July 31, 2024).

A Taiwan Invasion Would be Disastrous

On January 2, 2019, Xi Jinping made his first and only speech on PRC policy toward Taiwan at an event commemorating the 40th anniversary of the “Message to Compatriots in Taiwan (告台湾同胞书).” He delivered messages echoing CCP leaders reaching as far back as Jiang Zemin: “The motherland must be, and will inevitably be unified” and “the Taiwan question arose due to the weakness and disorder of the nation, and it will end with the revival of the nation.” Xi also called for exploring a “‘Two Systems’ Taiwan Plan (‘两制’台湾方案),” indicating that the formula for absorbing Hong Kong and Macau was unsuitable for Taiwan (Xinhua, January 2, 2019; China Brief, February 15, 2019).

Resulting studies by CCP-approved scholars stressed so-called “peaceful reunification (和平统一),” albeit not ruling out military action. They also offered a revamped scheme to avoid popular resistance, such as the 2014 Umbrella Movement and the 2019 protests in Hong Kong. However, the controlled debate between conservative and less conservative contributors and the lack of a timeline for final conquest indicated an escalating campaign of intimidation aimed at making Taiwan’s population give up hope, though perhaps with nothing more serious in the next several years (GMF, August 2024).

While the rhetoric of the CCP regarding Taiwan has not greatly changed, Beijing’s ability to project power beyond its shores has grown, especially since 2022 (China Brief, November 1, 2024; January 17). Of specific concern is the growth of PLA missile brigades along the coast that could threaten U.S. Navy vessels and civilian shipping well beyond Taiwan. [3]

TSMC’s market dominance at the high end of semiconductor manufacturing and its physical exposure to the hostile political-military force of the PRC seems to have prompted the company to hedge its bets on the future viability of a free Taiwan, Washington’s support for Taipei, and Beijing’s wrathful power projection. Taking precautions to minimize risk and playing to both sides is not dissimilar from business decisions made by other multinationals that have sought to simultaneously maintain footholds in the large markets of China, North America, and Europe.

Diversification Versus the ‘Silicon Shield’

After encouragement from Washington and the passage of the CHIPS Act, TSMC is expanding its semiconductor manufacturing presence in the United States beyond its existing facility in Camas, Washington. It has three projects in Phoenix, Arizona that the company says brings its total investment in the country to $65 billion (Govinfo, August 9, 2022; TSMC, accessed January 28).

The adjustment to operating overseas has not been smooth. In the United States, TSMC has encountered cultural and legal problems as they hire non-Asian staff and face local regulations. Their highest-profile problem may be a class action lawsuit filed in Arizona by former and current employees alleging “anti-American bias” (Arizona Family, November 13, 2024).

The company’s first Arizona fab nevertheless is near completion and will manufacture wafers at 4nm. A second one slated to open in 2028 will achieve 2–3nm. Both will be approximately two or three years behind TSMC’s most advanced facilities in Taiwan. This indicates that TSMC is reserving its premier technology for its home facilities. While not in itself an unusual business decision, it also helps preserve Taiwan’s “silicon shield”—the idea that the PRC would not want to destroy a leading technology source that benefits its economy. Of course, the “silicon shield” only remains effective so long as the PRC is unable to close the technology gap and if the CCP’s leaders actually care about PRC access to these high-end chips. If that changes, the “shield” could become a magnet, tempting Beijing to cripple the West by destroying TSMC (IEEE Spectrum, December 27, 2024).

Conclusion

Beijing will continue to pursue all avenues to shrink the technology gap between TSMC and its indigenous firms. It has likely already increased funding for its technology diversion efforts, and there is evidence of freelance smuggling via India, Malaysia, Singapore, and elsewhere (China Brief, December 6). The rise of formidable AI startups in the PRC are reminders that official technology diversion and unofficial smuggling are challenges that require a stronger and more dynamic effort than the United States currently pursues. For instance, DeepSeek, whose open source model has shaken Western tech giants in recent weeks, has 50,000 Nvidia H-100 chips, according to Scale AI CEO Alexandr Wang (QQ, March 14, 2024; PC Magazine, July 3, 2024; 163, December 20, 2024; Geopolitechs, January 20; WCCFTech, January 25; Wired, January 25). Though DeepSeek’s V-3 AI model has been independently tested, to date the startup’s claim that it achieved this feat for only $6 million in investment remains unsubstantiated.

Export controls are having an effect, as Beijing’s complaints indicate (People’s Daily, November 1, 2023; Journal of Finance and Economics, December 2023). But they are likely to be insufficient on their own to prevent the PRC acquiring the most advanced semiconductor technology. Reducing the flow of talent between TSMC and PRC competitors would be one way of maintaining the resiliency of the “silicon shield” and mitigating the risk that TSMC punctures that very shield by ceding its advantage. As the company goes down its current path of expansion and transition, reducing such risks may be key to retaining its dominance.

Notes

[1] One of the authors was previously employed by two American technology firms manufacturing in the PRC. This article is informed in part by his experience working in the sector.

[2] Lin Jones, Sarah Krulikowshi, Nathan Lotze, Samantha Schreiber, “U.S. Exposure to the Taiwanese Semiconductor Industry.” Working Paper 2023-11-A, U.S. International Trade Administration, November 2023.

[3] 龔龍峰中校, “中共火箭軍發展對陸軍化學兵戰力防護作為之研究”, Taiwan Ministry of National Defense, https://www.mnd.gov.tw/opendata.aspx?f=陸軍化生放核半年刊, p.12.