General Electric Subsidiary to Provide Russian LNG Project With Key Equipment

Publication: Eurasia Daily Monitor Volume: 17 Issue: 145

By:

The poisoning of Russian opposition leader Alexei Navalny caused an uproar in the international community, even leading to debates inside Germany about whether to punish Moscow by canceling the Nord Stream Two natural gas pipeline (see EDM, September 21). While the fate of Gazprom’s multi-billion-dollar infrastructure project remains uncertain, the development of Russia’s largest liquefied natural gas (LNG) facility is continuing on track, with the financial and technological backing of Western companies from Europe and the United States. A consortium of Russian and foreign energy firms have committed to financing the $21-billion LNG project, expected to be operational in 2023 (Neftegaz.ru, June 15, 2019).

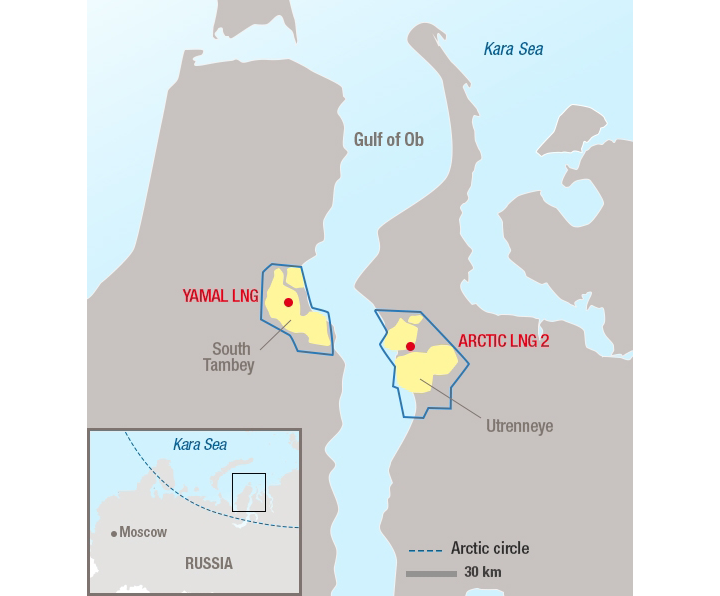

In mid-September, the Novatek-led Arctic LNG 2 consortium awarded the substation equipment contract to GE Renewable Energy’s Grid Solutions SAS, a Paris-based subsidiary of Boston-headquartered General Electric (Gegridsolutions.com, September 22). Based on the company’s press release, GE will be supplying grid equipment to Arctic LNG 2 to help ensure reliable power supply to the project’s three LNG production trains, each with a capacity of 6.6 million tons per year. The Novatek-led corporate grouping, comprised of European and Asian companies (the US’s GE has no controlling stake), is building Arctic LNG 2 on the Gydan Peninsula, in western Siberia’s Yamal-Nenetsk Okrug. Novatek, which already operates one functioning liquefied gas terminal (Yamal LNG), is the largest LNG exporter in Russia.

Novatek has built reliable business relations with General Electric, which has also provided Yamal LNG with power supply equipment. The companies even signed a strategic partnership agreement in 2016 (Ge.com, June, 17 2016). In December 2018, Novatek signed a contract with Florence-based Nuovo Pignone, part of Baker Hughes, a GE subsidiary (Offshore-energy.biz, December 21, 2018). According to the report, Nuovo Pignone is to supply gas turbine compressors and generators for Arctic LNG 2. GE is not the only US firm engaged in the project. Technip FMC, which was formed out of the 2016 merger of US FMC Technologies and French Technip, scooped the critical engineering and procurement contract from Novatek in July 2019 (see EDM, June 3, 2019).

Arctic LNG 2 has largely evaded the United States’ sanctions, which choked off some of Russia’s significant energy-production initiatives in the Arctic basin, such as Rosneft’s oil project with Exxon in the Kara Sea. The US Treasury did impose sanctions on both Novatek and its key executives over Moscow’s annexation of Crimea (Treasury.gov, July 16, 2014). However, these sanctions’ scope was relatively narrow, only prohibiting US nationals and corporate entities from engaging in activities to organize long-term financing for sanctioned companies. Novatek managed to continue its activities thanks to the laxness of the sanctions regime against Russian natural gas projects. When faced with possible penalties, Novatek resorted to the Kremlin’s assistance. For instance, the Kremlin quickly granted Novatek’s CFO, US citizen Mark Gyetway, a Russian passport, thus shielding him from the sanctions (1prime.ru, July 22, 2020).

Last month, a number of European and Asian banks also expressed their commitment to providing multi-billion-dollar financing to Arctic LNG 2. China Development Bank plans to offer more than half of the external funding ($5 billion), while the French state investment bank Bpifrance and German Euler Hermes are offering a total of $1 billion in loans to the project (Kommersant, September 18). Alongside state support and various tax exemptions, Novatek’s project will likely receive substantial financing from Russia’s state-owned Sberbank (Interfax, September 10).

Novatek is traditionally considered an independent Russian energy company. It is publicly traded on the London Stock Exchange, and the state does not have direct majority ownership. But, in reality, it is not much different from Russia’s other government-owned energy firms. Firstly, state-owned Gazprom controls 9.4 percent of the company. While President Vladimir Putin’s close associates, Leonid Mikhelson and Gennadiy Timchenko, own half of the shares. Novatek’s founder, Mikhelson, directly controls 24.8 percent, while Timchenko’s shares are retained via his Volga Group (Forbes.ru, accessed October 15).

That said, Novatek plays an important role in Russia’s domestic natural gas industry as a competitor to Gazprom. The company is also crucial for increasing Russia’s gas export potential, especially given the recent challenges with accessing the European market via pipeline infrastructure. Finally, Novatek’s Arctic projects contribute to the economic development of the Russian Far East and the enhancement of Moscow’s strategic plans concerning the Northern Sea Route (see EDM, April 16, 2019, May 6, 2019, May 14, 2020).

Novatek’s rapidly growing natural gas export potential poses a challenge to US LNG. The company has plans to ramp up its production to 70 million tons per year within the next decade from the current 20 million. The Russian LNG giant currently exports half of its production, accounting for less than 10 percent of the global market share (Finam.ru, September 29).

Assertive and aggressive energy diplomacy is one of Moscow’s foreign policy pillars. And, by helping Russia’s export plans, US companies are unwittingly contributing to Putin’s strategic goals to undermine the West and solidify his own rule.