Russia’s Western High Command and the Role of Belarus in Russian Strategic Planning

By:

Executive Summary

Russia’s last friend on its border with Europe, Belarus acquired new significance for Russian strategy after the emergence of an anti-Russian regime in Kyiv in 2014. However, Moscow takes little interest in Minsk’s policies even as Russia’s Western High Command relies upon Belarusian cooperation in its contingency planning for conflict in continental Europe. Analysis of Russian military exercises and diplomatic patterns since 2017 shows how the Western High Command is thinking about future war with NATO in each of its three strategic directions.

In the northwestern direction—encompassing the Baltic States and coastal Poland—a compliant Belarus plays into the Russian high command’s planning as a staging area from which to take control of east-west rail links to isolated Kaliningrad Oblast. In the western strategic direction, mainly targeting Poland, Russian radars on Belarusian soil and Belarusian air-defense assets as well as Belarusian forces may be expected to defend supply lines through Belarus during a broader Russia-NATO confrontation. Losing Belarus would significantly impact Russian power projection, removing Warsaw from the reach of Russian ground forces without committing virtually its entire armed forces to the task. Belarus appears to play the most indirect role in the southwestern direction, covering Ukraine: mainly serving for Moscow’s war planners as a Russian salient, complicating European military support for Ukraine in wartime conditions given the presence of CSTO air-defense assets in Belarus. At the same time, if Russian land forces are able to use Belarus as a staging ground for escalated conflict with Ukraine or simply threaten to do so, this would force Kyiv to withdraw its military front line significantly further westward, leaving the capital region significantly more vulnerable.

A Belarusian exit from Moscow’s security planning—whether through neutrality or a changed geopolitical orientation—would seriously complicate Russian military thinking in Europe, significantly elevate Poland’s security and strategic influence, and potentially banish Moscow’s military threat from the North European plain for the first time in 500 years. However, such a transformation would put Belarus in an extremely precarious political situation that would be difficult to sustain. These considerations underline the significance of the current instability in Belarus following President Alyaksandr Lukashenka’s contested reelection on August 9, 2020. For as long as the current present Belarusian government remains politically vulnerable, it raises the risks of Minsk losing its sovereign freedom of maneuver and adherence to de facto neutrality in the face of Russian pressure to join Moscow in the latter’s strategic standoff with the West.

Introduction

Tasked with defending Russia from the North Atlantic Treaty Organization (NATO), the Western High Command of the Russian Federation holds a prominent place in the country’s security architecture. The command was created as part of former Defense Minister Anatoly Serdyukov’s broader reform of the Russian Armed Forces’ command-and-control structure. Most of its forces are supplied by the Western Military District, which was created at the same time by combining the preceding Moscow and Leningrad military districts.

Since 2014, ongoing overt strategic rivalry between Russia and the West has increased visibility for this command. Until that time, the Western High Command had focused on using next-generation technologies to reduce demand for massing force. Since the outbreak of war in Donbas, however, Russia has greatly increased its force in the West, standing up a tank army around Moscow and two divisions on the Ukrainian border. Though technological modernization remained a priority, it no longer offset an absence of force but complemented it.

This paper assesses how Russian diplomatic and military bureaucratic behavior reflects the Western High Command’s current contingency planning for war in Europe. And in assessing the state of Russian military modernization on its European border, it the following study will specifically evaluate the importance of Belarus to current Russian strategic thinking.

How Russia Perceives Its Western Neighbors

Since the end of the Cold War, Russia has had a fraught relationship with Europe. Western investment entered the undercapitalized Russian economy in the early years of President Vladimir Putin’s regime. In return, Russian natural gas not only heated Europe but also repaid the Soviet Union’s legacy debt.[1] However, the enlargement of the NATO strategic alliance into former Warsaw Pact territory and the former Soviet republics of Estonia, Latvia and Lithuania helped sustain a residual Russian security skepticism of the West. In 2019, the Russian Ministry of Foreign Affairs’ commemoration of the 30th anniversary of the fall of the Berlin Wall claimed that the hope for a “peaceful, prosperous Europe without dividing lines” was “not realized.”[2]

When these tensions exploded into military conflict in the 2014 Ukraine crisis, Europe established a serious sanctions regime targeting Russia[3] and revitalized NATO’s historic mission of defending Europe.[4] But at the same time, long-obscured fault lines in Europe crystallized in Russian government messaging: Moscow demonized any European NATO member state supporting the initiatives of collective defense and deterrence, calling them “Russophobic” policies that prioritized war over their citizens’ prosperity while justifying raised defense spending to appease the United States.[5] Anti-Western political figures, already in vogue after the 2011–2012 anti-Putin demonstrations in Russia, became the exclusive voice of Russian opinion in the state-controlled media.[6]

Russian diplomatic officials had hoped that the election of Donald Trump as President of the United States would reduce Washington’s interest in backing a pro-Western regime in Ukraine.[7] However, bipartisan support for assisting Ukraine continued. Meanwhile, Poland, Estonia, Latvia and Lithuania successfully lobbied for a ramped-up and enduring NATO conventional force presence in their region to deter potential Russian aggression.[8]

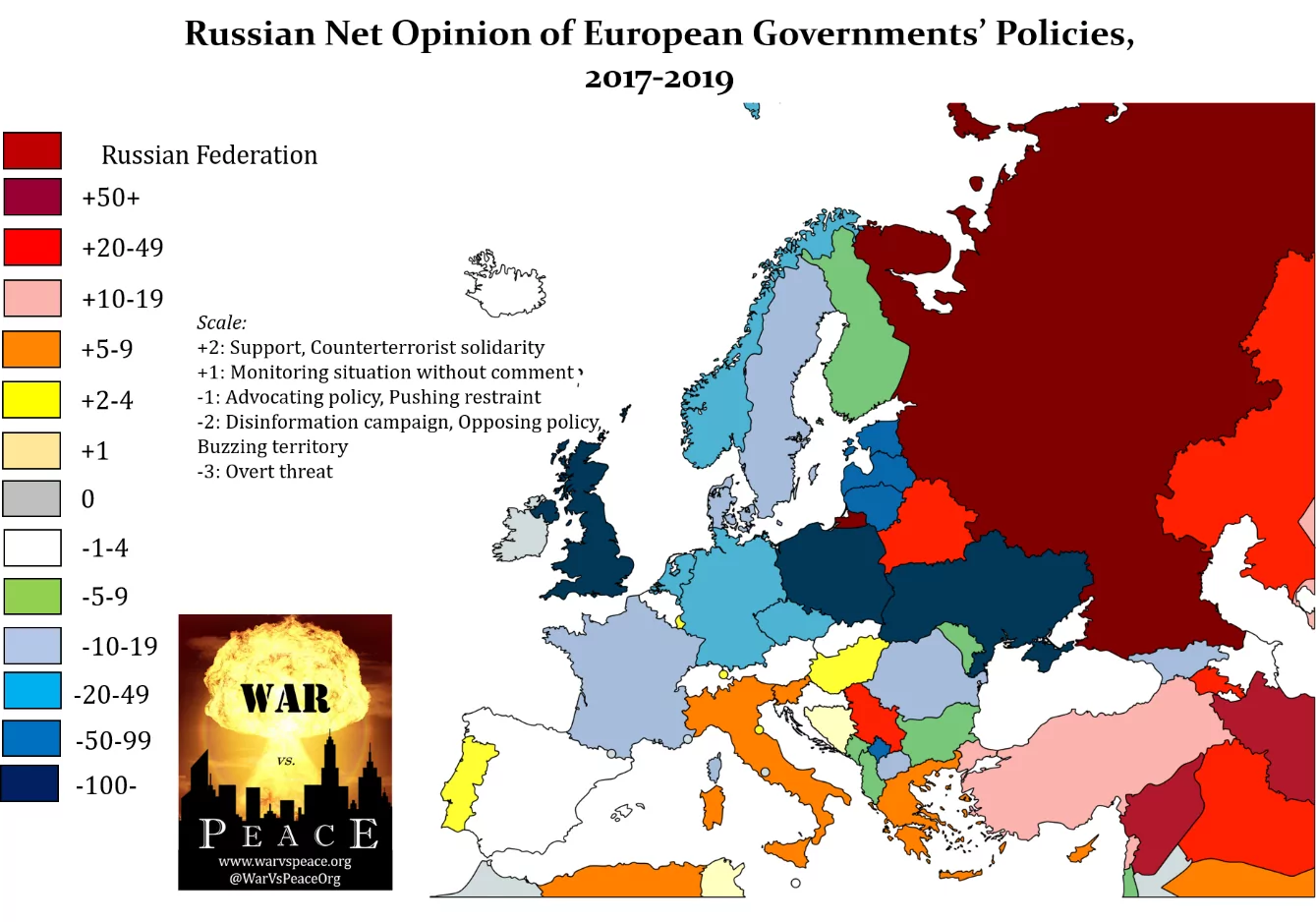

This divide has created a stark fissure in Europe. Map 1 depicts Russian perceptions of Europe by the frequency of diplomatic statements in favor of or against individual European states’ policies since the start of the Trump administration, with higher numbers/more red color denoting what Moscow perceives as friendlier states. As the conflict in Ukraine is already militarized, Russia has been forced to keep its military contingency plans for Europe updated to answer recent developments in NATO, even if the probability of a conventional war between Russia and the West remains quite low.

Compiled from official Russian government website press releases.

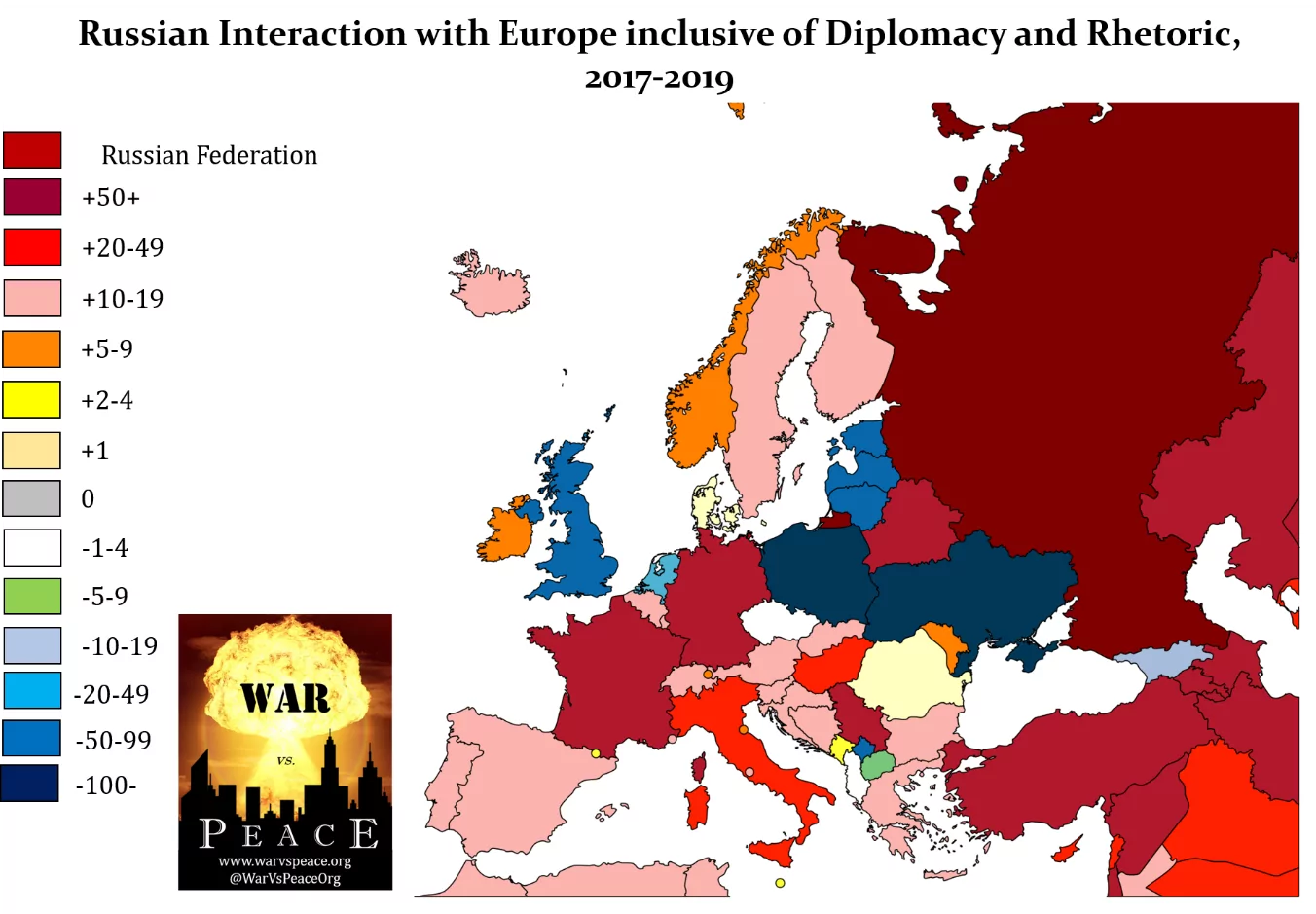

Before assuming that Map 1 represents the future battle lines of Europe, however, it must be noted that, despite the vitriolic rhetoric emanating from Moscow, Russian diplomatic engagement with Europe goes on. Much of this pertains to Russian actions in the Middle East, especially in Syria, but it also reflects the enduring bilateral relationships of much of Europe with Russia, regardless of the ongoing disputes over Ukraine. If one combines the frequency of these meetings, the rhetoric of Moscow, and the frequency of signing bilateral agreements (e.g. protocols for state meetings, visa-free travel, etc.) and exacting punishments (e.g. new sanctions, summoning the ambassador, etc.), Europe appears more as Map 2.

The latter map suggests that, in the event of a military confrontation with the West, Russia may yet be able to divide and conquer the NATO alliance, especially if the US remains lukewarm toward maintaining Transatlantic solidarity and cohesion. The map also clearly indicates that potential conflict is most highly anticipated in the Intermarium countries directly on Russia’s borders. Perhaps ironically, this divide follows roughly the cordon sanitaire of the interwar (1918–1939) years. Both maps indicate Poland and Ukraine as the center of Russia’s ire in the West, complemented by the United Kingdom, the Netherlands, Estonia, Latvia, Lithuania, Georgia and Kosovo. Less problematic states include Albania, Czechia (the Czech Republic), Denmark, North Macedonia and Romania. This suggests that Russian defensive and counteroffensive planning for the Europe-facing strategic direction revolves around defeating the militaries of Ukraine and the countries on NATO’s northeastern (Baltic) flank.

Another indication of Moscow’s strategic focus on these countries is the frequency of articles written on their present-day military-political situations in the Russian press. Out of just under 500 articles surveyed in 2019,[9] 141 examined the changing dynamic in Europe. Of those 141, 94 (two-thirds) considered Poland, Ukraine, Belarus or the Baltic States specifically.

Russian military planning in Europe therefore appears to concern itself primarily with these six countries in addition to NATO allies most likely to intervene on their behalf, especially the United States, United Kingdom and Canada.[10] Georgia boasts increased cooperation with NATO but lies outside the European strategic direction, while Kosovo represents a different potential challenge than those countries on Russia’s doorstep.

Notable from both above-presented maps is the unique role in Europe played by Belarus. Each one indicates that Moscow regards Belarus as a critical continental partner. However, unlike other major perceived partners France and Germany, Belarus is not considered an “important country” in Moscow. This is quantitatively demonstrated in Map 3, which tallies the number of separate deputy foreign ministerial interactions Moscow has conducted with each European capital throughout 2019. This metric is inherently illustrative because Moscow generally assigns only one deputy foreign minister to each region in addition to several responsible for specific diplomatic projects such as arms control. Thus, Moscow indirectly demonstrates the importance it attributes to foreign governments by whether it is worth dispatching deputy foreign ministers irrelevant to bilateral relations to better understand that government’s broader foreign policy.[11] Map 3 indicates that whereas Russian partnerships with France, Germany and Turkey are based at least in part on Paris’, Berlin’s and Ankara’s perceived importance, neither Minsk nor Belgrade receive this respect despite the sentiments displayed in Map 2.

Belarus’s geographic position between Russia and its perceived opponents in Central and Eastern Europe makes it a critical component of regional Russian military contingency planning, as will be shown below. However, Map 3 suggests that Minsk’s own policies are frequently ignored in Moscow and have little bearing on Russia’s foreign or defense policy calculations. This reveals a potential weakness in Russian military and strategic planning if Minsk objects to Russian use of force against Europe from Belarusian territory.[12]

Western High Command Training Patterns

The author does not consider overt Russian aggression against NATO members in Central and Eastern Europe probable. Indeed, such a scenario seems almost implausible given the North Atlantic Alliance’s vastly superior overall military capabilities, despite the demographic-driven weakness of Estonia, Latvia and Lithuania and an unfavorable (toward NATO) balance of forces within the Baltic region itself. This paper, therefore, assumes that Russian military contingencies in Europe involve Moscow perceiving its neighbors to be actively destabilizing either the Kaliningrad Oblast exclave, other Russian territories or Russian political society at large. A hypothetical example may be Poland, Lithuania and Latvia blocking the resupply of materials to Kaliningrad Oblast during anti-Kremlin civic disorder in the region. Yet, even in that circumstance, Russia would probably attempt to resolve the crisis by maritime and air lines of communication before resorting to armed force; the most likely instigation for war would be a NATO member’s use of force to support anti-Kremlin protesters, another improbable prospect, albeit one feared in Moscow and Minsk. The Zapad 2017 strategic-operational exercise scenario involved expunging Western special forces support for anti-government forces.[13] Belarusian President Alyaksandr Lukashenka’s military response to protesters after the disputed 2020 presidential election seems to follow this pattern,[14] suggesting the president’s suspicion of the West’s presence among his opponents.

It is also important to note that the Russian Western High Command (ZGK) does not consider the five aforementioned “problematic” border states—Ukraine, Poland, Estonia, Latvia and Lithuania—to form part of a single strategic direction. Rather, the ZGK plans along three strategic directions roughly analogous to the late Soviet teatr voennykh destvii (TVD) borders: northwestern, western and southwestern. The northwestern strategic direction encompasses the Baltic region, including Polish coastal areas. The western strategic direction primarily pertains to Poland and Belarus. The southwestern strategic direction includes Ukraine and the Balkans. As in the Soviet era, these regions include some territorial overlap. Belarus, Russia’s only ally in the region, also divides its forces between two strategic directions—northwest and west—seemingly contiguous with Russia’s definitions.

Though Russia could attempt operations along multiple of these strategic directions simultaneously, this would be a risky gamble. The ZGK’s strategic and strategic-operational exercises of recent years have each focused on an individual strategic direction at a time, as listed in Table 1.

| Table 1. Russian Strategic and Strategic-Operational Exercises in the West |

| Exercise | Strategic Direction |

| Zapad 2009 (West 2009) | Western |

| Zapad 2013 (West 2013) | Western |

| Shchit Soyuza 2015 (Union Shield 2015) | Northwestern |

| Zapad 2017 (West 2017) | Northwestern |

| Shchit Soyuza 2019 (Union Shield 2019) | Northwestern |

Belarus participated in each of those exercises, perhaps explaining why there has not yet been any focus on the southwestern strategic direction. At the very least, it suggests Belarus has made no overt contingency plans for attacking Ukraine with its own forces. To date, the war in eastern Ukraine’s Donbas appears to be managed from Rostov Oblast, under the auspices of Russia’s Southern High Command.

Understanding Russian military planning in Europe requires a greater depth of examination of the units available to the ZGK as well as how they train. The strategic and strategic-operational exercises listed above are merely capstone events of training cycles rather than displays of all capabilities.

The Western High Command’s Evolving Order of Battle

In Russian military parlance, a high command (glavnoe kommandovanie) is the staff commanding forces within a TVD or strategic direction.[15] A military district (voenniy okrug) is responsible for training and arming units in peacetime so that they are at maximum readiness for the demands of the high command in the event of war.[16] The ZGK is responsible for potential warfighting, but the Western Military District (ZVO) supplies only the core of the force that the ZGK would command.

The Western Military District

The ZVO is comprised of three armies, one air force and air-defense army, three airborne divisions, one airborne brigade, the Baltic Fleet, and an army corps attached to the Baltic Fleet.

– Ground Forces. The ZVO’s three armies fall neatly into the three strategic directions on a map, if less so in practice. The 6th Combined Arms Army is based around St. Petersburg, in the northwestern strategic direction; the 1st Guards Tank Army is around Moscow, in the western strategic direction; and the 20th Guards Combined Arms Army is based between Smolensk and Voronezh, in the southwestern strategic direction. The 11th Army Corps, formally attached to the Baltic Fleet, is based in the Kaliningrad Oblast exclave. These units’ paper-strength capabilities are not comparable, as shown in Table 2.

| Table 2. ZVO Ground Forces Unit Breakdown | |||||

| Army (Corps) | Tank Units | Motor Rifle Units | Artillery Units | Engineer Units | Attack Helo Units* |

| 1st Guards Tank Army |

1 Division,

1 Brigade |

1 Division,

1 Brigade |

2 ARTY Brigades,

1 Missile Brigade, 1 Thermobaric BAT |

3 Brigades,

1 Regiment, 1 LOG BGE, 1 Rail BGE |

1 Brigade |

| 6th Army | N/A | 2 Brigades | 2 ARTY Brigades,

1 Missile Brigade, 1 Thermobaric BAT |

1 Regiment,

1 LOG BGE, 1 Rail BGE |

2 Brigades |

| 20th Guards Army | 1 Brigade | 2 Divisions | 1 ARTY Brigade,

1 Missile Brigade |

1 Regiment,

1 LOG BGE, 1 Rail BGE |

N/A |

| 11th Army Corps | 1 REG | 1 Brigade,

1 Regiment, 1 Marine BGE |

1 ARTY Brigade,

1 Missile Brigade |

1 Regiment,

2 Battalions |

1 Squadron |

| *Attack helicopter units are technically part of the Air Force and Air Defense Army | |||||

Immediately notable is the far greater strength of the 1st Guards Tank Army compared to the others, though the 20th Guards Army is still not fully organized and may yet acquire additional forces. Another key specialization visible is that whereas the 1st Guards Tank Army possesses by far the most tanks, the 6th Army has the most attack helicopters. This suggests that the different units are expected to fight in different regions.

– Airborne Troops. The Airborne Troops (VDV) form a separate branch of the Russian Armed Forces. Though they follow their own training regimen and frequently exercise separately from the other services in the strategic exercises, they appear also to conform to the strategic directions based on their peacetime garrisons.

| Table 3. Distribution of ZVO VDV Units by Strategic Direction | |

| Northwestern | 1 Division |

| Western | 2 Divisions |

| Southwestern | 1 Brigade |

– Aerospace Forces. The Russian Aerospace Forces (VKS) combine combat aviation, air defense, and space-based capabilities. In the ZVO, this is organized into the 6th Air Force and Air Defense Army. This is augmented by a separate 15th Army responsible specifically for the air and missile defense of Moscow, but this unit is extremely unlikely to deploy away from the capital under any circumstances. The 6th Air Force and Air Defense Army frequently exercises moving its assets across ZVO territory but garrisons those assets in several bases analogous to the strategic directions. However, it should be assumed that in wartime, all these assets would be redirected as necessary to any of the three strategic directions.

| Table 4. Distribution of ZVO VKS Units by Strategic Direction in Peacetime | ||||

| Strategic Direction | Fighter Units | Strike Units | Reconnaissance Units | Air Defense Units |

| Northwestern | 2 Regiments | N/A | N/A | 1 Division |

| Western | N/A | N/A | 1 Regiment | 1 Division |

| Southwestern | 1 Regiment | 1 Regiment | N/A | N/A |

| Kaliningrad* | 1 Regiment | 1 Regiment | N/A | 1 Division |

| *Kaliningrad’s aviation assets are technically naval aviation but infrequently exercise as such. | ||||

– Navy. The ZVO possesses the Baltic Fleet, based out of Baltiysk, Kaliningrad Oblast, and Kronshtadt, St. Petersburg, though most assets are garrisoned in the former. While it possesses a decent number of ships, the Baltic Fleet generally keeps most of them at port. To illustrate this, Table 5 displays how many ships the Baltic Fleet possesses that have conducted an exercise at least once over the past three years arranged into how many training activities they have publicly reported in 2019.

| Table 5. Baltic Fleet Assets by Number of Reported Exercises in 2019 | |||||||

| Exercise Count | Destroyers | Frigates | Corvettes | Amphibious Ships | Minesweepers | Other Support | Submarines |

| 10+ | 1 | 5 | |||||

| 5–9 | 7 | 3 | |||||

| 1–4 | 1 | 8 | 8 | 5 | 4 | 1 | |

| 0 | 1 | 1 | 3 | 2 | 4 | ||

| Total | 1 | 2 | 21 | 14 | 7 | 8 | 1 |

As can be observed, the emphasized capability in the Baltic Fleet are the corvettes or small missile ships. These ships are specially equipped to offer distributed lethality against all targets—including shore and missiles.

Neighboring Military Districts

The ZGK can be augmented by assets outside the ZVO in wartime. Although most units could conceivably be redeployed in that manner, this paper will only list the most likely sources of reinforcement and their potential roles in the European strategic directions.

– Joint Strategic Command “North.” The Arctic-focused Northern strategic command was detached from the ZGK and ZVO only in 2014 and features Russia’s most powerful, if aging, Northern Fleet with considerable subsurface assets. This force would almost certainly augment operations in the northwestern strategic direction as well as provide medium- to long-range sea-launched cruise missile (SLCM) support from the Arctic. The Northern Fleet could also attempt to penetrate the so-called Greenland–Iceland–United Kingdom (GIUK) gap to provide a wider range of missile targets, though such an operation would imperil the fleet’s survival given the large number of NATO naval aviation assets around the North Sea. The ground and air assets in the North would likely engage Norway in wartime if the latter joined NATO’s defense, but these assets would be extremely unlikely to deploy to another strategic direction given Russia’s self-perceived vulnerabilities in the Arctic.[17]

– Central Military District. The Central Military District (TsVO) encompasses a vast swathe of Russian territory, from the Volga region to eastern Siberia, with only two armies. Its air assets have recently been modernized (see below) and its ground forces are specialized for deployment, so it could augment the ZGK, though this would leave central Russia virtually undefended. TsVO air assets and its 2nd Guards Army would likely move forward to augment Russian defenses wherever the ZVO’s deployed forces departed. For example, during the northwestern-focused Zapad 2017, the 2nd Guards Army deployed some forces to Karelia and Murmansk Oblasts opposite the Finnish border.[18] This probably was intended to absorb a hypothetical NATO attack on St. Petersburg or a Finnish counteroffensive honoring bilateral ties with Estonia.[19] In an extended conflict, these assets could also form a subsequent echelon of a Russian offensive.

– Southern Military District. The Southern Military District (YuVO) faces the Caucasus, Black Sea and Caspian Sea, and it has coordinated the military activities in Crimea and Donbas against Ukraine since 2014. However, whereas its assets would play a critical role in a southwestern strategic direction campaign, it appears that the impetus for creating the current 20th Guards Army since 2015 has been to reduce the demands of Ukraine on YuVO assets. As in the Second World War, the YuVO’s 8th Guards Army might deliberately fix Ukrainian assets in Donbas while the ZVO’s 20th Guards Army assaulted Kyiv directly. However, this would likely be the only scenario employing YuVO assets in Europe. Though the Baltic Fleet regularly exercises sending assets to the Mediterranean Sea and sometimes the Black Sea, the Black Sea Fleet has made no similar effort to the Baltic Sea in recent years, though this may simply be a product of the current military-political situation.

– Non-District Forces. Russia also possesses several assets unattached to a particular military district, including Long-Range Aviation, Strategic Rocket Forces, and some special airborne troops. During wartime, the Strategic Rocket Forces would prepare for strategic nuclear exchange if the war escalated out of control. However, Long-Range Aviation and the other special airborne troops would provide additional strike and disruption capabilities wherever the ZGK required them, as was, indeed, exercised in Zapad 2017.[20]

Recent Military Modernization

Since Zapad 2017, of 1,589 incidents reported by the Russian Ministry of Defense of new capabilities delivered to the Armed Forces or unit restructurings or standups, 222 (14 percent) have been reported in the ZVO. Table 6 indicates that, after a surge at the end of 2017, the recent focus of Russian military modernization has been in the TsVO. Table 7 breaks down deliveries of new equipment within the ZVO, showing that the 6th and 20th guards armies have received the most attention. However, the absence of any disproportionate spike suggests that these trends show no significant realignment of priorities within the Russian General Staff or Ministry of Defense leadership on priorities among the three European strategic directions.

| Table 6. Reported Deliveries of New Equipment to Each Military District Since Zapad 2017 | ||||

| Military District | 2017 | 2018 | 2019 | Total |

| West (ZVO) | 17.8% | 14.4% | 10.3% | 14.0% |

| South (YuVO) | 9.8% | 12.3% | 10.3% | 11.0% |

| Central (TsVO) | 9.5% | 16.1% | 17.2% | 14.8% |

| East (VVO) | 12.0% | 5.4% | 9.9% | 8.5% |

| North | 1.0% | 2.0% | 2.8% | 2.0% |

| Percentages do not add up to 100% because of excluded non-district-based assets. | ||||

| Table 7. Reported Deliveries of New Equipment Within the ZVO Since Zapad 2017 | ||||

| Strategic Direction | 2017 | 2018 | 2019 | Total |

| Northwestern | 31.5% | 18.8% | 36.5% | 27.0% |

| Western | 28.8% | 26.0% | 13.5% | 23.9% |

| Southwestern | 26.0% | 33.3% | 30.8% | 30.6% |

| Kaliningrad | 12.3% | 17.7% | 17.3% | 15.8% |

Exercise Trends in the Western Military District

This paper considers the data from 1,945 reported Russian military exercises and training activities conducted in the ZVO’s territory since the summer 2017 training season. This data set was compiled by the author for War Vs Peace.[21] For comparing the figures below, the total number of exercises for each strategic direction is 506 in the northwestern strategic direction, 417 in the western, 345 in the southwestern direction, and 641 in Kaliningrad Oblast.

Tactical Group Exercises

Despite the fact that the overwhelming majority of these exercises and training activities are tactical in scale, a subsection of them specifically exercises standing up tactical maneuver groups or specific tactical capabilities. Table 8 shows how these exercises were distributed among the different strategic directions and Kaliningrad Oblast. These exercises were conducted by the Ground Forces and VDV, occasionally augmented by the VKS.

| Table 8. Tactical Group Exercises in the ZVO, Summer 2017–Summer 2019 | |||||

| Type | Northwestern | Western | Southwestern | Kaliningrad | Total |

| Company Tactical Group | 6 | 3 | 4 | 1 | 14 |

| Battalion Tactical Group | 8 | 14 | 8 | 10 | 40 |

| Regiment Tactical Group | 4 | 11 | 1 | 0 | 16 |

| Brigade Tactical Group | 1 | 2 | 1 | 0 | 4 |

| Undefined-Scale Tactical Group |

1 | 2 | 2 | 7 | 12 |

| Command-Staff | 6 | 11 | 7 | 5 | 29 |

| Defense & Counteroffensive against Superior Enemy | 6 | 5 | 2 | 3 | 16 |

| Offensive | 1 | 0 | 0 | 0 | 1 |

| Total | 33 | 48 | 25 | 26 | 132 |

This table indicates that these tactical maneuver groups are exercised more frequently in the 1st Guards Tank Army than in the other major units within the ZVO. It also exercises these capabilities at a larger scale than the units based in the other strategic directions. Over this time period, the 20th Guards Army had not yet been fully established, and so the southwestern direction’s numbers may catch up in future training seasons.

Terrain Indicative Exercises

Certain exercise types indicate the type of terrain for which a unit is specialized. For the Russian Armed Forces, these exercises are special urban warfare, mountain warfare and river crossing exercises. Table 9 breaks down the frequency of each of these exercises in the different strategic directions.

| Table 9. Terrain Indicative Exercises in the ZVO, Summer 2017–Summer 2019 | |||||

| Type | Northwestern | Western | Southwestern | Kaliningrad | Total |

| Urban Warfare | 4 | 7 | 4 | 0 | 15 |

| River Crossing | 11 | 17 | 10 | 8 | 46 |

| Mountain Warfare | 4 | 0 | 2 | 0 | 6 |

That river crossings should be so much more common than the other two exercise types is hardly surprising: European Russia as well as Europe’s East feature many large rivers and few mountains. It nevertheless is interesting that it is exercised more frequently for the western strategic direction than in the more water-logged northwestern strategic direction. It is also worth noting the paucity of urban warfare exercises, indicating the Russian Armed Forces’ preference to conduct its combat operations outside urban areas. Finally, any training for mountain warfare is notable given how rare they are in eastern Europe. That they were conducted at all suggests a residual interest in combat capabilities in the Scandinavian (Scandes) and Carpathian mountain ranges.

Sustainment Exercises

Equally important in considering Russia’s ability to fight across its borders is the frequency of logistical exercises in each strategic direction, especially as most of the country’s post-Soviet combat operations have involved relatively short distances beyond its frontiers. Table 10 breaks down these exercises.

| Table 10. Sustainment Exercises in the ZVO, Summer 2017–Summer 2019 | |||||

| Type | Northwestern | Western | Southwestern | Kaliningrad | Total |

| Engineer | 17 | 22 | 8 | 15 | 62 |

| Repair & Logistics | 8 | 15 | 0 | 7 | 30 |

| Railway Sustainment | 0 | 8 | 0 | 0 | 8 |

| Refueling (AAR, Maritime, etc.) | 3 | 9 | 12 | 11 | 35 |

This breakdown shows a notable preponderance of these sustainment capabilities in the western strategic direction and general unreadiness in the southwestern. This suggests that the primarily Poland- and Belarus-oriented 1st Guards Tank Army is the most capable unit for conducting and sustaining an offensive beyond Russia. This may explain why during the northwestern strategic direction scenario of Zapad 2017, considerable elements of the 1st Guards Tank Army were deployed into the 6th Army area of responsibility.

Anti-Access and Area Denial (A2/AD) Exercises

Though Russia does not have an A2/AD operational concept, it has invested considerable resources into modernized air-defense and missile technologies to protect itself from Western standoff tactics demonstrated in Yugoslavia and Iraq. Unsurprisingly, these capabilities have a prominent place in Russian military exercises, as shown in Table 11.

| Table 11. A2/AD Exercises in the ZVO, Summer 2017–Summer 2019 | |||||

| Type | Northwestern | Western | Southwestern | Kaliningrad | Total |

| Air defense | 16 | 14 | 7 | 52 | 89 |

| Tactical surface missile | 14 | 9 | 1 | 16 | 40 |

| Ship-based missile | 0 | 0 | 0 | 25 | 25 |

| Coastal missile | 0 | 0 | 0 | 25 | 25 |

| Airbase suppression | 2 | 0 | 2 | 1 | 5 |

| Missile defense | 3 | 6 | 0 | 11 | 20 |

| Air strike | 17 | 5 | 14 | 36 | 72 |

| Close air support (CAS) | 1 | 1 | 2 | 3 | 6 |

| Suppression of enemy air defense (SEAD) | 2 | 0 | 4 | 0 | 6 |

| Total | 55 | 35 | 30 | 169 | 289 |

This again presents a curious dynamic: A2/AD capabilities are overwhelmingly concentrated in the Kaliningrad Oblast exclave. Whereas the western strategic direction has the most capabilities in the previous charts, here it ranks at the bottom with the still-forming southwestern strategic direction units. Kaliningrad’s numbers in Table 11 are, of course, boosted by the basing of most Baltic Fleet assets there, gaining all the maritime exercise numbers for itself. And yet, even without the naval exercises, Kaliningrad would still have almost as many A2/AD exercises as the three other regions combined.

This illustrates three factors in Russian strategic planning. First, the Belarusian alliance and erstwhile (pre-2014) Ukrainian neutrality led Moscow to reduce priority for A2/AD capabilities to the western and southwestern strategic directions, presumably under the assumption that there was no immediate threat to these regions. In other words, the Russian military leadership does not appear to consider the Ukrainian Air Force and missile capabilities as serious threats to Russia. Second, Kaliningrad Oblast is mostly regarded not as a launch pad for an offensive into Poland and Lithuania but rather as a vulnerability requiring considerable means to defend itself from a potential NATO attack. Third, the Baltic Fleet exercises less as a strike force than as an extended air- and missile-defense shield beyond Russia’s borders, providing an additional layer of shielding for Russian territory.

Combat Environment Exercises

Another aspect of Russian military planning discernible from the exercise patterns is the combat environment its expects its forces to encounter in the various strategic directions. In particular, Russia exercises cleanup from chemical, radiation, biological and nuclear (CBRN) attacks; recovering aircraft from “operational” airfields after their garrisons were suppressed (sometimes with CBRN weapons), and occasionally combat operations under conditions of enemy use of weapons of mass destruction. Over the past three years, outside of dedicated strategic nuclear exercises, Russia has never overtly practiced employing its own weapons of mass destruction in tactical exercises but also has not ruled out using them if the enemy launches them first. This is broken down in Table 12.

| Table 12. Combat Environment Exercises in the ZVO, Summer 2017–Summer 2019 | |||||

| Type | Northwestern | Western | Southwestern | Kaliningrad | Total |

| CBRN Defense | 11 | 8 | 20 | 15 | 54 |

| Airfield Recovery | 13 | 0 | 8 | 0 | 21 |

| Operations during Nuclear or Chemical Warfare | 1 | 1 | 2 | 0 | 4 |

| Total | 25 | 9 | 30 | 15 | 79 |

As with A2/AD exercises, the western strategic direction exercises these capabilities less frequently, likely because of the relative protection offered by Belarus. The more-exposed northwestern and southwestern strategic directions, therefore, exercise these capabilities more vigorously. Kaliningrad Oblast’s forces do not exercise airfield recovery, presumably because of a lack of available runways.

Belarus in Russian Strategic Calculations

Unavoidable in this appraisal is the centrality of Belarus to Russian strategic planning for war in Europe. Though the southwestern strategic direction appears to avoid using Belarusian territory, the 1st Guards Tank Army may still seek to utilize a forward deployment in Belarus during a crisis either to strike the western Ukrainian rear or simply fix Ukrainian forces behind the decisive front.

President Lukashenka of Belarus occasionally denounces the escalated tensions between Russia and the West, proclaiming that he does not want his country to become a battleground for their competition.[22] However, as indicated above, Minsk’s political position is not regarded as important in Moscow. Lukashenka’s ideal solution (and, indeed, the Putin regime’s[23]) arguably involves not leaving the Russian security orbit but rather finding a way for the Eurasian bloc to reconcile its differences and better integrate with Europe in an economic and security if not political framework. Considering the ongoing security friction between Russia and Europe—especially given the positions of the Moscow-skeptic countries Estonia, Latvia, Lithuania and Poland—this peaceful solution appears remote at the time of writing. Nevertheless, thinking through the potential impact that a Belarusian withdrawal from Russian planning would have on the ZGK yields important insights about Russian military strategy along NATO’s northeastern flank. In light of the Lukashenka regime’s instability following the Belarusian 2020 presidential election, Moscow is likely considering the potential implications of this possibility now.

Southwestern Strategic Direction

The southwestern strategic direction would be impacted least by Belarus’s hypothetical withdrawal from the Russian security sphere but would undergo some important changes. In the prevailing military-political situation since 2014, Belarus acts as a Russian salient, complicating European military support for Ukraine in wartime conditions given the presence of Collective Security Treaty Organization (CSTO) air-defense assets in Belarus.[24] Without this complication, European resupply to Ukraine would become considerably simpler. Nevertheless, this consideration is hardly the most important inhibitor to Ukrainian association with the NATO alliance.

Presuming that the Russian 1st Guards Tank Army cannot use Belarus as a concentration point ahead of a broader attack on Ukraine, the territory west of Kyiv becomes a far more secure rear area. Ukraine still has a border with the Moscow-supported “frozen” conflict zone of Transnistria (eastern Moldova), but Russian assets there amount to one battalion’s strength and could easily be shielded on either the northern or eastern frontiers. That said, the Russian Operational Group of Forces in Transnistria could still be used as a rear attack unit against Odesa, presuming a complementary Russian conventional strike toward the city from either the sea or overland from the east. Additionally, Transnistria has roughly 10,000–15,000 local though de facto Russian-commanded forces that, at the very least, could defend this small territory while the Russian battalion conducted an offensive.[25]

Ukraine’s immediate challenges would be unchanged: a war in Donbas, a long open border with Russia in the 20th Guards Army’s area of responsibility, and the Black Sea coast open to naval attack from forces in Crimea and Krasnodar Krai. However, a Belarus closed to Russia would broadly secure its rear area bordering NATO and facilitate potential reinforcement from the West in the event of war.

Russia’s power projection capabilities in the southwestern strategic direction beyond Ukraine would not be more seriously hampered than they already are by the departure of Belarus. Short of acquiring a willing partner with an accessible coastline, such as Bulgaria or Greece, Russia has no means of accessing the Balkans besides by air or negotiation for passage with NATO member states.

Western Strategic Direction

Sitting astride the western strategic direction, Belarus could profoundly impact this military option if it hypothetically were to withdraw from Moscow’s orbit. The western strategic direction primarily addresses Poland at present; without Belarus, Russia’s only direct access to Poland would be via already-disconnected Kaliningrad. If Russia were to seriously attempt an attack on Poland from Kaliningrad Oblast, the reinforcement of the exclave would represent such an obvious vulnerability as to invite possible preemptive strikes and sea interdiction from the West.

The withdrawal of Russian radars from Belarus and loss of Belarusian air-defense cover would almost certainly prompt a buildup of further air-defense assets around Smolensk. It could also encourage the buildup of additional ground and air forces to offset the loss of Belarusian forces that might otherwise have been called upon to defend supply lines through Belarus during a broader Russia-NATO confrontation.

However, the most profound shift could come less from the change to the order of battle itself than to Moscow’s disposition toward Minsk. Considering Minsk a traitor to the Eurasian order, Moscow would likely direct an avalanche of destabilizing propaganda at Belarus while supporting anti-government insurrectionists—as it did in Donbas in 2014. The 1st Guards Tank Army may simply adjust its planning away from fighting Poland to fighting Belarus given the general similarity in terrain.

During the ongoing crisis in Belarus in August 2020, Russian messaging on the situation in Belarus has been decidedly mixed. Immediately prior to the election, Belarus arrested 33 Russians in the country on suspicion of their being part of the Wagner Group private military company.[26] Russian officials denounced the move before the election but opinion[27] shifted dramatically to one of support for Lukashenka’s legitimacy afterward.[28] As the crisis has dragged on, Russian confidence in Lukashenka’s regime appears to have become shaken, with Russian Foreign Minister Sergei Lavrov admitting the elections were not “perfect.”[29]

Losing Belarus would significantly impact Russian power projection, removing Warsaw from the reach of Russian ground forces without committing virtually its entire armed forces to the task. Though Kaliningrad would likely remain under Russian control absent larger civic unrest within Russia itself, the removal of a serious risk to NATO’s section of the North European Plain beyond medium- to long-range missile strikes would offer significant insulation to European security. The effect would be to restore the political balance to something akin to that between Muscovy and the Polish-Lithuanian Commonwealth four centuries ago, albeit with a Russian rather than German enclave in East Prussia (today’s Kaliningrad).

Even before the 2020 election, Lukashenka was unlikely to voluntarily enact such a geopolitical transition as it would transform his country into a battlefield between West and East, making his political survival contingent upon Warsaw’s (and Brussels’) good graces rather than Moscow’s.[30]

Northwestern Strategic Direction

Belarus’s impact on the northwestern strategic direction is the most debatable of the three. A glance at the map suggests that it could be as significant as Belarus’s disappearance from the western strategic direction, given that it would deprive the Russian Armed Forces of easy access to the potential Suwałki Corridor chokehold on NATO resupply to the Baltic States. However, Belarus’s significance on this front may be less definitive than first meets the eye.

A hypothetical Russian attack against Estonia, Latvia and Lithuania is still assumed to be contingent on the unlikely scenario of necessary Russian ground reinforcement to Kaliningrad Oblast being denied by the region’s governments. Though Russia’s objectives may experience subsequent mission creep, the initial military objective would be achieving a land bridge with Kaliningrad, presumably including a rail link. The Suwałki Corridor features no east-west rail corridor along the geographically short gap between Kaliningrad Oblast and Belarus.[31] Instead, the shortest rail link from Belarus to Kaliningrad passes through Vilnius and Kaunas in Lithuania. However, assuming that Belarus is no longer friendly territory for Russia, the shortest rail link would be that from Pskov via Daugavpils in Latvia and subsequently via either Panevezys or Vilnius and Kaunas in Lithuania. Fighting to gain control of this entire stretch of railway appears infinitely more complicated on a map but affords the possibility of avoiding the two largest cities of Lithuania, a welcome consideration for the Russian Ground Forces.

Furthermore, as Map 4 suggests, this thinking is already prominent for the northwestern strategic direction in Russia today, contingent on the continuation of the alliance with Belarus. During Zapad 2017, the main groupings of Russian forces were localized near the start of the Pskov railway running south toward Daugavpils and along the Belarusian railway running northwest toward Vilnius, with only attack helicopters exercising anywhere near the Suwałki Corridor to potentially provide supply harassment.[32] Without Belarusian support, Moscow would likely first secure Minsk’s neutrality in this conflict before committing to the operation; fighting both Belarus and NATO simultaneously would be an exceptionally tall order for the Russian Armed Forces. This would also mean that the Pskov rail line would be the only potential path to victory. Without the option to fix enemy forces in place with threats from Belarusian territory, it becomes significantly simpler for Latvia, Lithuania, and any NATO forces assisting them to identify and plug the main axes of a Russian advance.

The possibility of an attack out of Kaliningrad Oblast should be considered at least briefly. Baltic Fleet amphibious forces do exercise marine offensive capabilities. However, this is likely intended to attack the rear areas of Estonia, Latvia or Lithuania to pull their meager forces away from the main axis of the Russian advance. Using Russian naval infantry to attack elsewhere may produce a tactical victory but it would be unexploitable and would likely only serve to convince NATO member states beyond Poland, Estonia, Latvia and Lithuania that Russia is a threat worth fighting. The other Russian units in Kaliningrad Oblast occasionally exercise offensive tactics, but, as Table 8 showed, almost always do so in the context of deflecting an enemy attack into the exclave. Considering the size of the Polish Armed Forces relative to the Russian 11th Army Corps and the difficulty of resupplying the exclave during wartime (i.e. the presumed reason why a war would start), it seems extremely unlikely that Russia would launch any offensive out of Kaliningrad before Russian reinforcements could arrive.

Without Belarus, this plan for relieving Kaliningrad becomes far riskier and more singularly minded. However, Belarus’s absence does not doom such an operation it to failure, especially if Russia can convince NATO member state governments that its opponents are destabilizing Kaliningrad Oblast and that it, therefore, is the victim, as Moscow surely would attempt in this scenario.

Russian power projection in the Baltic Sea and into Scandinavia further in the northwestern strategic direction is not seriously impacted by Belarusian neutrality. However, the likelihood of such an attack is considered extremely low given the relatively functional state of diplomacy between Russia and the Nordic countries as illustrated above. Attempting to conventionally attack Sweden or Norway would be complicated and result in little reward; attacking Finland would, at best, result in a massive war of attrition.

Conclusion

In the time of Russian-Ukrainian antipathy since 2014, Russia has retooled its forces facing Europe to prepare for conflict against its immediate border states, largely disregarding the probability of conflict with European states further away. Russia’s diplomats have worked to maintain functional relationships with key NATO member states, such as France, Germany, Italy and Turkey, to keep them aloof from potential problems in Estonia, Latvia, Lithuania, Poland and (non-member) Ukraine. This strategy may be borne from Russian military weakness, namely an inability to carry on a protracted long-distance war; but it nevertheless appears at least partially successful.

Moscow perceives rising risk of conflict on its western borders with Europe according to the following basic scenarios:

- Northwestern strategic direction: Latvia, Lithuania and Poland may attempt to seal Kaliningrad Oblast from external reinforcement during an internal governance crisis.

- Western strategic direction: Poland seems willing to use force to stop Russia from defending, maintaining, or expanding its sphere of influence in the former Soviet Union.

- Southwestern strategic direction: Ukraine may try to retake Crimea or even attempt an offensive against Russia proper if hardliners in Kyiv choose to riposte losing the peninsula and control over Donbas with an anti-Russia crusade.

Russia has configured training in the three strategic directions under the Western High Command toward three basic objectives:

- Northwestern strategic direction: Opening a land bridge to Kaliningrad Oblast via Latvia and Lithuania using assets designed for fighting in canalized swampy terrain as well as rapid-reaction capabilities to defend targeted points of infrastructure and fix enemy forces away from the decisive battlefield.

- Western strategic direction: Fixing the Polish Armed Forces with a defense of Warsaw and potentially cut off NATO access to the front with heavy or long-range weapons.

- Southwestern strategic direction: Restoring capabilities on previously demilitarized territory, ready to seize the initiative and take Kyiv if the conflict escalates in Donbas or if Ukraine attempts to retake Crimea.

These capabilities reflect Russia’s perceived risks in light of a growing NATO military presence on its western frontiers. Ironically, this response in turn justifies a further NATO buildup, which then marginally raises the threat of war, even one unwanted by both sides, despite actions intended to obviate such a possibility.

Though none of the above-described risk scenarios directly involve Belarus, Russia’s only treaty ally in Europe, they all require—to a greater or lesser extent—Belarusian cooperation to achieve planned military objectives. This puts Belarus in the awkward position of potentially being a major battleground between Russia and NATO, all while its government remains isolated from the West and with little influence over Moscow. A Belarusian withdrawal from Moscow’s security planning would seriously complicate Russian military thinking in Europe, significantly elevate Poland’s security and strategic influence, and potentially banish Moscow’s military threat from the North European plain for the first time in 500 years. However, such a transformation would put Belarus in an extremely precarious political situation that would be difficult to sustain.

These considerations underline the significance of the current instability in Belarus following Lukashenka’s apparently fraudulent reelection on August 9, 2020. Whereas Moscow fervently adheres to a script of denying any legitimate course for Europe to intervene in its ally,[33] it keeps the option of its own military support open through either the Union State or CSTO alliance.[34] In 2019, the Russian government made a total of 214 statements about Belarus, a number only topped by the United States (444) and the People’s Republic of China (244).[35] If Lukashenka’s regime remains unstable, a Russian intervention may become progressively more likely, regardless of current Russian statements.

Notes

[1] “Russia Pays Off Last Soviet Debt,” The Moscow Times, August, 22, 2017, https://www.themoscowtimes.com/2017/08/22/russia-pays-off-last-soviet-debt-a58718.

[2] Maria Zakharova, “O 30-letii padeniya Berlinskoy steny,” Russian Ministry of Foreign Affairs (MID), November 8, 2019, https://www.mid.ru/ru/foreign_policy/news/-/asset_publisher/cKNonkJE02Bw/content/id/3891813#9.

[3] “EU restrictive measures in response to the crisis in Ukraine,” European Council, Accessed August 23, 2020, https://www.consilium.europa.eu/en/policies/sanctions/ukraine-crisis/.

[4] “Our 5 priorities for the NATO Summit Wales 2014,” Government of the United Kingdom, September 1, 2014, https://www.gov.uk/government/publications/our-5-priorities-for-the-nato-summit-wales-2014/our-5-priorities-for-the-nato-summit-wales-2014.

[5] A typical example is this for the United Kingdom: “Diplomaty otvetili na slova britanskogo generala o kibervoyne c Rossiey,” RIA Novosti, September 30, 2019, modified March 3, 2020, https://ria.ru/20190930/1559297334.html.

[6] War Vs Peace has created a system for compiling all Russian statements for and against government policies, assigning a positive score of +1 to +3 for all statements of favor and -1 to -3 for all condemnations, oppositions, and threats. Methodology can be explored in further detail at https://www.warvspeace.org/official-russian-supportcondemnation. Since the start of the Trump Administration, this system has found a net balance of Russian opinion of European state behavior of -1,369. This compares, for example, to a net score of +207 in Asia.

[7] “Intervyu Ministra inostrannykh del Rossii S.V. Lavrova zhurnalu ‘Natsionalniy interes’ opublikovannoe 29 marta 2017 goda,” MID, March 29, 2017, https://www.mid.ru/ru/foreign_policy/news/-/asset_publisher/cKNonkJE02Bw/content/id/2710445.

[8] “Multinational Corps Northeast,” NATO, Accessed August 23, 2020, https://jfcbs.nato.int/operations/multinational-corps-northeast.

[9] Sources consulted to compile this database include official Russian defense ministry press releases and official journals such as Krasnaya Zvezda as well as excerpts from speeches by Russian government officials, but also unofficial Russian defense-focused newspapers and blogs such as Voenno-Promyshlennyi Kurier and BMPD Blog.

[10] The Netherlands register a negative relationship primarily due to the MH-17 disaster, which originated from Amsterdam, was carrying many Dutch citizens onboard, and has been subjected to a vigorous legal campaign from the Netherlands. Its military contribution to a potential military conflict with Russia will, therefore, not be examined as closely as the others.

[11] For example, Russia’s deputy foreign minister responsible for Middle Eastern and African affairs occasionally consults with Berlin’s ambassador in Moscow to understand and potentially coordinate with Germany’s Middle East policy, whereas he does not do so with perceived friendly but “unimportant” governments such as Budapest. “O vstreche spetspredstavitelya Prezidenta ROssiyskoy Federatsii po Blizhnemu Vostoku i stranam Afriki, zamestitelya Ministra inostrannykh del Rossii M.L. Bogdanova s Poslom FRG v Moskve Ryudigerom fon Frichem,” MID, May 8, 2019, https://www.mid.ru/ru/foreign_policy/news/-/asset_publisher/cKNonkJE02Bw/content/id/3638961.

[12] Key members of the Belarusian government have recently reiterated their objection to being the battlefield between Russia and NATO, signaling daylight between Minsk and Moscow. “Makey: Belorussiya ne khochet okazat’sya na ostrie protivostoyaniya Rossii i NATO,” RIA Novosti, October 7, 2019, last revised March 3, 2020, https://ria.ru/20191007/1559512730.html.

[13] Nicholas J. Myers, “Russia’s Union Shield Exercises – in Transition?” Eurasia Daily Monitor, September 24, 2019, https://jamestown.org/program/russias-union-shield-exercises-in-transition/.

[14] “Zamok na zapade. Belorussiya usilivaet granitsu s Pol’shey i Litvoy,” Radio Sputnik, August 20, 2020, https://radiosputnik.ria.ru/20200820/1576054883.html.

[15] “GLAVNOE KOMANDOVANIE,” Russian Ministry of Defense, Accessed August 23, 2020, https://энциклопедия.минобороны.рф/encyclopedia/dictionary/details.htm?id=5366@morfDictionary.

[16] “VOENNYY OKRUG,” Russian Ministry of Defense, Accessed August 23, 2020, https://энциклопедия.минобороны.рф/encyclopedia/dictionary/details.htm?id=4458@morfDictionary

[17] For example, “Problema Kraynego Severa,” Viniti Ran, Issue 4, 2011, https://militaryarticle.ru/viniti-ran/2011-viniti/11560-problema-krajnego-severa.

[18] “Oni srazhalis’ za Siriyu,” Kommersant, December 11, 2017, https://www.kommersant.ru/doc/3486877#id=5.

[19] “Estonian and Finnish ministers of defence concluded a bilateral defence cooperation framework agreement,” Estonian Ministry of Defense, January 19, 2017, https://www.kaitseministeerium.ee/en/news/estonian-and-finnish-ministers-defence-concluded-bilateral-defence-cooperation-framework.

[20] “Ekipazhi VKS otrabotali soprovozhdenie samoletov Dalney aviatsii,” Russian Ministry of Defense, September 15, 2017, https://деятельность.минобороны.рф/news_page/country/more.htm?id=12142409@egNews.

[21] “War Vs Peace,” accessed August 23, 2020, https://www.warvspeace.org/.

[22] “Gradus nedoderiya mezhdu Rossey i Zapadnom dostig predela, zayavil Lukashenko,” RIA Novosti, October 8, 2019, https://ria.ru/20191008/1559535129.html.

[23] As illustrated by Russia’s occasional anti-“false choice” of Europe vs Russia narrative on the EU and EEU, “Vystuplenie i otvety na voprosy Ministra inostrannykh del Rossii S.V. Lavrova v khode lektsii dlya vysshego ofitserskogo sostava Akademii Genshtaba, Moskva, 23 marta 2017 goda,” MID, March 23, 2017, https://www.mid.ru/ru/foreign_policy/news/-/asset_publisher/cKNonkJE02Bw/content/id/2702537.

[24] “Rossiya i Belorussiya nachali nesti sovmestnoe boevoe dezhurstvo po protivovozdushnoy oborone granits Soyuznogo gosudarstva,” Russian Ministry of Defense, September 6, 2017, https://деятельность.минобороны.рф/news_page/country/more.htm?id=12141197@egNews.

[25] Dmitru Minzarari, “Crimea Crisis Exposes Severe Deficiencies in Transnistria Negotiations Format,” Eurasia Daily Monitor, April 9, 2014, https://jamestown.org/program/crimea-crisis-exposes-severe-deficiencies-in-transnistria-negotiations-format/.

[26] “V MID Belorussii sostoitsya vstrecha po delu o zaderzhannykh rossiyanakh,” RIA Novosti, July 30, 2020, https://ria.ru/20200730/1575144642.html.

[27] “O zaderzhanii belorusskoy storonoy grazhdan Rossii,” MID, July 30, 2020, https://www.mid.ru/ru/foreign_policy/news/-/asset_publisher/cKNonkJE02Bw/content/id/4276463.

[28] “Kommentariy Departmenta informatsii I pechati MID Rossii po itogam prezidentskikh syborov v Belorussii,” MID, August 10, 2020, https://www.mid.ru/ru/foreign_policy/news/-/asset_publisher/cKNonkJE02Bw/content/id/4281983. “Telefonniy razgovor s Prezidentom Belorussii Aleksandrom Lukashenko,” Kremlin, August 15, 2020, https://kremlin.ru/events/president/news/63893.

[29] “Fragment interv’yu Ministra inostrannykh del Rossiyskoy Federatsii S.V. Lavrova telekanalu ‘Rossiya’, Moskva, 19 avgusta 2020 goda,” MID, August 19, 2020, https://www.mid.ru/ru/foreign_policy/news/-/asset_publisher/cKNonkJE02Bw/content/id/4290963.

[30] A consideration Moscow frequently reminds its Belarusian partners. “Kommentariy DIP MID Rossii ob otsenkakh nablyudeniya za paralementskimi vyborami v Respublike Belarus’,” MID, November 21, 2019,https://www.mid.ru/ru/foreign_policy/news/-/asset_publisher/cKNonkJE02Bw/content/id/3908552.

[31] Open Railway Map, https://www.openrailwaymap.org/

[32] It should be noted that the Belarusian poligon where the attack helicopters exercised in Zapad 2017 is, indeed, a specialized helicopter training ground and may have been selected purely for pragmatic considerations. However, it is not the only such training ground in Belarus and so can plausibly be considered indicative evidence.

[33] “O telefonnom razgovore Ministra inostrannykh del Rossii S.V. Lavrova s Prem’er-ministrom, Ministrom evropeyskikh I inostrannykh del Albanii, Deystveyushchim predsedatelem OBSE E. Ramoy,” MID, August 20, 2020, https://www.mid.ru/ru/foreign_policy/news/-/asset_publisher/cKNonkJE02Bw/content/id/4293674.

[34] “B Kremle otritsayut voennoe pristustvie Rossii v Belorussii,” RIA Novosti, August 19, 2020, https://ria.ru/20200819/1575981775.html.

[35] This compares to eight mentions of Belarus by the United States and 17 by the People’s Republic of China in the same year.