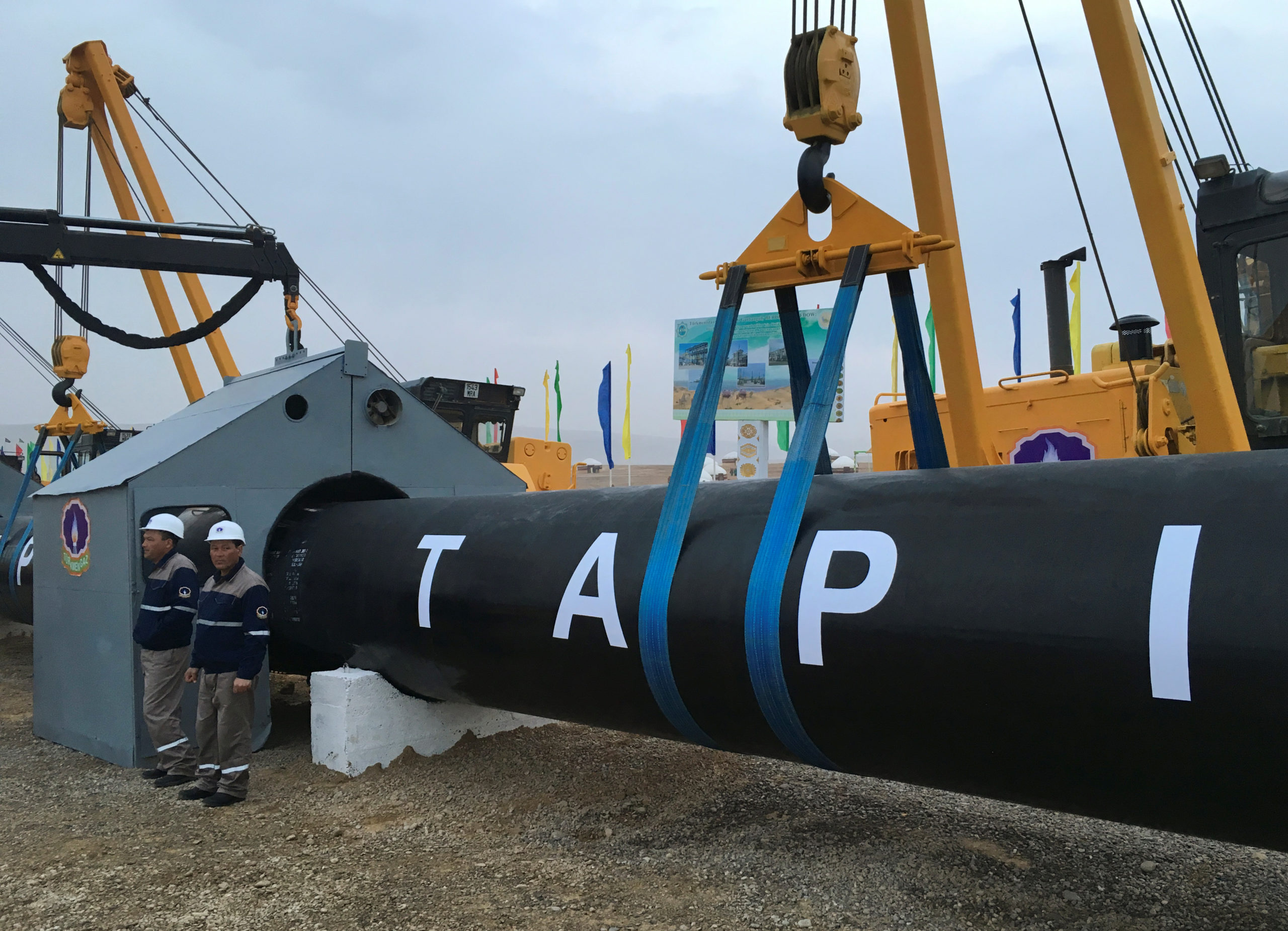

TAPI Pipeline Project and Stakeholder Interests: Business, Geopolitics or Both?

Publication: Eurasia Daily Monitor Volume: 18 Issue: 181

By:

On November 1, Afghanistan’s minister of defense, high-level Taliban leader Mohammad Yaqoob, stated that he bears special responsibility for the safety, physical security and ultimate execution of the Turkmenistan–Afghanistan–Pakistan–India (TAPI) natural gas pipeline project, adding, “we are ready for any sacrifices for this project to be implemented” (TASS, November 1). This declaration echoed an earlier statement in support of the pipeline by the Taliban’s spokesperson in Qatar, Suhail Shaheen. Indeed, for the Taliban, TAPI has strategic meaning of potentially crucial importance: according to some estimates, the project could result in up to $1 billion in annual revenues (for the exploitation of the pipeline) to Afghanistan and generate at least 12,000 new jobs in the war torn and impoverished country, thus possibly providing a significant boost to the Taliban’s popularity domestically (Nangs.org, August 17).

The history of the TAPI pipeline starts in 2008, when Ashgabat hosted the first Turkmenistani-Afghan inter-governmental commission on trade, economic and technical cooperation; at the meeting, the two sides acknowledged the necessity of building a pipeline connecting Turkmenistan’s vast natural gas deposits to downstream consumers in Afghanistan. The project soon attracted the attention of Pakistan and India and, in 2010, all four parties signed a preliminary agreement on building TAPI. Despite numerous subsequent discussions, declarations and even signed documents, however, construction on the project did not move forward until 2018, when the first works were initiated (though soon stopped) on the territory of Afghanistan. Only in February 2020, in Dubai—within the scope of the international conference “Turkmen Oil and Gas–2020”—was the final plan for the project officially presented to the broad public (Mirperemen.net, September 9, 2020). Yet continuing destabilization in the region prevented any concrete results. Paradoxically, the situation may finally change after the Taliban’s return to power: though having retaken Kabul, the Taliban regime continues to struggle with internal enemies, while the local economy is worsening. The group’s leadership is, thus, on the lookout for any economic and business prospects to remedy these twin challenges, and TAPI could represent one such major opportunity.

This strategic energy mega-project (approximate length is 1,735 kilometers) is expected to run through Turkmenistan (200 km), Afghanistan (735 km) and Pakistan (800 km), culminating in the Punjabi Indian town of Fazilka. The gas reserves earmarked for the pipeline are located in southern Turkmenistan—the Galkynysh field (in Mary Province), the world’s second-largest single hydrocarbon field, with an approximate capacity (estimates were made in 2013) of more than 14 trillion cubic meters of natural gas (estimates vary) and up to 300 million tons of oil (Turkmenistan.ru, September 5, 2013). Construction and operation of this pipeline project—which requires major investments of up to $10 billion and agreement among all the parties involved—could become an important factor contributing to both viable economic dividends for TAPI’s transit nations as well as energy security for consumers of natural gas in India.

The project plays into the strategic interests of several powerful players. For India—today, the world’s third-largest energy consumer—the TAPI pipeline will help fill its tremendous dependence on imports of energy resources. Moreover, given the rapid growth of India’s industrial potential on the one hand, and New Delhi’s determination to cut down on the use of carbon-heavy coal on the other hand, deliveries of natural gas from Turkmenistan could become an increasingly important new factor in the South Asian country’s energy security strategy. That said, India’s openly skeptical stance toward the Afghan Taliban as well as its chronically poor relations with Pakistan provide ongoing fuel for Indian voices critical of TAPI. This, however, might change thanks to opposing tendencies in Pakistan. In effect, given current trends, by 2030, Islamabad might be looking at an annual deficit of up to 40 billion cubic meters of natural gas, which could have a calamitous effect on Pakistan’s energy security (Nezavisimaya Gazeta, June 7). So despite his country’s challenging relations with India, the head of Pakistani diplomacy, Shah Mahmood Hussain Qureshi, stated earlier this year that the TAPI project is strategically important for the entire macro-region and should be initiated (Business.com.tm, August 27).

Aside from these two, directly involved states, the project also indirectly engages several other actors. One of them is Turkey, which Turkmenistan’s President Gurbanguly Berdimuhamedow invited to join the project back in 2015 (Hronikatm.com, August 11, 2015). In November 2021, while referring to the approaching tripartite Azerbaijan-Turkmenistan-Turkey summit, Berdimuhamedow once again reiterated his desire to see Ankara join the TAPI project, calling for the establishment of a transportation and energy “bridge” between East and West (Hronikatm.com, November 10). Aside from the TAPI pipeline’s economic and business aspect, its cultural-civilizational element—particularly given the internal transformations experienced by Turkey and the growing regional role of pan-Turkism (see EDM, November 17)—must not be ignored. Thus, while, for now, Ankara’s reaction to these invitations has been rather limited, that could change in the future.

Another interested party is Saudi Arabia, which, incidentally, has already invested twice in the project. It appears that the Saudis are now renewing their focus on TAPI, which flows from a recent article by the Saudi ambassador to Turkmenistan, Said Osman Ahmed, who stated that, “[T]he Kingdom will support this important project because it is likely to have a positive impact on the development of the whole region” (Report.az, September 23).

Finally, Russia, which is itself strategically interested in increasing gas deliveries to India (see EDM, November 2), has also expressed support for this seemingly rival energy project. Speaking in Tashkent last summer, Russian Foreign Minister Sergei Lavrov announced his country’s interest in taking part in construction of the pipeline. Among other points, Lavrov said that Russia wants to play a role in linking up Central and South Asian energy infrastructure—something closely in line with the Taliban’s rhetoric (Neftegaz.ru, July 20).

Two key motivations may stand behind Moscow’s supportive stance vis-à-vis this Eurasian pipeline project. First, its involvement may facilitate Russia’s goal of normalizing ties with the Taliban, thus avoiding the destabilization of neighboring Central Asia and some of its own regions vulnerable to radicalization coming out of Afghanistan. Second, by permitting Turkmenistani gas to flow to South Asia, Russia may be seeking to derail any near-to-medium-term possibility of Turkmenistan sending its resources westward to Europe (via the long-proposed Trans-Caspian Pipeline). As such, by backing TAPI, Russia is effectively safeguarding its own dominant position on the European gas market.