Chinese PSCs in MENA: The Cases of Iraq and (South) Sudan

By:

Executive Summary

- In the Middle East and North Africa (MENA), China is determined to continue expanding its footprint primarily using economic and business-related tools. Defense and security cooperation, for now, plays a less important role in Beijing`s actions in the region.

- The activities of Chinese private security companies (PSCs) in the MENA region, though they do exist, are rather opaque and, based on available information, much more limited than in other regions, such as Central Asia and Sub-Saharan Africa.

- The security crises in Sudan and Iraq vividly demonstrated two aspects of Chinese activity. First, Chinese PSCs have been present in the region. Second, they could not or were not authorized to play a key role in crisis situations. As a result, the Chinese side chose to rely on official (military) channels while protecting Chinese nationals in distress.

- In the future, Beijing might increase its reliance on PSCs in the MENA region, though, based on current trends, this is likely to become a longer-term ploy.

China’s interest in the Middle East and North Africa (MENA) is relatively new, yet is steadily growing with Beijing’s increasing need for natural resources. In addition to traditional energy resources (oil and natural gas), China is interested in acquiring access to new sources of energy, including wind and solar power, as well as logistics- and transportation-related benefits offered by the countries of the region. On top of that, the Chinese side is interested in developing partnerships with local actors in the realms of new technologies, information technology and artificial intelligence. In general, Beijing’s interests and actions in MENA can be formulated in four primary ways[1]:

- China’s paramount interest is in acquiring new energy providers and deepening economic partnerships.

- China seeks to balance against Washington’s influence in the Middle East but does not actively oppose the United States. Beijing prefers to increase its power and influence in the region incrementally, without becoming directly involved in conflicts with other regional actors.

- China wants to ensure domestic tranquility, which involves quashing any public criticism of Beijing’s policies, notably with regard to Chinese Muslims and the Uyghurs of Xinjiang.

- China aims to enhance its great-power status. This, however, is primarily done through establishing and forging economic and business ties, whereas security cooperation has yet to play a central role.

Given China’s emphasis on economic and business tools in the region, MENA remains challenging for developing trade and transit ties due to concerning levels of violence and political instability, which, though seemingly on the decline, remain quite high. Perhaps, the most recent destabilization in Sudan (2023) is the best confirmation of this thesis. Overall, this paper seeks to discuss the main forms of cooperation between China and its key partners in the MENA region through the lens of its use of PSCs in Iraq and (South) Sudan.

China’s Strategic Interests in MENA

The MENA region includes between 19 and 27 countries (based on various interpretations).[2] The World Bank considers MENA to be comprised of 21 country stretching form Morocco in the west to Iran in the southwest and Sudan in the south.

The region’s strategic importance rests on several main pillars:

Hydrocarbons. According to the Organization of Petroleum Exporting Countries, MENA holds more than half of the world’s oil reserves and two-fifths of the world’s natural gas reserves.[3] Moreover, the region—and Qatar specifically—is becoming a key supplier of liquefied natural gas (LNG).[4]

Critical Transportation and Transit Nodes. This is visible mainly though maritime and land-based transportation routes. The Suez Canal plays a central role on the maritime side of things. Following the de-facto conclusion of the COVID-19 pandemic, the canal made its highest monthly revenue ever in April 2022 ($629 million) with 114.5 million net tons being carried through it waters, representing the largest monthly tonnage in the canal’s history.[5] This passage remains the dominant international maritime transportation route despite the emergence of alternatives, including the Northern Sea Route. The Strait of Hormuz, which connects the Persian Gulf with the Gulf of Oman and the Arabian Sea, is also pivotal in this regard as one of the world’s most important chokepoints for the maritime trade of energy resources.

In terms of land-based routes the so-called “Middle Corridor” and Lapis Lazuli transit corridor, among others, are key focuses for regional trade. Land-based strategic pipelines, such as the Sumed Pipeline (Suez-Mediterranean Pipeline), ensure the uninterrupted supply of hydrocarbons to the Mediterranean Sea region.

Green and Renewable Energy. This area is rapidly becoming one of the key priorities for leading regional actors, including the United Arab Emirates (UAE), Saudi Arabia, Qatar and others. According to the report “Transforming Energy Scenario,” the International Renewable Energy Agency in Abu Dhabi anticipates that the share of modern renewables, such as hydropower, wind and solar, in total global energy consumption will increase from 10 percent to 28 percent by 2030 and 66 percent by 2050.[6] According to a 2019 study, the largest export potential in the MENA region for expanding green energy consumption and production by 2050 is seen in Egypt, Algeria and Saudi Arabia, as these countries are prioritizing renewable energy. They are followed by Iran, Morocco, Oman, Qatar, Tunisia, Turkey and the UAE.[7] A study published by the International Energy Agency has argued that renewable energy production in the region will more than double over the coming five years,[8] turning the attention of the world`s largest economies—including China—to MENA in search of green energy potential.

Yet, despite its sizable economic potential and rapidly emerging business activities, the MENA region is permeated by a series of conflicts and instabilities in Syria, Iraq, Iran, Libya and Yemen, to name the most active cases, which pose security-related challenges to potential investors. This is stipulated by the fact that the security environment in the aforementioned countries has been greatly undermined by a series of internal conflicts, as well as regional developments, that have lasted for years.

Chinese Involvement in Business, Trade and Security

By virtue of geography, relatively loose prior contacts and a number of differences (mainly social, cultural and linguistic), for many years, MENA remained outside China’s main regions of interest. While diplomatic relations were first established with Egypt in 1956, Beijing did not establish diplomatic relations with all states in the region until 1992. This was primarily related to the Chinese Communist Party (CCP) launching market reforms[9] as well as the growing demand for natural resources (hydrocarbons in particular).[10]

The CCP’s current involvement in the MENA region can be conditionally broken down to the following three segments.

1. Political Engagement. Over the years China has established three types of political partnerships with regional players: comprehensive strategic partnerships (Egypt, Saudi Arabia, Iran and the UAE); strategic partnerships (Turkey, Jordan, Qatar, Iraq, Oman and Kuwait); and innovative comprehensive partnerships (Israel).[11] In 2019, during the Middle East Security Forum held in Beijing, with the attendance of more than 200 representatives from both the Middle East and China, the CCP presented a “new idea” for the Middle East that upheld the philosophy of “development” rather than “divisions and confrontations.”[12] Specifically, it outlines four “points of common understanding:

- To set up a new security concept that is collective, comprehensive, cooperative and sustainable;

- To realize a final peace between Palestine and Israel (among other regional issues) in a just and equal manner;

- To highlight the role of “development” in regional management;

- To encourage and facilitate mutual dialogue and understanding between different civilizations over counterterrorism and counterextremism, thereby “eliminating double standards in international and regional affairs.”

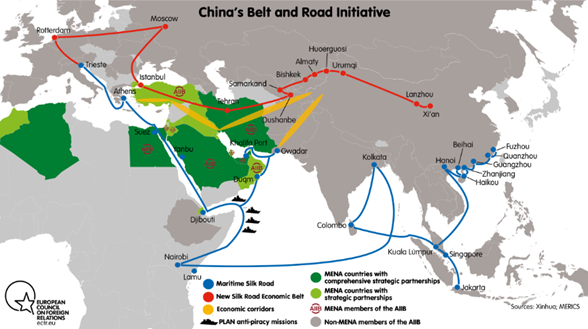

2. Economic Engagement. As stated, the MENA region has been gaining importance for China—primarily as a key supplier of hydrocarbons—since the early 1990s. Beijing massively relies on the Middle East’s vast supplies of oil[13] and natural gas.[14] Primarily oil- and gas-related deals with Saudi Arabia and Qatar have made China the largest trading partner of the region.[15] This partnership is likely to grow due to the CCP’s ambitious plans with the Belt and Road Initiative (BRI), where MENA is to become an integral part of the China–Central Asia–West Asia Economic Corridor and a strategic juncture of the BRI. Indeed, Beijing is expected to invest in building large infrastructure projects that include ports, railways, highways, power stations, pipelines, landmarks and even entire cities across the region.

China’s BRI in the MENA Region

Source: European Council on Foreign Relations.

In addition to traditional infrastructure projects and business deals in energy, the MENA region is rapidly becoming a hub for Chinese technological outreach (internet, software and cybersecurity)[16] and an important part of the Digital Silk Road initiative.[17] For example, Huawei is heavily involved in digital and surveillance-related projects in the region.[18] Similarly, China is actively promoting its BeiDou Navigation Satellite System (北斗卫星导航系统) in industries that include environmental monitoring, smart agriculture, disaster relief and regional transportation in countries such as Saudi Arabia, Algeria, Lebanon, Oman and Morocco.[19]

Moreover, China, which is emerging as one of the world’s leading powers in AI and robotics, is actively developing cooperation with MENA countries in these areas.[20] Saudi Arabia[21] and the UAE[22] have seemingly become Beijing’s central regional partners in this regard. China is also successfully combining partnership with the Islamic countries of the region and cooperation with Israel: Some studies claim that Chinese investments in Israel (in the ream of IT and new technologies) stands at $9 billion.[23] In addition to these areas, Chinese corporations are actively involved in boosting research and development (R&D) cooperation with MENA countries. For example, Huawei’s Istanbul branch launched its own on-premises R&D venture in 2009 and since then has seen it grow to the tech company’s largest R&D center abroad.[24]

Finally, in terms of economic engagement, China has been actively pressing forward with negotiations on creating a free-trade agreement with the other 21 regional players, which would establish a strategic juncture between Beijing’s economic cooperation and (growing) political involvement in regional affairs.[25]

3. Security Cooperation. Chinese military exports to the Middle East began in the mid-1970s, peaking in the 1980s and subsequently declining in the 1990s and 2000s. Currently, the volume and extent of military and defense cooperation between China and MENA actors—Beijing’s main regional partners being Egypt (first weapons deal was concluded in 1975), Iraq, Iran, Turkey and Saudi Arabia—is considerably lower than that of the US, the European Union or even Russia.[26] This, however, might change (to an extent) due to many MENA countries prioritizing upgrading economic ties with China and external developments, such as Russia’s war against Ukraine.[27]

In developing defence and security ties with MENA actors, China is most likely to rely on two major tools. First and foremost, arms and weaponry supplies constitute the central pillar of regional partnerships. The table below provides information on China’s arms weaponry deliveries to its main customers in the region.

|

Country |

Types of Weaponry Delivered (Since 2000s) |

| Egypt | CH-4B Unmanned Combat Aerial Vehicles (UCAV)

Wing Loong 1 Unmanned Aerial Vehicles (UAV) ASN-209 Reconnaissance UAVs 120 K-8 Karakorum Training Aircraft J-10C Multirole Fighters (Unconfirmed)[28] |

| Iraq | 4 CH-4B UCAVs

20 FT-9 Bombs and AR-1 Air-to-Air Missiles HJ-10A Anti-Tank Guided Missile Systems Mounted on Chinese VN-1 Armored Personnel Carriers (Unconfirmed) |

| Iran[29] | VT-4 Tanks (Unconfirmed)

J-10s (Unconfirmed) |

| Turkey | WS-1B Rocket Launchers

200 B-611 Short-Range Ballistic Missiles |

| Saudi Arabia |

DF-3A (CSS2) Ballistic Missiles (Secretly Concluded in the 1980s but Disclosed Only in 2014) DF-21 Ballistic Missiles PLZ-45 Self-Propelled Guns Wing Loong 1 UAVs and CH-4B UCAVs 5 Wing Loong 2 UAVs HQ-17AE Air Defense System Sky Saker FX80 (Currently Being Negotiated[30]) CR500 Vertical Take-Off and Landing Drones (Currently Being Negotiated) Cruise Dragon 5 (Currently Being Negotiated) HQ-17AE Short-Range Air Defense System (Currently Being Negotiated) |

Source: Author

Second, China is renewing efforts to establish naval and military bases in the region, which, given current trends, appears to be a less viable option, at least for now. In 2017, the People’s Liberation Army (PLA) set up its first overseas military base in Djibouti, which is located in close proximity to the US military’s Camp Lemonnier in the Horn of Africa. Later, some authoritative Western outlets and think tanks began to argue that China is planning to open military bases in the Persian Gulf and the Gulf of Oman,[31] though this was denied by CCP officials. As of writing, such alleged plans have yet to materialize.

As another way of forging security cooperation, under certain circumstances, the Chinese side could also embark on the greater use of PSCs in the MENA region. This could be stipulated by both internal developments in some MENA countries (such as an existing range of security-related challenges) and China`s interests to expand its paramilitary presence in the region through the use of PSCs and similar entities. The two case studies discussed below, Iraq and Sudan, provide some context for the nature of the activities and functions performed by Chinese PSCs in the region.

Chinese PSCs in the MENA Region

General Patterns

Despite the seeming mitigation of most active regional conflicts and security crises, MENA still remains subject to a wide range of political and security risks. According to the Fragile States Index, Yemen, Somalia, Syria, Afghanistan and Iraq remain the most fragile countries in the world.[32] According to the most recent Global Terrorism Index, the MENA region, despite significant improvement[33] still ranks as one of the least peaceful regions in the world. It also reports that the Islamic State was responsible for 57 percent of all terrorism-related deaths in the region between 2012 and 2022.[34]

Overall, the Chinese state (and businesses) need to seriously consider this trend when thinking about the potential perils faced by Chinese nationals in MENA countries. As of 2019, some studies claimed that up to 550,000 Chinese nationals were located in the Middle East.[35] The function of providing ample security for these Chinese citizens could be partially covered by Chinese PSCs. As has been argued by Alessandro Arduino, “Well before the BRI, when the host states were not able to guarantee even the most basic modicum of security, the Chinese energy sector’s SOEs [state-owned enterprises] started to employ well-known multinational private security firms … [including] Control Risk, a UK-headquartered security company protecting Chinese oil fields in Iraq. … Since 2015, the Chinese market for private security started to move outside its own borders in partnership with the international security companies contracted by Chinese SOEs. Since then, cooperation with foreign security firms has been evolving, with Chinese counterparts increasing their share and responsibilities. Now the most active Chinese PSCs are able to maneuver abroad by outsourcing their armed security requirements to local militias and security companies without the need to pay high premiums required by the multinational companies.” Arduino also noted that “Chinese market trends are going to witness a growing interaction between Chinese PSCs, Chinese SOEs and international special insurance providers for two main reasons: first, the BRI is generating an increasing number of special insurance needs for Chinese companies and individuals operating abroad; second, the Chinese government is neither willing nor able to deploy the necessary resources to reach all the areas in the MENA region. Nevertheless, the capacity of the Chinese PSCs to perform recovery missions is unproven and, most importantly, it is not codified by Chinese law.”[36]

Another study pointed out that, as part of their activities in the MENA region, Chinese investors do not simply rely on Western PSCs and local security forces. Instead, China dispatches its own PSCs to protect Chinese expatriates and Chinese-funded infrastructure. As examples, the study names such bodies as the “Snow Leopard” commando unit (雪豹突击队), which is affiliated with the People’s Armed Police; Tianjiao Tewei; and Huaxin Zhong’An as Chinese firms involved in the private security market in MENA.[37]

Iraq

In 2005, one of the first major incidents involving the kidnapping of eight Chinese nationals in Iraq produced widespread reactions from the Chinese political leadership, including, among others, Chinese President Hu Jintao (胡锦涛) and Premier Wen Jiabao (温家宝), who directly ordered the Foreign Ministry and Chinese Embassy in Iraq to take effective measures to rescue the hostages.[38] Appearing in a video, the insurgents (their faces covered) identified themselves as fighters from the Movement of the Islamic Resistance Nuamaan Brigade and declared, “We captured these Chinese as they were trying to leave Iraq. Interrogations showed they worked for one of the Chinese companies helping to build American facilities in Iraq. The position of the Chinese Government towards our cause was clear—not taking part in invasion forces and their aggression against our country. We call on the Chinese Government to clarify its position on them and other Chinese. We will kill them 48 hours after their pictures are televised unless that is done.”[39] The incident became a major concern for the Chinese authorities that recognized the vulnerability of Chinese nationals working in the country.

In 2014, during an interview with a Chinese media outlet, Zhang Dongfang, vice president of International Bodyguard Association China, stated that Chinese nationals in Iraq—at that time between 10,000 and 15,000 Chinese nationals primarily working for PetroChina and Sinopec were living in the country[40]—are safeguarded by a three-layered protective mechanism. According to him, “The most wide ranging protection is offered by Iraqi security forces; the second is police directly controlled by the Northern Oil Company, who guard the camp and work places of Chinese workers while Chinese security forces provide the innermost cover.”[41] Zhang also touched on the biggest challenge faced by Chinese security providers: “Chinese security forces are only equipped with weapons for self-defence” and their ability to react to security-related crises was relatively limited.[42]

The year 2014, however, was remarkable due to an event in the city of Samarra, when in the late June, Chinese nationals were extracted from the area with the help of one Chinese PSC, the VSS Security Group (伟之杰安保公司). All in all, the PSC managed to evacuate over 1,000 Chinese workers fleeing the Iraqi government’s standoff with ISIS.[43] The official Chinese side refrained from providing any details on the operation, including the extent of VSS Security’s involvement and specific tasks performed. However, in an expert comment, Yin Gang, a researcher on Middle East affairs at the Chinese Academy of Social Sciences, noted: “An evacuation on such a massive scale cannot succeed without multilateral coordination. … Securing confidentiality is also a routine part of evacuation strategies.”[44]

The episode in Samarra highlighted the presence of Chinese PSCs on Iraqi soil. While not much information is available on VSS and its activities in the public arena, an analysis of various sources provides some insights into the structure of the company and the nature of its activities. The PSC positioned itself as a “new type of security organization that is different from traditional [Chinese] security service companies.” According to the group`s website, its uniqueness is premised on a combination of the following qualities[45]:

- High-end services, including VIP protection;

- Risk management;

- Security consulting;

- Counterterrorism training;

- Project management in Chinese-funded enterprises;

- Security solutions for high-risk environments.

The company’s description also mentions one interesting detail, though it was not verified by other sources: namely, that it “[is] training hundreds of thousands of overseas employees of Chinese-funded enterprises.” The website also claims the company has two main branches: First, Domestic Total Security Service reportedly includes task-related sub-branches, including information technology and security consulting companies, as well as domestic regional branches in Hangzhou (杭州市), Yunnan (云南省) and Fanshan (房山區). Second, Overseas Total Security Service has branches in the Middle East, East Africa, Southern Asia, Hong Kong and South America. Apparently, the main focus of the overseas branches is counterterrorism training and consultations that include security risk evaluation and data analysis. There is no mention of any practical tasks performed by the company in these areas.

Based on open-source information pertaining to VSS, in the future, the Chinese side is likely to continue using these entities. Yet, given the rather limited array of tasks they can perform, their employment is likely to be concerned with providing only basic tasks such as the physical protection of Chinese nationals working in the area and supervision of functioning infrastructure. That said, however, most likely, these entities will work closely with local security providers.

Sudan and South Sudan[46]

According to a report published by Helena Legarda and Meia Nouwens in 2018, the deployment of Chinese PSCs in Sudan and South Sudan “provides another example of the achievements and limitations of Chinese PSCs’ work overseas.” The first appearance of Chinese security providers in the area dates back to 1990s, being attributed to China’s increasing interest in local oil resources. Yet, a majority of the path toward deepened cooperation was paved through steady arms deals.[47]

While strategically interested in local oil resources—Sudan has approximately 3.5 billion barrels of crude oil in proven reserves with only an estimated 30 percent of its possible deposits geologically explored[48]—the Chinese side became increasingly concerned over the tense security situation in the region. During one episode in 2008, nine Chinese workers employed by China National Petroleum Corporation (CNPC) were kidnapped in South Kordofan and four were eventually killed.[49] During another episode in 2012, 70 foreign nationals, including 29 Chinese workers, were kidnapped by rebels from the Sudan People’s Liberation Movement–North.[50] As a result of instability and multiple security risks faced by personnel primarily working for oil companies, the number of Chinese nationals based in Sudan and South Sudan decreased dramatically between 2012 and 2021.[51]

The downward trend continued into 2023 with the outbreak of a new crisis in Sudan, when an internal armed conflict broke out on April 15, spreading to Khartoum and the Darfur region.[52] The aggravated security climate led the Chinese authorities to send warships to evacuate 1,300 Chinese nationals trapped in the war-torn country.[53] This marked the third time that the People’s Liberation Army Navy had sent vessels to carry out an evacuation abroad (Libya, 2011; Yemen, 2015).[54]

Available data on Chinese PSCs—their tasks and functions as well as involvement in rescue missions—operating in Sudan and South Sudan is inconsistent and frequently lacks clear and specific details. A report from the Mercator Institute for China Studies (MERICS) has claimed that China’s largest oil-extracting corporations working in the area (such as CNPC) “have long used PSCs for … protection,” Yet, the report argued that, based on open-source data, no evidence suggested that, in 2018 (when the first notable kidnapping of the Chinese nationals occurred), there was any Chinese private security presence in Sudan. However, by 2012, the presence of several Chinese PSCs was detected.[55] Later, Chinese PSCs were confirmed to be in South Sudan after events in the capital during the so-called Battle of Juba (a series of clashes between rival factions) in July 2016.

An investigation conducted by the Financial Times[56] unravelled two interesting details regarding Chinese PSCs in the region. First, these entities, while being primarily focused on security consulting, may occasionally be involved in combat scenarios for which they are, however, unprepared. Second, the Juba events uncovered the name of a specific Chinese PSC involved in the evacuation of Chinese nationals from the site of hostilities, Beijing DeWe Security Service (北京德威保安服务有限公司; DeWe). The investigation showed that members of DeWe were largely unprepared (and unarmed) to appropriately react to the unravelling situation. Therefore, the Chinese personnel were evacuated to Nairobi, Kenya, only after the official involvement of Beijing.

DeWe is not the only security provider spotted working in Sudan and South Sudan. The aforementioned VSS Security Group reportedly helped the Sudanese military rescue 29 kidnapped Chinese oil workers in South Kordofan province.[57] Based on available information, the main client of VSS in South Sudan is PetroChina.[58]

The MERICS report also argued that “as Beijing encourages Chinese SOEs to hire Chinese PSCs … we can expect that Chinese PSCs will use the momentum of the growing Chinese involvement in the region to gradually increase their market share. This is, of course, not a guaranteed outcome, as political conditions in the countries may change or non-Chinese oil companies may decide to invest in the region again, among several other factors. If current trends continue, however, we can expect to see a growing Chinese PSC presence in both Sudan and South Sudan.” That said, however, the post-2018 interim, including the 2023 evacuation of Chinese nationals, has not witnessed an increase in the activities of Chinese PSCs in the region, which primarily stems from their structural weaknesses and the lack of political will from the Chinese authorities to introduce drastic changes to their organization, structure and level of preparedness.

Conclusion

Open-source information pertaining to the activities of Chinese PSCs in the MENA region is scarce and rather inconclusive primarily due to an exceedingly limited range of tasks that these entities can perform. Aside from several episodes that confirmed the presence and activities of Chinese PSCs in Iraq and (South) Sudan, no other notable occasions have been reported. Scarce as the information space is, these bits and pieces allow to make two important conclusions on the matter.

First, the specific cases described in this paper confirm the presence of Chinese PSCs in the MENA region. For now, this presence appears to be quite limited and does not play a central role in China projecting its influence throughout the region. Clearly, economic and business ties take precedence over defence/security and paramilitary engagement. Given the fact that the most influential regional players have strong militaries, it is rather doubtful that in the next eight to ten years Chinese PSCs will dramatically increase their involvement.

Second, the two case studies discussed here demonstrate that Chinese PSCs operating in MENA—akin to other regions discussed in the scope of this project[59]—are not yet ready to perform sophisticated tasks associated with ensuring the safety and security of Chinese nationals in distress. At the time of a severe crisis, the Chinese side—being aware of this aspect, yet unwilling to drastically reform the PSC industry—would rather opt for relying on official, state-sponsored groups to provide security to Chinese nationals rather than delegate this responsibility to PSCs, which, for now, may not be functionally ready to perform complex and dangerous missions.

Notes

[1]Andrew Scobell and Alireza Nader, “China in the Middle East: The Wary Dragon,” RAND Corporation, accessed July 10, 2023, https://www.rand.org/pubs/research_reports/RR1229.html#:~:text=China%20Has%20Four%20Key%

20Interests%20in%20the%20Middle,4%20China%20aims%20to%20enhance%20its%20great-power%20status.

[2]Istizada, “MENA Region Countries List 2020 Update,” accessed July 1, 2023, https://istizada.com/mena-region/ .

[3]OPEC, “The MENA Region in the International Arena,” accessed July 2, 2023, https://opec.org/opec_web/en/press_room/2211.htm.

[4]Sergey Sukhankin, “Sino-Qatari LNG Deal: A New Phase for Doha-Beijing Relations?,” Gulf International Forum, accessed June 30, 2023, https://gulfif.org/sino-qatari-lng-deal-a-new-phase-for-doha-beijing-relations/.

[5]Azza Guergues, “Ukraine War Drives More Traffic to Egypt’s Suez Canal, Increasing Revenues,” Al-Monitor, May 14, 2022, https://www.al-monitor.com/originals/2022/05/ukraine-war-drives-more-traffic-egypts-suez-canal-increasing-revenues#ixzz7nfedax5J.

[6]Luigi Narbone, ed., “Revisiting Natural Resources in the Middle East and North Africa,” European University Institute, https://cadmus.eui.eu/bitstream/handle/1814/69265/QM-04-20-713-EN-N.pdf?sequence=1.

[7]M. Jensterle et al., Grüner Wasserstoff: Internationale Kooperations-potenziale für Deutschland: Kurzanalyse zu ausgewählten Aspekten potenzieller Nicht-EU-Partnerländer (Berlin: Dena, 2020).

[8]International Energy Agency, “Renewables 2021. Analysis and Forecast to 2026,” December 2021, https://enterprise.press/wp-content/uploads/2021/12/Renewables2021-Analysisandforecastto2026.pdf.

[9]Erzsébet N. Rózsa, “China’s Interests in the Middle East and North Africa,” IEMed Mediterranean Yearbook 2021, (Barcelona: European Institute of the Mediterranean: 2021), https://www.iemed.org/publication/chinas-interests-in-the-middle-east-and-north-africa/.

[10]Nicholas Lyall, “China in the Middle East: Past, Present, and Future,” The Diplomat, February 16, 2019, https://thediplomat.com/2019/02/china-in-the-middle-east-past-present-and-future/.

[11]Jonathan Fulton, “China’s Changing Role In The Middle East,” Atlantic Council, June 2019, https://www.atlanticcouncil.org/wp-content/uploads/2019/06/Chinas_Changing_Role_in_the_Middle_East.pdf.

[12]Wang Jin, “Can China’s ‘New Idea’ Work in the Middle East?” The Diplomat, December 5, 2019, https://thediplomat.com/2019/12/can-chinas-new-idea-work-in-the-middle-east/.

[13]Felicity Bradstock, “Is China Overly Reliant On Middle Eastern Oil?” Oil Price, January 4, 2023, https://oilprice.com/Energy/Energy-General/Is-China-Overly-Reliant-On-Middle-Eastern-Oil.html.

[14]Gulf News, “China Seals One of the Biggest LNG Deals Ever With Qatar,” November 21, 2022.

[15]Roie Yellinek, “The Strengthening Ties Between China and the Middle East,” Middle East Institute, January 26, 2022, https://www.mei.edu/publications/strengthening-ties-between-china-and-middle-east.

[16]Dale Aluf, “China’s Tech Outreach in the Middle East and North Africa,” The Diplomat,

November 17, 2022, https://thediplomat.com/2022/11/chinas-tech-outreach-in-the-middle-east-and-north-africa/.

[17]Sam Blatteis, “The Middle East’s Role in China’s Digital Silk Road,” The MENA Catalysts, accessed June 30, 2023, https://themenacatalysts.com/the-middle-easts-role-in-chinas-digital-silk-road/.

[18]Huawei, “Marrakesh Safe City,” accessed July 15, 2023, http://web.archive.org/web/20191017073201/https:/e.huawei.com/en/videos/industries/2018/201812060902.

[19]Deng Xiaoci, “China, Arab States Ink New Action Plan Over BDS Cooperation,” Global Times, December 09, 2021, https://www.globaltimes.cn/page/202112/1241054.shtml.

[20]Arab News, “Robots Will Soon Be Working in Factories,” October 23, 2022, https://www.arabnews.com/node/

2186131/amp.

[21]Zawya, “Saudi’s SCAI Invests $206.54mln With SenseTime to Deliver AI-Powered Solutions,” September 13, 2022, https://www.zawya.com/en/business/technology-and-telecom/saudis-scai-invests-20654mln-with-sensetime-to-deliver-ai-powered-solutions-pps3pcsm.

[22]Desert Life Science Laboratory, “ICBA, BGI Partner to Set Up Advanced Genomics Center in UAE,” accessed July 2, 2023, https://dlsl.biosaline.org/news/icba-bgi-partner-set-advanced-genomics-center-uae.

[23]Doron Ella, “Chinese Investments in Israel: Developments and a Look to the Future,” Institute for National Security Studies, February 1, 2021, https://www.inss.org.il/publication/chinese-investments/#:~:text=China’s%20economic%20involvement%20in%20Israel,which%20they%20began%20to%20wane.

[24]Investment Office of the Presidency of the Republic of Türkiye, “Huawei,”accessed July 10, 2023, https://www.invest.gov.tr/en/whyturkey/successstories/pages/huawei.aspx#:~:text=Huawei

%20T%C3%BCrkiye%20R%26D%20Center,Huawei’s%20largest%20R%26D%20center%20abroad.

[25]Deborah Lehr, “How China Is Winning Over the Middle East,” The Diplomat, July 21, 2018, https://thediplomat.com/2018/07/how-china-is-winning-over-the-middle-east/.

[26]Hiddai Segev and Ofek Riemer, “Not a Flood, but a Rising Current: Chinese Weapons Sales to the Middle East,” Institute for National Security Studies, August 2019, https://www.inss.org.il/wp-content/uploads/2019/08/Hiddai.pdf#:~:text=Chinese%20military%20exports%20to%20the%20Middle%20East%20began,weapons%20to%20both%20sides%

20in%20the%20Iran-Iraq%20War.

[27]Some experts believe that it would take a considerable time for the Chinese to displace Russia as the region’s main arms provider. For more information see: Paul Iddon, “China Emerges as an Arms Supplier of Choice for Many Middle East Countries, Say Analysts,” Middle East Eye, July 22, 2022, https://www.middleeasteye.net/news/china-emerges-major-exporter-weapons-middle-east-north-africa.

[28]Russia’s 2022 invasion of Ukraine has forced Egypt to drop its planned purchase of 24 Su-35 fighter jets. The poor performance of Russian weapons in the ongoing war may have tainted their appeal to established buyers like Egypt, causing Cairo to look for alternatives from China.

[29]Many types of weapons, including unconventional, such as those designed for chemical warfare, used by Iran are Chinese replicas or developed within the scope of clandestine agreements between Beijing and Teheran. For more information see: Leonard S. Spector, “Chinese Assistance to Iran’s Weapons of Mass Destruction and Missile Programs” (congressional testimony, House International Relations Committee, Carnegie, September 12, 1996, https://bit.ly/2Jio9QM.

[30]Jane Cai, “China Said to Be Negotiating Arms Deals With Saudi Arabia and Egypt,” South China Morning Post, 24 May, 2023, https://www.scmp.com/news/china/military/article/3221715/china-said-be-negotiating-arms-deals-saudi-arabia-and-egypt?utm_content=article&utm_medium=Social&utm_source=Facebook&fbclid=IwAR3Z5GIiR-pngSPOYcFDFLJ_u6CbEn5wXuxLSw3tnZY_8fipAZlL74NkNN8.

[31]Michael Rubin, “China’s Next Military Move: A Base in the Persian Gulf?” American Enterprise Institute, July 6, 2020, https://www.aei.org/op-eds/chinas-next-military-move-a-base-in-the-persian-gulf/.

[32]The Fragile States Index uses the following criteria/indicators to assess states’ vulnerability to conflict/collapse. These indicators include: Security Apparatus; Factionalized Elites; Group Grievance; Economic Decline and Poverty; Uneven Economic Development; Human Flight and Brain Drain; State Legitimacy; Public Services; Human Rights and Rule of Law; Demographic Pressures; Refugees and Internally Displaced Persons; and External Intervention. Taken together, these indicators form a framework consisting of the following four macro-factors: Cohesion, Economic, Political and Social. Chuchu Zhang and Chaowei Xiao, “China’s Belt and Road Initiative Faces New Security Challenges in 2018,” The Diplomat, December 21, 2017, https://thediplomat.com/2017/12/chinas-belt-and-road-initiative-faces-new-security-challenges-in-2018/.

[33]Over the past ten years, deaths from terrorism in MENA decreased from 57 percent of all deaths globally in 2016 to 12 percent in 2022.

[34]Institute for Economics & Peace. “Global Terrorism Index 2023: Measuring the Impact of Terrorism,” March 2023, available at: http://visionofhumanity.org/resources.

[35]Nicholas Lyall, “China’s Rise in the Middle East: Beyond Economics,” The Diplomat, February 25, 2019.

[36]Alessandro Arduino, “Chinese Private Security Companies in the Middle East,” in Routledge Handbook On China–Middle East Relations (New York, Routledge: 2021).

[37]Camille Lons, Jonathan Fulton, Degang Sun and Naser Al-Tamimi, “China’s Great Game in the Middle East,” European Council on Foreign Relations, October 21, 2019, https://ecfr.eu/publication/china_great_game_middle_east/.

[38]Another seven workers were taken hostage in April 2004 but were all later released without harm.

[39]China Daily, “Eight Chinese Nationals Kidnapped in Iraq,” January 19, 2005, https://www.chinadaily.com.cn/english/doc/2005-01/19/content_410289.htm.

[40]Radio Free Europe/Radio Liberty, “1,200 Chinese Evacuated From Iraq,” June 28, 2014, https://www.rferl.org/a/china-iraq-/25438241.html.

[41]China Daily, “Concern Surrounds Chinese Security Forces in Iraq,” June 24, 2014, https://global.chinadaily.com.cn/usa/world/2014-06/24/content_17612026.htm.

[42]China Daily, “Concern Surrounds Chinese Security Forces in Iraq.”

[43]Reuters, “Stranded Chinese Workers in Iraq Being Evacuated,” June 27, 2014, https://jp.reuters.com/article/us-iraq-security-china-idUSKBN0F20P720140627.

[44]Xu Jingxi and Zhang Yunbi, “Evacuated Chinese Fly Home From Iraq,” China Daily, June 30, 2014, http://www.chinadaily.com.cn/china/2014-06/30/content_17623629.htm.

[45]VSS Security Group, “Our Services,” accessed July 7, 2023, http://www.vss911.cn/EN/Services.aspx.

[46]First comprehensive analysis on Chinese PSCs operating in these areas was offered in the following paper: Helena Legarda and Meia Nouwens, “Guardians of the Belt and Road: The Internationalization of China’s Private Security Companies,” Mercator Institute for China Studies, August 16, 2018, https://merics.org/sites/default/files/2020-04/180815_ChinaMonitor_Guardians_final.pdf.

[47]Human Rights Watch, “China’s Involvement in Sudan: Arms and Oil,” accessed July 2, 2023, https://www.hrw.org/reports/2003/sudan1103/26.htm.

[48]Julius Barigaba, “Are Big Boys About to Enter South Sudan Oil Territory? Russian Firms Lead Way,” The East African, November 25, 2018, https://www.theeastafrican.co.ke/business/Are-big-boys-about-to-enter-South-Sudan-oil-territory/2560-4868458-23wtw4/index.html.

[49]China Daily, “5 Chinese Oil Workers Kidnapped, Killed in Sudan,” October 28, 2008, https://www.chinadaily.com.cn/china/2008-10/28/content_7146896.htm.

[50]Al Jazeera, “Kidnapped Chinese Workers Freed in Sudan,” February 7, 2012, https://www.aljazeera.com/news/2012/2/7/kidnapped-chinese-workers-freed-in-sudan.

[51]China Africa Research Initiative, “Chinese Workers in Africa,” accessed June 30, 2023, http://www.sais-cari.org/data-chinese-workers-in-africa.

[52]Al Arabiya, “South Kordofan Residents Flee as Sudan War Escalates,” June 23, 2023, https://english.alarabiya.net/News/middle-east/2023/06/23/South-Kordofan-residents-flee-as-Sudan-war-escalates.

[53]Nadya Yeh, “China Evacuates Its Citizens Out of Sudan,” The China Project, April 27, 2023, https://thechinaproject.com/2023/04/27/china-evacuates-its-citizens-out-of-sudan/

[54]Barron’s, “China Evacuates 1,300 Citizens, Other Nationals From Sudan,” April 26, 2023, https://www.barrons.com/news/china-sends-navy-to-evacuate-citizens-in-sudan-defence-ministry-35f01e93.

[55]Brian Spegele, Peter Wonacott and Nicholas Bariyo, “China’s Workers Are Targeted as Its Overseas Reach Grows,” The Wall Street Journal, February 1, 2012, https://www.wsj.com/articles/SB10001424052970204652904577194171294491572.

[56]Charles Clover, “Chinese Private Security Companies Go Global,” Financial Times, February 26, 2017, https://www.ft.com/content/2a1ce1c8-fa7c-11e6-9516-2d969e0d3b65.

[57]Paul Nantulya, “Chinese Security Firms Spread Along the African Belt and Road,” Africa Center for Strategic Studies, June 15, 2021, https://africacenter.org/spotlight/chinese-security-firms-spread-african-belt-road/.

[58] VSS Security Group, “南苏丹内战,” http://www.vss911.cn/Solution.aspx?Id=346.

[59]For instance, see: Sergey Sukhankin, “Chinese PSCs in Sub-Saharan Africa: The Case of Anglophone Africa,” Guardians of the Belt and Road, The Jamestown Foundation, May 19, 2023, https://jamestown.org/program/chinese-pscs-in-sub-saharan-africa-the-case-of-anglophone-africa/.