Russia, Kazakhstan and Belarus Endorse Further Integration, but Obstacles Remain

Publication: Eurasia Daily Monitor Volume: 10 Issue: 106

By:

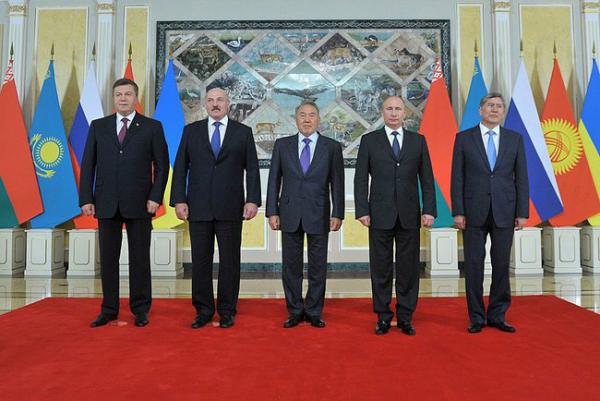

On May 29, the presidents of Russia, Belarus, Kazakhstan, Kyrgyzstan and Ukraine met in Astana to participate in a scheduled meeting of the Supreme Economic Council of the Eurasian Economic Community (EurAsEC), established in 2001. Since Moscow, Minsk and Astana have lately been engaged in enhanced economic cooperation within the Customs Union and the Common Economic Area, their leaders’ discussions were primarily centered upon the future development of regional integration in the post-Soviet space. Following the official session of talks under Kazakhstani President Nursultan Nazarbayev’s chairmanship, Russia’s Deputy Prime Minister Igor Shuvalov, in charge of integration issues on behalf of his government, confirmed the forthcoming creation of the Eurasian Union. In Shuvalov’s words, this Union would automatically inherit all the existing institutions of the EurAsEC, including the parliamentary assembly and the specialized court (Newskaz.ru, May 29).

As Nursultan Nazarbayev later told the journalists, the final set of documents to be signed by Russia, Kazakhstan and Belarus before the three states could enter a new stage of their trade and economic partnership would be prepared by May 1, 2014. While the treaty establishing the Eurasian Union will still need to be ratified by the national parliaments, the entry into force of this new integration structure is expected no later than January 1, 2015. Furthermore, the acting chairman of the EurAsEC’s Eurasian Commission, Viktor Khristenko, recently called on the Russian, Kazakhstani and Belarusian business communities to take part in the elaboration of the so-called “white book of exceptions” to the common trade rules. This collection of restrictive legal norms identified in each of the three countries is due to be made public by September 1, 2013 (Newskaz.ru, May 31).

Currently, the Customs Union recognizes 333 national exceptions concentrated in such sectors as pharmaceuticals, alcohol and tobacco production. While the total value of yearly sales in its pharmaceutical and alcohol markets is $30 billion and $50 billion, respectively, the car industry also figures among the most regulated commercial fields. According to Khristenko, both producers and consumers would only benefit from increased competition in a sector responsible for over $85 billion worth of annual sales. Finally, the Eurasian Commission also deems necessary to tackle the excessive regulation of the services sector, which is now protected from fair competition by 139 restrictive clauses (Belta.by, May 31).

Khristenko’s announcement came weeks after the publication of negative trade statistics relative to the sales of Belarusian trucks in Russia. The share of heavy vehicles manufactured by the Minsk car plant in Russia’s domestic market decreased from 14.3 percent in early 2012 to 7.4 percent at the end of March 2013. Even though Russia’s Kamaz succeeded in slightly improving its market position despite the plummeting demand, market analysts have also noted the growing popularity of imported trucks. At a time when the Russian market is still protected from Belarusian goods, Russia’s recent membership in the World Trade Organization has already made it easier for foreign carmakers to sell their products in Russia (Gazeta.ru, May 16).

Nazarbayev’s bilateral meeting with Vladimir Putin also provided an opportunity to announce progress in the strengthening of the Kazakhstani-Russian strategic cooperation. Both sides are currently working on the text of a comprehensive good-neighborly and alliance treaty for the 21st century that would replace a 1998 declaration bearing a similar title, albeit deprived of binding provisions. According to Nazarbayev, Astana and Moscow are planning to sign this new agreement by the end of 2013. Moreover, the Kazakhstani parliament ratified on May 30 a protocol amending the 1992 agreement on friendship, cooperation and mutual aid between Russia and Kazakhstan. The protocol not only enhances coordination on such issues as combating terrorism, extremism, arms smuggling and drug trafficking, but also reinforces cross-border information sharing and measures against illegal migration (Regnum.ru, May 30; Cntv.ru, May 30).

While Russia, Kazakhstan and Belarus are all poised to further integrate their economies, Ukraine is still in the process of weighing its potential gains and losses. Ukrainian President Viktor Yanukovych said on May 29 that his country’s Prime Minister Mykola Azarov would be signing a memorandum on enhanced cooperation with the Eurasian Commission during a meeting of Commonwealth of Independent States (CIS) heads of government two days later. As Russian Deputy Minister Shuvalov noted, the current legislation does not provide for the possibility of granting observer status in the Customs Union to any third party, which means that Ukraine could potentially become an observer only in January 2015 when the Eurasian Union would be fully established. However, Ukrainian representatives would be allowed to participate in some meetings of the Customs Union upon invitation from the chairing side. Although Ukraine thereby aims to strengthen its economic ties with its post-Soviet neighbors, it still aspires to sign an association agreement with the European Union (scheduled for November 2013). In this context, Russia’s advisor, Sergei Glaziev, was prompt to clarify the situation by saying that Ukraine had to choose between its European aspirations and Eurasian integration. The Russian view is that by committing itself to the Customs Union, Ukraine has actually made up its mind in Moscow’s favor (Gazeta.ru, May 30).

As for Kyrgyzstan, its Deputy Prime Minister Joomart Otorbayev unambiguously confirmed his country’s willingness to join the Customs Union by signing a similar memorandum providing Bishkek with unofficial observer prerogatives. Yet, Kyrgyzstan was recently hit by a new wave of instability targeting its strategic mining sector. On May 28, around 200 protesters interrupted gold production at the Kumtor Gold Mine, blocking access to the site for hours. While their number grew first to 700 and then to over 1,000 (reaching 1,500, according to some accounts), a group of local dwellers cut off the electric power supply to Kumtor, leading the head of Kyrgyzstan’s mining trade union to predict a 30-percent drop in production. Kyrgyz Republic President Almazbek Atambayev’s decision to declare a state of emergency in Issyk-Kul province’s Jety-Oguz district has only reinforced the already strong fears of further economic decline in a country badly affected by the recent crisis. Thus, Ukraine’s ambivalence, Kyrgyzstan’s political troubles as well as diminished growth forecasts in Russia, Kazakhstan and Belarus could all contribute to the Eurasian Union progressively losing its attractiveness in the context of growing nationalist and protectionist moods (RIA Novosti, May 31; Vesti.kg, May 30).