Russia’s Diamond Industry Under Pressure of Stricter Sanctions

Russia’s Diamond Industry Under Pressure of Stricter Sanctions

Executive Summary:

- EU member states and other Western powers have introduced restrictive sanctions against Russia’s diamond-producing industry, a major contributor to the Russian economy, such as restrictions against the import of Russian diamonds directly or from other countries.

- Other diamond-producing countries, many of which are in Africa, are enthusiastic about the prospect of these sanctions opening opportunities, as Russian diamonds have heavily saturated the market in the past.

- The new sanctions are unlikely to result in the total collapse of Russia’s diamond industry. They nevertheless could further degrade the Russian economy and inflame anti-Moscow sentiments in the country’s diamond-producing, ethnically non-Russian regions.

On June 24, the European Union adopted its 14th sanctions package against Russia. The package included new restrictions on Russian-mined diamonds, including on the import of Russian diamonds and an “indirect import ban on Russian diamonds processed in third countries other than Russia” (Eur-lex.europa.eu, June 24). The Group of Seven (G7) countries along with Switzerland had previously introduced similar sanctions. Russia’s diamond-producing industry, however, has managed to survive the pressure, albeit while suffering some losses (Npral.ru, July 15). Now, the new sanctions combined with growing competition look to have a more significant impact on Russia’s diamond industry. Perhaps more importantly, the new measures may serve to destabilize the Sakha Republic, one of Russia’s top diamond-producing regions. Sakha is ethnically non-Russian and has traditionally been deprived by Moscow of its resource-generated income. Destabilization in regions like the Sakha Republic could lead to more protests against the war in Ukraine—which led to these sanctions in the first place— reluctance to continue working for the diamond industry, and open a door for China to further its influence in the Russian Far East (see EDM, February 6, 2023).

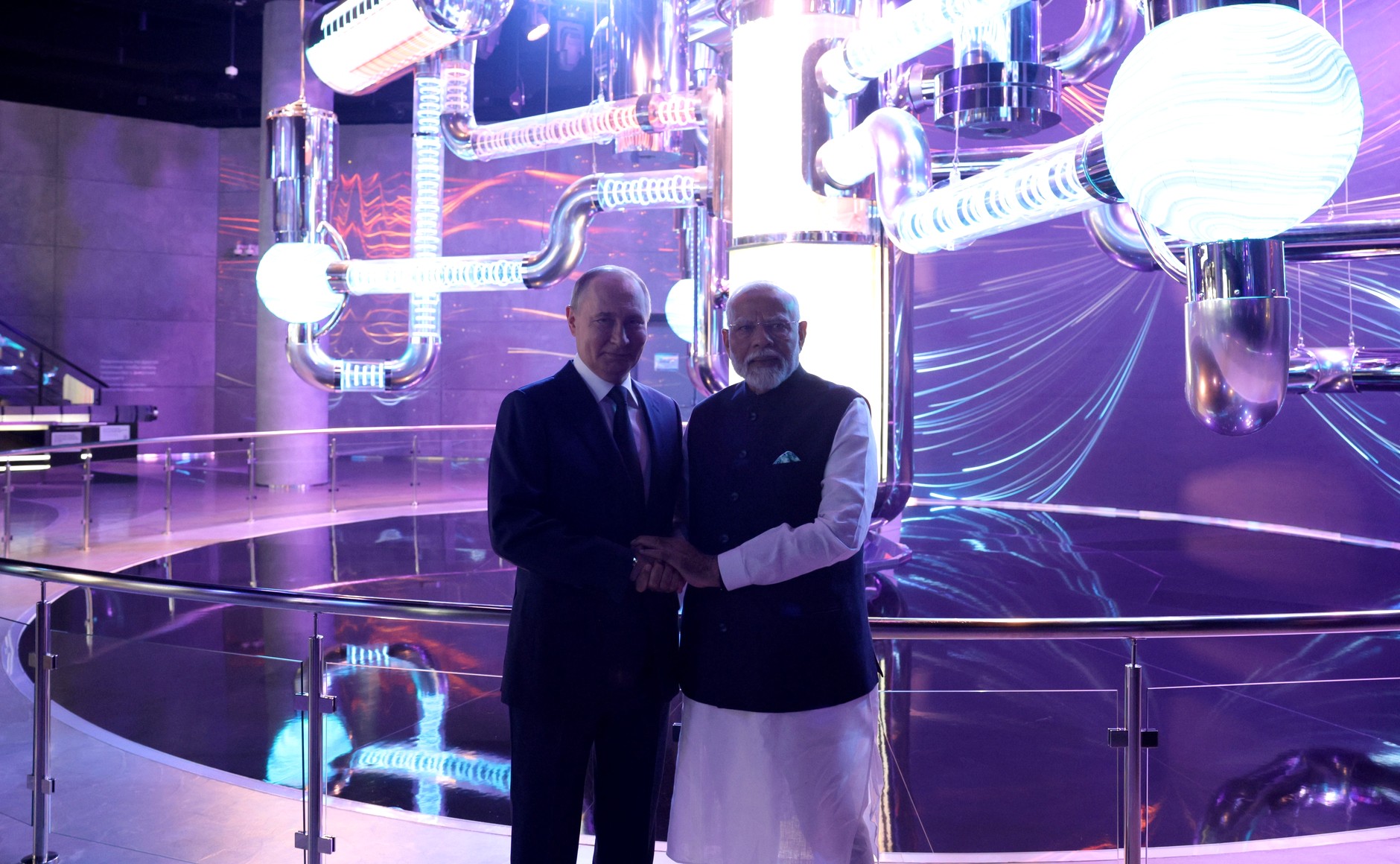

Russia is one of the world’s leading diamond producers. Moscow’s flagship state-owned diamond mining company ALROSA supplies up to 35 percent of the world’s diamonds and owns more than 40 percent of global diamond deposits (Forbes.ru, December 7, 2023). The export of diamonds provides the Russian budget with approximately $4.7 billion annually (Vedomosti.ru, August 15, 2023). Despite sanctions and restrictions, Moscow managed to salvage its diamond-producing industry primarily due to three main reasons: a lack of detecting mechanisms to ascertain a diamond’s origins; India, China, as well as some Middle Eastern and Northern African countries are unwilling to join Western sanctions; and key Western authorities in the diamond business, such as the Antwerp World Diamond Centre (AWDC), oppose sanctions (Brusselstimes.com, February 23, 2022).

Following two years of sanctions, Western countries and their partners are seemingly toughening their stance on this vital facet of the Russian economy. In early February, the US Office of Foreign Assets Control, European Union, and G7 introduced new and reportedly stricter measures against Russia’s diamond-producing industry, including tightening control mechanisms over the origins of diamonds to prevent their presence in Western markets (Vedomosti.ru, February 9; Interfax.ru, June 24).

Moscow’s official reaction to these restrictions was nonchalant. Russia’s massive diamond deposits, its central position in the global diamond supply chain, and mounting concerns among both Western and non-Western actors on the state of the global diamond economy have created a veneer of invincibility as Moscow faces new sanctions (Eurointegration.com.ua, May 17). The Kremlin is counting on the potential of a deep structural crisis in the global diamond and high-end jewelry industry if stricter sanctions are introduced.

The first signs of a looming crisis are already appearing. The Gem & Jewellery Export Promotion Council, World Federation of Diamond Bourses, and International Diamond Masters Association, along with 146 companies, have drafted an open letter to AWDC officials complaining about the potential impact of sanctions (Kommersant.ru, April 18). Russian sources also highlight the reported “chaos” in India’s diamond-processing industry. Following the imposition of the first sanctions in 2022, India emerged as the top importer of unprocessed Russian diamonds that, having been processed in India, ended up in the West as “Indian” diamonds. This process is said to have already harmed the supply chain mechanism—causing payment delays and supply disruptions—and has resulted in growing discontent among Indian businesses that blame the G7 and the West for these issues (Frankmedia.ru, April 4).

Russian experts express unyielding confidence in Moscow’s ability to overcome the new restrictions. They claim that the West—specifically, European and North American companies and end-users—would have to pay more to receive essentially the same diamonds through India, the United Arab Emirates, or other parties. These commentators do not believe that the West will be able to establish an effective and comprehensive certification and controlling mechanism to “catch” Russia-produced diamonds (Izvestiya, March 25). In anticipation of new sanctions, Russian Deputy Finance Minister Alexey Moiseev initially dismissed rumors about the government’s preparations to render financial assistance to ALROSA. He claimed that “the company is ready for sanctions” and that its books are in excellent shape (Interfax.ru, January 9).

The situation, however, seems more complex than Russian officials and Kremlin-backed experts have presented. Regarding economic sustainability, ALROSA appears to be searching for help. According to official Russian sources, in 2023, the head of ALROSA, in a meeting with Aysen Nikolaev, head of the Sakha Republic, stated that the company has decreased diamond production by 2.8 percent, with net profits shrinking by 35 percent (in the first half of 2023 compared to 2022) (Vedomosti.ru, February 9). Furthermore, Russia was not prepared for sanctions. In early March, ALROSA signed an agreement with the Ministry of Finance stipulating that the latter purchase (with public funds) a large part of the diamonds produced by the company but not exported due to external pressure. Russian officials claim this measure is “temporary,” though the negative trends at ALROSA say otherwise (The Moscow Times, March 28, 2024).

ALROSA is one of the key pillars of the Sakha Republic’s economy. The government holds a 33-percent share in the company. ALROSA is one of the main financers of the local economy, comprising around one-third of the regional budget (Zapiska.substack.com, May 23). In this regard, the Sakha Republic, an ethnically non-Russian region colonized by Moscow, is rich in diamonds, gold, and other commodities but remains one of the poorest regions in Russia (TASS, March 14). As a result, problems for ALROSA would translate into significant issues for the local population. That, in turn, could pose a risk of further inequality, unemployment, alcoholism, criminality, and social tensions that could have visible “ethnic” aspects (see EDM, December 9, 2021, July 20, 2022, June 8, 2023).

Under these circumstances, the new sanctions could pose a broader geopolitical challenge for Moscow. Angola, where ALROSA has operated since 1992, is trying to dissolve an agreement with the company and expel it from the country. Local diamond producers have stated that it is becoming “increasingly toxic to work with Russian partners.” Thus, Angola is urging ALROSA to leave the country “immediately … and without any compensation.” The Angolan government has reportedly promised ALROSA that the company would be welcomed back once the sanctions regime is lifted (or at least eased). Some in the Kremlin are skeptical of these prospects, however, based on the conviction that political-economic ties between Angola and the United States have and will continue to be strengthened (The Moscow Times, January 27). Despite African diamond-producing countries feeling frustrated over Western sanctions, enthusiasm is growing among many African players—especially Botswana, South Africa, and Angola—over emerging opportunities given Russia’s weakening position. Many African countries are frustrated with a lack of communication and transparency with the West’s sanctions regime. To avoid inflaming these frustrations further, Western countries will need to communicate early and often with Africa’s diamond-producing states when considering restrictions (DW, June 21).

New sanctions are unlikely to result in the collapse of Russia’s diamond industry. Nevertheless, they will likely exacerbate existing weaknesses within the Russian economy. More crucially, growing issues in the diamond-producing industry could contribute to anti-Moscow sentiments in the Sakha Republic and other resource-endowed regions, as these predominantly non-Russian subjects are intentionally deprived of revenue by Moscow. The further degradation of Russia’s economy and rising unease among its population—especially among ethnically non-Russian populations—may very well lead to wider unrest across the country.